The Dream vs. Reality of Retirement Debt

The general belief for decades has been that you should definitely, definitely not have any debt before you retire. Many of us heard stories as kids about “mortgage-burning parties” where our grandparents celebrated being free from debt. But is this still the best way to handle money in this day and age?

I’ve been researching this topic extensively and what I’ve found might surprise you. The answer isn’t as black-and-white as many financial gurus would have you believe.

The percentage of households headed by someone 65 and older who had debt increased dramatically from 38% in 1989 to 61% in 2016, according to Federal Reserve data. Not only that, but the average debt held by families headed by individuals 55 and older stood at $75,082 in 2010, up more than $1,300 from 2007.

These statistics show we’re facing a new reality more retirees are carrying debt into their golden years than ever before But is this necessarily a bad thing?

Two Perspectives on Retirement Debt

When considering whether to be debt-free in retirement, there are two main perspectives to consider:

1. The Mathematical Perspective

This is the cold, hard numbers approach. You have to compare the return on your investment (after taxes) to the interest rate on your debt (after taxes).

“When your after-tax investment return is higher than the after-tax cost of borrowing, then it makes sense to keep your money invested and carry the debt,” says Bob Carlson of Retirement Watch. But if the after-tax returns on your money are less than the after-tax cost of the debt, it makes sense to pay off the debt with the money. “.

However, this approach has some fuzziness because you have to choose what investment return to use in your calculations. Many economists argue that since paying off debt is risk-free, you should compare the after-tax cost of the debt to the risk-free rate of return you could earn from treasury bonds or similar investments.

2. The Emotional Perspective

This is the subjective side of the equation. Some people derive enormous comfort from being debt-free. Not having debt means:

- Fewer mandatory monthly expenses

- More flexibility if income declines

- Home equity available to be tapped in emergencies

On the flip side, other retirees feel better knowing they have more money invested in the markets rather than using it to eliminate debt. It provides comfort knowing they can always sell some investments to pay the debt or other expenses if needed.

As Carrie Schwab-Pomerantz puts it in The Charles Schwab Guide to Finances After Fifty: “Only you know which will ultimately give you more peace of mind. It could also be a matter of proportion.”

Good Debt vs. Bad Debt in Retirement

Not all debt is created equal. The financial world commonly distinguishes between “good debt” and “bad debt.” Understanding this distinction is crucial for making smart decisions about what debt to eliminate before retiring.

Good Debt

- Creates opportunities

- Is low-cost

- Has tax advantages

- Is used to buy potentially appreciating assets

Examples: Mortgages, home equity lines of credit (HELOCs)

Bad Debt

- Is high-cost

- Isn’t tax-deductible

- Is used to buy depreciating assets

Examples: Credit card debt, car loans

If being completely debt-free isn’t realistic for your situation, your practical goal should be to pay down any bad debt while keeping the good debt working for you.

How Much Debt Can You Afford in Retirement?

The industry standard 28/36 rule suggests:

- No more than 28% of your pretax income should go to servicing home debt

- No more than 36% of your pretax income should go to all debt combined

However, Schwab suggests being even more conservative in retirement. While these percentages may be manageable when you’re working, it’s advisable to keep debt much lower once you’ve stopped receiving a regular paycheck.

9 Smart Strategies for Managing Debt in Retirement

If you’re approaching retirement with debt or are already retired with outstanding obligations, consider these practical strategies:

1. Stop Digging the Debt Hole

This might seem obvious, but it’s not always clear to retirees. Many people think expenses go down in retirement, but they often increase as retirees travel, pursue hobbies, or even buy dream retirement homes. When you’re on a fixed income, take extra care not to add more debt, especially high-interest debt.

2. Don’t Try to Fix Mistakes with Bigger Mistakes

Some retirees realize they haven’t saved enough and make rash decisions trying to make up for lost time. This can lead to day trading or other risky investments that jeopardize what retirement savings they do have.

3. Find an Extra Income Stream

Establishing a new income stream is often the best answer for those who don’t have enough retirement savings. Part-time work—as a consultant, gig worker, or even at a coffee shop—might not be your dream retirement scenario, but it’s often the least-bad choice for dealing with debt in retirement.

4. Carefully Consider Using Retirement Funds to Pay Debt

This approach can be tempting but risky. You lose not only the cash you withdraw but also potential future market gains. Plus, you may create unintended tax consequences, especially if you’re taking money from a traditional IRA or 401(k).

5. Downsize, Especially If Home Prices Are Rising

If you own your home—or most of it—consider scaling back on your house size and amenities. Take that equity and move into a smaller home that’s cheaper to maintain, with more predictable repair costs and property taxes.

6. Evaluate Consolidation Options Carefully

Pooling some debts to get a lower interest rate can work in specific circumstances, especially if you have untapped equity in your home. However, this strategy carries risks if the underlying spending/income mismatch isn’t fixed.

7. Consider a Reverse Mortgage for Mortgage Debt

For homeowners aged 62 and over, a reverse mortgage allows you to borrow against home equity without making payments until you sell, move, or die. While these products have a checkered past, new regulations have improved the industry somewhat.

8. Look Into Cashing Out Life Insurance Policies

You might have value in a cash value life insurance policy you no longer need. You can access this money by taking a loan against it or surrendering the policy, though fees can eat up as much as 30% of the settlement value.

9. Prioritize Your Debt Payments

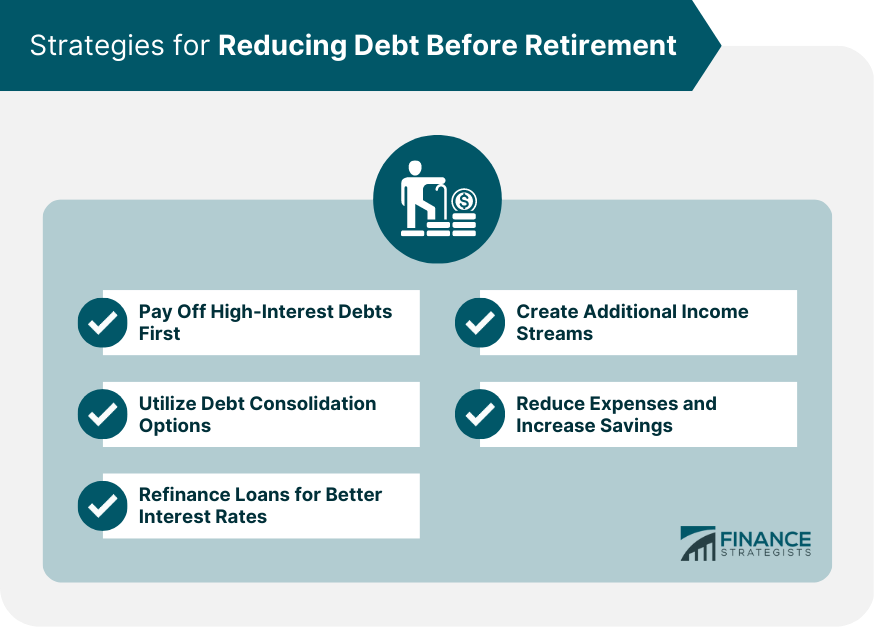

Don’t try to tackle all your debt at once. Instead, make a list of your credit cards and balances, from highest-interest to lowest. Focus on highest-interest debt first while making minimum payments on the rest.

Should You Pay Off Your Mortgage Before Retiring?

Your mortgage is likely your largest debt, and eliminating it before retirement is certainly a worthy goal. But this decision involves both financial and psychological factors.

From a financial perspective, consider:

- The interest rate (adjustable or fixed?)

- Tax deductibility

- Your alternative investment options

Let’s look at an example from the Schwab guide: If you have a 5% fixed loan and your combined federal/state income tax bracket is 30% (assuming full deductibility), your mortgage is really only costing you 3.5%. Paying it off is equivalent to a risk-free 3.5% return on an investment.

From a psychological perspective, weigh the value of having more money in your investment portfolio versus being mortgage-free. It might also be a matter of proportion—if you have a $250,000 portfolio and a $100,000 mortgage, it’s probably unwise to deplete 40% of your assets to pay it off. But if you have $1 million in assets, paying off a $100,000 mortgage is more reasonable.

The Bottom Line: Balance Is Key

So, should you be debt-free when you retire? As with most financial questions, the answer is: it depends.

For many retirees, a balanced approach makes the most sense:

- Eliminate high-interest, non-tax-deductible “bad debt” before retiring

- Be strategic about “good debt” like low-interest, fixed-rate mortgages

- Consider both the mathematical and emotional aspects of carrying debt

- Make decisions based on your specific financial situation, not generic advice

The old conventional wisdom of retiring completely debt-free isn’t necessarily the right approach for everyone in today’s financial environment. What’s most important is having a thoughtful plan that considers your unique circumstances, preferences, and goals.

Remember, financial security in retirement isn’t just about being debt-free—it’s about having sufficient income to cover your expenses (including any debt payments) while maintaining your desired lifestyle and preparing for unexpected costs. Sometimes, strategically carrying certain types of debt can be part of a sound retirement plan.

What’s your take? Are you planning to be completely debt-free by retirement, or are you taking a more nuanced approach? I’d love to hear your thoughts in the comments!

Paying off debt now equals more flexibility later

This hypothetical illustration assumes an auto loan balance of $22,000 and an interest rate of 4%, a credit card balance of $22,000 and an interest rate of 21%, and that you make additional debt payments of $12,500 per year.

We’re here to help

Talk with one of our investment specialists

Monday through Friday 8 a.m. to 8 p.m., Eastern time

Do I Need to be Debt Free to Retire? – Financial 15

FAQ

What percent of retirees are debt-free?

Only a small fraction of retirees are completely debt-free, with estimates often citing figures around 37% or less. However, this number varies by age group and type of debt.

How much do you need to retire with no debt?

To find out how much money you need to retire debt-free, you need to figure out how much you earn each year in retirement and multiply that number by 25. This is called the 4% Rule.

What is the biggest mistake most people make regarding retirement?

The top ten financial mistakes most people make after retirement are:1) Not Changing Lifestyle After Retirement. 2) Failing to Move to More Conservative Investments. 3) Applying for Social Security Too Early. 4) Spending Too Much Money Too Soon. 5) Failure To Be Aware Of Frauds and Scams. 6) Cashing Out Pension Too Soon.

Should you have no debt when you retire?

The best amount to have in debt when you retire is $0. 00. If you have debt you are still paying for whatever you bought when you had a job. It’s silly to go into retirement with debt. If at all possible you should be debt free at least ten years before retirement.

Should you pay off your debt before saving for retirement?

And if you’re debt-free, your next right step is to build up your emergency fund and then move on to investing for retirement (keep reading for a step-by-step plan for how to get started). But that’s the short answer. Let’s dig a little deeper into why paying off your debt before you save for the future is your best option. Feeling Stuck?.

Should you pay down debt in retirement?

Cost-of-living increases for Social Security have hovered around 2% for many years, so it’s not hard to see how cruel the math of a 19% credit card APR or even 8% student loan interest rate can be for retirees. Here’s the truth: There are no easy answers when it comes to paying down debt in retirement.

Is the dream of retiring debt free fading?

Today, the reality is that the dream of retiring debt free is fading, and debt among older Americans is soaring. According to the Federal Reserve, the percentage of households led by someone aged 65 or older that had any debt rose from 20% in 1989 to 20% in 2016. This was up from 20% in 2009. The real average debt also rose from $29,918% to $86,797% (in 2016 dollars).

Should you buy a dream retirement home?

Retirees want to do things that cost money, like travel. Some people buy a dream retirement home, when they should be downsizing, Miller says. When you’re on a fixed income in retirement, take extra care not to add more debt. That’s especially true of high-interest debt, like credit card debt.

How much should a retiree pay off a depreciating debt?

“Depending on the case, you could end up with 60 to 70 cents for every $1 withdrawn,” says Chen. “In this case, the retiree gives up an appreciating asset, pays taxes, in order to pay off a depreciating debt. ”.

Should you pay off your debt now?

Finally, if you’ve been paying off your debt for a while, keep in mind that you may not actually save that much in interest by paying your debt off now. Chen says that if you only have a few years left to pay off a loan, most of your payment goes toward the principal, so you don’t save much on interest.