Retirement is a big milestone, but getting there doesnât happen overnight. Financially preparing yourself to leave the workforce requires some forward thinkingâparticularly about your money. If youâre wondering whether youâre saving enough, youâre not alone.

Here, youâll get an idea of how much youâll want to have in your 401(k) at different ages and how much you should be contributing to your 401(k).

You’re not the only one who doesn’t understand how much to put into your 401(k). I’ve spent a lot of time researching retirement planning and one of the most common questions people have is “how much should I put into my 401(k)?”

Whether you’re just starting your career or approaching retirement, knowing the right amount to sock away can make a huge difference in your financial future. Let’s break down everything you need to know about 401(k) contributions in 2025.

The Magic Number: 15%

The short answer is that financial experts usually say you should put at least 15% of your pre-tax income into retirement accounts every year. This includes any employer match. This recommendation comes from research that shows most people need between 20% and 80% of their pre-retirement income to keep up their current lifestyle in retirement.

But here’s the thing – this isn’t a one-size-fits-all solution. Your personal situation might require more or less depending on

- When you start saving

- Your retirement timeline

- Expected lifestyle in retirement

- Other income sources (like pensions)

2025 Contribution Limits: What You Need to Know

Before diving deeper let’s look at what the IRS allows for 401(k) contributions in 2025

| 401(k) Limits for 2025 | Amount |

|---|---|

| Employee contribution limit | $23,500 |

| Catch-up contribution (age 50+) | $7,500 |

| Total possible contribution (age 50+) | $31,000 |

| Combined employer/employee limit | $70,000 |

The old limit was $23,000, so that’s an extra $500. Now you have a little more room to save!

Starting Small is Better Than Not Starting at All

As realistic as it sounds, reaching that 2015 goal isn’t always possible, especially when you’re just starting out and have to deal with student loans, buying a house, or starting a family. And that’s okay!.

If 15% feels overwhelming, start with what you can. Even 3-5% is better than nothing. The most important thing is building the habit of consistent retirement saving. You can gradually increase your contributions over time, especially when you:

- Get a raise

- Pay off debts

- Receive bonuses

- Experience lifestyle changes

Don’t Leave Free Money on the Table!

Here’s my #1 rule for 401(k) contributions: Always contribute enough to get your full employer match!

If your employer offers to match 50% of your contributions up to 6% of your salary, you should contribute at least 6%. Otherwise, you’re literally turning down free money. That employer match effectively boosts your contribution rate without costing you a penny more.

Age-Based 401(k) Targets

While everyone’s situation differs, having a general benchmark can be helpful. Here are the average retirement savings by age according to the Federal Reserve (including 401(k) accounts and other retirement savings):

- Under age 35: around $30,000

- Ages 35-44: around $132,000

- Ages 45-54: around $255,000

- Ages 55-64: around $408,000

- Ages 65-74: around $426,000

Remember, these are averages! Many financial experts suggest having much more saved to ensure a comfortable retirement.

How Your Age Affects Your 401(k) Strategy

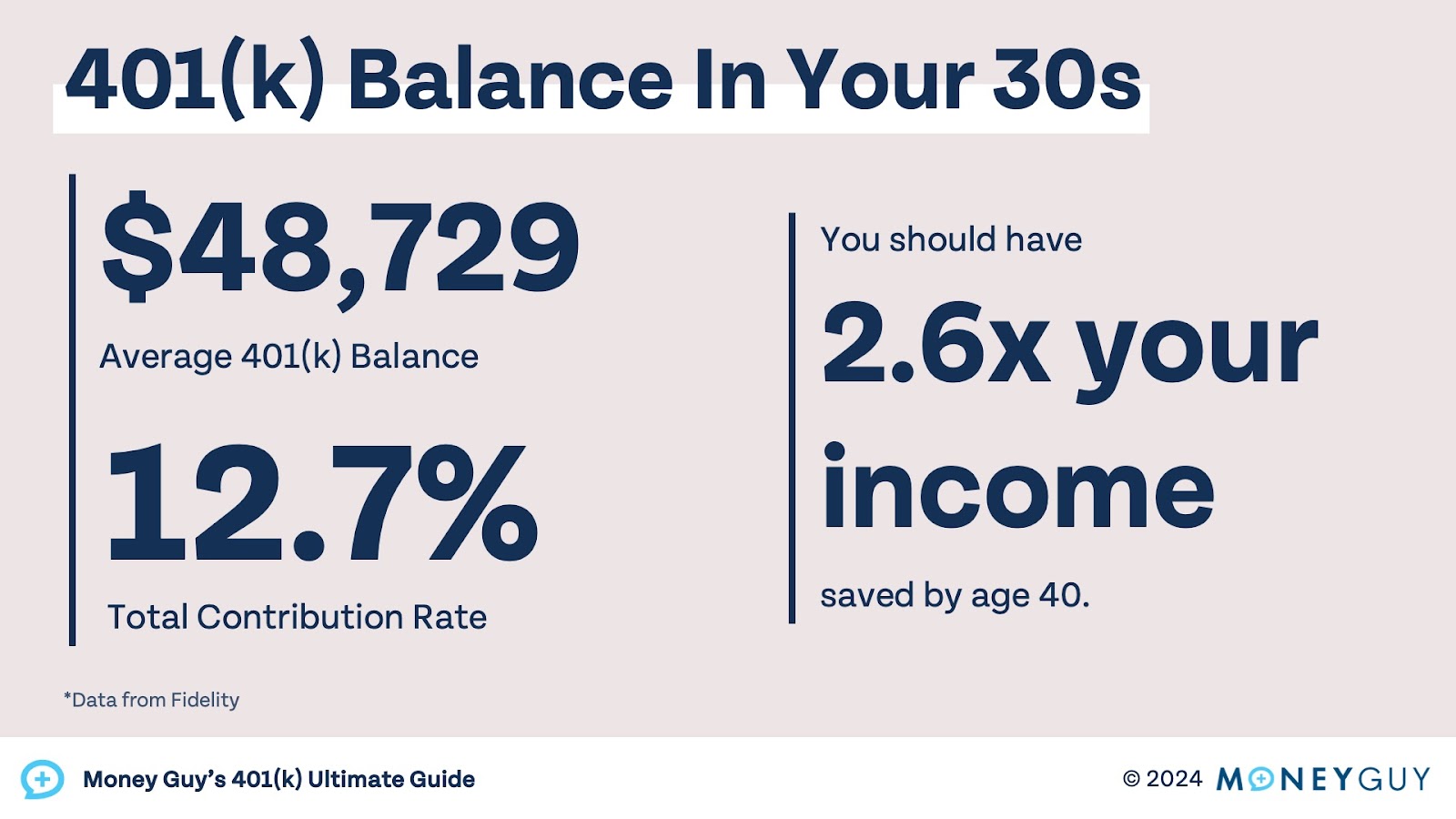

In Your 20s and 30s

Starting early is your secret weapon! Even small contributions have decades to compound. Time is truly your best friend when it comes to retirement savings.

If you start at 25 contributing just $200 monthly with an 7% average annual return, you’d have about $525,000 by age 65. Wait until 35 to start, and you’d need to contribute $400 monthly to reach a similar amount!

In Your 40s

By now, you should be hitting your stride career-wise. If you haven’t been contributing much to your 401(k), it’s time to ramp things up. Try to get closer to that 15% target if possible.

In Your 50s

Once you turn 50, you can make those additional $7,500 “catch-up” contributions. If you’re behind on savings, this is a great opportunity to make up ground!

In Your 60s

As retirement approaches, you’re in the home stretch. You’ll want to have the bulk of your retirement nest egg saved by now, and might consider shifting to more conservative investments to protect what you’ve accumulated.

Beyond the Percentages: Other Factors to Consider

When deciding how much to contribute to your 401(k), consider:

1. Your Debt Situation

High-interest debt (like credit cards) might need to be prioritized over retirement contributions beyond the employer match.

2. Emergency Fund Status

Do you have 3-6 months of expenses saved? If not, you might need to balance building this safety net with retirement savings.

3. Other Savings Goals

Saving for a home down payment or college for kids? These might temporarily affect how much you can put toward retirement.

4. Tax Situation

Traditional 401(k) contributions reduce your current taxable income but are taxed when withdrawn. Roth 401(k) contributions (if available) are made with after-tax dollars but grow tax-free.

Real Talk: Balancing 401(k) Contributions With Life

I’ve been there – trying to save for retirement while also paying rent, student loans, and trying to have some fun once in a while! It can feel impossible to set aside 15% when there are so many demands on your paycheck.

Here’s what worked for me: I started by contributing just enough to get my company match (5% in my case), then increased my contribution by 1% every time I got a raise. Within a few years, I was contributing 12% without feeling the pinch!

The most important thing is consistency. Contribute regularly and increase when you can – the habit is just as important as the amount.

Maximizing Your 401(k): Smart Strategies

-

Automatic increases: Many 401(k) plans offer an auto-increase feature that raises your contribution percentage annually.

-

Contribute bonuses: Consider directing all or part of any work bonuses directly to your 401(k).

-

Check your investments: Make sure your contributions are being invested appropriately for your age and risk tolerance.

-

Consider a Roth 401(k): If your employer offers it, a Roth 401(k) allows for tax-free withdrawals in retirement.

-

Don’t cash out when changing jobs: Roll over your 401(k) to your new employer’s plan or an IRA rather than taking the cash.

The Bottom Line

So, how much should you put in your 401(k)? Start with at least enough to get your full employer match, then work toward that 15% goal over time. If you’re getting a late start, aim for more if possible.

Remember that your 401(k) is just one piece of your retirement puzzle. IRAs, taxable investments, and other savings all play important roles too. The most important thing is taking action – even small contributions today can grow into substantial savings over time.

Have you started contributing to your 401(k) yet? What percentage of your income are you currently saving? I’d love to hear about your retirement savings journey in the comments!

FAQs About 401(k) Contributions

What happens if I contribute too much to my 401(k)?

If you exceed the annual contribution limit, you’ll need to request the excess amount (and any earnings on it) be returned by Tax Day. You’ll pay taxes on this returned amount.

Can I change my 401(k) contribution amount during the year?

Yes! Most employers allow you to adjust your contribution percentage throughout the year.

Should I max out my 401(k) before investing elsewhere?

Not necessarily. While maxing out your 401(k) has advantages, you might want to consider other accounts (like Roth IRAs) for tax diversification or more investment options.

What if I can’t afford to contribute 15% right now?

Start with what you can afford, even if it’s just 1-2%. The most important thing is to begin saving and increase your contributions over time.

How much will I need for retirement?

The average American thinks they’ll need about $1.46 million for retirement, according to Northwestern Mutual’s 2024 Planning & Progress study. Your personal number may vary based on your desired lifestyle and expected expenses.

Remember, the journey to retirement is a marathon, not a sprint. Start where you can, stay consistent, and adjust as your financial situation improves. Your future self will thank you!

How much should I have in my 401(k) by age 30?

While you may not be able to afford to make the maximum 401(k) contribution early in your career, the more you contribute at a young age, the more time your money has to grow.

By the time you reach age 30, you should aim to have a solid start on your retirement savings. That way, time is on your side. You can save smaller amounts each month to reach your retirement goal, compared to starting later and needing to save larger amounts to catch up. Starting in your 20s puts the impressive power of compounding interest in your favor. Your earnings will have many years to earn interest. If instead you wait to start putting money away for retirement, youâll lose out on the extra potential growth from the interest.

How much should I have in my 401(k)?

Without knowing you and understanding your situation, itâs tough to give a benchmark. The truth is that your retirement savings plan hinges on your individual goals and financial situation. When determining how much youâll want to save, here are a few questions youâll want to answer that will help determine how much youâll need:

- How long do you plan to work? Will you stop working all together or keep working part-time for a while? If you quit before age 65, you will still need to pay for health insurance.

- Do you plan to relocate somewhere warmer? Downsize?

- Do you want to travel, spend time with your grandchildren, or take classes?

It can help to answer these kinds of questions to get a feel for how much money you’ll need in retirement. One rule of thumb is that youâll need about 80 to 85 percent of your pre-retirement income to cover your retirement lifestyle. At Northwestern Mutual, we realize that everyoneâs situation is uniqueâso our advisors ask deep questions to get to know you and how you imagine living in retirement. Then they make recommendations based on your goals. $1. 46 million.

The average amount Americans think they will need to retire, according to our 2024 Planning & Progress study.

A 401(k) is an employer-sponsored account thatâs specifically built to help you save for retirement. The contributions you make during your working years are typically made via automatic payroll deductions. That money may then grow over timeâand if your employer offers any sort of match, all the better.

If youâre able, try to put 20 percent of your paycheck toward retirement. Anywhere from 5 to 15 percent might go into your 401(k) each month. However, this isnât always possible, so any money youâre able to put in is going to help you in the long run. It’s better to save something than nothing, even if it’s only 3 to 5 percent at first and then more as you can. (We do recommend putting in enough to get your full company match. ).

The IRS does put limits on how much youâre able to contribute, however. In 2025, the individual contribution limit for a 401(k) is $23,500 (or $31,000 if youâre 50 or older). There are also limits to how much your employer is able to contribute. There are tax penalties for putting too much money into your 401(k), so if you make a lot of money, you should plan ahead to make sure you don’t go over the limits.

When it comes to using your 401(k) in retirement, youâll typically have to wait until age 59½ to make withdrawals in order to avoid a 10 percent penalty. Of course, you certainly donât have to begin taking 401(k) distributions at this age. Letting that money continue to grow can help you shore up your nest egg and avoid additional taxes. However, you will need to begin taking required minimum distributions (RMDs) starting at age 73.

In retirement, youâll be taxed on 401(k) distributions as if they were ordinary income. Therefore, itâs important to remember that a portion of what youâve saved will go to Uncle Sam. Being strategic about how much you withdraw each year can help prevent you from paying more income taxes than necessary.