When they become eligible for Medicare, federal retirees have to make a big choice about their health care: they have to decide if they want to enroll in Medicare Part B. Federal retirees with Federal Employee Health Benefits (FEHB) have different things to think about than retirees with employer coverage. This makes the decision more difficult. Let’s get into this subject and look at what most federal retirees do and why they do it.

The Big Question: Is Part B Necessary with FEHB?

If you are a federal retiree with FEHB coverage, you may be wondering, “Do I really need to pay for Medicare Part B when I already have good health insurance?” This is a good question, especially since Part B costs $174 a month. 70/month for most people in 2024).

Unlike most retiree health plans, FEHB continues to pay as primary if you don’t enroll in Medicare Part B This creates a genuine choice for federal retirees that most other retirees don’t have.

What Most Federal Retirees Actually Do

It’s hard to find exact numbers, but a lot of federal retirees choose to sign up for Medicare Part B even though they already have FEHB coverage. The Office of Personnel Management (OPM), which runs FEHB, usually tells federal retirees to sign up for both Part A (which usually doesn’t cost anything) and Part B.

That said, this isn’t a one-size-fits-all situation. Many federal retirees make different choices based on their personal circumstances, health needs, and financial situation.

Key Factors That Influence the Decision

1. Reduced Out-of-Pocket Costs

When you have both FEHB and Medicare, Medicare becomes your primary insurance and FEHB becomes secondary. This coordination often results in significantly lower out-of-pocket costs because:

- Many FEHB plans waive deductibles, copays, and coinsurance when you have Medicare

- With both coverages, you’re typically only responsible for the difference between what Medicare and your FEHB plan pay and Medicare’s limiting charge (which is 115% of Medicare’s approved amount)

- Some states don’t even allow excess charges above what Medicare approves

2. Expanded Provider Access

If you’re in an FEHB HMO plan, you’re normally limited to providers within that network. But with Medicare Part B, you can see any doctor who accepts Medicare, even if they’re outside your HMO network.

3. Additional Coverage in Some Areas

FEHB plans might have more limited coverage than Medicare Part B for certain services like

- Orthopedic and prosthetic devices

- Durable medical equipment

- Home healthcare

- Medical supplies

- Chiropractic care

4. Penalty for Late Enrollment

When you first become eligible for Part B, if you choose not to enroll, you may face:

- A late enrollment penalty (10% for each 12-month period you delayed enrollment)

- Limited enrollment periods (only during the General Enrollment Period from January through March each year)

- Higher lifetime premiums as a result

5. Premium Costs and Income Considerations

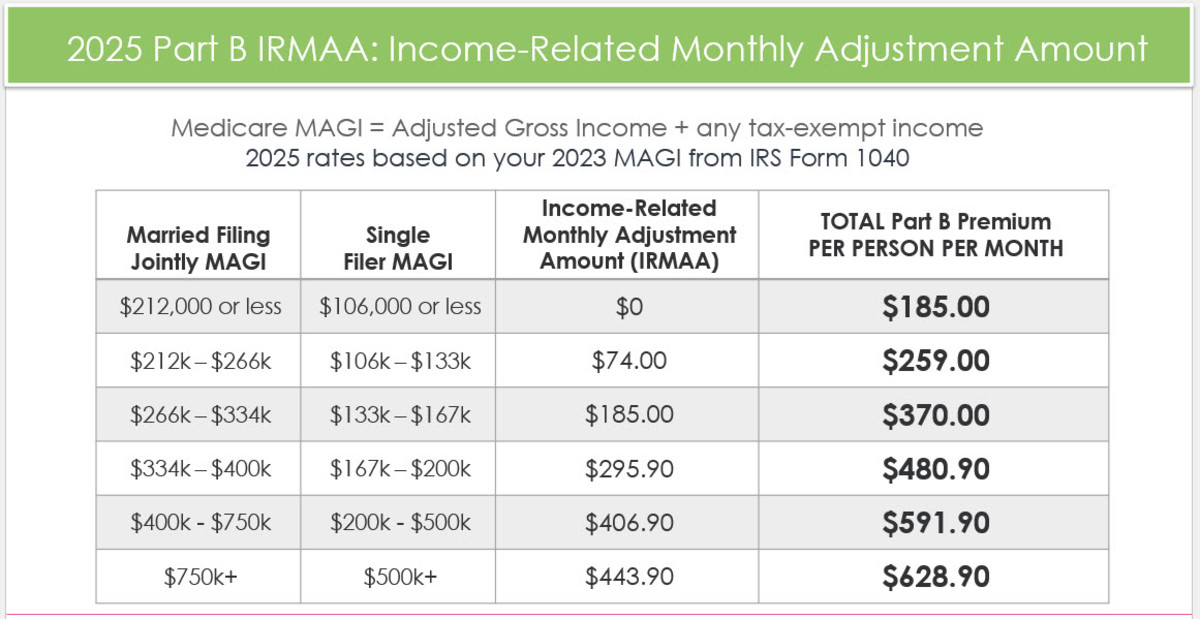

The standard Part B premium is $174.70/month in 2024, but you’ll pay more if your income is above certain thresholds. For high-income earners, premiums can range from $244.60/month to $594/month in 2024.

Advantages of Keeping FEHB Without Part B

There are legitimate reasons why some federal retirees choose not to enroll in Part B:

1. Cost Savings on Premiums

The most obvious benefit is avoiding the additional monthly premium for Part B. If you’re healthy and don’t use many medical services, this could make financial sense.

2. International Coverage

FEHB plans typically cover emergency care received outside the United States, which is something Original Medicare doesn’t cover at all (and Medicare Advantage rarely covers).

3. Additional Benefits

Some FEHB plans offer vision and dental benefits that aren’t covered by Original Medicare and are limited in Medicare Advantage plans.

What About Postal Service Retirees?

Starting in 2025, there’s a new Postal Service Health Benefits (PSHB) Program. Important notes for postal retirees:

- Medicare Part B is required for Medicare-eligible Postal Service annuitants and their Medicare-eligible family members

- All PSHB plans will provide pharmacy benefits via Medicare Part D for Medicare-eligible enrollees

- There was a special Part B enrollment period from April through September 2024 to allow enrollment without penalties

Making Your Decision: A Step-by-Step Approach

If you’re trying to decide whether to enroll in Part B, consider these steps:

1. Review Your Current FEHB Plan

Look at your FEHB plan brochure carefully. Some plans provide significant incentives for enrolling in Medicare, such as waiving deductibles, copays, and coinsurance.

2. Ask These Key Questions:

- Which providers do you see regularly, and do they accept both your FEHB plan and Medicare?

- What types of medical services do you use most frequently?

- How much flexibility do you need in choosing healthcare providers?

- How would your total costs (premiums plus out-of-pocket expenses) compare with and without Part B?

3. Consider Your Health Status and Future Needs

If you’re in excellent health with few medical needs, the premium savings might outweigh the benefits. If you have chronic conditions or anticipate significant healthcare needs, the combined coverage might save you money overall.

4. Check If You Qualify for Assistance

Some people qualify for Medicare Savings Programs that help pay Part B premiums. If you’re eligible, this could make the decision much easier.

Timing Your Enrollment Decision

You have an 8-month Special Enrollment Period to sign up for Part B without penalty after you retire or lose FEHB coverage as an active employee. This gives you some time to make your decision, but don’t wait too long!

What About Medicare Part D?

Generally, you don’t need to enroll in a Part D prescription drug plan if you have FEHB coverage, as FEHB prescription coverage is considered “creditable” (meaning it’s expected to pay, on average, at least as much as standard Medicare prescription drug coverage).

However, starting in 2024, some FEHB plans shifted to employer group waiver plan (EGWP) Part D coverage. If you’re in one of these plans, you would have been notified about this change.

Real-Life Scenarios to Consider

Scenario 1: Healthy Federal Retiree

Mary is a 66-year-old federal retiree in excellent health who rarely sees doctors except for annual checkups. She has an FEHB plan with a $350 monthly premium. For her, skipping Part B might make sense to save on premiums.

Scenario 2: Retiree with Chronic Conditions

John has diabetes, heart disease, and sees multiple specialists regularly. With both FEHB and Medicare Part B, his FEHB plan waives all deductibles and copays, saving him thousands each year despite the additional Part B premium.

Scenario 3: High-Income Earner

Susan and her spouse have a combined income over $206,000, which means they would pay higher Part B premiums. They need to carefully calculate whether the benefits outweigh the increased premium costs.

My Personal Take on This Decision

As someone who’s helped many federal retirees navigate this decision, I find that most people who can afford the Part B premium do benefit from having both coverages. The peace of mind and potential savings on out-of-pocket costs often outweigh the premium expense.

However, I’ve also seen cases where healthy retirees with tight budgets made a reasonable choice to delay Part B enrollment, understanding the potential penalties if they change their minds later.

Final Thoughts

There’s no universal “right answer” to whether federal retirees should enroll in Medicare Part B. It depends on your individual health needs, financial situation, and personal preferences.

The good news is that, unlike many retirees, you have a genuine choice. Your FEHB benefits won’t disappear or be drastically reduced if you decline Part B.

Whatever you decide, make sure you understand the long-term implications, including potential penalties if you delay enrollment and later change your mind.

Have you made this decision already as a federal retiree? I’d love to hear about your experience in the comments below!

This article is for informational purposes only and does not constitute professional advice. For personalized guidance on your Medicare decisions, consult with a qualified healthcare advisor.

Medicare and FEHB | Do You need Part B?

FAQ

Do retired federal employees need part B Medicare?

Enrolling in Part B is necessary to qualify for TRICARE For Life or an MA plan, but it is optional when continuing FEHB coverage after age 65. The standard Part B premium in 2021 is $148. 50 per person per month.

How many federal retirees take Medicare Part B?

About 70% of federal retirees enroll in Part B, which means paying two premiums and in essence two duplicative insurance programs.

Do all retirees pay for Medicare Part B?

According to the CMS, most Medicare beneficiaries will pay the standard Medicare Part B premium amount. If you’re enrolled in a CalPERS Medicare health plan, you must pay for and maintain enrollment in Medicare Part B to remain enrolled in the CalPERS health program.

Should I cancel FEP when I get Medicare?

Combine your coverage to get more Together, FEP and Medicare can protect you from the high cost of medical care. Medicare works best with our coverage when Medicare Part A and Part B are your primary coverage. That means Medicare pays for your service first, and then we pay our portion.

Can a retiree get Medicare Part B?

If you get federal employee health benefits (FEHB) as a retiree, you can choose whether to also enroll in Medicare Part B. If you do, your FEHB premiums stay the same, and there may be some advantages. When you turn age 65, you will become eligible for Medicare. If you are a retiree with health insurance from a FEHB plan, you can use both together.

Should retired federal employees enroll in Medicare Part B?

These are reasons to enroll (or not) in retirement. Signing up for Medicare Part B is one of the most important things you’ll have to do when you turn 65 and stop working, or when you stop working for good if you plan to keep working after age 65.

Does Medicare Part B work with federal plans?

Medicare Part B may work well with federal plans, but you don’t have to sign up if you think your current and future health plan meets your needs.

Can I enroll in Part B If I retire?

If you’re still working when you turn 65, you can join Part B after you retire without having to pay a late enrollment fee for up to 8 months. FEHB provides coverage for prescription medications, and Medicare considers this to be creditable coverage.

Should I enroll in Medicare Part B If I have FEHB?

The decision to enroll in Medicare Part B is more complicated. If you have Part A and Part B, you may be able to switch to a less expensive FEHB plan. You may choose to suspend your FEHB coverage to enroll in Medicare Advantage or other eligible coverage. You generally don’t have to enroll in Medicare Part D if you have FEHB coverage.

Should I join Part B & enroll in Medicare Advantage?

For retirees that fall into the first tier of IRMAA—above $91,000 and below $114,000 for an individual and above $182,000 and below $228,000 for a couple, you should still consider joining Part B and enrolling in a Medicare Advantage plan, discussed below.