The Reality Check You Need About Retiring with $100,000

Hey there! If you’re wondering whether $100K is enough to retire on, you’re not alone. I’ve been digging into this question for weeks now, and lemme tell you – the answer isn’t as simple as you might think.

When I first started researching this topic, I honestly thought $100K sounded like a decent chunk of change But after looking at what financial experts say and crunching some numbers, I realized we need to get real about what retirement actually costs these days

Understanding the $100K Retirement Math

Let’s break this down in simple terms. If you’ve managed to save $100,000 by retirement age, you’re probably wondering how long that money will last. Using the widely-accepted 4% withdrawal rule (which suggests taking out no more than 4% of your retirement savings each year to make it last 30 years), here’s what your annual income would look like

$100,000 × 0.04 = $4,000 per year

That’s just $333 per month. No way! That’s not really what most of us have in mind for our retirement.

As Steve Azoury, owner of Azoury Financial in Troy, Michigan, points out, “Some people get bad breaks.” Life happens – illness, unemployment, or other circumstances beyond our control can make saving difficult “It’s not their fault,” he notes But regardless of how we got here, we need to figure out how to make it work.

Can You Actually Live on $100K in Retirement?

The short answer? Yes, but with some significant adjustments and supplemental income sources.

According to the articles I’ve reviewed, here’s how retirement might look with just $100K saved:

-

Social Security will be your main lifeline

- The average Social Security benefit was about $22,000 per year as of June 2023

- Combined with the $4,000 from your savings, that’s around $26,000 annually or $2,200 monthly

-

You’ll need to drastically reduce expenses

- Track every expense and cut anything non-essential

- Consider downsizing your home dramatically

- Eliminate vehicle expenses when possible

-

You’ll likely need to work part-time

- Transitioning slowly from full-time work

- Picking up seasonal employment

- Starting a “microbusiness” based on skills or hobbies

The Gap Between Perception and Reality

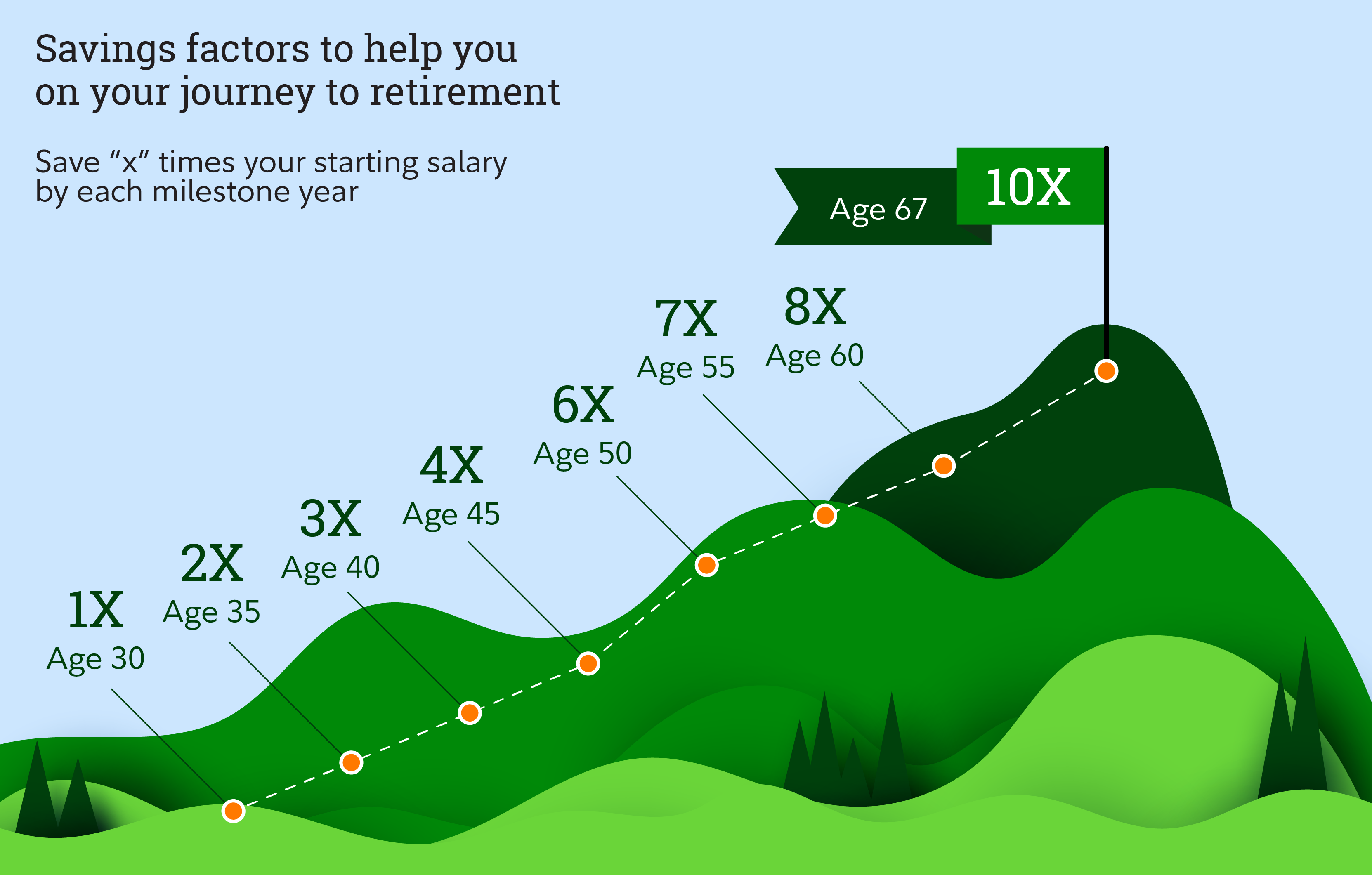

When you look at what experts actually say, the $100,000 savings is pretty shocking. Bank of America says that by age 61, you should have saved more than nine times your current salary!

Here’s a reality check:

- If you make $50,000 a year, you should aim for $450,000 in savings

- If you make $100,000 a year, your target should be at least $900,000

And if you want to make $100,000 a year in retirement? A Schroders study found that savers think they need $1 3 million, but a study by Northwestern Mutual says it’s $1 million. 26 million. The bar set by people who answered the Charles Schwab survey was even higher at $1 6 million.

But let’s get real – we’re talking about making $100K work, not ideal scenarios.

7 Strategies to Make $100K Work in Retirement

When you’re working with limited savings, every dollar counts. Here are some strategies that financial experts recommend:

1. Maximize Free Services and Senior Discounts

One of the most overlooked retirement strategies is taking full advantage of free services available to seniors. These might include:

- Free meal sites and community dining programs

- Senior transportation services

- Library services (free entertainment, classes, WiFi)

- Senior discount days at museums, zoos, and parks

- National Park Service reduced-price senior pass

Contact your state’s agency on aging to discover what’s available in your area – you might be surprised!

2. Be Strategic About Social Security

This is SUPER important! When you claim Social Security can make a huge difference:

- Starting benefits at age 62 reduces your payment by up to a third

- Waiting until full retirement age (66-67) gives you 100% of your benefit

- Delaying until 70 increases your benefit by 8% for each year you wait

As Mindy Yu, director of investing for Betterment at Work, explains: “Most of the time, you want to defer as long as possible.” However, with limited savings, you might need to start earlier to avoid debt.

3. Tap Into Your Home’s Equity

If you own your home, you’re sitting on a potential goldmine:

- Sell and downsize to a cheaper location/property

- Consider a reverse mortgage (though this should be approached cautiously)

As John Traynor, managing director at Fiduciary Trust International, notes: “I typically don’t recommend them [reverse mortgages],” but they may make sense for those with few other income options.

4. Keep Some Money Invested

Don’t make the mistake of moving all your savings out of the stock market when you retire!

“You need part of that to still grow,” says Azoury. He recommends a bucket approach:

- Put 20% in cash for immediate needs

- Keep 40% in mutual funds for growth

- Place the remainder in conservative investments for safety with some return

5. Utilize Tax-Advantaged Accounts

If you’re still saving, maximize tax-advantaged accounts:

- For 2025, 401(k) contribution limits are $23,500 for those under 50

- Those 50+ can add $7,500 in catch-up contributions

- Ages 60-63 can save an additional $3,750 in super-catch-up contributions

- IRA contribution limit is $7,000, with an additional $1,000 for those 50+

6. Consider Alternative Living Arrangements

Think outside the box about housing:

- Shared housing with family members

- Moving to a lower-cost area (even internationally)

- Mobile home or tiny house living

7. Develop a Side Income

According to Interactive Wealth Advisors, starting a microbusiness can require as little as $3,000. Consider:

- Turning a hobby into income

- Offering consulting in your area of expertise

- Online work that can be done remotely

Location, Location, Location: Where $100K Goes Further

Your retirement dollars will stretch much further in some places than others. Consider:

- Rural areas vs. urban centers

- States with no income tax

- Countries with lower costs of living and good healthcare

The Psychological Side of Retiring with $100K

Let’s be honest – retiring with less money than ideal can be scary. But I’ve talked to folks who are making it work and staying positive. Their advice:

- Focus on experiences over possessions

- Build strong community connections

- Volunteer to stay engaged and give back

- Embrace simple living as a lifestyle choice

Is $100K Enough? The Final Verdict

So, is $100K enough for retirement? If we’re being totally honest, for most Americans, $100,000 alone probably won’t provide the comfortable retirement many dream about. But it’s not a hopeless situation either.

With careful planning, supplemental income, Social Security benefits, and lifestyle adjustments, you can create a sustainable retirement plan. It may not include luxury cruises or a vacation home, but it can still be fulfilling and secure.

The most important takeaway? Start wherever you are, with whatever you have. Even if $100K is your starting point, implementing smart strategies can help you stretch those dollars further than you might think.

And if you’re still in the saving years? This should be a wake-up call to boost your retirement contributions as much as possible. Future you will be SO grateful!

What’s your retirement saving strategy? Have you thought about how to make your savings last? I’d love to hear your thoughts and experiences in the comments below!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial professional about your specific situation before making retirement decisions.

Can you retire at 50 with $100k?

It’s certainly possible, but it won’t be easy. Suppose you hope to retire at 50 with $100k in retirement savings and plan for a life expectancy of 80 years. In that case, you’ll need that money to keep you afloat for 30 years, equating – without accounting for any other possible sources of retirement income such as Social Security – to $278 a month.

This figure could be higher if you do get income from other sources. Or if you can invest some of that money as a retiree and increase your wealth over time. But it could also be lower if, for instance, you have to cover more medical bills than expected.

Some people who retire at age 50 don’t have a lot of money saved up, so they go back to work in some way after they retire, even if it’s only part-time or in a completely different field.

“Securing a comfortable retirement means proactively diversifying your savings through plans like 401(k) and IRAs, carefully timing your social security benefits and considering long-term care planning.

Regularly reviewing your investment strategy, especially as retirement nears, is vital to balance risk with income needs. Addressing these practical steps early can make a significant difference in achieving the retirement lifestyle youve envisioned. “.

Can you retire at 60 with $100k?

Taking the same calculations as if you plan to retire at 50, suppose you plan to retire at 60 with $100k in savings, and you need this money to last for now 20 years until the age of 80. Without including income from other sources, this would leave you with a monthly income of just $417.

While this figure will be higher if you factor in income from other sources – such as Social Security, which, in 2022, was approximately $1,825 a month – this figure is still quite low.

If you decide to retire at age 50 or 60, anything that will give you extra money on a regular basis can help you keep the books balanced and make your budget for your golden years more flexible. Particularly when you remember that inflation and cost of living increases between now and your retirement age could further reduce how far your money can go.

I Don’t Know What to Do With My $100,000 in Savings

FAQ

How long will $100,000 last in retirement?

$100,000 will likely last between 17 to 30 years in retirement, depending on investment returns and your annual expenses, which vary significantly by location and personal lifestyle.

Is 100K a good retirement income?

Whether $100,000 is a good retirement income depends on your expenses and location, but it can be a very comfortable income for many, especially if it’s a combined income for a married couple, according to CBS News. To generate $100,000 per year, you typically need a retirement nest egg of about $2. 5 million, assuming you follow the 4% rule for withdrawals.

What percent of Americans have $100,000 in retirement?

Data from the Employee Benefit Research Institute indicates that 22. 1% of Americans have at least $100,000 saved up. Most people in this group have retirement savings that range from $100,000 – $499,000. Out of everyone in the study, 13. 9% of Americans have savings in that range.

Can I retire with $100K and social security?

Retiring with $100,000 and Social Security is possible but difficult, requiring a significant reduction in monthly expenses, potentially to under $2,000 per month, or a move to a lower-cost area. The key factors determining your ability to retire are your annual Social Security benefits, the rate of return on your $100,000 savings, and your retirement expenses.

How much money can you withdraw if you retire with $100,000?

According to the 4% rule, if you retired with $100,000 in savings, you could withdraw just about $4,000 per year in retirement. It’s nearly impossible for anyone to survive on $4,000 per year, but the majority of retirees will also be entitled to Social Security benefits.

Can you retire on 100K?

You can live off of $100,000 for a short time if you don’t have any debt, plan to keep a part-time or consulting job, and have enough in Social Security benefits. Check your spending habits, inflation, and the way of life you want to live to see if you can retire on $100,000.

What if I have $100,000 in retirement savings?

If you have $100,000 in retirement savings, don’t turn in your retirement notice just yet. Divided over one or two decades or more, you might need more than $100,000 to see you through. If you live in an inexpensive place, you can make $100,000 a viable retirement savings amount by continuing to work part-time and paying off your mortgage.

How much money do you need to retire?

How much you need to retire depends on a number of factors, including retirement age, intended lifestyle, other income sources, and expected expenditures. Figures suggest that the average American has savings over $100,000 in savings when they reach traditional retirement age.

Is $100K for retirement a good investment?

$100k for retirement is doable with the right approach to spending and planning. Discover the key steps to make it work. If your annual spending amounts to $20,000, $100k will last you for five years.

How much tax do you pay for a 100K retirement?

If you’re hoping to spread $100k across 20 years of retirement, that’ll only be around $5,000 a year, putting you in the lowest bracket and seeing you taxed at 10 percent. The top income tax rate, comparatively, is 37 percent. Don’t forget you’ll also have to account for state-level income tax.