These reviewers are experts in their fields and professional writers who often work for reputable newspapers and magazines like The New York Times and The Wall Street Journal.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

Are you scratching your head trying to figure out if that annuity offer is actually any good? You’re not alone! As a retirement planning tool, annuities can be super confusing, especially when it comes to understanding what counts as a “good” return. Let me break it down for you in plain English.

Understanding Annuity Returns: The Basics

That being said, let’s get one thing straight: annuities aren’t meant to get you rich quick. They’re designed to provide stability and guaranteed income during retirement. That’s why it’s not fair to compare the returns on annuities to those of stocks or other risky investments.

There are various types of annuities with various returns. What is “good” for you depends on your financial goals, risk tolerance, and when you plan to retire. Let’s explore what you can realistically expect in 2025.

Average Returns by Annuity Type

Each type of annuity comes with its own return profile. Here’s what you can typically expect:

Multi-Year Guaranteed Annuities (MYGAs)

- Average Return: 4% to 5%

- Risk Level: Low

- How it works: Similar to CDs but often with better rates

- Best for: Safe, predictable growth with zero market risk

- Avoid if: You’re looking for growth above inflation or need immediate income

MYGAs are pretty straightforward – you get a guaranteed interest rate in writing when you buy the contract. Think of it as a tax-deferred CD issued by an insurance company. In today’s market, anything above 4.75% for a 3-5 year term is considered quite competitive.

Fixed Indexed Annuities (FIAs)

- Average Return: 5% to 7%

- Risk Level: Low to Moderate

- How it works: Returns linked to market index performance, but with downside protection

- Best for: Pre-retirees wanting growth potential without risking losses

- Avoid if: You want full control over investments or short-term access to all funds

The neat thing about FIAs is that they offer a safety net – your principal is protected even when markets tank. However, your upside is usually limited by caps, participation rates, or spreads. For example, if the S&P 500 grows by 10% and your participation rate is 50%, you’d earn 5%. If the market falls, you typically earn 0% but don’t lose anything.

Variable Annuities

- Average Return: 6% to 8% (after fees)

- Risk Level: Moderate to High

- How it works: Invest in mutual-fund-like subaccounts with full market exposure

- Best for: Long-term investors comfortable with market fluctuations

- Avoid if: You’re risk-averse or nearing retirement

Variable annuities potentially offer the highest returns, but they come with more risk and typically higher fees. These fees can seriously eat into your returns, so it’s crucial to understand the total cost structure before jumping in.

Single-Premium Immediate Annuities (SPIAs)

- Average Return: 1% to 2% (internal rate of return)

- Risk Level: Low

- How it works: Converts lump sum into immediate lifetime income

- Best for: Retirees needing predictable monthly income they can’t outlive

- Avoid if: You need flexibility or are worried about inflation

SPIAs are a bit different since they’re focused on income rather than growth. The internal rate of return depends on factors like your age, gender, and how long you live. At age 70, a payout rate over 6% is considered fair, though the actual return remains relatively low.

Comparing Annuity Returns Side by Side

Here’s a quick comparison to help you visualize the differences:

| Type | Avg. Return | Market Risk | Principal Guarantee | Optional Income | Liquidity | Best Use Case |

|---|---|---|---|---|---|---|

| MYGA | 4%–5% | No | Yes | No (unless annuitized) | Limited | Safe growth with no risk |

| FIA | 5%–7% | No | Yes | Yes (via GLWB) | Partial | Protected growth + income |

| VA | 6%–8% | Yes | No | Yes (rider) | Limited | Market growth + income |

| SPIA | 1%–2% | No | Yes | Yes (immediate) | No | Guaranteed lifetime income |

What Makes a “Good” Annuity Rate in 2025?

So what’s considered “good” in today’s market? Here’s my take:

- For MYGAs: Anything above 4.75% for 3-5 years is excellent

- For FIAs: Averaging 5-7% with downside protection is strong

- For Variable Annuities: 6-8% after fees is solid (though rarely achieved consistently)

- For SPIAs: A payout rate over 6% at age 70 is considered fair

Remember, a good rate isn’t just about the highest number. It’s about finding the right balance between return, risk, and features that match your retirement needs.

Factors That Affect Your Annuity Payouts

Several factors influence how much your annuity will pay:

Age and Gender

Younger people typically receive lower monthly payments since they’ll likely receive payments for longer. Women often receive smaller monthly payments than men because of longer average life expectancy.

Amount Invested

This one’s pretty obvious – the more money you put in, the bigger your potential payouts. For example, a $100,000 investment will typically generate larger payments than a $75,000 investment.

Payout Period

The length of your payout period dramatically affects your monthly income. For a $100,000 fixed annuity with a 6% interest rate:

- 10-year payout: Approximately $1,102 monthly

- 15-year payout: About $835 monthly

- 20-year payout: Around $707 monthly

Interest Rates

Higher interest rates generally mean bigger payouts. For instance, an annuity with a 10% interest rate will typically provide larger payouts than one with a 7% rate.

How to Maximize Your Annuity Returns

Want to get the most out of your annuity? Here are some practical tips:

- Choose longer terms when possible – 7+ years often access higher rates

- Shop multiple carriers – don’t rely on a single quote

- Compare indexed annuity crediting strategies carefully – annual point-to-point with participation rate only is often best

- Avoid optional riders unless you actually need the benefits – they add costs

- Work with a fiduciary broker – not an insurance company’s captive agent

Who Should (and Shouldn’t) Consider Annuities

Annuities aren’t for everyone. They make the most sense if you’re:

- Looking for guaranteed retirement income

- Concerned about outliving your savings

- Wanting to balance your portfolio with something stable

- In or approaching retirement

They’re probably NOT a good fit if you’re:

- A high-growth investor wanting market-level returns

- Someone needing full liquidity (annuities typically have surrender schedules)

- A short-term saver (you’re better off with high-yield savings accounts or treasury bills)

- Extremely fee-sensitive, especially regarding variable annuities

The Bottom Line: Think Beyond Just the Return

When evaluating annuity returns, I always tell my clients to look beyond just the percentage. While stocks might average 8-10% over the long term, they come with no guarantees and significant volatility – something many retirees can’t afford.

An annuity’s real value isn’t just its return on investment; it’s what it gives you: steady, guaranteed income that you can’t outlive. That’s something traditional investments simply can’t offer.

For example, depending on the contract structure, payout options, and deferral period, income payouts can reach as high as 16% of the original premium per year. If you put $100,000 into a deferred income annuity and waited 10 years, your annual payout might be around $16,000 for life. You’d get your original investment back in just over 6 years – everything after that is pure gain!

Final Thoughts

In 2025, a “good” annuity rate really depends on your personal situation and what you’re looking for. If guaranteed income is your priority, even a seemingly modest return might be excellent if it provides the security you need.

Before making any decisions, I recommend consulting with a financial advisor who specializes in retirement planning. They can help you determine if an annuity makes sense for your situation and which type offers the best combination of returns and features for your needs.

Remember – the best investment isn’t necessarily the one with the highest return, but the one that helps you sleep at night knowing your retirement is secure.

Have you had experiences with annuities? What kinds of returns have you seen? I’d love to hear your thoughts in the comments!

Today’s Best Annuity Rates

The table below highlights today’s best fixed annuity rates across common term lengths. These rates are updated regularly and sourced from top-rated providers.

| Rate Term | Rate | Provider | Product | Insurer Rating |

|---|---|---|---|---|

| 1 Year | 6.43% | Corebridge Financial | American Pathway Fixed 7 Annuity | A |

| 2 Year | 5.50% | Axonic Insurance Services | Skyline MYGA | A- |

| 3 Year | 6.10% | Wichita National Life Insurance | Security 3 MYGA | B+ |

| 4 Year | 6.05% | Mountain Life Insurance Company | Alpine Horizon | B+ |

| 5 Year | 6.45% | Atlantic Coast Life | Safe Harbor Bonus Guarantee | B+ |

| 6 Year | 6.67% | Atlantic Coast Life | Safe Harbor Bonus Guarantee | B+ |

| 7 Year | 6.90% | Atlantic Coast Life | Safe Harbor Bonus Guarantee | B+ |

| 8 Year | 6.00% | Mountain Life Insurance Company | Secure Summit | B+ |

| 9 Year | 5.40% | Mountain Life Insurance Company | Secure Summit | B+ |

| 10 Year | 7.65% | Atlantic Coast Life | Safe Harbor Bonus Guarantee | B+ |

- Top Rate: 7. 65% of the time for the last ten years, Atlantic Coast Life has led with a 65 percent rate for the next 10 years on its Safe Harbor Bonus Guarantee (B rating). This is the best choice for buyers who want to get the most money back over a long period of time, but it has a mid-tier insurer rating.

- Mid-Term Sweet Spot: 6. 45%–6. 90% for 5 years, 20% for 20 years, and 90% for 30 years. Atlantic Coast Life also leads the mid-range with 45% for 5 years, 6. 67% for 6 years, and 6. 90% for 7 years, as long as you follow the Safe Harbor Bonus Guarantee (B rating). These terms are still some of the best for buyers because they offer a good mix of yield and moderate commitment.

- Short-Term Highlight: 6. Kansas National Life Insurance Company is currently offering a 20% discount for three years. 10% for three years (B rating), appealing to people looking for slightly longer short-term commitments.

Is Now the Right Time for a Fixed Annuity?

There are many reasons why right now could be the perfect time for a fixed annuity. Since the last time rates were raised at the federal level and bond market yields are high, fixed annuity rates are some of the highest they’ve been in over ten years. And if you lock in now, your rate won’t change if interest rates decline.

In 2024, there was also record sales of fixed annuities, with continued growth expected. This indicates that there is a strong investor sentiment. Also, in most cases, fixed annuities are outperforming bonds, offering stable income and principal protection.

If you plan to hold your annuity for a long time, it could be smart to lock in a higher rate now, instead of waiting. You can also choose specific terms, allowing you to secure the current rates but positioning yourself to potentially have higher future rates.

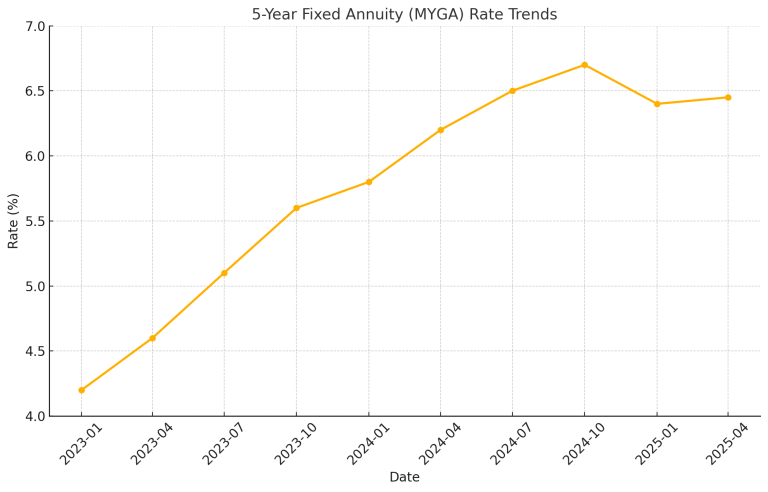

5-Year MYGA rates have risen steadily since early 2023, reaching a peak in late 2024. Locking in now can help preserve gains before rates begin to flatten.

5-Year MYGA rates have risen steadily since early 2023, reaching a peak in late 2024. Locking in now can help preserve gains before rates begin to flatten.

Not all “rates” in an annuity mean the same thing. When you first look into annuities, it’s important to know that your interest rate, payout rate, and overall cash flow may all be different.

| Rate Type | What It Means | What You See | What You Get |

|---|---|---|---|

| Declared Interest Rate | Guaranteed growth for fixed terms (MYGAs, DIAs) | “5.50% 5-Year MYGA” | $5,500 growth on $100k over 1 year |

| Payout Rate* | The percentage of premium paid to you annually in income | “$6,800/year from a $100k annuity” | Equals 6.8%, not interest earned |

| Cash Flow Rate | Annual income divided by initial premium — includes return of principal | Same as payout rate in most cases | Includes both interest + principal |

There’s the interest rate, which shows how your money grows. It’s also called the declared or guaranteed rate. Then there’s the payout rate, which shows how much you withdraw annually compared to your premium. And the cash flow rate tells you your annual income as a percentage of your original investment — but it’s often mistaken for your true yield. It’s easy to feel unsure, put off making a choice, or end up with a product that doesn’t meet your needs if you don’t fully understand these differences.

Lock In Today’s Very Best Fixed Annuity RatesExplore annuity products and rates.

Dave, Can You Clarify What A Fixed Index Annuity Is?

FAQ

What is a typical return on an annuity?

Average Return on a Multi-Year Guarantee Annuity (MYGA): The return rate is set at the start of the contract and stays the same for as long as the agreement lasts. You can expect an average return of 4% to 5%. This predictability can be vital to your retirement plan, providing a stable income stream.

What is a good annuity payout rate?

| Term | Rate | AM Best Rating |

|---|---|---|

| 1-Year | 6.00% | A |

| 2-Years | 5.25% | B |

| 3-Years | 6.00% | B |

| 4-Years | 5.30% | A |

How much does a $100,000 annuity pay per month after?

… 2025, if you have a $100,000 annuity, you’ll get a payment of $600 a month at age 60, $660 a month at age 65, or $713 a month at age 70.

What is the biggest disadvantage of an annuity?

The biggest problems with annuities are that they are hard to get money out of because they have high fees and penalties for taking money out early, and they are also hard to understand, which can lower long-term returns by a lot.

What is the average annuity return?

An investor can expect an average rate of return between 4% to 6%. The average annuity return for variable annuities is potentially the highest among the three but carries a higher risk level. It greatly depends on the underlying investment performance.

Which annuity has the highest average rate of return?

The type of annuity with the highest average rate of return depends on various factors, such as the investor’s risk tolerance and time horizon. Generally speaking, variable annuities offer higher rates of return than fixed annuities but at a greater level of risk.

What is the average return of a fixed indexed annuity?

The average return of fixed-indexed annuities is harder to determine. It depends on the specific index performance and the contract’s participation rate, cap rate, and spread. It typically offers higher returns than an MYGA but less than a variable annuity. An investor can expect an average rate of return between 4% to 6%.

What is the average variable annuity rate of return?

Again, the average variable annuity rate of return depends on the investment options that you select. Variable annuities usually feature many choices, but returns are often similar to popular ETFs and index funds (8% to 10% annually, on average). Your contract fees and investment expense ratios will eat into these returns, though.

What is a good a- rating for annuities?

For example, Knighthead Life’s A- rating combined with 6.35%-6.60% rates provides an optimal balance of security and return. For annuities longer than 5 years, prioritize companies with A- ratings or higher.

What factors affect the rate of return on annuity?

Several factors can impact the rate of return on an annuity, including market interest rates, inflation rates, taxation, the charges and fees associated with the annuity contract, and the performance of underlying investments for variable annuities. How to improve the rate of return on my annuity?