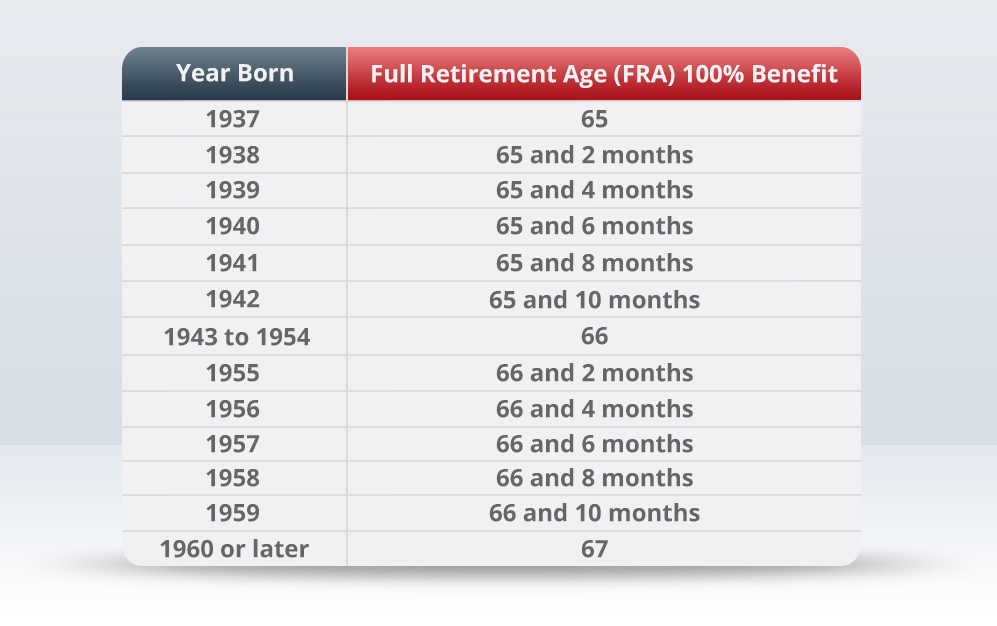

A long time ago, when you turned 65, you could get both full Social Security retirement benefits and Medicare coverage at the same time. But in the past few years, the Social Security Administration (SSA) has raised the full retirement age twice. First, for people born between 1948 and 1954, it was raised to 66 years old. Then, for people born in 1955 or later, it was raised to 67 years old. ADVERTISEMENT UnitedHealthcare does not endorse companies or products.

No matter what full retirement age is required for you to get full Social Security benefits (which you can quickly find using the chart below), Medicare eligibility still begins at age 65. 1.

Figuring out when you can retire might feel like solving a puzzle, especially with all the changing rules around Social Security If you were born in 1955, I’ve got good news – I can help clear up the confusion about your retirement options!

Your Full Retirement Age: 66 and 2 Months

By Social Security rules, if you were born in 1955, you are 66 years and 2 months old and can retire. This is when you can get all of your full retirement benefits.

Depending on your exact birth date, people born in 1955 will be able to retire at any time between March 2, 2021, and March 1, 2022.

This is different from people born earlier or later

- If you were born between 1943-1954: FRA is 66

- If you were born in 1956: FRA is 66 and 4 months

- If you were born in 1957: FRA is 66 and 6 months

- If you were born in 1958: FRA is 66 and 8 months

- If you were born in 1959: FRA is 66 and 10 months

- If you were born in 1960 or later: FRA is 67

Early Retirement Option: Starting at Age 62

You can start getting Social Security benefits as early as age 62, even though your full retirement age is 66 and 2 months. There is, however, a big catch: your benefit amount will remain lower for good.

If you were born in 1955 and decide to start benefits at 62, you’ll only receive about 74.2% of your full retirement benefit. Your spouse would receive an even more drastically reduced amount – only about 34.6% of the full benefit amount.

Here’s how the reduction works if you claim early:

| Age When You Start Benefits | Percentage of Full Benefit (Worker) | Percentage of Full Benefit (Spouse) |

|---|---|---|

| 62 | 74.2% | 34.6% |

| 63 | 79.2% | 37.1% |

| 64 | 85.6% | 41.0% |

| 65 | 92.2% | 45.1% |

| 66 | 98.9% | 49.3% |

| 66 + 2 months (FRA) | 100.0% | 50.0% |

The reduction happens on a monthly basis, so every month you wait to claim (up until your FRA) increases your benefit amount slightly.

Benefits of Waiting Until Full Retirement Age or Beyond

I always tell my clients that patience can literally pay off when it comes to Social Security. If you can wait until your full retirement age of 66 and 2 months, you’ll receive 100% of your benefit amount.

But here’s something even better – you can actually get MORE than 100% if you delay beyond your full retirement age! For every month you delay claiming benefits after your FRA (up until age 70), Social Security adds a delayed retirement credit to your eventual benefit.

This means that if you can wait until you are 70, you might get a much bigger monthly benefit than if you started getting it at your FRA. If you’re healthy and think you’ll live a long time, this may be a good idea.

How Your Birth Month Affects Your Retirement Age

One quirky thing about Social Security: if your birthday falls on the 1st of the month, they actually calculate your benefit as if your birthday were in the previous month. This small detail can sometimes give you an extra month of benefits!

Important Considerations for Your Retirement Decision

When deciding when to retire, here are some factors I think you should consider:

- Your health and family longevity: If you’re in good health and have family members who lived into their 90s, waiting for a higher benefit might make sense.

- Your financial situation: Can you afford to wait? Do you have other sources of retirement income?

- Your employment status: Are you still working? If so, claiming early might result in benefit reductions due to the earnings test.

- Spousal benefits: How will your claiming decision affect your spouse?

- Survivor benefits: If you’re married, delaying can increase the survivor benefit for your spouse.

What About Medicare?

Even though your full retirement age for Social Security is 66 and 2 months, Medicare eligibility still begins at age 65. You should generally sign up for Medicare during the 7-month period around your 65th birthday to avoid late enrollment penalties, even if you plan to delay Social Security benefits.

The Reality of Retirement Planning for 1955 Babies

Many of my clients born in 1955 have already reached their full retirement age as of 2022. If you’re reading this and haven’t claimed your benefits yet, you’re now in the position to either:

- Claim your full benefits immediately

- Wait longer to increase your monthly payment (until age 70)

My Personal Advice

As someone who helps people with these decisions regularly, I’ve seen that there’s no one-size-fits-all answer. Your retirement timing depends on your unique situation.

However, if you’re still working and enjoy your job, waiting until at least your FRA of 66 and 2 months gives you the most options. You can claim full benefits while still working without any earnings test reductions after FRA.

If you’ve already stopped working and need the income, claiming now makes perfect sense – you’ve reached your full retirement age and are entitled to 100% of your benefit.

For those who can afford to wait, delaying until 70 will maximize your monthly payment – which can be especially valuable if you’re concerned about outliving your savings.

Planning Beyond Social Security

Remember that Social Security was never designed to be your only source of retirement income. Most financial experts suggest it will replace about 40% of your pre-retirement income. Having additional savings through 401(k)s, IRAs, or other investments is crucial for a comfortable retirement.

Ready to Make Your Decision?

If you’re ready to apply for Social Security benefits, you can:

- Apply online at the Social Security Administration website

- Call Social Security at 1-800-772-1213

- Visit your local Social Security office

Before making your final decision, you might want to create a my Social Security account on the SSA website. This lets you see your personalized benefit estimates based on different claiming ages.

As a 1955 baby, your full retirement age is 66 and 2 months. You could have started receiving reduced benefits as early as age 62, or you can wait until 70 for maximum benefits.

The best time to claim depends on your health, financial situation, and personal preferences. Remember that this decision will affect your monthly income for the rest of your life, so it’s worth taking the time to consider all your options.

Have you already claimed your benefits, or are you still deciding? I’d love to hear about your experience in the comments!

Medicare enrollment can be impacted by Social Security benefits

Depending on your situation, you with either need to enroll in Medicare at age 65 or you may be able to delay. If you continue to work past age 65 and have creditable employer coverage (or you have creditable employer coverage through a spouse), you can likely delay enrolling in Medicare until you lose that employer coverage. Most of the time, people who turn 65 must sign up for Medicare during their Initial Enrollment Period (IEP), which lasts for 7 months. If they do not, they will have to pay fines. Your IEP begins 3 months before the month of your 65th birthday and ends 3 months after.

Social Security benefits fit in the Medicare enrollment journey in one special way. If you are receiving either Social Security benefits for retirement or for disability, or Railroad Retirement Board benefits, you will be automatically enrolled in Medicare Part A and Part B when you first become eligible.

SSA benefits and Medicare

So let’s go back to how your full retirement age and Medicare may interact. The biggest thing is that in the past, at age 65, you both got your SSA benefits and became Medicare eligible. This meant you could use your SSA benefits to help pay for Medicare. However, with the full retirement age being at least a year or more past 65, you need to think carefully about when you take your SSA benefits if you want to use them for Medicare costs.

Born in 1955? Social Security Math Just Changed on January 1st.

FAQ

When can I draw Social Security if I was born in 1955?

If you were born in 1955, your full retirement age is 66 and 2 months (En español) You can start receiving your Social Security retirement benefits as early as age 62, but the benefit amount you receive will be less than your full retirement benefit amount.

When did Social Security change from 55 to 62?

On June 30, 1961, the Social Security Act was changed so that all workers, regardless of gender, could start getting retirement benefits at age 62. July 30, 1965: President Lyndon Johnson signs Medicare into law.

At what age do you get 100% of your Social Security?

When you reach your Full Retirement Age (FRA), which is 67 years old for people born in 1960 or later, you get 100% of your Social Security benefits.

What is the state pension age for people born in 1955?

The State Pension Age is currently increasing for both men and women. For men it is currently 65, this will be increasing to 66 from 2024 to 2026, to 67 from 2034 to 2036 and to 68 from 2044 to 2046. For women born before 06 April 1950 your State Pension Age is 60, if you were born after 05 April 1955 it is 65.

What is my retirement age if I was born in 1955?

For those born in 1955, your full retirement age is 66 years and two months. This age is not just a milestone; it determines the amount of your benefit and those of your family. The longer you delay filing for benefits, up to age 70, the higher your monthly payments will be.

What is the full retirement age if you were born in 1960?

67 is the full retirement age for individuals born in 1960 or later. If you were born before 1960, your full retirement age may be slightly different. For those born between 1943 and 1954, the full retirement age is 66. For those born in 1955, the full retirement age is 66 and 2 months.

What is the retirement age if you were born in 1959?

People born in 1959 can now get full benefits at age 66 years and 10 months. Starting in 2026, people born in 1960 or later will be able to retire at age 67. This marks the conclusion of a phased increase initiated under the 1983 amendments.

What is the full retirement age?

For those born between 1943 and 1954, the full retirement age is 66. For those born in 1955, the full retirement age is 66 and 2 months. For those born in 1956, the full retirement age is 66 and 4 months. For those born in 1957, the full retirement age is 66 and 6 months. For those born in 1958, the full retirement age is 66 and 8 months.

When is the full retirement age for Social Security?

People born in 1959 reach their full retirement age at 66 years and 10 months, while those born in 1960 or later will reach full retirement age at 67. This change is important for anyone nearing retirement and considering when to begin collecting benefits. In 2025, the full retirement age for Social Security reached a significant milestone.

What is the full retirement age in 2025?

In 2025, the full retirement age has now reached its final phase of gradual increases. People born in 1959 reach their full retirement age at 66 years and 10 months, while those born in 1960 or later will reach full retirement age at 67. This change is important for anyone nearing retirement and considering when to begin collecting benefits.