“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

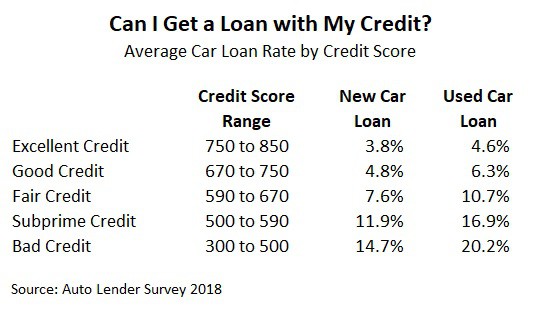

Getting a car loan is one of the most common ways that people finance a new or used car purchase However, interest rates can vary widely depending on your credit score In this article, we’ll take a look at what kind of interest rates you can expect with a credit score of 700 when taking out an auto loan.

Understanding Credit Scores

Your credit score is a number between 300 and 850 that is calculated based on information in your credit report. This includes payment history, amounts owed, length of credit history, new credit, and credit mix. Scores are ranked as:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Very Poor

Higher scores indicate to lenders that you are a lower credit risk and more likely to repay debt obligations. A 700 credit score is in the good range, though not yet excellent.

What Determines Your Interest Rate?

When you apply for a car loan several factors determine the interest rate you will be offered, including

- Credit score: The biggest factor. Higher scores mean lower rates.

- Income: Lenders want to see you can afford the monthly payments.

- Down payment: More money down means less risk for the lender.

- Term length: Shorter loans have lower rates.

- Vehicle: New car loans tend to have lower rates than used.

- Overall economic conditions: Interest rates tend to be lower when the economy is weaker.

While you can’t control all these factors, having a higher credit score gives you the most leverage to negotiate a lower rate.

Average Rates for a 700 Credit Score

According to data from credit bureau Experian in 2025, borrowers with a 700 credit score had an average interest rate of:

- New car loan: 7.1%

- Used car loan: 8.09%

- Refinancing loan: 6.73%

So with a 700 credit score, you should expect average interest rates between 6-8% for a new or used auto loan, assuming a standard 5-year repayment term. Refinancing tends to have lower rates on average.

However, you still may be able to find loans both above and below these averages if you shop around. Our company has found car loan rates as low as 3% and as high as 20% for borrowers with 700 credit. The ability to qualify for the lowest and highest advertised rates depends on other factors like your debt-to-income ratio.

Estimated Monthly Payments

To give an idea of how interest rates translate to monthly payments, here are estimated payments on a 5-year, $25,000 car loan with a 700 credit score:

| Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|

| 7.1% | $530 | $5,688 |

| 8.09% | $542 | $6,497 |

| 6.73% | $522 | $5,257 |

As you can see, the higher the rate, the more you pay each month and overall. Just a 1-2 percentage point difference in rates can cost $1,000+ extra in interest charges over the life of the loan.

How to Get the Best Interest Rate

While your credit score is a big factor, there are things you can do to help get the lowest rate possible for your situation:

- Shop around: Compare rates from banks, credit unions, online lenders. Pre-qualify with multiple lenders.

- Improve your credit: Pay bills on time and lower debt. Even small improvements can help.

- Make a larger down payment: Put down 20% of the car’s value if possible to get the best terms.

- Choose a shorter loan term: Opt for a 3-year instead of 5-year loan.

- Have a co-signer: A cosigner with higher credit can help you qualify for better rates.

- Ask about discounts: Some lenders offer discounts for things like setting up autopay.

Taking some time to research different lenders and programs can really pay off through lower monthly payments and less interest charges over the life of your loan. With a credit score of 700, it’s possible to get competitive rates with some shopping savvy.

The Bottom Line

A 700 credit score is considered good and puts you in a better position to get approved for a car loan as well as negotiate the interest rate. For both new and used car loans, average interest rates are 7-8% but rates can vary more widely based on the lender and other qualifying factors. Improving your credit, putting more money down, and shopping around gives you a better shot at landing the most favorable financing. By understanding average rates and taking steps to boost your profile, you can feel confident about getting the lowest auto loan interest rate for your situation.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- • Personal finance

- • Consumer loans

Calendar Icon 4 Years of personal finance experience Brittany Howard joined the Bankrate team in 2024. Before specializing in loans, she wrote on a range of personal finance topics, including checking and savings accounts, credit cards, and credit scores.

- • Auto loans

- • Personal loans

Calendar Icon 8 Years of personal finance experience Kellye Guinan is an editor and writer with over seven years of experience in personal finance.

- • Business finance

- • Corporate consolidations

Thomas is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. His investment experience includes oversight of a $4 billion portfolio for an insurance group. Varied finance and accounting work includes the preparation of financial statements and budgets, the development of multiyear financial forecasts, credit analyses, and the evaluation of capital budgeting proposals. In a consulting capacity, he has assisted individuals and businesses of all sizes with accounting, financial planning and investing matters; lent his financial expertise to a few well-known websites; and tutored students via a few virtual forums.

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

Average auto loan interest rates by credit score

| FICO score | New car loans | Used car loans |

|---|---|---|

| Superprime (781 to 850) | 5.18% | 6.82% |

| Prime (661 to 780) | 6.70% | 9.06% |

| Near prime (601 to 660) | 9.83% | 13.74% |

| Subprime (501 to 600) | 13.22% | 18.99% |

| Deep subprime (300 to 500) | 15.81% | 21.58% |

Borrowers with the highest scores receive the lowest rates, but it’s possible to get a good rate without a perfect score. Lenders consider several factors when determining interest rates, including your credit score. By improving your score for a car loan, you can save money by qualifying you for a better rate. There isn’t a significant difference between a superprime borrower and a prime borrower, but rates increase significantly if you fall outside of the prime range.

What APR Will I Get With a 700 Credit Score? – CreditGuide360.com

FAQ

What is a good APR for a car with a 700 credit score?

| FICO score | New car loans | Used car loans |

|---|---|---|

| Superprime (781 to 850) | 5.18% | 6.82% |

| Prime (661 to 780) | 6.70% | 9.06% |

| Near prime (601 to 660) | 9.83% | 13.74% |

| Subprime (501 to 600) | 13.22% | 18.99% |

What is a good interest rate on a 72 month car loan?

Is a 700 credit score good enough to buy a car?

What auto loan interest rate can I get with a 750 credit score?