Want to know when you can retire with full benefits if you were born in 1957? The short answer is that you can retire at age 66 years and 6 months. But there’s a lot more you should know about how to retire!

I’ve spent years helping people understand their Social Security benefits. Today, I’m going to tell you everything you need to know if you were born in 1957. Let’s talk about what this means for your retirement plans and how to get the most out of your benefits.

Understanding Full Retirement Age for Those Born in 1957

If you were born in 1957, your full retirement age (FRA) is 66 years and 6 months. This is the age at which you become eligible to receive 100% of your primary insurance amount (PIA) – basically, your full Social Security benefit based on your lifetime earnings.

Social Security sets different retirement ages for people based on the year they were born. This wasn’t always the case; since 1937, the retirement age for people has been slowly rising.

Here’s how the full retirement ages break down by birth year:

| Birth Year | Full Retirement Age |

|---|---|

| 1943-1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960+ | 67 |

So if you were born in 1957, you’ll reach your full retirement age of 66 and 6 months in 2023 or 2024, depending on your birth month.

Your Options: Claiming Before Full Retirement Age

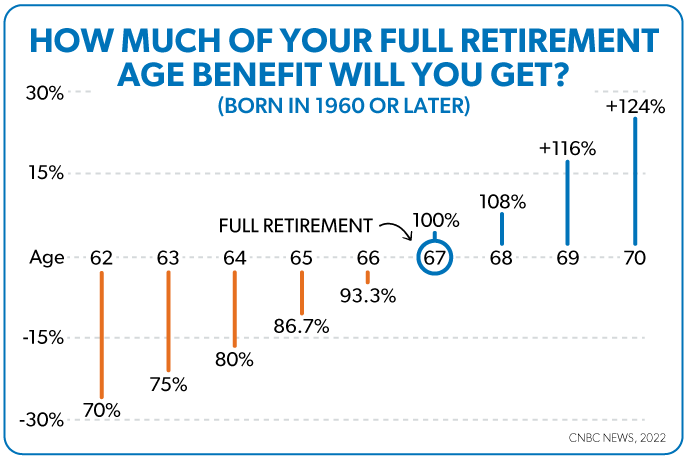

There is no need to wait until you reach full retirement age to start getting Social Security. As early as age 62, you can start getting benefits. But—and this is a big but—if you claim early, your monthly benefit amount will go down for good.

If you were born in 1957 and decide to claim benefits at age 62, your benefit will be reduced to approximately 72.5% of your full retirement amount. That’s a significant reduction that will affect your monthly income for the rest of your life!

The reduction is calculated based on how many months before your FRA you claim benefits:

- For the first 36 months before your FRA, your benefit is reduced by 5/9 of 1% per month

- For months beyond 36, an additional reduction of 5/12 of 1% applies for each month

This means if you claim at exactly age 62 when your full retirement age is 66 and 6 months (54 months early), you’ll face a substantial permanent reduction.

Here’s a clearer picture of how early claiming affects your benefits if you were born in 1957:

- Age 62: 72.5% of full benefit

- Age 63: 77.5% of full benefit

- Age 64: 83.3% of full benefit

- Age 65: 90.0% of full benefit

- Age 66: 96.7% of full benefit

- Age 66 and 6 months: 100% of full benefit

The Benefits of Waiting: Delayed Retirement Credits

On the flip side, you can also choose to delay receiving your Social Security retirement benefits beyond your full retirement age. This strategy can significantly increase your monthly payments through what are called “delayed retirement credits.”

For those born in 1957 (and anyone born in 1943 or later), these delayed retirement credits accumulate at a rate of 8% per year – or about 2/3 of 1% per month. These credits continue to accrue until age 70, after which there’s no additional benefit to delaying.

So if you were born in 1957 and delay claiming until age 70, you could receive approximately 28% more than your full retirement age benefit (that’s 42 months of delay × 2/3% per month).

Let me break it down with an example:

If your full retirement benefit at age 66 and 6 months would be $2,000 per month, waiting until age 70 could increase your benefit to about $2,560 per month. That’s a significant difference that will continue for the rest of your life!

Spousal Benefits Considerations for 1957 Babies

If you’re married and were born in 1957, there are some special considerations regarding spousal benefits that you should be aware of.

A spouse can claim benefits based on their own work record or up to 50% of their partner’s benefit at full retirement age, whichever is higher. However, just like regular retirement benefits, claiming spousal benefits early results in a reduction.

If you claim spousal benefits at age 62, you’ll only receive about 33.8% of your spouse’s full benefit amount, rather than the full 50%. The reduction schedule is different than for regular retirement benefits, so it’s important to understand these differences when planning.

Here’s a quick glance at spousal benefit reductions:

- Age 62: 33.8% of spouse’s full benefit

- Age 63: 36.3% of spouse’s full benefit

- Age 64: 39.6% of spouse’s full benefit

- Age 65: 43.8% of spouse’s full benefit

- Age 66: 47.9% of spouse’s full benefit

- Age 66 and 6 months: 50% of spouse’s full benefit

Making Your Decision: Early, Full, or Delayed Benefits?

Deciding when to claim your Social Security benefits is one of the biggest financial decisions you’ll make. There’s no one-size-fits-all answer – it depends on your personal situation.

Here are some factors to consider:

Reasons to claim early:

- You need the income immediately

- Your health is poor and you don’t expect to live to average life expectancy

- You want to enjoy retirement while you’re younger and more active

- You plan to continue working part-time and can manage the earnings limits

Reasons to claim at full retirement age:

- You want your full benefit amount

- You’re still working and want to avoid the earnings test

- You want to balance between early income and maximizing lifetime benefits

- You plan to file a restricted application for spousal benefits (if eligible)

Reasons to delay beyond full retirement age:

- You don’t need the income yet

- You’re still working

- You expect to live longer than average

- You want to maximize survivor benefits for your spouse

- You can afford to wait and want the larger monthly check

How to Apply for Social Security Retirement Benefits

When you’re ready to apply for your Social Security retirement benefits, you’ll need to gather some information first. This makes the process much smoother.

You’ll need:

- Your Social Security number

- Your birth certificate (original or certified copy)

- W-2 forms or self-employment tax returns from the previous year

- Your bank’s routing number and account number for direct deposit

You can apply in several ways:

- Online through the Social Security Administration website (the most convenient method)

- By phone through the SSA’s toll-free number

- In person at your local Social Security office

After submitting your application, it typically takes several weeks for the SSA to process your claim. You can check the status online or by phone, and the SSA will notify you when they’ve made a decision.

Real-Life Examples: Making the Most of Your 1957 Birth Year

Let me share a couple examples of how different claiming strategies might play out for someone born in 1957:

Example 1: Early Claiming

Maria was born in June 1957 and decides to claim benefits at age 62. Her full retirement age benefit would have been $2,000 monthly at age 66 and 6 months, but by claiming 54 months early, her benefit is reduced to about $1,450 per month. While this means she receives less money each month, she gets benefits for an additional 4.5 years compared to waiting until her full retirement age.

Example 2: Delayed Claiming

James was also born in 1957 but has decided to delay claiming until age 70. His full retirement benefit would be $2,400 at age 66 and 6 months, but by waiting until 70, his monthly benefit grows to about $3,072 (a 28% increase). Though James forgoes benefits for 3.5 years after reaching full retirement age, his higher monthly amount will be advantageous if he lives into his mid-80s or beyond.

The Break-Even Point: When Delaying Makes Financial Sense

A common question I get is: “When does delaying benefits actually pay off?” This is known as the “break-even point.”

If you were born in 1957, the break-even point between claiming at full retirement age (66 and 6 months) versus age 70 typically occurs in your early 80s. If you live beyond this point, delaying will have provided more total lifetime benefits. If you don’t reach this age, claiming earlier would have been financially advantageous.

But remember – this isn’t just about maximizing the total dollar amount. It’s also about having sufficient income when you need it most. Some people prefer the security of a larger monthly check later in life when other resources might be depleted.

Special Considerations for Those Born on the First of the Month

Here’s something many people don’t realize: If your birthday falls on the 1st of the month, the Social Security Administration actually considers you to have been born in the previous month for benefit calculation purposes.

So if you were born on January 1, 1957, the SSA would treat your birth date as December 1956 for determining your benefits. This would actually give you a slightly earlier full retirement age of 66 and 4 months instead of 66 and 6 months.

Wrapping Up: Planning Your Retirement Strategy

If you were born in 1957, understanding that your full retirement age is 66 and 6 months is just the beginning. The best claiming strategy depends on your individual circumstances, including your health, financial needs, marital status, and other retirement resources.

Remember these key points:

- Your full retirement age is 66 years and 6 months

- Claiming at age 62 reduces your benefit to 72.5% of your full amount

- Waiting until age 70 increases your benefit by approximately 28%

- Spousal benefits work differently and have different reduction rates

- The decision is personal and should take into account your unique situation

Don’t hesitate to reach out to the Social Security Administration directly with specific questions about your benefits, or consider consulting with a financial advisor who specializes in retirement planning to develop a strategy that works for your unique situation.

What’s full retirement age?

| If you were born in… | Your full retirement age is… |

|---|---|

| 1957 or earlier | Youve already hit full retirement age |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 or later | 67 |

How much will my Social Security benefits be?

What is the full retirement age for Social Security born in 1957?

FAQ

At what age can you earn unlimited income on Social Security born in 1957?

If you were born between 1957, your full retirement age is 66 and 6 months (En español)

Can you collect Social Security at 66 and still work full time?

At what age is Social Security no longer taxed?

There is no set age at which you no longer have to pay taxes on your Social Security benefits; you are taxed based on your total income, not your age. If your “combined income” (adjusted gross income, tax-free interest, and up to half of your Social Security benefits) is less than a certain amount, you may not have to pay taxes on your Social Security.

At what age do you get 100% of your Social Security benefits?

The full retirement age increases gradually if you were born from 1955 to 1960 until it reaches 67. For anyone born 1960 or later, full retirement benefits are payable at age 67.

What is the retirement age if you were born in 1959?

People born in 1959 can now get full benefits at age 66 years and 10 months. Starting in 2026, people born in 1960 or later will be able to retire at age 67. This marks the conclusion of a phased increase initiated under the 1983 amendments.

When would you retire if you were born in 1957?

If you were born in 1957, you may have had the year 2022 on your radar as the year you would retire. After all, you turned 65 in 2022, and 65 has long been associated with retirement.

When is the full retirement age for Social Security?

People born in 1959 reach their full retirement age at 66 years and 10 months, while those born in 1960 or later will reach full retirement age at 67. This change is important for anyone nearing retirement and considering when to begin collecting benefits. In 2025, the full retirement age for Social Security reached a significant milestone.

What is a full retirement age?

Your full retirement age is the point at which you are entitled to receive 100% of your Social Security benefit, which is based on your lifetime earnings record. This age varies depending on your year of birth. For anyone born in 1960 or later, the FRA is 67.

What is the target age for Social Security retirement?

But the age for full retirement, meaning the age at which you can begin collecting full Social Security retirement benefits, has crept up over time and now exceeds age 65 for many Americans. If you were born in 1957, your full Social Security retirement age is 66 years and six months. That means 2023 is actually the target year for your retirement.

When can I start collecting my retirement benefits?

Claiming at 62: You can start collecting as early as 62, but your monthly benefit is permanently reduced. The reduction can be up to 30% depending on your full retirement age. Claiming at FRA: Waiting until your full retirement age ensures you receive 100% of your earned benefit. For people born in 1960 or later, this means waiting until age 67.