Are you turning 65 this year? If youve been looking forward to receiving your full Social Security benefits, youve still got a couple of years to wait. That goes for the record number of other Americans who will be 65 years old in 2025.

Congress passed a law in 1983 to gradually raise the full retirement age (FRA) from 65 to 67. This was done because people are living longer and the move could help Social Security funds that are running out. For people born in 1960 or later, 67 is the official age you need to reach to get your full benefit this year.

You dont have to wait. As early as age 62, everyone can start getting less money from Social Security, but if you wait until FRA, you’ll get a bigger monthly check. Waiting at least to your FRA not only ensures someone receives 100% of their personal benefits, “but it also means your spouse may receive higher spousal and/or survivor benefits,” said Ben Rizzuto, wealth strategist at Janus Henderson Investors.

Its one of five changes to Social Security that took effect in 2025. The others were a cost-of-living adjustment, higher Social Security work credit requirements, a higher ceiling on Social Security payroll taxes, and higher earnings test limits.

If you were born in 1956, figuring out your Social Security retirement benefits can feel like solving a puzzle I’ve helped many clients navigate this confusing territory, and the most common question I hear is “When exactly can I retire with full benefits?”

The short answer? If you were born in 1956, your full retirement age for Social Security is 66 years and 4 months.

But there’s a lot more you need to know to get the most out of your benefits. Let’s get into the specifics that will help you make the best choice for your retirement.

Understanding Full Retirement Age (FRA)

When you reach full retirement age, you can start getting 10% of your earned Social Security benefit. This age changes based on the year you were born; the Social Security Administration has set different FRAs for each birth year.

For many years, 65 was considered the standard retirement age. But changes to Social Security law have slowly raised this age.

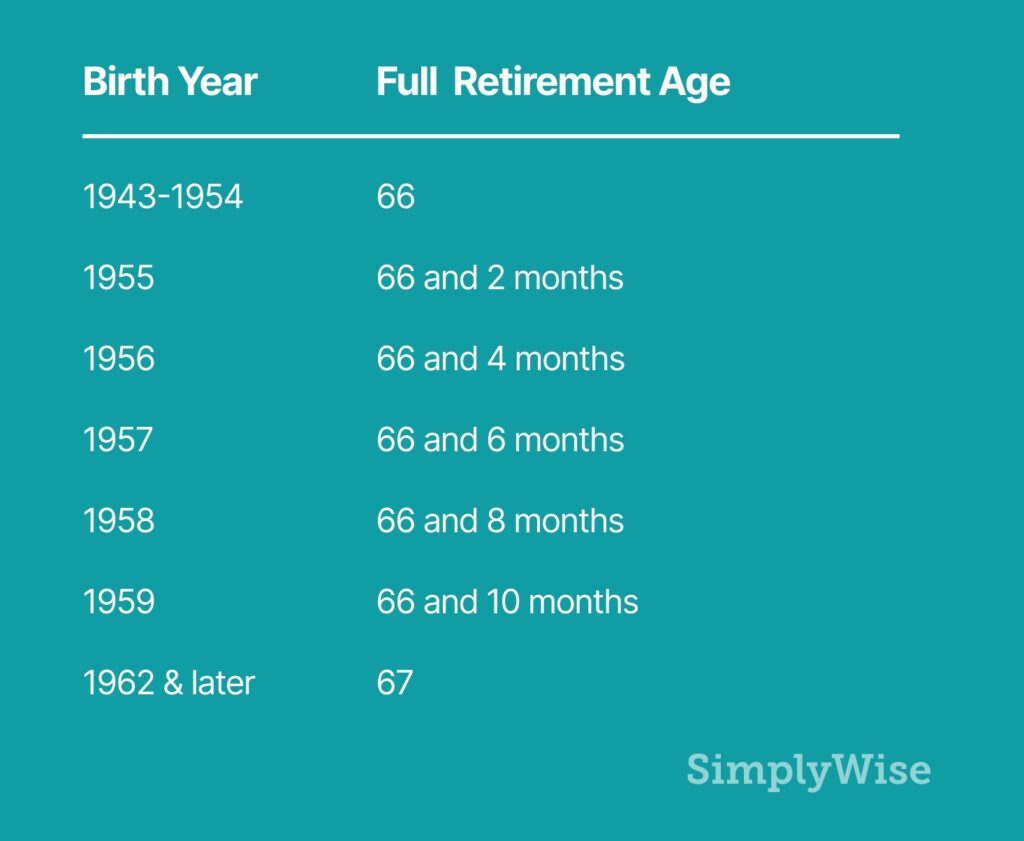

Here’s a quick breakdown of full retirement ages by birth year:

- 1937 and earlier: 65 years

- 1938: 65 years and 2 months

- 1939: 65 years and 4 months

- 1940: 65 years and 6 months

- 1941: 65 years and 8 months

- 1942: 65 years and 10 months

- 1943-1954: 66 years

- 1955: 66 years and 2 months

- 1956: 66 years and 4 months

- 1957: 66 years and 6 months

- 1958: 66 years and 8 months

- 1959: 66 years and 10 months

- 1960 and later: 67 years

As you can see if you were born in 1956 you’ll need to wait until you’re 66 years and 4 months old to receive your full Social Security benefit.

Early Retirement: What Happens If You Claim Before FRA?

Many people wonder if they can start taking Social Security before reaching their full retirement age. The answer is yes, but there’s a catch – your benefits will be permanently reduced.

You can start getting benefits as early as age 62 if you were born in 1956, but your monthly payment will go down to about 73 three percent of what you would get when you retire at the full age of sixty-six years and four months.

Here’s how the reduction works for those born in 1956:

| Age When You Claim | Percentage of Full Benefit (Wage Earner) | Percentage of Full Benefit (Spouse) |

|---|---|---|

| 62 | 73.3% | 34.2% |

| 63 | 78.3% | 36.7% |

| 64 | 84.4% | 40.3% |

| 65 | 91.1% | 44.4% |

| 66 | 97.8% | 48.6% |

| 66 + 4 months | 100% | 50% |

As the table shows, the closer you get to your full retirement age, the smaller the reduction. But remember, these reductions are permanent – your benefit won’t increase when you reach your full retirement age.

Delaying Benefits: The Advantages of Waiting

On the flip side, you don’t have to take your benefits exactly at your full retirement age. If you delay claiming benefits beyond your FRA, your monthly payment will increase.

For each year you delay claiming benefits after your full retirement age, your benefit increases by approximately 8%, up until age 70. After 70, there’s no additional increase for delaying.

So if you were born in 1956 and delay claiming until age 70, your benefit would be about 29.3% higher than if you claimed at your full retirement age of 66 years and 4 months.

That’s a significant boost! This delayed retirement credit can be especially valuable if you’re in good health and expect to live a long life.

Working While Receiving Benefits

Many people ask me if they can work while receiving Social Security benefits. The answer is yes, but there may be some temporary reductions in your benefits depending on your age and earnings.

Here’s what you should know:

-

If you claim benefits before reaching your full retirement age: In 2025, if you earn more than $23,400, $1 in benefits will be withheld for every $2 you earn above that limit.

-

In the year you reach your full retirement age: The earnings limit increases significantly. You can earn up to $62,160 before any reduction, and the reduction rate is milder – $1 for every $3 earned above the limit. This reduction only applies to months before you reach your FRA.

-

After reaching your full retirement age: Once you hit 66 years and 4 months (for those born in 1956), you can earn as much as you want with no reduction in benefits.

It’s important to note that any benefits withheld while working aren’t lost forever. Once you reach your full retirement age, your benefit will be recalculated to account for the months when benefits were reduced or withheld due to earnings.

Making Your Decision: Factors to Consider

Deciding when to claim Social Security benefits is a highly personal choice. Here are some factors that might influence your decision:

Financial Needs

- Do you need the income now, or can you afford to wait?

- Do you have other sources of retirement income?

Health and Life Expectancy

- How’s your health?

- What’s your family history of longevity?

- Generally, if you expect to live past 80, waiting to claim benefits often results in more total lifetime benefits.

Employment Status

- Are you still working?

- How much are you earning?

Spouse’s Benefits

- Is your spouse eligible for benefits?

- Would your spouse receive a higher benefit as a survivor if you delay claiming?

Special Considerations for Those Born in 1956

If you were born in 1956, you’re part of a transition group as the full retirement age gradually increases from 66 to 67. The 4-month addition might seem like an odd increment, but it’s part of the way the Social Security Administration is phasing in the increase.

One thing to keep in mind: if your birthday falls on the 1st of the month, Social Security considers you to have been born in the previous month for benefit calculation purposes. This could actually work in your favor by effectively moving your full retirement age up by one month.

Steps to Take Now if You Were Born in 1956

-

Create a my Social Security account: This online tool will show you personalized estimates of your future benefits based on your actual earnings history.

-

Request a Social Security statement: Review your earnings history to ensure it’s accurate, as your benefit amount is based on your 35 highest-earning years.

-

Calculate your break-even point: This is the age at which the total benefits you’d receive by waiting begins to exceed what you’d receive by claiming early.

-

Consider your tax situation: Up to 85% of your Social Security benefits may be taxable, depending on your combined income.

-

Consult a financial advisor: A professional can help you integrate Social Security into your overall retirement plan.

Real-Life Example

Let me share a quick story about my client Margaret, who was born in October 1956. She was planning to retire and claim Social Security at exactly 66, not realizing her full retirement age was actually 66 and 4 months.

By waiting those extra four months, Margaret was able to receive her full benefit amount instead of the permanently reduced amount of 97.8% she would have received at exactly 66. Those four months made a difference of about $40 per month in her benefit – which adds up to $9,600 over 20 years of retirement!

Common Questions About Full Retirement Age for Those Born in 1956

Q: If I was born in 1956, can I still get Medicare at 65?

Yes! Medicare eligibility still begins at age 65, regardless of your full retirement age for Social Security. You can enroll in Medicare without claiming Social Security benefits.

Q: Does my full retirement age affect spousal benefits?

Yes. If you claim spousal benefits before your full retirement age of 66 and 4 months, they will be permanently reduced. At your FRA, you’re eligible for 50% of your spouse’s full benefit amount.

Q: What if I’ve already started claiming benefits early?

If it’s been less than 12 months since you filed, you may be able to withdraw your application and repay the benefits received, allowing you to restart benefits later at a higher amount. Otherwise, once you reach your full retirement age, you could suspend benefits until age 70 to earn delayed retirement credits.

Conclusion

If you were born in 1956, your full retirement age for Social Security is 66 years and 4 months. This is when you’re eligible to receive 100% of your earned benefit.

You can claim as early as 62 (with a permanent reduction) or delay until 70 (with a permanent increase). The decision should be based on your individual circumstances, including health, financial needs, and employment status.

Remember, there’s no one-size-fits-all answer to when you should claim Social Security. What matters most is making an informed decision that supports your overall retirement goals.

How do you calculate full retirement age?

The year and month you reach full retirement age depends on the year you were born.

- If you were born between 1943-1954, FRA is 66 years.

- FRA is 66 years and two months old if you were born in 1955.

- FRA is 66 years and 4 months old if you were born in 1956.

- FRA is 66 years and six months old if you were born in 1957.

- Your FRA is 66 years and 8 months if you were born in 1958.

- Your FRA is 66 years and 10 months if you were born in 1959.

- If you were born after 1960, your FRA is 67 years.

You can also use the Social Security Administration’s (SSA) tool to calculate your FRA by entering your birthday.

Note: People born on January 1 of any year should look at the previous year’s full retirement age.

What if I take Social Security later than full retirement age?

If you can wait, you can get even more every month. If you wait eight years after your FRA to start getting Social Security, your benefit will go up by eight percent every year until you reach age 70.

“This is where a lot of value can be gained by waiting to file for benefits,” Rizzuto said. “In order to do this, however, someone needs to make sure they have assets and income to use after they retire and before they take Social Security. “.

On the other hand, if you keep working after your FRA, each extra year you work adds to your Social Security record. Higher lifetime earnings can mean higher benefits when you retire, the SSA said.