You might like to save for retirement in a Roth account, but you make too much money to put money into a Roth IRA directly. And maybe you dont have access to a Roth 401(k) plan at work. In that case, you may want to learn more about the strategy called a backdoor Roth IRA.

You may have heard of the “backdoor Roth” if you’re making a lot of money but feel like you can’t get the benefits of a Roth IRA because of your income. It’s like finding the VIP entrance when the main door is closed. But does this plan work for you? Let’s break it down so you can decide if this hack for saving for retirement is worth your time.

What Exactly Is a Backdoor Roth IRA?

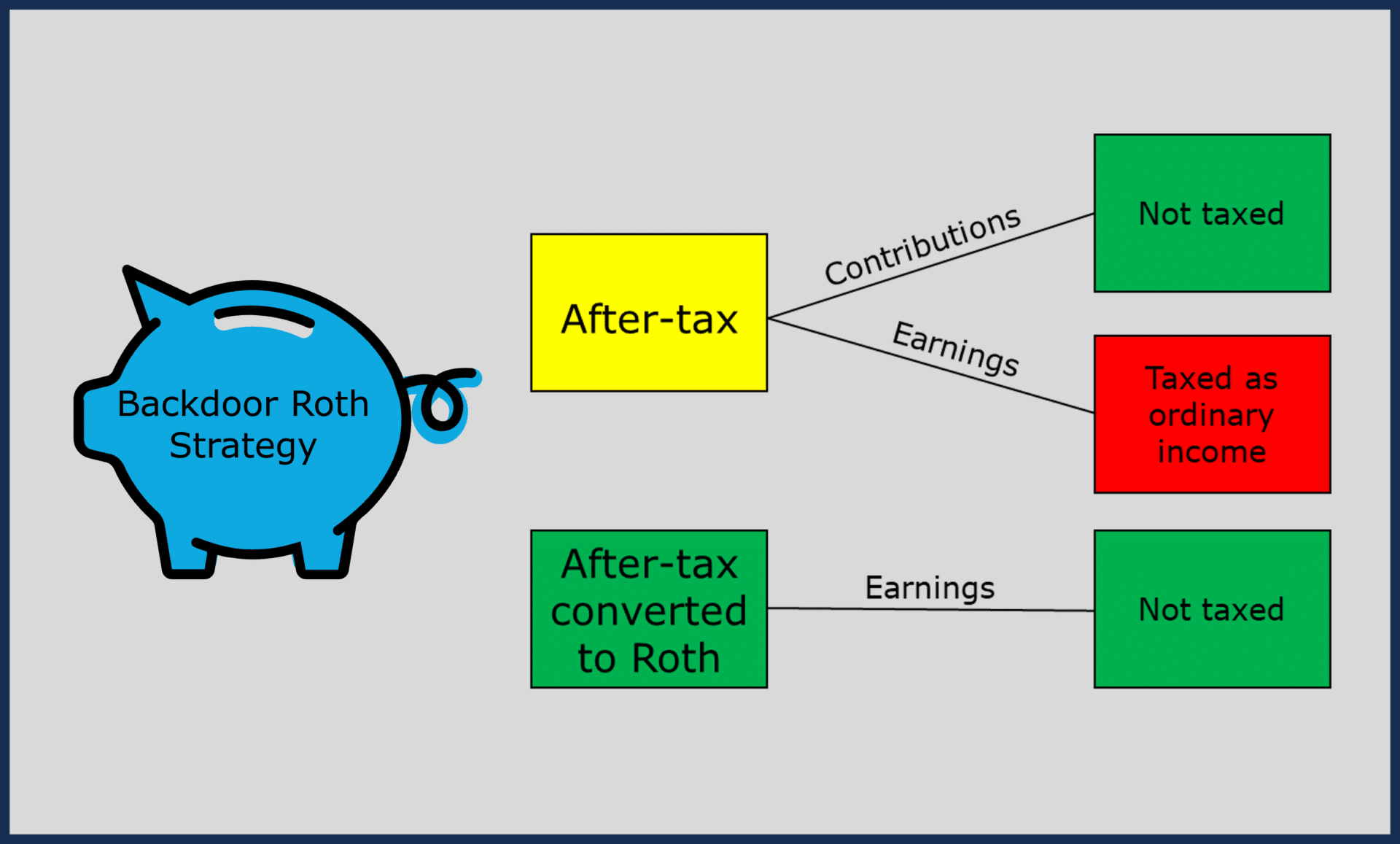

The backdoor Roth is a way for people with high incomes to contribute to a Roth IRA even though their income is higher than the limits.

Here’s how it works in two simple steps

- Open and fund a traditional IRA with after-tax dollars (up to $7,000 in 2024, or $8,000 if you’re 50+)

- Convert those funds to a Roth IRA shortly after

That’s it! Well kinda. Even though the idea seems simple, there are some important details and possible problems you should be aware of before you start.

Why Would I Want a Roth IRA Anyway?

Before we go any further with the backdoor plan, let’s go over why Roth IRAs are so popular:

- Tax-free growth – Your investments grow without any tax burden

- Tax-free withdrawals in retirement (as long as you’re 59½ and the account is at least 5 years old)

- No required minimum distributions (RMDs) – Unlike traditional IRAs, you’re never forced to withdraw money

- Great for estate planning – You can leave tax-free money to your heirs

Who Needs the Backdoor? Income Limits for 2024

For 2024, direct Roth IRA contributions are limited if your modified adjusted gross income (MAGI) exceeds:

- $240,000 for married couples filing jointly

- $161,000 for single filers

If you make more than these amounts, that’s when the backdoor strategy comes into play.

The Backdoor Process: Step by Step

Let me walk you through how this actually works:

- Open a traditional IRA if you don’t already have one

- Make a non-deductible contribution (after-tax dollars)

- Convert to a Roth IRA soon after funding (the sooner the better to minimize any taxable gains)

- File IRS Form 8606 to report the non-deductible contributions when you do your taxes

Sounds easy enough, right? But wait – there are some gotchas you should know about.

4 Major Backdoor Roth Pitfalls to Watch Out For

Pitfall #1: The Pro-Rata Rule Could Hit You With a Surprise Tax Bill

This is the BIG one that trips up many people. If you have existing pre-tax money in ANY traditional IRA accounts (including SEP and SIMPLE IRAs), the IRS won’t let you just convert your new after-tax contribution. Instead, they look at all your IRAs as one big account.

Here’s an example:

- You have $93,000 in existing traditional IRAs (pre-tax money)

- You make a new $7,000 non-deductible contribution

- You try to convert just that $7,000 to a Roth

The IRS sees this as: $7,000 ÷ $100,000 = 7% after-tax money

So only 7% of your conversion ($490) would be tax-free. You’d owe income tax on the other $6,510!

As the Schwab article explains: “That may diminish the appeal somewhat, but once the account has been converted, earnings compound tax-free.”

Pitfall #2: The Five-Year Rule(s)

With Roth IRAs, there’s a 5-year waiting period that applies in two different ways:

-

For contributions: You must wait 5 years from your FIRST Roth contribution before withdrawing earnings tax-free (even if you’re over 59½)

-

For conversions: Each backdoor conversion has its own 5-year clock before you can withdraw that converted amount penalty-free if you’re under 59½

As Brian Robinson, a CFP in Phoenix, notes in the Forbes article: “If you think there’s any chance you may need the money sooner than five years, you might want to reconsider making the move.”

Pitfall #3: Impact on Social Security and Medicare

If you’re already receiving Social Security or enrolled in Medicare, a Roth conversion could have unexpected consequences:

- Social Security taxation: The taxable portion of your conversion might make more of your Social Security benefits taxable

- Medicare premiums: Your Medicare Part B and Part D premiums are based on your income from two years prior – a large conversion could temporarily increase your costs

Pitfall #4: Your Future Tax Rate Matters

The whole point of a Roth is to pay taxes now to avoid taxes later. But this only makes sense if:

- You expect to be in the same or higher tax bracket in retirement

- You believe tax rates in general will increase in the future

- You want to leave tax-free money to heirs

If you expect to be in a significantly lower tax bracket in retirement, paying taxes now through a backdoor Roth might not be the best move.

Is a Backdoor Roth Right for ME?

To help you decide, ask yourself these questions:

-

Do I already have other traditional IRA assets? If yes, be prepared for pro-rata tax consequences.

-

Will I need this money within 5 years? If yes, consider other strategies.

-

Am I already taking Social Security or on Medicare? If yes, calculate the potential impact on benefits and premiums.

-

Do I expect my tax rate to be higher or lower in retirement? Be honest about your future income expectations.

-

Can I afford to pay the taxes now? Remember, any pre-tax money that gets converted will be taxed at your current income tax rate.

What About the Legal Status of Backdoor Roths?

It’s worth noting that the IRS hasn’t officially blessed this strategy. As the Schwab article points out: “The lack of a definitive ruling means there is some risk involved.”

However, the backdoor Roth has been around for many years, and countless taxpayers have used it without problems. Still, it’s always smart to work with a tax professional who can guide you through the process correctly.

Alternatives to Consider

If the backdoor Roth seems too complicated or risky for your situation, consider these alternatives:

- Roth 401(k) – Many employer plans now offer Roth options with no income limits

- Mega Backdoor Roth – If your 401(k) plan allows after-tax contributions and in-plan Roth conversions

- Health Savings Account (HSA) – Often called the “stealth IRA” due to its triple tax advantages

- Taxable brokerage account – With proper tax management, this can be surprisingly efficient

The Bottom Line: Proceed With Professional Help

A backdoor Roth IRA can be a powerful way to build tax-free retirement savings when you’re otherwise locked out due to income. But as we’ve seen, there are several potential pitfalls that could make this strategy less attractive or even costly.

Before proceeding, I strongly recommend consulting with a qualified financial advisor and tax professional who understands your complete financial picture. They can help you navigate the complex rules and determine if this strategy aligns with your long-term goals.

As the Forbes article concludes: “Talk to a trusted tax professional or financial advisor who understands all the moving pieces first. Backdoor Roth IRAs impact your taxable income, and a professional can help you navigate the potential pitfalls of this useful strategy.”

Have you tried the backdoor Roth strategy? I’d love to hear about your experiences in the comments below!

Note: This article is for informational purposes only and should not be considered financial or tax advice. Always consult with qualified professionals regarding your specific situation.

Roth IRA income requirements

| Filing status | Modified adjusted gross income (MAGI) | Contribution limit |

| Single individuals | < $146,000 | $7,000 |

| ≥ $146,000 but < $161,000 | Partial contribution (calculate) | |

| ≥ $161,000 | Not eligible | |

| Married (filing joint return) | < $230,000 | $7,000 |

| ≥ $230,000 but < $240,000 | Partial contribution (calculate) | |

| ≥ $240,000 | Not eligible | |

| Married (filing separately) 2 | ||

| < $10,000 | Partial contribution (calculate) | |

| ≥ $10,000 | Not eligible |

| Filing status | Modified adjusted gross income (MAGI) | Contribution limit |

| Single individuals | < $150,000 | $7,000 |

| ≥ $150,000 but < $165,000 | Partial contribution (calculate) | |

| ≥ $165,000 | Not eligible | |

| Married (filing joint return) | < $236,000 | $7,000 |

| ≥ $236,000 but < $246,000 | Partial contribution (calculate) | |

| ≥ $246,000 | Not eligible | |

| Married (filing separately) 2 | ||

| < $10,000 | Partial contribution (calculate) | |

| ≥ $10,000 | Not eligible |

Internal Revenue Service, November, 2024.

Good to know: People who are 50 or older are entitled to an additional catch-up contribution amount of $1,000 in both 2024 and 2025.

How to set up a Roth IRA to make a backdoor contribution

The steps for implementing a backdoor Roth IRA strategy are relatively straightforward:

- Set up a traditional IRA if you don’t already have one and put money in it with after-tax contributions. (If you already have an IRA, think about how the above-mentioned IRA aggregation rule will affect the conversion.) ) File Form 8606 each year to track your basis.

- If you don’t already have a Roth, open one and follow the instructions from the IRA administrator to convert the after-tax contribution.

- Pay taxes on any converted earnings or deductible contributions. Don’t forget that a conversion must be finished by December 31 in order to be counted toward this year’s taxes. You might want to talk to a tax expert about how a backdoor Roth IRA might affect your taxes.

Simple Back Door ROTH IRA Guide (TAX FREE FOR LIFE!)

FAQ

Is Backdoor Roth really worth it?

A backdoor Roth IRA is worth it for high-income earners who can’t contribute directly to a Roth IRA, as it allows them to contribute after-tax dollars into a traditional IRA and then convert those funds to a Roth IRA for tax-free growth and withdrawals in retirement. It’s a beneficial strategy if you have no other traditional IRA balances, as the pro-rata rule can trigger taxes on the conversion if you have existing pre-tax IRA funds.

When should you not do a backdoor in Roth IRA?

If you have a balance in a rollover IRA, you may not want to make a backdoor Roth conversion because of the pro rata rule. This rule requires all IRA distributions to be taken proportionally from your pre-tax and after-tax contribution sources, which could limit the tax benefits you’d receive from a Roth conversion.

Should I max 401k or backdoor Roth first?

Some say to do an IRA before 401k, simply because of more options. But if you want to do pre-tax but make too much to deduct IRA contributions then you max the pre-tax options first, then do a Roth or backdoor Roth.

Do you get double taxed on Backdoor Roth?

why else would he have provided something that was easy to understand. No, backdoor Roth conversion is not taxed twice. Jan 22, 2025.

What is a backdoor Roth IRA?

A backdoor Roth IRA is not a specific type of IRA, but rather a strategy to help wealthier taxpayers avoid certain Roth IRA restrictions. Backdoor Roth IRAs have been in the news as of late due to provisions in President Joe Biden’s ‘Build Back Better’ legislation that would limit their use.

Could a backdoor Roth IRA benefit high-income earners?

A backdoor Roth IRA could benefit high-income earners. A “backdoor Roth IRA” is just a name for a strategy of converting nondeductible contributions in a traditional IRA to a Roth IRA. The strategy can be helpful for those who earn too much to contribute directly to a Roth IRA.

Should you invest in a backdoor Roth IRA?

For tax savings, that may mean investing in a Roth IRA. This account provides tax-free income in retirement. But only some workers are eligible to contribute to one directly. In that case, a backdoor Roth IRA may be the ticket to this valuable tax benefit. What is a backdoor Roth IRA? Roth IRAs have several benefits.