A 710 credit score falls into the “good” band and will qualify you for some credit cards and loans, but may not get you the lowest rates.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

Having a good credit score is important for getting approved for loans, credit cards, and other financial products. But what exactly constitutes a “good” credit score? Specifically, is a 710 credit score from TransUnion considered good?

The short answer is yes, a 710 TransUnion credit score is generally considered good Let’s take a deeper look at what credit scores mean and why 710 is a solid score

What is a Credit Score?

A credit score is a three-digit number that lenders use to evaluate your creditworthiness for loans and credit cards. The most commonly used credit scoring models are FICO scores and VantageScores.

FICO scores range from 300 to 850. VantageScores also use a 300-850 scale. The higher the number the better your credit is considered to be.

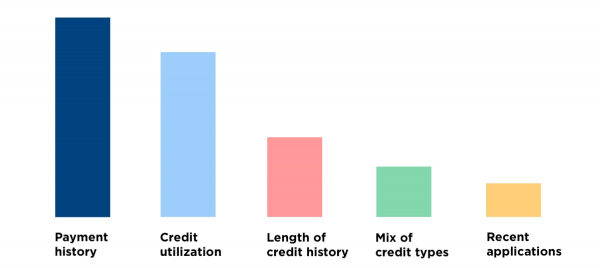

Credit scores are calculated based on the information in your credit reports from the three major credit bureaus: Experian, TransUnion, and Equifax. Key factors that influence your score include:

-

Payment history – Whether you pay your bills on time. This has the greatest impact on your score.

-

Credit utilization – The amount of credit you’re using compared to your total available credit. Using more than 30% of your total credit limits can negatively affect your scores.

-

Credit history length – How long you’ve had credit. Longer histories tend to help raise scores.

-

Credit mix – The variety of credit types, such as credit cards, installment loans, and mortgages.

-

New credit – Opening several new credit accounts in a short period can lower scores.

Each of the three credit bureaus may have slightly different information about your credit history, so you can have varying credit scores depending on the bureau. It’s a good idea to check your credit reports and scores from all three bureaus periodically.

Credit Score Ranges

Credit scores fall into different ranges that give lenders a quick snapshot of your creditworthiness. Here are the score ranges for FICO and VantageScore:

FICO Score Ranges

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Very Poor

VantageScore Ranges

- 750-850: Excellent

- 700-749: Good

- 650-699: Fair

- 550-649: Poor

- 300-549: Very Poor

In general, scores of 700 and above are considered good to excellent, and will qualify you for most loans and credit cards at decent interest rates. Scores below 600 are considered poor and will make it difficult to get approved for financing.

Is 710 a Good TransUnion Credit Score?

Now that you understand credit score ranges, let’s discuss whether a 710 TransUnion credit score is considered good.

The answer is yes – a TransUnion score of 710 is solidly in the “good” credit range according to both the FICO and VantageScore models.

A 710 TransUnion score means:

-

You’ll likely qualify for most credit cards and loans as long as you meet lenders’ other requirements.

-

You may not get the absolute lowest interest rates, but you should still be eligible for competitive rates.

-

Your creditworthiness is well above average. Consumers with scores over 700 make up over half of the scoring population.

-

You’re on the right track for a top-tier score. With some credit building strategies, you could likely boost your TransUnion score above 750 over time.

While 710 is a good score, it’s still worth taking steps to continue building your credit. Aim to get all your credit scores above 750 to qualify for the very best loan terms and credit card rewards programs.

Here are some tips for improving your TransUnion credit score:

-

Pay all bills on time – Set up autopay if needed. Payment history has the biggest impact on scores.

-

Keep credit card balances low – Shoot for less than 30% of the card limits and pay in full each month if possible.

-

Limit hard inquiries – Only apply for credit when you need it to avoid too many inquiries.

-

Ask for credit line increases – Higher limits help keep utilization low.

-

Monitor all 3 credit reports – Make sure there are no errors negatively impacting your scores.

The Takeaway

A 710 credit score from TransUnion is considered a good score by lending standards. While an excellent 750+ score unlocks the most favorable loan terms and credit card offers, a score of 710 will qualify you for competitive rates from most lenders. A TransUnion score in the low 700s is a great foundation to build upon as you take steps to maximize your credit. Monitoring all three credit reports and continually practicing good credit habits will help bump your scores into the very good or exceptional ranges over time.

Strategies to keep building your 710 credit score

Credit scores fluctuate, so you may be closer to — or further from — the top band than you think. To know what to do to build credit, it helps to understand which factors matter most in calculating a credit score.

Credit cards

Many credit cards are marketed to people in the good and excellent bands. However, some 0% APR cards and premium travel cards have minimum credit scores that are higher than 710.

What Is A Good TransUnion Credit Score? – CreditGuide360.com

FAQ

What is a good score on TransUnion?

| **Score** | **Band** | **Rating** |

|---|---|---|

| 551–565 | Poor | Rating 2 |

| 566–603 | Fair | Rating 3 |

| 604–627 | Good | Rating 4 |

| 628–710 | Excellent | Rating 5 |

What will a 710 credit score get me?

Quick insights. A 710 credit score is considered “good” by the two main credit scoring models. You may be able to access several financial opportunities with a good credit score, such as more favorable rates for mortgages. There are ways to help improve your credit score, including improving your debt-to-income ratio.

Can I buy a house with a 710 credit score?

Is TransUnion a reliable credit score?

That’s done by credit-scoring companies like FICO® and VantageScore. If you see a reference to a TransUnion credit score, that’s likely a score that was calculated by a credit-scoring company, like FICO or VantageScore, using information from a TransUnion credit report. Is TransUnion legitimate? Yes.