Someone else has probably looked at retirement account acronyms and felt the same way. I know I did. When I first started looking into retirement options, I kept wondering if a 403(b) was just another type of IRA. It turns out that the animals in the retirement zoo are very different from each other.

Let’s clear up this confusion once and for all. A 403(b) is NOT the same as an IRA. They are two different types of retirement accounts with different rules, limits on contributions, and requirements for who can use them. But understanding both can seriously level-up your retirement planning game.

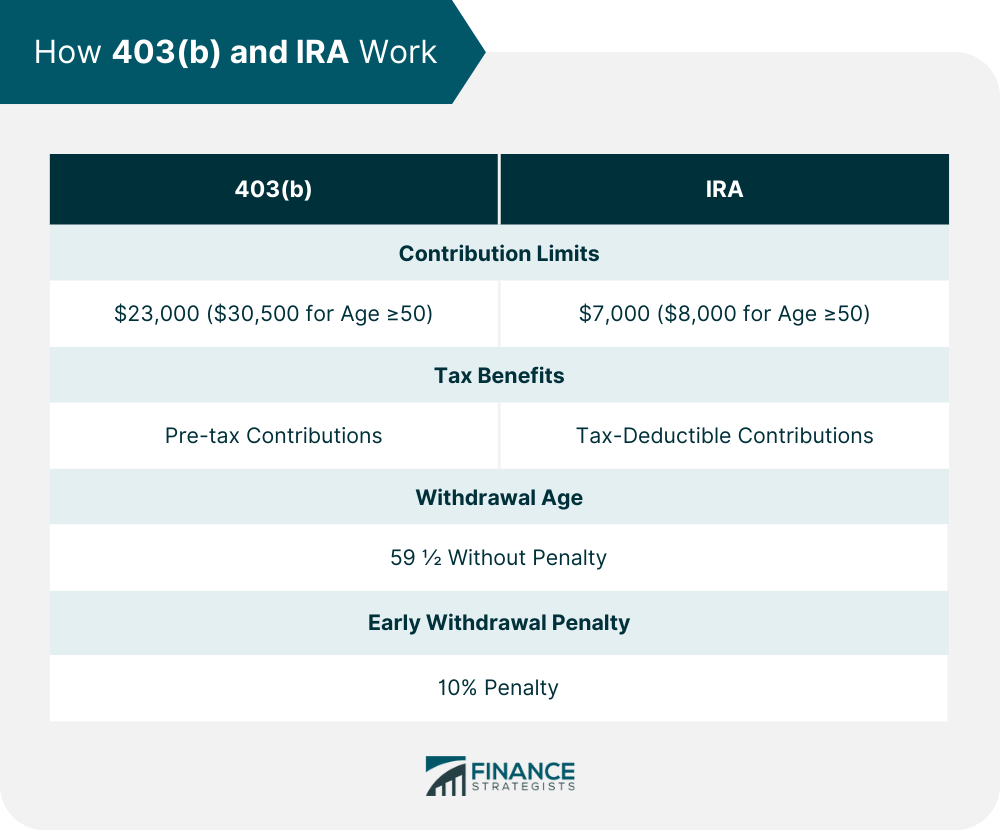

The Quick Answer: 403(b) vs. IRA at a Glance

Before diving into the details, here’s what you need to know:

- A 403(b) is an employer-sponsored retirement plan offered by schools, nonprofits, religious organizations, and certain government employers

- An IRA (Individual Retirement Account) is something you open yourself, independent of your employer

- Both offer tax advantages but work differently in terms of contribution limits, investment options, and eligibility

What Exactly Is a 403(b) Plan?

A 403(b) plan, which is also known as a tax-sheltered annuity (TSA), is a type of retirement account that is only for employees of:

- Public schools and universities

- Churches and religious organizations

- 501(c)(3) nonprofit organizations

- Certain government organizations

Your boss sets up the 403(b) plan, and you put money into it by having money taken out of your paycheck. To compare, think of it as a 401(k) for nonprofits.

Key Features of a 403(b)

- Contribution limits: For 2025, you can contribute up to $23,500 annually to your 403(b). If you’re 50 or older, you can add another $7,500 as a “catch-up” contribution. Between ages 60-63, you can make “super catch-up contributions” of $11,250.

- Employer contributions: Your employer may also contribute to your 403(b), with a combined employer+employee limit of $70,000 for 2025.

- Tax benefits: Contributions are typically pre-tax, reducing your taxable income now. The money grows tax-free until withdrawal.

- Investment options: Usually limited to annuities and mutual funds

- Early withdrawal penalties: 10% penalty plus income tax on withdrawals before age 59½ (with some exceptions)

What Is an IRA Anyway?

An IRA (Individual Retirement Account) is a retirement account YOU open yourself through a bank, brokerage, or investment firm. Anyone with earned income can open an IRA – you don’t need a specific type of employer.

There are two main flavors of IRAs:

- Traditional IRA: Contributions may be tax-deductible now, and you pay taxes when you withdraw in retirement

- Roth IRA: Contributions are made with after-tax dollars, but withdrawals in retirement are completely tax-free

Key Features of an IRA

- Contribution limits: For 2025, you can contribute up to $7,000 annually ($8,000 if you’re 50+)

- Investment options: Way more flexibility! Stocks, bonds, ETFs, mutual funds, and more

- Eligibility: Anyone with earned income can contribute (though Roth IRAs have income limits)

- Tax treatment: Depends on whether you choose Traditional or Roth

- Early withdrawal rules: Similar to 403(b), but Roth IRAs let you withdraw contributions (not earnings) penalty-free

Major Differences Between 403(b) and IRA

Now that we understand the basics, let’s compare these two retirement account types side-by-side:

| Feature | 403(b) Plan | IRA |

|---|---|---|

| Who can open? | Only employees of specific organizations (schools, nonprofits, etc.) | Anyone with earned income |

| 2025 Contribution Limit | $23,500 ($31,000 if 50+) | $7,000 ($8,000 if 50+) |

| Employer contributions | Often available | Not applicable |

| Investment choices | Limited, typically annuities and mutual funds | Broad range of investment options |

| Required Minimum Distributions | Start at age 73 (75 if born 1960+) | Traditional: Same as 403(b), Roth: No RMDs for account owner |

| Early withdrawals | 10% penalty plus taxes before 59½ with some exceptions | Similar rules, but Roth contributions can be withdrawn anytime |

Can You Have Both a 403(b) AND an IRA?

Absolutely YES! This is actually one of the smartest retirement moves you can make.

Since the contribution limits are separate, you can max out both a 403(b) AND an IRA in the same year. For 2025, that means you could potentially save:

- $23,500 in your 403(b)

- $7,000 in your IRA

- Plus any catch-up contributions if eligible

That’s a whopping $30,500 in tax-advantaged retirement savings annually!

Which One Should You Choose First?

If you’re eligible for both, here’s a general strategy:

- If your employer offers a match: Contribute enough to your 403(b) to get the full employer match (it’s free money!)

- Consider a Roth IRA next: The tax diversity can be valuable for retirement planning

- Then max out 403(b): If you still have money to save after steps 1 and 2

- Finally, consider taxable accounts: Once you’ve maxed out tax-advantaged options

Who Can Participate in a 403(b) Plan?

According to the IRS, eligible participants include:

- Employees of 501(c)(3) tax-exempt organizations

- Public school employees

- Church employees

- Ministers employed by 501(c)(3) organizations

- Self-employed ministers

- Chaplains meeting certain requirements

I was surprised to learn that even former employees can receive contributions to their 403(b) for up to 5 years after leaving employment (if the plan allows it).

The Universal Availability Rule for 403(b) Plans

Here’s something interesting – 403(b) plans must follow what’s called the “universal availability rule.” This means if your employer offers the plan to one employee, they generally must offer it to ALL employees.

However, some employees can be excluded:

- Those who work less than 20 hours per week

- Those who will contribute $200 or less annually

- Employees participating in another retirement plan with the same employer

- Non-resident aliens

- Students performing certain services

What Happens If You Leave Your Job?

If you leave the employer that sponsors your 403(b), you typically have several options:

- Leave the money in the plan (if allowed)

- Roll it over to another 403(b), a 401(k), or an IRA

- Take a distribution (though you’ll likely face taxes and penalties if under 59½)

With an IRA, since it’s not tied to your employer, nothing changes job-to-job. That’s a big advantage!

Common Mistakes to Avoid

After researching both account types, I’ve noticed some common pitfalls:

-

Not getting the employer match: If your 403(b) offers matching contributions, not contributing enough to get the full match is leaving free money on the table!

-

Ignoring fees: 403(b) plans, especially those offering annuities, can have higher fees than many IRA options.

-

Not diversifying: Having all your retirement eggs in one basket can be risky. Consider using both account types for tax diversification.

-

Forgetting about Required Minimum Distributions: Both traditional IRAs and 403(b)s require minimum withdrawals starting at age 73 (or 75 if born in 1960 or later).

Final Thoughts: It’s Not Either/Or

The biggest takeaway here is that a 403(b) and an IRA aren’t competing options – they’re complementary tools in your retirement toolkit. If you’re eligible for both, consider using both to maximize your savings and tax advantages.

Remember that retirement planning isn’t one-size-fits-all. Your specific situation, including your income, tax bracket, employer benefits, and retirement timeline, should guide your decisions.

Have you been contributing to a 403(b) or an IRA? Or maybe both? I’d love to hear about your experiences in the comments below!

FAQ About 403(b) and IRA Accounts

Can I contribute to both a 403(b) and an IRA in the same year?

Yes! The contribution limits are separate, so you can max out both.

Which has higher contribution limits?

The 403(b) has much higher limits – $23,500 vs. $7,000 for IRAs in 2025.

What if my employer doesn’t offer a 403(b)?

If you’re not eligible for a 403(b), focus on maxing out an IRA and explore other retirement savings options like a taxable brokerage account.

Can I roll over my 403(b) to an IRA?

Yes, if you leave your employer, you can roll your 403(b) funds into an IRA without tax penalties.

Do I need to take RMDs from both accounts?

Yes for traditional IRAs and 403(b)s. Roth IRAs don’t require RMDs for the original account owner.

Remember, while this article provides general information, it’s always a good idea to consult with a financial advisor about your specific situation. Retirement planning is too important to leave to chance!

Consider an IRA (Traditional or Roth) if:

- You can’t use a 403(b) or any other retirement plan at work.

- You’ve already saved as much as you can in your 403(b) plan, especially with the employer match. You want to save even more.

- You want more investment options and more control than your 403(b) gives you.

- You think your tax rate will change when you retire (a traditional IRA may be better if it’s lower; a Roth IRA may be better if it’s higher or stays the same; or if you want to take out money tax-free most of the time).

- You want to be able to take out your contributions (but not your earnings) from a Roth IRA before you retire, sometimes without having to pay taxes or penalties.

Consider prioritizing a 403(b) if:

- You work for an eligible employer, like a public school or a non-profit. This is your main retirement savings account sponsored by your employer.

- Your employer offers a matching contribution. Yes, you should contribute enough to get the full match; it’s like getting your money back.

- You like how easy it is for automatic payroll deductions to help you save for retirement every month.

- You want to put more money into your IRA each year than the annual contribution limit lets you.