At Upstart, we believe you’re more than your credit score. Your credit score is simply a number based on the information in your credit report, and doesn’t consider anything else. Having said that, it can still be a great idea to know what your credit score is and what it could mean to you.

While there is no universal definition of an “excellent” credit score, virtually all lenders would consider your 818 FICO Score to be in that category. Here’s a rundown of what this credit score means to you, different types of lenders, and how to make sure your 818 credit score stays in the top tier for years to come.

Hey there, fam! If you’re wondering, “Is 818 a good credit score?” lemme hit ya with the quick answer right outta the gate: Hell yeah, it is! An 818 credit score ain’t just good—it’s exceptional, elite, top-tier, the kinda number that makes lenders roll out the red carpet for ya. It’s way above the average score of 714, sittin’ pretty in the 800-850 range that’s considered the gold standard. Honestly, it’s nearly perfect, and I’m pumped to break down why this score is such a big deal and how you can keep rockin’ it or get there if you ain’t yet.

At our lil’ corner of financial wisdom here, we’re all about keepin’ it real and helpin’ you understand what this number means for your wallet Whether you’ve got an 818 FICO score or you’re dreamin’ of hittin’ that mark, stick with me We’re gonna dive deep into why this score is a game-changer, the perks it unlocks, how to maintain it, and even how to protect it from shady folks tryin’ to mess with your financial vibe. Let’s get rollin’!

Why Is 818 Considered an Exceptional Credit Score?

Alright, let’s get down to the nitty-gritty. An 818 credit score lands you in the “exceptional” or “excellent” category, dependin’ on who’s talkin’. This range—800 to 850—is the highest you can get, and bein’ at 818 means you’re just a hop, skip, and a jump from the absolute max. Compared to the average score of 714, you’re killin’ it, and lenders see you as someone who’s got their money game on lock.

What makes it so special? Well, it shows you’ve been super responsible with credit You’re likely payin’ bills on time, keepin’ debt low, and managin’ your finances like a pro Less than 1% of folks with a score this high are expected to miss payments or default, which is why banks and credit card companies trust ya big time. They ain’t worried about losin’ money with you, so they’re ready to offer the best deals around.

Now, could you push it higher to, say, 850? Sure, but here’s the real talk most lenders don’t see much difference between an 818 and an 850. You’re already in the VIP club, so the benefits are pretty much maxed out That’s why I say it’s nearly perfect—cuz it basically is!

The Sweet Perks of Havin’ an 818 Credit Score

If you’ve got an 818 credit score, you’re sittin’ on a goldmine of opportunities. Lemme paint the picture for ya with some of the awesome benefits you can snag:

- Killer Interest Rates: Banks and lenders offer you the lowest rates possible on loans, whether it’s for a car, a house, or personal stuff. This means you save a ton on interest over time.

- Easy Approvals: Applyin’ for credit? You’re basically a shoo-in. Mortgages, auto loans, credit cards—you name it, you’re likely gettin’ approved without breakin’ a sweat.

- Premium Credit Cards: Expect offers for top-shelf cards with crazy rewards, like cash back, travel points, or fancy perks such as airport lounge access. These cards often come with higher credit limits too.

- Refinancin’ Power: Got older loans with high rates? With a score like this, you can refinance ‘em at much better terms, savin’ you some serious cash.

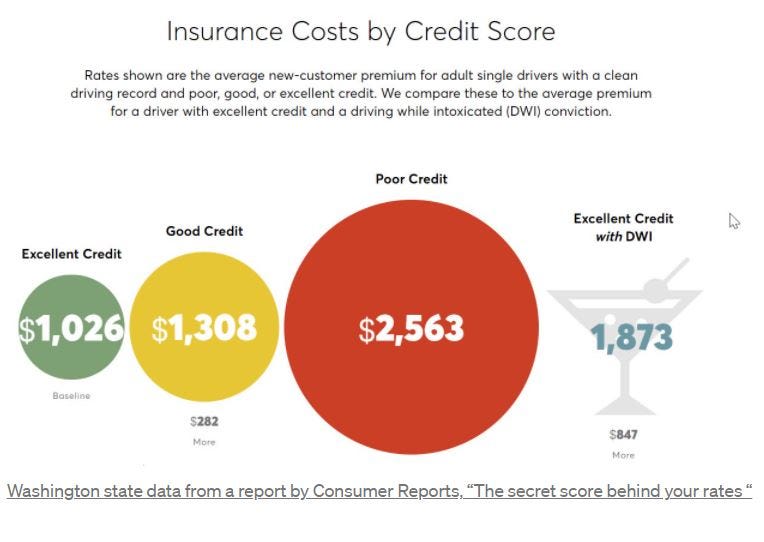

- Better Insurance Deals: Yup, even car insurance companies check your score sometimes, and a high one like 818 can snag you lower premiums.

I remember when a buddy of mine hit a score close to this—he got approved for a mortgage so fast, it made his head spin, and the rate was stupid low. That’s the kinda power we’re talkin’ about. It ain’t just a number; it’s a ticket to financial freedom, or at least a big step closer to it.

How Rare Is an 818 Credit Score, Really?

You might be wonderin’, “Am I, like, one of the few with this score?” And the answer is, yeah, you kinda are! Only about 21% of people have a score in the exceptional range of 800-850. That means you’re in an exclusive club, standin’ out from the crowd. To give ya a clearer view, let’s check out how this stacks up across generations with a lil’ table:

| Generation | Percentage with 750-850 Scores |

|---|---|

| Gen Z | 15.4% |

| Millennials | 24.4% |

| Gen X | 26.1% |

| Baby Boomers | 44.1% |

| Silent Generation | 58.7% |

See that? The older folks tend to have higher scores, prolly cuz they’ve had more time to build credit history. But if you’re younger and rockin’ an 818, you’re way ahead of the game. It’s somethin’ to be proud of, for sure.

What Got You to 818? Key Factors Behind Your Score

Now, I bet you’re curious about what’s keepin’ your score so high—or what ya need to focus on to get there. There’s a few big pieces to the credit score puzzle, and understandin’ ‘em can help you stay on top. Here’s the breakdown:

- Payment History (35% of your score): Payin’ bills on time is the biggest deal. Missin’ a payment can ding your score hard, and with an 818, you’ve likely got a near-spotless record. Only about 0.7% of folks with scores like yours have late payments showin’ up.

- Credit Utilization (30%): This is how much of your available credit you’re usin’. Keep it under 30% per card and overall, and you’re golden. Folks with an 818 often average around 7.7% utilization—super low!

- Length of Credit History (15%): The longer you’ve had credit, the better. It shows you’ve got experience managin’ debt without messin’ up.

- Credit Mix (10%): Hav’in a variety of credit types—like cards and loans—can help. It proves you can handle different kinds of debt.

- New Credit (10%): Applyin’ for too much new credit at once can look risky. Hard inquiries from applications might drop your score a few points, but with an 818, you’re likely keepin’ these to a minimum.

We’ve all been there, stressin’ over a bill or wonderin’ if we should apply for that shiny new card. But if you’ve got an 818, you’ve clearly been playin’ it smart. Keep that up, and you’ll stay in this elite zone.

How to Maintain or Even Boost Your 818 Score

Alright, so you’ve got an 818 credit score—congrats! But you don’t wanna just rest on your laurels, right? Or maybe you’re close and wanna nudge it up a bit. Either way, here’s some practical tips to keep your score poppin’ or push it closer to that max of 850, even if the extra points don’t change much with lenders.

- Keep Utilization Low: Like I said, aim for under 10% if ya can. If your credit card limit is $10,000, try not to carry more than $1,000 balance at a time. Pay it down quick if it creeps up.

- Never Miss a Payment: Set up auto-payments or reminders on your phone. One late payment can mess things up, and you don’t want that after workin’ so hard.

- Don’t Close Old Accounts: Even if you ain’t usin’ an old card, keep it open. It helps your credit history length and boosts your total credit limit, which lowers utilization. Just make a small purchase now and then so the issuer don’t close it on ya.

- Limit New Applications: Every time you apply for credit, it might trigger a hard inquiry, droppin’ your score a tad. Only apply when you really need somethin’. People with scores like 818 average just 3 inquiries, so keep it chill.

- Check Your Reports: Peek at your credit report now and again to make sure there’s no errors or weird activity. You can get free reports from the big bureaus once a year, or use free tools online to keep tabs.

I’ve gotta admit, I once forgot to pay a tiny bill and freaked out thinkin’ it’d tank my score. Luckily, I called the company, and they waved it off since it was my first slip-up. If that ever happens to ya, don’t be shy—give ‘em a ring and ask for a break.

Can You Get to 850? And Should Ya Even Try?

Here’s a question I get a lot: “Should I aim for a perfect 850 if I’m at 818?” My take? Nah, not really. Don’t get me wrong, it’s cool to have the absolute highest score, but the truth is, the benefits don’t change much past 800 or so. Lenders already see you as super low-risk, and you’re gettin’ the best rates and offers. Pushin’ for 850 might just be braggin’ rights, and that’s fine if it’s your vibe, but it ain’t gonna save ya more money.

If you’re set on tryin’, focus on tweakin’ the stuff I mentioned—like droppin’ utilization even lower or waitin’ out your credit history to get longer. But honestly, at 818, you’re already a rockstar. Spend that energy on other money goals, like savin’ up or investin’.

Protectin’ Your 818 Score from Fraud and Mishaps

Listen up, cuz this part’s important. With a score as high as 818, you’re a prime target for identity thieves and scammers. They know you’ve got access to great credit, and they’d love to mess with that. Plus, one wrong move could knock your score down a peg, so let’s talk defense.

- Monitor Your Credit: Keep an eye on your score and reports for weird stuff—like accounts you didn’t open or sudden drops. Credit monitorin’ services can alert ya to suspicious activity fast.

- Freeze If Needed: If you think somethin’s fishy, you can put a freeze on your credit with the big bureaus. It stops anyone from openin’ new accounts in your name ‘til you lift it.

- Be Smart Online: Don’t share personal info on sketchy sites, and use strong passwords. I know, I know, it’s basic, but you’d be surprised how many folks get caught slippin’.

- Watch for Fraud Alerts: Some services let ya set fraud alerts, which tell lenders to double-check before approvin’ new credit in your name.

A high score like yours took time and discipline to build, so guard it like it’s your baby. I’ve had a scare before where someone tried usin’ my info, and catchin’ it early saved my butt. Stay sharp, alright?

Common Myths About High Credit Scores Like 818

There’s a lotta nonsense floatin’ around about credit scores, even for folks with awesome ones like 818. Let me bust a few myths so you ain’t stressin’ over nothin’:

- Myth: A High Score Guarantees Approval – Nope, not quite. While 818 makes it super likely, lenders still look at your income, debt, and other stuff. It’s a huge help, but not a golden ticket.

- Myth: Checkin’ Your Score Hurts It – Wrong! Checkin’ your own score is a “soft inquiry” and don’t affect it at all. Do it as much as ya want to stay in the loop.

- Myth: You Need to Carry a Balance – Big nope. Carryin’ a balance on cards don’t help your score—it just costs ya interest. Pay ‘em off each month if you can.

- Myth: Clos’in Cards Boosts Your Score – Actually, it can hurt ya by lowerin’ your credit limit and shortenin’ your history. Keep old cards open unless there’s a fee you can’t dodge.

I used to think carryin’ a balance was the way to go ‘til I learned it was just burnin’ my money for no reason. Don’t fall for these traps—stick to the smart moves we talked about.

What If Your Score Ain’t 818 Yet?

If you’re readin’ this and your score ain’t at 818, don’t sweat it. Gettin’ there is totally doable with some focus. Start by checkin’ where you’re at—grab your free credit report and see what’s holdin’ ya back. Focus on payin’ bills on time every dang month, cuz that’s the biggest factor. Keep your credit card balances low, don’t apply for a buncha new stuff at once, and let your accounts age naturally.

We’ve helped plenty of folks climb the credit ladder, and the key is consistency. Make a lil’ budget if ya gotta, track your spendin’, and chip away at any debt. Before ya know it, you’ll be inchin’ closer to that 818 sweet spot. And hey, even if you’re at 750 or 780, you’re still in great shape—don’t be too hard on yourself.

Wrappin’ It Up: Your 818 Score Is Your Superpower

So, is 818 a good credit score? Man, it’s way more than good—it’s freakin’ fantastic! Sittin’ at 818 means you’re in the top tier, with lenders lovin’ your reliability and showerin’ ya with the best rates, approvals, and offers. It’s a sign you’ve managed your money with serious skill, and only a small chunk of people can say the same.

Keep doin’ what you’re doin’ by payin’ on time, keepin’ debt low, and watchin’ out for fraud. If you’re not at 818 yet, use these tips as your roadmap to get there. We’re rootin’ for ya every step of the way, and I’m stoked to see you crushin’ your financial goals with a score like this as your wingman. Got questions or wanna share your credit journey? Drop a comment below—I’d love to chat and swap stories! Keep slayin’ it, fam!

Getting a credit card or personal loan with an 818 credit score

Most credit card issuers don’t have a formal “minimum” credit score they’ll accept, and most that do have a cutoff don’t make it public. However, an exceptional credit score of 818 should qualify you for pretty much every credit card offer. This also depends on meeting the credit card issuer’s other requirements—for example, some won’t open a new credit card if you’ve applied for too many other credit cards recently, regardless of your score.

To qualify for a personal loan, you don’t need such a high credit score, but it can certainly help you access a lender’s best rates and loan origination fees.

Buying a home with an 818 credit score

To be perfectly clear, you don’t need a top-tier credit history to qualify for a mortgage. Even the most restrictive mortgage products have credit score requirements in the mid-700s.

A credit score of 818 will generally qualify you for a lender’s best interest rates. As a real-world example, the average 30-year fixed mortgage interest rate was just over 7% as of late October 2022. However, the average rate paid by a homebuyer whose FICO credit score was 760 or higher was 6.583%.

This might not sound like a huge difference but consider this. Let’s say that you’re buying a $500,000 home with a 20% down payment, so you’re borrowing $400,000. The typical borrower with top-tier credit would save about $59,000 over the term of a 30-year mortgage compared with someone with a good credit score of 670.

What is a GOOD Credit Score in 2025? What’s the Average Credit Score Overall & By Age / Generation?

FAQ

How many people have an 818 credit score?

Membership in the 800+ credit score club is quite exclusive, with fewer than 1 in 6 people boasting a score that high, according to WalletHub data. Since so few people have such high scores, lenders don’t split the 800+ credit score crowd into smaller groups that get separate offers.

What can I do with an 818 credit score?

An 818 score will make it much easier for you to qualify for auto loans, which are secured loans and usually installment loans. Lots of lenders offer car loans, and with great credit, you’ll likely be able to filter through several options to find the best auto loan for you.

What is a realistically good credit score?

For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent. For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good.

How common is an 800 credit score?

Twenty-four percent of Americans have a credit score between 800 and 850, considered “exceptional” by FICO. A credit score at the top of that range — 850 — is perfect. Twenty-four percent have a FICO® Score between 750 and 799, making the “very good” bracket. Data source: FICO (2024).May 21, 2025

Is 818 a good credit score?

An 818 FICO ® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850. Among consumers with FICO ® credit scores of 818, the average utilization rate is 7.7%.

Can you get a car loan with a credit score of 818?

You should have no issues getting an auto loan with a credit score of 818. You should qualify for the best interest rates they have to offer. However, remember that other factors are taken into account, so even with an excellent credit score, it’s not a guarantee that you’ll be approved for a loan.

What does a 818 FICO score mean?

21% of all consumers have FICO ® Scores in the Exceptional range. Less than 1% of consumers with Exceptional FICO ® Scores are likely to become seriously delinquent in the future. A FICO ® Score of 818 is well above the average credit score of 714. An 818 FICO ® Score is nearly perfect.

What is the average utilization rate for a credit score of 818?

Among consumers with FICO ® credit scores of 818, the average utilization rate is 7.7%. The best way to determine how to improve your credit score is to check your FICO ® Score. Along with your score, you’ll receive a report that uses specific information in your credit report that indicates why your score isn’t even higher.

Is the 818 a good car?

The 818S is a well-engineered, easy to build street car with the performance of a supercar – for one-tenth NOTE: The 818 is not currently in production, and we are not taking more orders at this time. We have a wait list if you’d like to sign-up. Email us at [email protected] to be added to a wait list.

What is a good credit score for a car loan?

If you’re holding a credit score of 818, you’re in a commendable position. This score is deemed excellent on the credit scale and is likely to affirm the trust lenders need to provide you with a car loan.