On a scale of 300-850, a “good” credit score falls somewhere in the mid-600s to mid-700s. Learn how to get a good score and what opportunities it unlocks.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

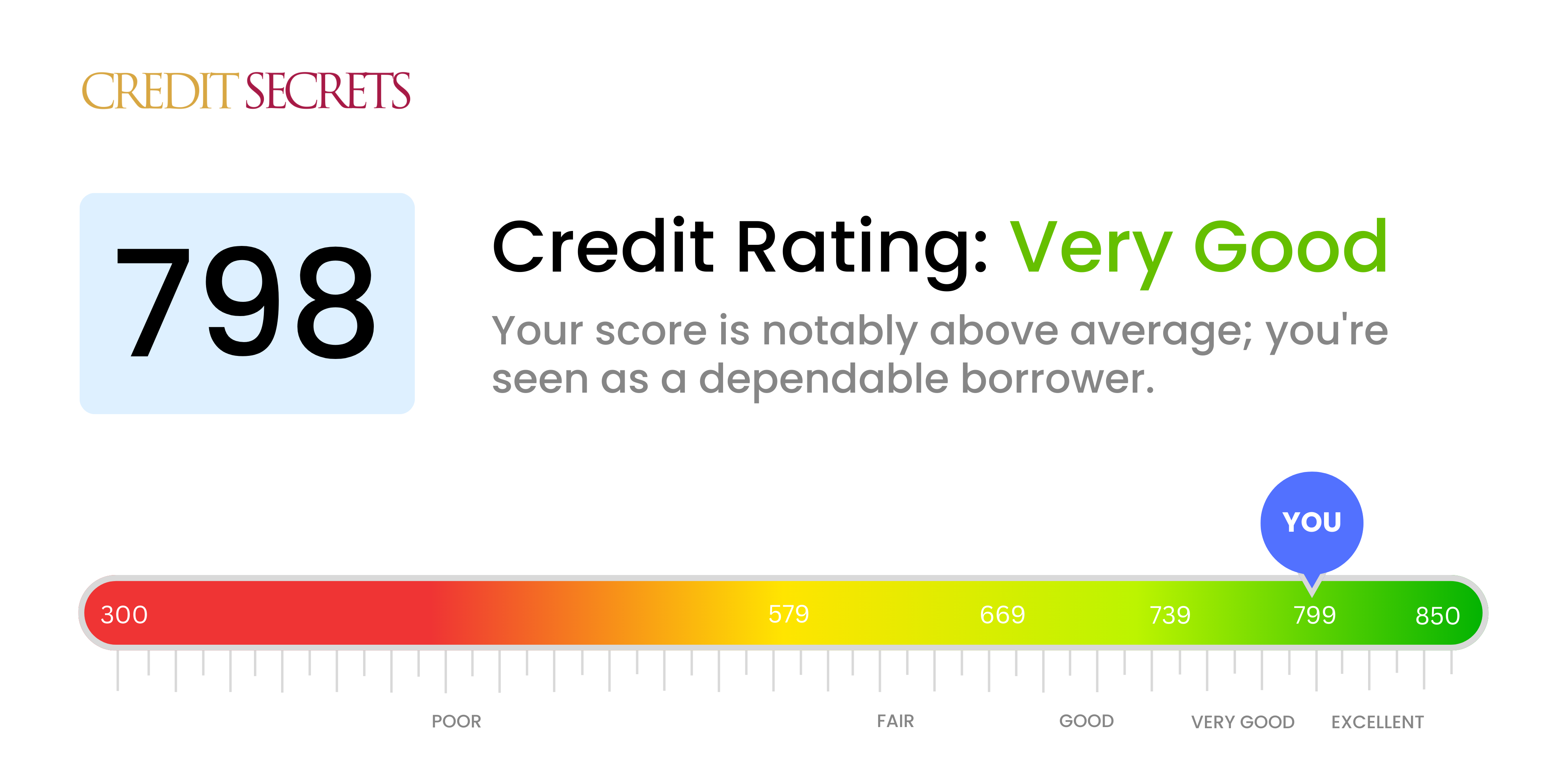

Your credit score is one of the most important factors lenders consider when reviewing your application for a loan or credit card. It provides a three-digit snapshot of your creditworthiness with higher scores signaling lower risk. But what exactly constitutes a “good” credit score? And is 798 good enough to get approved for the best rates and terms? Let’s take a closer look.

What is a Credit Score?

A credit score is a number calculated based on information in your credit reports from the three major credit bureaus – Equifax Experian and TransUnion. It takes into account factors like your payment history, credit utilization, credit age, credit mix, and recent credit inquiries.

The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850. In general, the higher your FICO score, the lower the risk you pose to lenders.

Each of the three credit bureaus may have a different FICO score for you based on the information in your credit reports. When you check your credit score, you’ll likely see a score range rather than a single number. Lenders often use the middle score when evaluating your application.

FICO Score Ranges

FICO scores fall into the following categories:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Poor

As you can see, a FICO score of 798 falls into the “Very Good” range. But what does that really mean in practical terms?

What Does a 798 Credit Score Mean?

A FICO score of 798 is considered excellent by both FICO and most lenders. It falls within the top 25% of scores nationally. This means you have an established credit history, use credit responsibly, and pay bills on time.

Specifically, a score of 798 indicates:

- Low risk of defaulting on debt obligations

- Long credit history with diverse types of credit

- Responsible credit management with low balances and multiple open accounts

- No negative information on credit report such as collections, charge-offs, bankruptcies, etc.

Only 1% of people with a 798 FICO score are expected to become seriously delinquent on debt payments in the future, compared to the average delinquency rate of 8.6% across all scores.

Is 798 a Good Credit Score?

Yes, a FICO score of 798 is undoubtedly a good, even exceptional, credit score. It falls well within the range lenders consider favorable for approving applications and offering the best terms.

According to Experian data, borrowers with Very Good credit scores typically qualify for the lowest interest rates from lenders. Those with scores of 798 and higher also tend to get the most competitive credit card rewards programs and benefits.

You’re in excellent company with a 798 credit score. However, it’s still about 50 points away from a perfect 850 score. Fortunately, your high score puts you in a great position to qualify for top-tier financial products.

What Credit Is Available with a 798 Score?

A 798 credit score means you should have your pick of the most favorable loans and credit cards. Here are some of the advantages available to you:

Mortgages

- Lowest mortgage rates, saving thousands over the life of the loan

- Larger loan amounts and higher lending limits

- Lower down payment requirements

- Option to forego mortgage insurance

Auto Loans

- Preferred interest rates averaging 3-4% from lenders

- Larger loan amounts with longer repayment terms

- Higher loan-to-value ratios

- Low or no down payment required

Credit Cards

- Low introductory APR offers on purchases and balance transfers

- Higher credit limits to keep utilization low

- Most lucrative rewards programs with bonus perks

- No security deposit required for approval

In addition to great loan terms, a Very Good score also translates to lower insurance premiums and better chances of apartment rental approval.

How to Raise Your 798 Credit Score

While a 798 credit score is excellent, here are a few ways to potentially inch it closer to 850:

- Keep credit card balances very low to decrease utilization

- Don’t close your oldest credit accounts

- Limit credit inquiries by only applying for needed accounts

- Maintain perfect payment history across all accounts

- Ask for credit limit increases without spending more

- Continue growing credit history through responsible management

With diligent credit habits, you can maximize and maintain your 798 score over time. Be sure to check your credit reports regularly and dispute any inaccuracies that could be artificially lowering your score.

Could a 798 Score Be Too Low?

For most borrowers, a 798 FICO is more than high enough to get approved for credit at the best terms. However, a small subset of consumers may find a 798 score limiting for specialized lending situations including:

- Jumbo mortgages over $647,200

- Luxury auto loans over $100,000

- High-end credit cards with $10k+ limits

- Private student loans without a cosigner

- Multi-million dollar business lines of credit

In these cases, scores in the 800-850 range are sometimes required for approval. If you’re seeking unusually large lending amounts, it pays to check individual lender requirements and boost your score closer to 850.

Maintaining and Monitoring Your 798 Score

Now that you’ve reached the upper echelon of credit scores, it’s important to monitor your credit and continue practicing good financial habits. To keep your 798 score going strong:

- Review credit reports monthly and dispute errors immediately

- Never miss a payment deadline on any credit account

- Use credit cards lightly and pay off balances each month

- Limit new credit applications to reduce inquiries

- Watch for signs of identity theft and fraud

Also consider signing up for credit monitoring or identity theft protection services. These provide alerts that help you catch any suspicious activity that could threaten your perfect credit score.

A 798 credit score is an impressive achievement that reflects dedication to financial responsibility. With some monitoring and upkeep, you can relish your entry into exceptional credit territory for years to come!

Leave credit cards open

Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Closing an account cuts into your overall credit limit, driving up your credit utilization. However, there are some compelling reasons to close an account, including high fees or poor service.

How to get a good credit score

If you want to improve your credit score, youll need to establish good credit habits and practice them consistently. Heres a list of financial habits that have the biggest impact on your score:

What’s a Good Credit Score (or Excellent, Fair, Bad)? What do credit score ranges mean (really)?

FAQ

What percentage of people have a 798 credit score?

| Range | Percentage of Consumers |

|---|---|

| Fair (580-669) | 15.8% |

| Good (670-739) | 21.6% |

| Very good (740-799) | 28.1% |

| Exceptional (800-850) | 21.9% |

How rare is credit score over 800?

What it means to have a credit score of 800. A credit score of 800 means you have an exceptional credit score, according to Experian. According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

What is a realistically good credit score?

For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent. For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good.

How rare is a 900 credit score?

What does a 798 credit score mean?

A 798 credit score is often considered very good — or even excellent. A very good or excellent credit score can mean you’re more likely to be approved for good offers and rates when it comes to mortgages, auto loans and credit cards with rewards and other perks. This is because a high credit score may indicate that you’re less risky to lend to.

Can you get a student loan with a 798 credit score?

Student loans are some of the easiest loans to get with a 798 credit score, seeing as roughly 90% of them are given to applicants with a credit score below 780. A new degree may also make it easier to repay the loan if it leads to more income. Note: Borrower percentages above reflect 2022 Equifax data.

What is the average utilization rate for a 798 credit score?

Among consumers with FICO ® credit scores of 798, the average utilization rate is 17.0%. The best way to determine how to improve your credit score is to check your FICO ® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file.

What does a 798 score mean for a bike loan?

A 798 score makes you eligible for smoother approvals and better interest rates. These loans can support equipment purchase, space renovation, or operational needs. A high score makes it easy to get a bike loan with low interest rates and smaller down payments.

Is a Model 798 a good value?

The Model 798 is a great value, even at the full list price. Both the 798 and 799 barreled actions could easily form the basis of a fine custom rifle. In fact, at Guns and Shooting Online we already have a custom stocked Model 798 in the works.