Hey there! So, you’ve got a 777 credit score, or maybe you’re just curious if that number is any good. Well, lemme tell ya straight up—yes, 777 is a damn good credit score! It’s considered “Very Good” and sometimes even “Excellent,” sitting way above the average. With a score like that, you’re in a sweet spot for snagging better interest rates and loan terms from lenders. But there’s a whole lot more to unpack about what this number means, why it’s dope, and how to keep that credit mojo strong—or even push it higher.

At our lil’ corner of the internet, we’re all about breaking down financial stuff so it ain’t a headache. In this deep dive, I’m gonna walk ya through everything you need to know about a 777 credit score. We’ll chat about where it stands in the grand scheme of things, the perks it brings, what factors got you here, and some real-deal tips to maintain it or level up. So grab a coffee, and let’s get into it!

What Does a 777 Credit Score Really Mean?

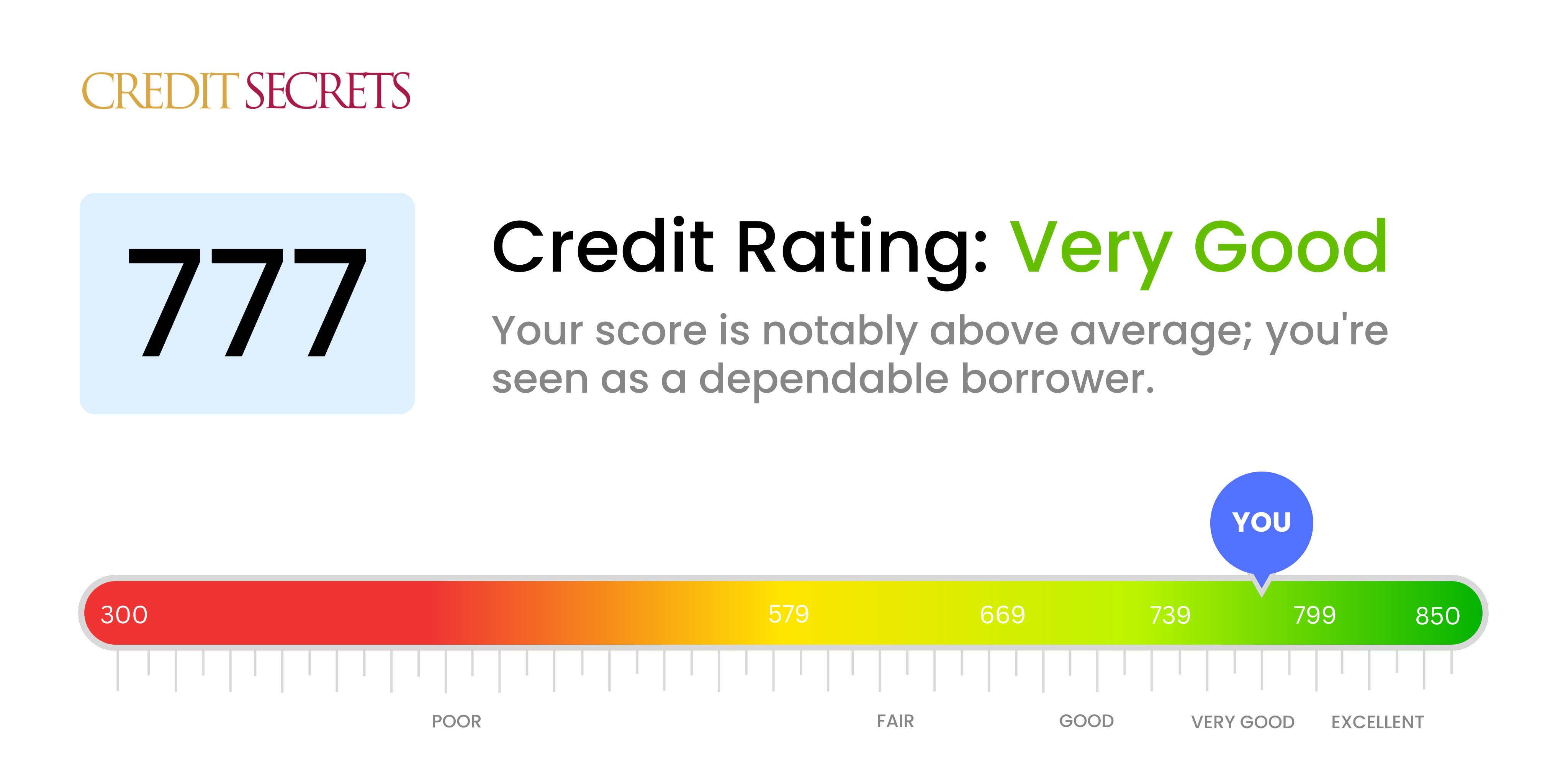

First off, let’s put 777 in context. Credit scores usually range from 300 to 850, and they’re like a report card for how well you handle money—think loans, credit cards, and bills. A 777 falls in the “Very Good” category, specifically between 740 and 799. Some folks might even call it “Excellent” depending on who’s judging. Compared to the average score of about 714, you’re killin’ it with a 777.

Here’s a quick breakdown of the credit score ranges to see where you stand

| Score Range | Category | What It Means |

|---|---|---|

| 300-579 | Poor | Tough to get loans, high interest rates. |

| 580-669 | Fair | Okay, but limited options for credit. |

| 670-739 | Good | Decent rates, most lenders will work with ya. |

| 740-799 | Very Good | Great rates, you’re a lender’s fave! |

| 800-850 | Exceptional/Excellent | Top-tier, best terms possible. |

So, with a 777, you’re in that sweet “Very Good” zone. About 25% of folks have scores in this range, which means you’re ahead of most. Lenders see this number and think, “Yo, this person’s got their act together.” It’s a sign you’ve been payin’ bills on time and managing debt like a pro.

Why Is 777 Such a Big Deal?

Now, why should you care about havin’ a 777? ‘Cause it opens doors, my friend! A score this high tells banks and credit card companies that you’re low-risk They’re more likely to trust ya with their money, and that comes with some serious perks Here’s why 777 is a game-changer

- Better Interest Rates: Whether it’s a car loan, mortgage, or personal loan, lenders often give you lower rates. That means savin’ cash over time.

- Easier Approvals: Need a new credit card or a loan? With a 777, you’re more likely to get a “hell yeah” instead of a “nah, sorry.”

- Premium Credit Cards: You can qualify for fancy rewards cards with travel perks, cash back, or points. Some of these cards got benefits like airport lounge access or free hotel stays.

- Refinancing Options: Got an old loan with a crap rate? A high score like this lets you refinance for somethin’ better.

- Mortgage Advantages: If you’re house huntin’, a 777 can help you lock in a great mortgage rate, though other stuff like income matters too.

I remember back when I was stressin’ over my own score, wonderin’ if I’d ever get approved for a decent car loan. Hittin’ a number like 777 felt like a weight off my shoulders—suddenly, lenders weren’t lookin’ at me like I was gonna flake. It’s a confidence boost, for real.

How Did You Get to 777? The Factors Behind the Score

Alright, let’s talk about what got you to this awesome 777. Credit scores ain’t random—they’re built on a few key things that show how you handle money. Here’s the breakdown of what matters most:

- Payment History (35% of your score): This is the biggie. Payin’ your bills on time is huge, and with a 777, you’ve probably been pretty damn good at it. Late payments can tank your score, but only about 18% of folks with scores like yours have missed one.

- Credit Utilization (30%): This is how much of your available credit you’re usin’. Experts say keep it under 30%—so if you got a $10,000 limit, don’t owe more than $3,000. For peeps with a 777, the average usage is around 14.7%, which is solid.

- Length of Credit History (15%): How long you’ve had credit accounts matters. The longer, the better. Folks with scores in the 750-850 range often have accounts open for about 7.5 years on average.

- Credit Mix (10%): Lenders like seein’ a variety—think credit cards, car loans, or mortgages. About 61% of people with a 777 got auto loans, and 51% have mortgages in their mix.

- New Credit (10%): Applyin’ for too much new credit at once can ding your score a bit. If you’ve got a 777, you’ve likely been chill about openin’ new accounts.

So, if you’re sittin’ at 777, you’ve likely been on point with payments, ain’t maxin’ out cards, and got some history under your belt. Props to ya!

Can 777 Get Any Better? Aim for the Top!

Now, here’s the thing—777 is great, but it ain’t the peak. There’s still room to hit the “Exceptional” range of 800-850, where you get the absolute best terms. Boostin’ your score even higher can save you more money and give ya that extra flex. Here’s how to push past 777:

- Keep Payin’ on Time: Set up autopay for bills so you don’t slip. Even one late payment can mess things up.

- Lower That Utilization: Pay down credit card balances before the billin’ cycle ends. If your balance gets reported as $0, it can give your score a nice bump.

- Don’t Close Old Cards: Even if you ain’t usin’ an old credit card, keep it open. It helps with that length of credit history. Unless it’s got a crazy annual fee, just let it sit.

- Be Smart About New Credit: A new card can help by givin’ you more available credit, lowerin’ your utilization. But don’t go wild—too many applications look sketchy.

- Check Your Report: Peek at your credit report for errors. If somethin’ looks off, dispute it. Mistakes can drag ya down for no reason.

I’ve been there, obsessin’ over gettin’ to the 800 club. It’s not just about the number—it’s knowin’ you’ve maxed out your financial cred. Keep at it, and you might get there!

How to Keep Your 777 From Slippin’

Got a 777? Awesome. Now don’t let it drop! It’s easier to mess up than you think if you ain’t careful. Here’s what can hurt your score and how to dodge those pitfalls:

- Missed Payments: Like I said, this is 35% of your score. Miss a bill, and it’s gonna sting. Set reminders or autopay to stay on track.

- High Credit Usage: If you start maxin’ out cards, your utilization shoots up, and your score takes a hit. Keep it low—under 30% is the goal.

- Too Many New Accounts: Applyin’ for a bunch of credit at once makes lenders nervous. Space it out if you need new stuff.

- Public Records: Stuff like bankruptcies or liens can wreck your score. If you’ve got any, settle ‘em fast. They can stick around for years otherwise.

Also, watch out for identity theft. With a score this high, you’re a target for scammers tryin’ to steal your good name. Consider credit monitorin’ services that alert ya if somethin’ funky’s goin’ on. Back in the day, I didn’t think much of it ‘til a buddy got hit with fraud. Better safe than sorry, ya know?

What 777 Means for Loans and Credit Cards

Let’s get real about what a 777 does for ya when you’re applyin’ for stuff. Whether it’s a car, a house, or just a new card, your score plays a big role—but it ain’t the only thing lenders look at They also check your income, job status, and debt. Still, here’s how 777 helps

- Auto Loans: You’re more likely to snag the best rates, though dealerships might still try to jack up the price. Shop around at banks or credit unions for better deals. If you’ve got an old car loan, refinancin’ with your score could save ya cash.

- Mortgages: A 777 sets you up for solid mortgage rates, makin’ home buyin’ less of a wallet-killer. Get preapproved to see what you can borrow—it makes your offer stronger.

- Credit Cards: You can go for top-tier cards with killer rewards—think travel credits or cash back. Just watch out for high annual fees. If you’re payin’ off debt, look for balance transfer cards with long 0% intro periods.

I’ve seen peeps with scores like this get offers left and right. But don’t just jump at the first shiny thing—read the fine print. Some “great” deals got hidden catches.

How Does 777 Compare Across Generations?

Here’s somethin’ kinda cool—your credit score can vary a lot dependin’ on your age group. Older folks tend to have higher scores ‘cause they’ve had more time to build credit. Check this out:

- Gen Z: Only about 15.4% have scores between 750-850.

- Millennials: Around 24.4% are in that high range.

- Gen X: About 26.1% got top scores.

- Baby Boomers: A solid 44.1% are killin’ it with 750-850.

- Silent Generation: A whopping 58.7% are in the elite zone.

So if you’re younger and rockin’ a 777, you’re way ahead of the curve. If you’re older, you might be closer to the norm—but it’s still somethin’ to be proud of.

Why You Might Wanna Aim Higher Than 777

Sure, 777 is awesome, but hittin’ that 800+ range is like the ultimate flex. It don’t just mean better rates—it’s a sign you’ve mastered the money game. For some of us, it’s not even about the perks; it’s just knowin’ we did the work to get there. If that’s your vibe, keep pushin’. Pay early, keep old accounts open, and don’t let debt creep up.

I gotta admit, when I first saw my score climb past 750, I was pumped. But then I got greedy for more. It’s like a lil’ personal challenge, ya feel me?

Wrappin’ It Up: 777 Is Your Financial Superpower

So, is 777 a good credit score? Hell yeah, it is! It’s a “Very Good” or even “Excellent” score that puts you above most folks and makes lenders wanna work with ya. It means better rates, easier approvals, and access to some sweet financial products. You got here by payin’ on time, keepin’ debt low, and buildin’ a solid credit history.

No Minimum Credit Score Required

4.8 Google Rating

- Network of lenders

- Home purchase

- Home equity line of credit

- Home refinance

eMortgage is here to help you find the right home loan, refinance, HELOC, or reverse mortgage you need. Fill out some simple information about the type of property and loan you need, and they’ll connect you with up to 5 lenders who can help.

Products to Help Maintain a 777 Credit Score

Here are some products that can help you maintain a 777 credit score:

Is 777 Credit Score Good? – CreditGuide360.com

FAQ

How to get a 777 credit score to 800?

- Pay on Time. You don’t have to be a perfectionist to become a member of the 800 Club, but it does help. …

- Limit Credit Use. …

- Mix and Match Methods of Borrowing. …

- Credit History Matters. …

- Don’t Apply for Credit …

What percentage of people have a 777 credit score?

Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 777 FICO® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders. 25% of all consumers have FICO® Scores in the Very Good range.

What can you do with a credit score of 777?

Credit cards are unique from most borrowing options because of that reason, and they offer rewards. With a 777 credit score, you’ll likely have access to premium rewards credit cards and have an easy time when it comes to approval.

What is an excellent credit score?

What does a 777 credit score mean?

People with credit scores of 777 typically pay their bills on time; in fact, late payments appear on just 22% of their credit reports. People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms.

What is a 777 FICO ® score?

Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 777 FICO ® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders. 25% of all consumers have FICO ® Scores in the Very Good range.

Can I get a car loan with a 777 credit score?

With a 777 credit score, you should be able to get approved for a car loan. However, it’s important to compare your auto loan options carefully if you want to secure a low APR, as approximately 80% of all auto loans are given to individuals with credit scores below 780.

Can I get a student loan with a 777 credit score?

A 777 credit score makes it relatively easy to get a student loan, as only approximately 10% of student loans are given to applicants with a credit score above 780 (2022 Equifax data).

What is the average utilization rate for a 777 credit score?

Among consumers with FICO ® credit scores of 777, the average utilization rate is 23.7%. The best way to determine how to improve your credit score is to check your FICO ® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file.

What is a good credit score?

A credit score of 750+ is considered good based on the approval rates for loans and lines of credit that we have seen. Many people consider excellent credit to be a score of 720+, but setting the bar higher may lead to even better borrowing options.