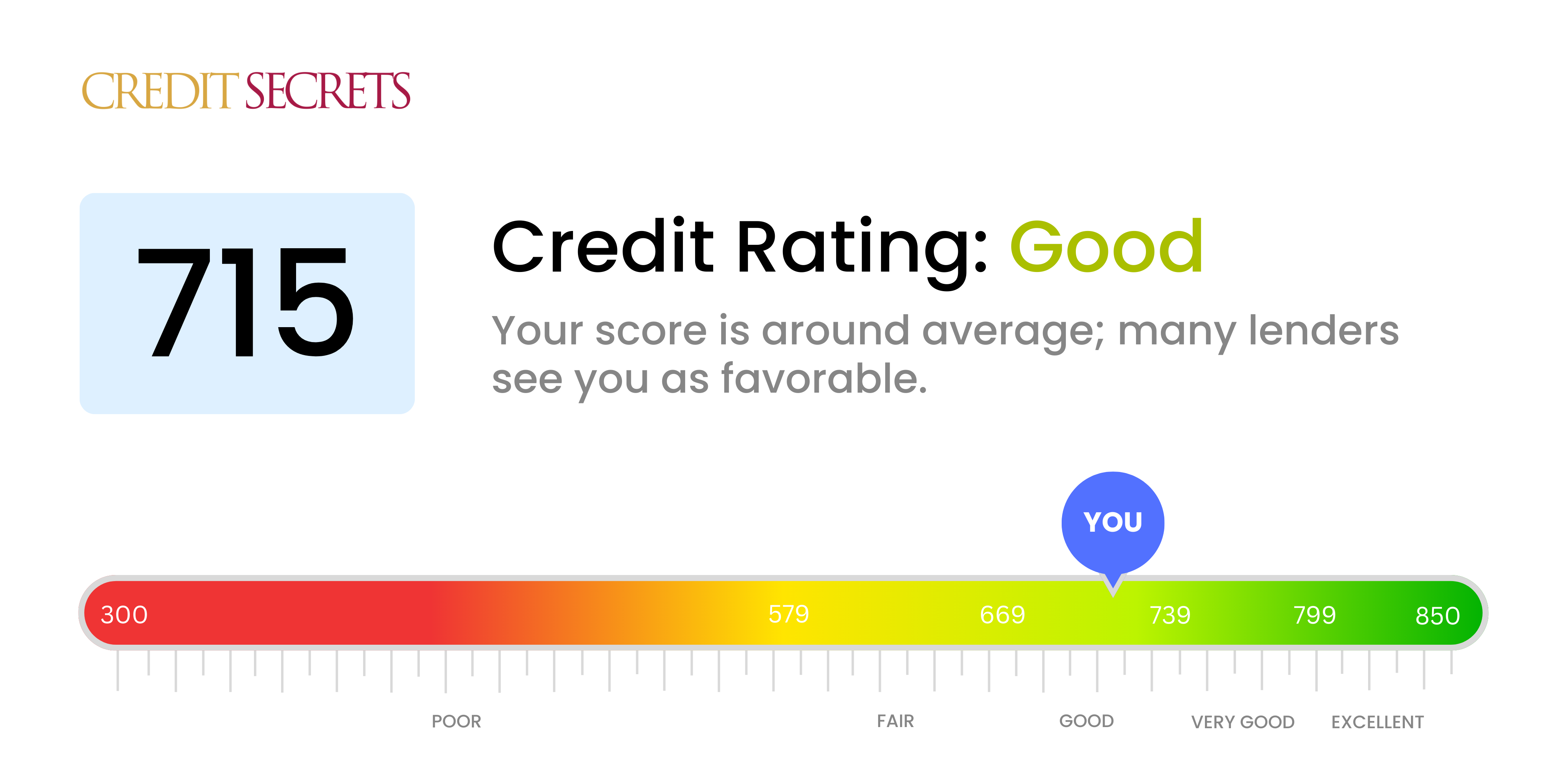

Your score falls within the range of scores, from 670 to 739, which are considered Good. The average U.S. FICO® ScoreÎ, 714, falls within the Good range. Lenders view consumers with scores in the good range as “acceptable” borrowers, and may offer them a variety of credit products, though not necessarily at the lowest-available interest rates.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

A credit score of 715 falls within the “good” credit range, but is it good enough to qualify for a mortgage and get a decent interest rate when buying a house? The short answer is yes, a credit score of 715 is generally considered good enough to qualify for most mortgage options, though aiming for a higher score will help ensure access to the lowest rates

What Credit Score is Considered Good for Buying a House?

Most mortgage lenders view a credit score above 620 as the minimum threshold for home loan approval. However, the higher your credit score, the better your interest rate will likely be.

Here’s a look at the credit score ranges most commonly cited as “good” for qualifying for a mortgage

- 720+: Excellent credit

- 680-719: Very good credit

- 670-679: Good credit

- 620-669: Fair credit

So while a score of 715 falls at the lower end of the “good” credit band for mortgage lending purposes, it still surpasses common minimum requirements. Those with excellent credit scores of 720+ will qualify for the very lowest interest rates.

What Credit Score Do You Need for Different Mortgage Types?

The minimum credit score requirements vary slightly depending on the type of mortgage you are applying for. Here are typical minimum scores:

- Conventional loans: 620

- FHA loans: 580

- VA loans: 580

- USDA loans: 640

- Jumbo loans: 700

FHA, VA, and USDA loans are government-backed mortgages that often have more lenient credit standards than conventional loans. Jumbo loans are for very high loan amounts and tend to have stricter criteria.

While the minimum can be lower, a credit score of at least 620 is recommended for most mortgage types to get reasonable interest rates. So at 715, your score surpasses common minimums.

Can You Get a Mortgage with a Credit Score of 715?

The short answer is yes. A 715 credit score is well within the range considered “good” for mortgage approval with most lenders.

Your interest rate may not be absolutely rock bottom with a 715 score, but it should still be competitive. According to myFICO’s mortgage rate estimator, a borrower with a 715 credit score could expect interest rates around:

- 30-year fixed: 5.125%

- 15-year fixed: 4.125%

- 5/1 ARM: 4.438%

These estimated rates are based on a $300,000 loan with a 20% down payment as of June 2025 – so your actual rates may vary depending on your specific loan factors.

While excellent credit (720+) unlocks the very lowest rates, a 715 score will still qualify you for mortgage options with reputable lenders at reasonable interest rates.

Strategies to Raise Your Credit Score for a Mortgage

If your goal is to land the very best mortgage rates, there are steps you can take to boost your credit score into the “very good” or “excellent” ranges.

Pay Down Balances

High amounts of revolving credit card debt can negatively impact your credit. Pay down balances to lower your credit utilization ratio.

Make Payments On Time

Payment history is the most important factor in your credit score. Avoid late payments and bring any past-due accounts current.

Limit New Credit Accounts

Too many new accounts can lower your score temporarily. Try to avoid applying for new credit in the months before you apply for a mortgage.

Monitor Your Credit

Regularly check your credit reports from the three bureaus for any errors that may be hurting your score.

Let Length of History Grow

In general, the longer your established credit history, the better. Allow your accounts to continue aging.

With diligent credit management over time, it’s possible to go from a 715 credit score to a 750+ score and unlock the most favorable mortgage interest rates.

What Else Matters for Mortgage Approval Besides Your Credit Score?

While your credit score is very influential, lenders look at other key factors as well when determining your eligibility for a home loan, including:

-

Down payment amount – In general, the larger your down payment, the lower your rate will be. A down payment of at least 20% can help you avoid private mortgage insurance (PMI).

-

Debt-to-income ratio – Lenders look at your total monthly debt payments in relation to your gross monthly income. A ratio below 50% is preferable.

-

Loan-to-value ratio – This compares how much you are borrowing against the appraised home value. A lower LTV ratio is better for qualifying for the lowest rates.

-

Employment history – Having steady income from your job will be verified and is key for approval.

-

Assets and reserves – Lenders want to confirm you have enough assets and cash reserves to comfortably handle the mortgage.

So while an excellent credit score in the 720+ range is hugely helpful for getting approved and securing the lowest interest rates, lenders take a holistic look at your entire financial picture when making mortgage decisions.

The Takeaway

A credit score of 715 is considered a “good” score by most mortgage lenders. While excellent credit in the 720+ range is ideal for the best terms, a 715 FICO score meets the credit standards for approval with many popular mortgage programs.

Just be sure to also pay close attention to the other key factors lenders review, like your debt-to-income ratio, assets, and down payment amount. Preparing those elements can help complement your 715 credit score to qualify for competitive mortgage rates.

How to keep on track with a Good credit score

Having a Good FICO® Score makes you pretty typical among American consumers. Thats certainly not a bad thing, but with some time and effort, you can increase your score into the Very Good range (740-799) or even the Exceptional range (800-850). Moving in that direction will require understanding of the behaviors that help grow your score, and those that hinder growth:

Late and missed payments are among the most significant influences on your credit scoreâand they arent good influences. Lenders want borrowers who pay their bills on time, and statisticians predict that people who have missed payments likelier to default (go 90 days past due without a payment) on debt than those who pay promptly. If you have a history of making late payments (or missing them altogether), youll do your credit score a big solid by kicking that habit. More than one-third of your score (35%) is influenced by the presence (or absence) of late or missed payments.

Utilization rate, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure utilization on an account-by-account basis by dividing each outstanding balance by the cards spending limit, and then multiplying by 100 to get a percentage. Find your total utilization rate by adding up all the balances and dividing by the sum of all the spending limits:

| Balance | Spending limit | Utilization rate (%) | |

|---|---|---|---|

| MasterCard | $1,200 | $4,000 | 30% |

| VISA | $1,000 | $6,000 | 17% |

| American Express | $3,000 | $10,000 | 30% |

| Total | $5,200 | $20,000 | 26% |

Most experts agree that utilization rates in excess of 30%âon individual accounts and all accounts in totalâwill push credit scores downward. The closer you get to âmaxing outâ any cardsâthat is, moving their utilization rates toward 100%âthe more you hurt your credit score. Utilization is second only to making timely payments in terms of influence on your credit score; it contributes nearly one-third (30%) of your credit score.

Its old but its good. All other factors being the same, the longer your credit history, the higher your credit score likely will be. That doesnt help much if your recent credit history is bogged down by late payments or high utilization, and theres little you can do about it if youre a new borrower. But if you manage your credit carefully and keep up with your payments, your credit score will tend to increase over time. Age of credit history is responsible for as much as 15% of your credit score.

New credit activity typically has a short-term negative effect on your credit score. Any time you apply for new credit or take on additional debt, credit-scoring systems determine that you are greater risk of being able to pay your debts. Credit scores typically dip a bit when that happens, but rebound within a few months as long as you keep up with your bills. Because of this factor, its a good idea to “rest” six months or so between applications for new creditâand to avoid opening new accounts in the months before you plan to apply for a major loan such as a mortgage or an auto loan. New-credit activity can contribute up to 10% of your overall credit score.

A variety of credit accounts promotes credit-score improvements. The FICO® credit scoring system tends to favor individuals with multiple credit accounts, including both revolving credit (accounts such as credit cards that enable you to borrow against a spending limit and make payments of varying amounts each month) and installment loans (e.g., car loans, mortgages and student loans, with set monthly payments and fixed payback periods). Credit mix accounts for about 10% of your credit score.

Public records such as bankruptcies do not appear in every credit report, so these entries cannot be compared to other score influences in percentage terms. If one or more is listed on your credit report, it can outweigh all other factors and severely lower your credit score. For example, a bankruptcy can stay on your credit report for 10 years, and may shut you out of access to many types of credit for much or all of that time.

How to improve your 715 Credit Score

A FICO® Score of 715 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 715 FICO® Score is on the lower end of the Good range, youll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range (580 to 669).

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, youll receive information about ways you can boost your score, based on specific information in your credit file. Youll find some good general score-improvement tips here.

Best Home Loan for First Time Home Buyer With 700 Credit Score or Better

FAQ

What can a 715 credit score get you?

As you can see from the above, a credit score of 715 is considered good for both credit scoring models. This can help you qualify for loans, including personal loans (which Chase does not offer), auto loans and mortgages.

Can I get a mortgage with a 715 credit score?

As you can see, unless you’re applying for an FHA loan, your credit score should be at least 640 to qualify for most mortgages.Feb 18, 2025

What credit score is needed for a $250000 house?

What credit score do I need to buy a $250,000 house? You can buy a $250,000 house with a wide range of credit scores, from as low as 500 to as high as 800+.Mar 19, 2025

How to increase credit score from 715 to 750?

- Make On-Time Payments.

- Pay Down Revolving Account Balances.

- Don’t Close Your Oldest Account.

- Diversify the Types of Credit You Have.

- Limit New Credit Applications.

- Dispute Inaccurate Information on Your Credit Report.

- Become an Authorized User.

Can a 715 credit score be used to get a mortgage?

With a 715 credit score, you should qualify for rates on-par with national averages for a mortgage. However, it’s important to note that even though your score qualifies you for a mortgage, the stronger the rest of your qualifications need to be due to the lower score.

How to improve a credit score of 715?

A credit score of 715 is considered good, but there’s always room for improvement. To improve a credit score of 715, you can reduce the credit utilization on your credit card accounts and continue paying bills on time moving forward.

What does a 715 credit score signify?

An average credit score of 715 indicates that you generally pay your bills on time, according to most lenders. In this article, we’ll delve deeper into what your 715 credit score signifies when applying for loans and ways to enhance your score.

Can a 715 credit score qualify for an auto loan?

Your 715 credit score qualifies you for an auto loan. However, it’s important to note that your credit score can significantly impact the interest rate you receive. This is particularly true in auto lending.

Can I get a student loan with a 715 credit score?

A 715 credit score is relatively easy to get approved for a student loan, as more than 70% of student loans are given to applicants with a credit score below 740.

What is a good credit score to buy a house?

A favorable credit score to buy a house is typically in the high 600s and 700s. Anything higher than that is considered “exceptional”, and helps borrowers get the very best mortgage rates. Certain loan types even allow you to buy a house with a credit score as low as 500.