Are you staring at your 62nd birthday and wondering if you should hit that Social Security button right away? Or maybe you’re thinking “What if I just wait ONE more year?” Well you ain’t alone in this confusion!

I’ve been researching Social Security strategies for years, and lemme tell you – that single year between 62 and 63 can make a surprising difference to your monthly checks. Let’s break down exactly how much moolah we’re talking about and whether waiting might be worth it for your situation.

The Basic Jump: What Happens to Your Benefits From 62 to 63

When you claim Social Security at 62 (the earliest possible age), you’re taking a pretty significant haircut on your benefits. But hold on for just one year, and things start looking better.

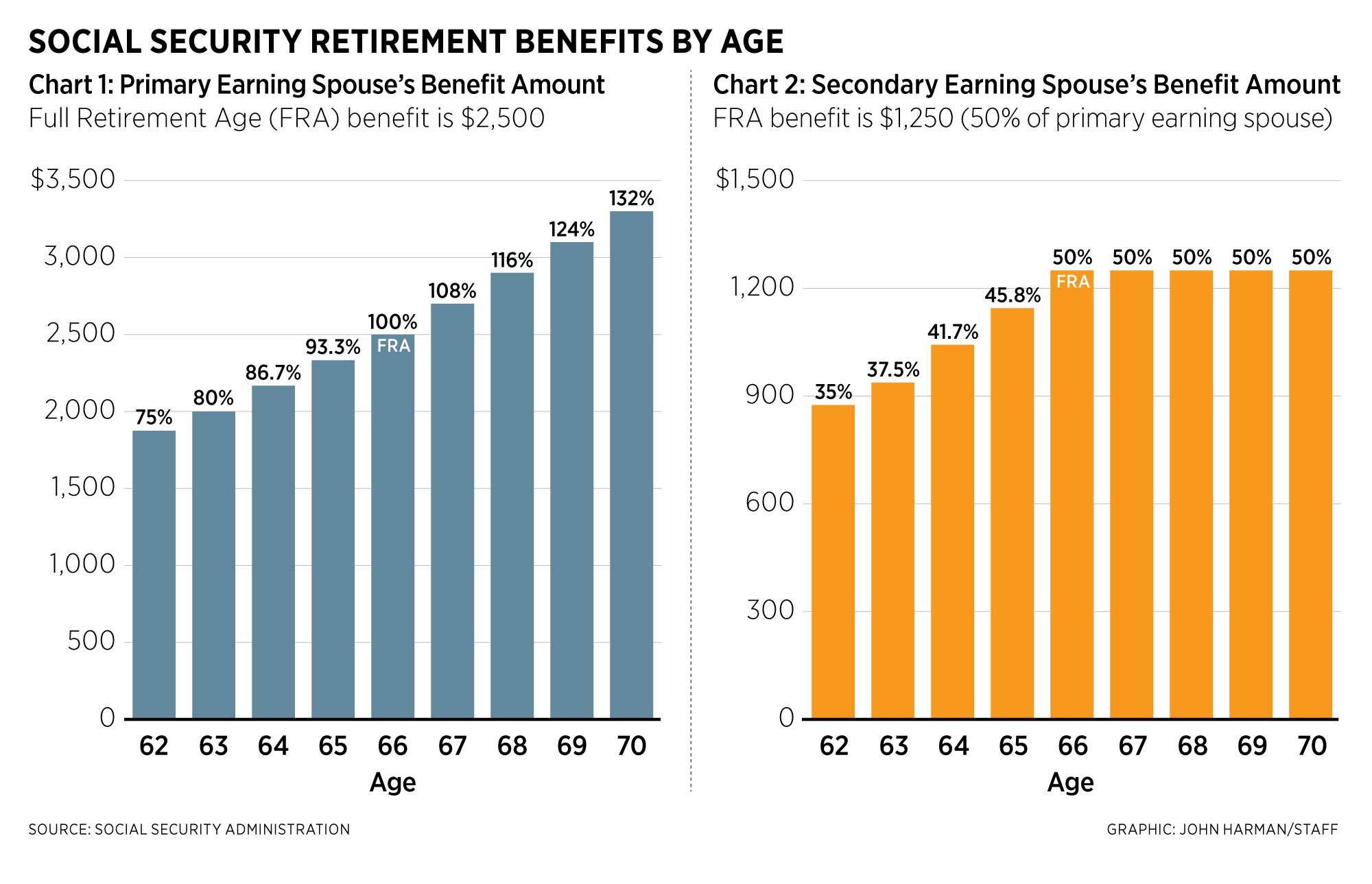

The simple truth is that your Social Security benefit goes up by about 5% to 8% for every year you wait to claim between the ages of 62 and 70, depending on your birth year and when you actually claim.

Say you can get a $1,000 monthly benefit when you reach full retirement age (FRA). You might only get $700 to $750 if you file at age 62. But if you wait until you’re 63, you might get $700 to $800 instead.

That’s an extra $600-$1,200 per year just for waiting 12 months! Not too shabby, right?

The Numbers Behind the Increase (Birth Year Matters!)

Your exact increase depends on when you were born, because different birth years have different full retirement ages. Let’s look at the specifics:

If you were born in 1960 or later:

- Your FRA is 67

- At 62, your benefit is reduced by about 30%

- At 63, your benefit is reduced by about 25%

- The difference is roughly 5% of your full benefit

If you were born between 1943-1954:

- Your FRA is 66

- At 62, your benefit is reduced by 25%

- At 63, your benefit is reduced by around 20%

- The difference is roughly 5% of your full benefit

For those born in the years between (1955-1959), the percentages vary slightly since your FRA increases by 2 months for each birth year.

Real-World Example: Meet Betty

Let’s make this super concrete with an example.

Betty was born in 1961 and would receive $2,000 monthly at her full retirement age of 67. If she claims at:

- Age 62: She gets $1,400 per month ($2,000 reduced by 30%)

- Age 63: She gets $1,500 per month ($2,000 reduced by 25%)

That’s a $100 monthly increase, which translates to $1,200 more per year! Over 20 years, that’s an extra $24,000 in Betty’s pocket. Worth waiting for? Maybe!

But Wait… Is Delaying Always Better?

Hold your horses! Before you decide to wait, we gotta consider a few things:

Advantages of Claiming at 62

- You get more checks overall (an extra 12 of them compared to waiting till 63)

- Good choice if you need the money NOW

- Might make sense if you have health concerns or don’t expect to live into your 80s

- Can help you retire earlier if that’s your goal

Advantages of Waiting Until 63 (or Later)

- Larger monthly checks for life

- Bigger cost-of-living adjustments (COLAs) since they’re percentage-based

- Better for those expecting to live long lives

- No earnings test worries if you continue working (the earnings test is less restrictive at 63 than at 62)

The Breakeven Point: When Waiting Pays Off

Here’s the million-dollar question: When does waiting from 62 to 63 actually start paying off?

The “breakeven point” typically occurs somewhere in your late 70s to early 80s. That’s when the total benefits you’ve received by waiting till 63 surpass what you would’ve gotten by claiming at 62.

For example:

- If you claim at 62 and receive $1,400 monthly, you’ll get $16,800 per year.

- If you claim at 63 and receive $1,500 monthly, you’ll get $18,000 per year.

After the first year:

- Age 62 option: $16,800

- Age 63 option: $0 (because you haven’t started collecting yet)

After 10 years (at age 72/73):

- Age 62 option: $168,000 total

- Age 63 option: $162,000 total (9 years of payments)

After 15 years (at age 77/78):

- Age 62 option: $252,000 total

- Age 63 option: $270,000 total

As you can see, somewhere around age 77-78, waiting till 63 starts paying off!

Special Considerations for Working Folks

The earnings test is another HUGE thing to think about if you’re still working at 62 or 63.

In 2025, if you claim benefits before your FRA and earn more than $21,240, Social Security will temporarily withhold $1 in benefits for every $2 you earn above that limit.

The threshold is slightly higher at 63, and the penalty gets less severe the closer you get to your FRA. By waiting just that one year, you might avoid some benefit reductions if you’re still bringing home a paycheck.

What About Spouses? Double the Complexity!

If you’re married, the calculations get even trickier. Spousal benefits are reduced even more harshly than regular retirement benefits when claimed early.

A $500 spousal benefit (at FRA) would be reduced to:

- About $325-$350 if claimed at 62 (30-35% reduction)

- About $362-$387 if claimed at 63 (22-27% reduction)

That’s a slightly bigger percentage jump than for regular benefits!

Making Your Decision: Personal Factors to Consider

When deciding between claiming at 62 vs. 63, consider these factors:

- Health status: Be honest about your health and family longevity

- Financial needs: Can you afford to wait?

- Employment: Are you still working?

- Marital status: How will your decision affect your spouse?

- Other income sources: Do you have savings, pensions, or investments?

My Take: Is Waiting From 62 to 63 Worth It?

As a professional, I think that one-year wait from 62 to 63 is often a good idea, especially if:

- You’re in good health

- You have enough savings to cover that year

- You’re still working and might face earnings test penalties

- You’re concerned about having enough income in your later years

However, there’s no one-size-fits-all answer. Everyone’s situation is unique, and sometimes claiming at 62 is absolutely the right move.

Common Questions About the 62 to 63 Jump

Q: If I claim at 62, can I “undo” it when I turn 63?

A: Yes, but with limitations. You can withdraw your application within 12 months of claiming, but you must repay all benefits received. After that, it’s permanent.

Q: Does my 62 vs. 63 decision affect Medicare?

A: No. Medicare eligibility begins at 65 regardless of when you claim Social Security. In fact, you should still apply for Medicare within 3 months of turning 65 even if you delay Social Security.

Q: What if I need money at 62 but want the higher benefit at 63?

A: Consider withdrawing from savings for a year, working part-time, or exploring other income sources to bridge the gap.

Bottom Line: That One-Year Wait Can Be Significant

The jump from 62 to 63 might seem small, but it typically means a 5-6.7% increase in your monthly benefit for the rest of your life. For someone with a $2,000 FRA benefit, that’s about $100 more per month or $1,200 per year.

Whether that trade-off makes sense depends entirely on your personal circumstances. But now at least you know exactly what that year of waiting is worth!

Remember: Social Security will be around for decades to come (despite what some doomsayers might tell ya), but how and when you claim it could significantly impact your retirement lifestyle. Take your time, do the math, and choose what’s best for YOUR situation.

What’s your plan? Are you claiming at 62, waiting till 63, or holding out even longer? I’d love to hear your thoughts in the comments below!

Note: While I’ve made every effort to provide accurate information, Social Security rules can change. The numbers above are based on current regulations as of October 2025. Always check with the Social Security Administration before making your final decision.

Benefits of working past 62

Delaying Social Security allows you to increase your monthly checks as discussed above. This could lead to a larger lifetime benefit for those who live into their mid-80s or beyond. Larger monthly checks also mean larger cost-of-living adjustments (COLAs). These are annual Social Security increases that all beneficiaries receive to help their checks keep pace with inflation.

When you delay Social Security until your FRA or beyond, you also dont have to worry about the earnings test. Those who work while claiming Social Security under their FRA could lose a portion of their benefits if their annual income is too high. But the money isnt gone forever. When you reach your FRA, the government recalculates your benefit to include the amount that was taken out before. This means that your new checks will be bigger. For some, however, this is a hassle theyd rather not deal with.

Benefits of claiming Social Security at 62

Claiming Social Security at 62 means more years of benefits. This is why it remains one of the most popular ages to apply. Seniors who wish to retire in their early 60s but cannot afford to do so on their own can supplement their personal savings with Social Security to help them cover their expenses.

Signing up early can also be advantageous if you dont expect to live long. Youll likely get a larger lifetime benefit this way. If you try to delay benefits, theres a chance you could wait too long and miss out on Social Security altogether.