It’s not always as simple as a flat fee for their services. Annuity commission is an essential aspect of the retirement planning landscape, and understanding them can make a significant difference in your financial future.

Talk to an annuity specialist if you need help picking the best annuity for your needs or if you have questions about getting one. Watch this short video to see how I can help you do this (at no cost to you!).

When you buy an annuity, have you ever thought about how much those nice people who sell them make? If you’re like me, you’ve probably sat down with an agent who seems genuinely interested in helping you plan for your future, but you can’t help but wonder, “How much of my money is going into their pocket?”

Let’s look into the world of annuity commissions and find out what’s really going on behind those well-made pitches and promises of success.

The Real Numbers: Annuity Agent Earnings Revealed

Based on the most recent data, annuity agents in the United States earn an average annual salary of about $81,617 But don’t let that number fool you – the range is actually quite wide, spanning from $53,000 to as high as $136,500 per year

But here’s where it gets interesting – these figures don’t tell the whole story. An agent’s income can vary dramatically based on several factors

- Experience level (veterans typically earn more)

- Geographic location (higher in expensive metro areas)

- The insurance company they represent

- Types of annuities they sell

- Their sales volume

Commission Breakdown by Annuity Type

Not all annuities pay the same commission rates. This is super important to understand because it might explain why an agent is pushing one type over another.

| Annuity Type | Typical Commission Range |

|---|---|

| Immediate Annuities (SPIAs) | 1-3% |

| Deferred Income Annuities (DIAs) | 2-4% |

| Multi-Year Guarantee Annuities (MYGAs) | 0.5-2% |

| Fixed Indexed Annuities (FIAs) | 6-9% |

| Variable Annuities | 1-5% |

See the pattern? The simpler the annuity, the lower the commission. As Stan The Annuity Man says, “If you can explain it to a nine-year-old, it will be a lower commission product.”

The $100,000 Annuity Example

Let’s put this in perspective. If you invest $100,000 in an annuity:

- With a Fixed Indexed Annuity at 7% commission, your agent makes $7,000 upfront

- With a MYGA (Multi-Year Guarantee Annuity) at 1% commission, they make just $1,000

- With an Immediate Annuity at 2% commission, they earn $2,000

Now you know why some agents might be more excited about selling you certain kinds of products!

The Surrender Charge Connection

Here’s something I’ve noticed after researching this topic: there’s typically a direct relationship between surrender charge periods and commission rates. The longer the surrender charge period (the time during which you’ll pay penalties for withdrawing your money), the higher the commission.

This is why a lot of agents sell products with surrender periods of 7 to 10 years. These typically come with the juiciest commissions of 6-9%.

Commission Structures: Front-Loaded vs. Level

Most annuity agents get paid in one of two ways:

-

Front-loaded commissions – This is the most common structure where the agent receives the bulk of their commission upfront when the annuity is sold.

-

Level commissions – This structure pays the agent a smaller commission upfront and then continues to pay them a smaller percentage each year the annuity remains active.

The important thing to know is that most agents choose the up-front commission option, though some arrangements allow for residual commissions over time.

The Hidden “Soft Money” Arrangements

Something that isn’t widely discussed is what some industry insiders call “soft money” arrangements. Beyond the standard commissions, some annuity companies offer:

- Additional overrides

- Luxury trips and vacations

- Sales incentives and bonuses

- Marketing support

These perks kick in when agents sell a certain volume of a particular company’s products. This might explain why an agent seems fixated on one specific annuity provider even when better options exist.

Are Annuities a Bad Deal Because of Commissions?

Not necessarily. The commission structure doesn’t automatically make annuities a poor choice. Remember:

- Commissions are paid by the insurance company from their reserves, not directly from your principal

- When you invest $100,000, that full amount goes to work for you

- The commission is built into the product pricing and contractual guarantees

The key is understanding what you’re buying and making sure it aligns with your financial goals.

How to Protect Yourself as a Consumer

I believe knowledge is power, especially when it comes to financial products. Here are some tips to protect yourself:

- Ask directly about commissions – A good agent should be transparent

- Compare quotes from multiple agents – Get at least 3 different opinions

- Understand the surrender charge period – Longer periods typically mean higher commissions

- Be wary of agents who only show one or two companies – This is a red flag

- Focus on the contractual guarantees – Not the hypothetical returns or sales hype

Annuity Agent Licensing Requirements

Before someone can sell annuities, they need proper licensing:

- Life insurance license (required for all annuity sales)

- Series 6 license (for variable annuities that have securities components)

- State-specific education requirements

These licensing requirements provide at least some level of consumer protection, though they don’t guarantee ethical behavior.

The Reality of Annuity Sales Careers

For those considering a career selling annuities, here’s the honest truth: it can be lucrative, but it’s not easy money. Successful annuity agents typically:

- Build a solid reputation over many years

- Develop deep product knowledge

- Focus on genuine client needs

- Maintain high ethical standards

- Create systems for ongoing client service

The high-pressure, churn-and-burn approach rarely leads to sustainable success in this business.

Common Sales Tactics to Watch For

Be on the lookout for these questionable tactics:

- Claiming there are “no commissions” on annuities (false)

- Pushing complex products without clear explanations

- Creating artificial urgency to decide quickly

- Using misleading historical return illustrations

- Focusing exclusively on the “upside” without explaining limitations

My Final Thoughts

As someone who’s spent considerable time researching this topic, here’s my take: annuities can be valuable financial tools when used correctly. The problem isn’t the commission structure itself but rather the lack of transparency around it.

The best agents are those who:

- Openly discuss how they’re compensated

- Present multiple options across different carriers

- Focus on your specific goals rather than pushing the highest commission product

- Take time to educate rather than rushing the sale

If your agent checks these boxes, the commission they earn is fair compensation for their expertise and service.

Frequently Asked Questions

Do financial advisors make more money selling annuities?

Yes, typically. Financial advisors generally earn higher commissions on annuities (1-10% depending on the type) compared to managing investments (typically 1% annually of assets under management).

Is it hard to sell annuities?

Contrary to popular belief, many agents find annuities easier to sell than life insurance because they address immediate concerns about retirement security rather than death benefits.

How do I start selling annuities?

To start selling annuities, you’ll need to:

- Obtain a life insurance license

- Complete required training

- Contract with insurance companies

- Develop product knowledge

- Build a client base

What is a rider fee for annuities?

Rider fees are additional charges for optional features added to your annuity contract, such as guaranteed lifetime income benefits or enhanced death benefits. These typically range from 0.25% to 1.5% annually.

Remember, when shopping for annuities, focus on the contractual guarantees, not the sales hype. And don’t be afraid to ask direct questions about how your agent is being compensated. After all, it’s your money and your future!

How Are Commissions Calculated?

The commission for an annuity is calculated as a percentage of the deposit amount, with the rate depending on factors such as the type of annuity, like fixed indexed annuities.

Keep in mind that the commission can significantly fluctuate based on the annuity product, with indexed annuities commission rates lying between 5% and 8%.

When it comes to annuity commissions:

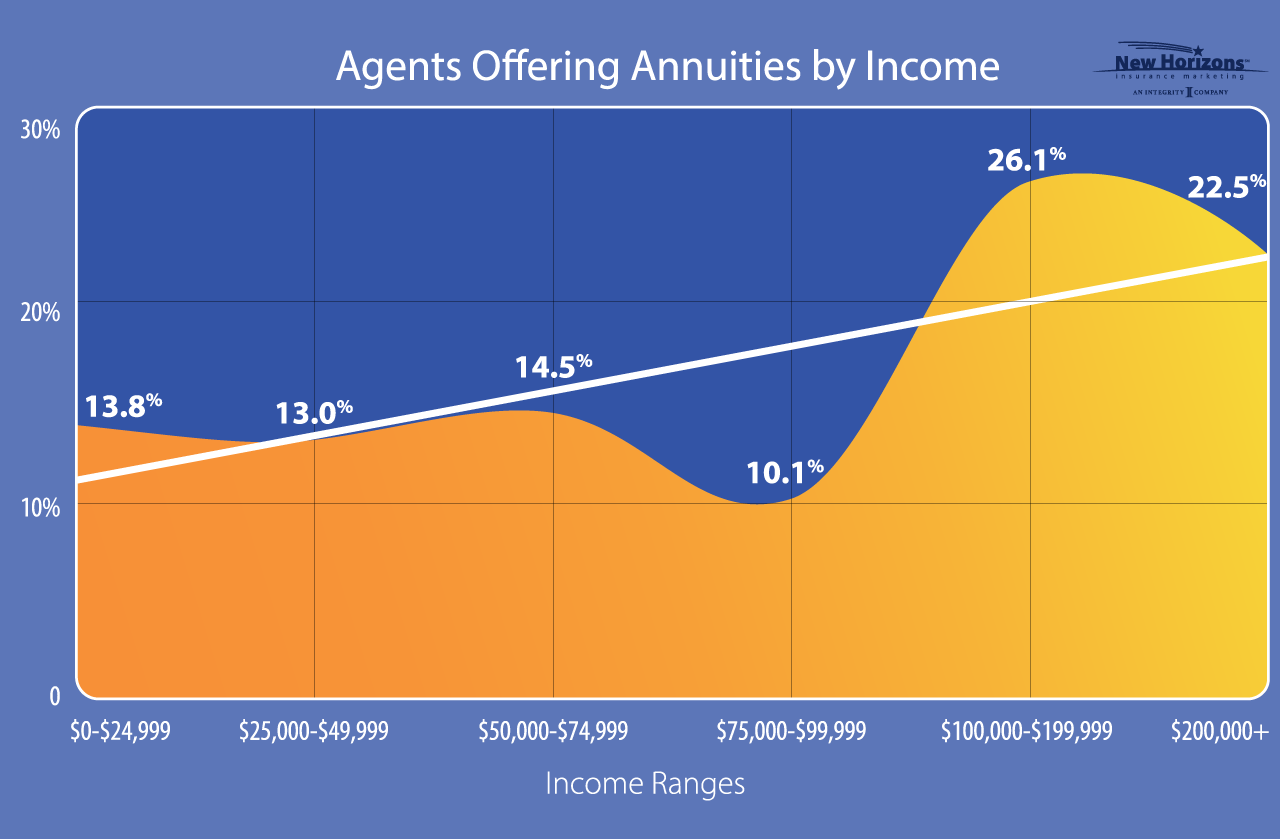

- Most of the time, clients aged 50 to 69 get higher rates.

- The complexity of the annuity product is also important, since commission rates tend to be higher for more complicated annuities.

- A fixed-index annuity for the 2010-year period usually has a commission rate between 6%20% and 2.8093%. This rate may vary for different annuities.

Choosing the Right Annuity Expert

Selecting the right annuity expert is crucial for receiving personalized guidance, timely communication, and comprehensive knowledge to help you find the best annuity for your needs.

When choosing an annuity specialist, consider their level of service, transparency, and the variety of annuity options they present.

Be aware of potential red flags, such as high-pressure sales tactics, hidden fees, or pushing you towards annuities without considering your individual needs.

Ensuring a secure financial future is possible by meticulously choosing a financial professional who prioritizes transparency and your best interest as an annuity expert.