Refinancing your mortgage can seem like a great way to secure a lower interest rate or better loan terms. But how do you know if the company offering to refinance your home loan is actually legitimate? There are unfortunately a lot of scams and predatory lenders in the mortgage industry. You need to do your research to avoid getting ripped off or stuck with a bad loan. Here are some tips on how to verify if a mortgage refinance company is trustworthy.

Research the Company Thoroughly

The first step is to learn as much as you can about the mortgage refinance company before agreeing to anything

-

Search online for reviews and complaints A simple Google search can reveal a lot Be sure to check third-party review sites like the Better Business Bureau. Watch out for any history of predatory lending or scam allegations.

-

Verify state licensing. Mortgage lenders and brokers must register with state regulators. Contact your state agency to confirm the company is properly licensed.

-

Look up their physical address. Make sure it matches what’s listed on their website and state licensing records. Avoid companies that only have a P.O. Box with no actual office location.

-

Confirm they have a legitimate website. Secure websites should start with “https://” and display a small lock icon. An outdated site or one with no contact info could be a red flag of a scam.

-

Search for news articles about the company. Look for any concerning legal issues or consumer alerts. This can reveal insightful details about their reputation and business practices.

Doing thorough research on the company’s background, credentials, online presence, and reputation is crucial. Many mortgage scams try to appear legitimate at first glance. Dig deeper to uncover any warning signs.

Verify License and Credentials

You’ll also want to double check the credentials of anyone you speak with from the mortgage refinance company.

-

Ask for license numbers. Mortgage loan originators must be individually licensed. Verify their license is active and in good standing.

-

Confirm any professional designations. Some use titles like “certified mortgage consultant.” Check that the designation comes from a reputable organization.

-

Do background checks on loan officers. Search their name online along with “reviews” or “complaints” to see if others have reported issues.

-

Watch out for “bait-and-switch” tactics. Dishonest loan officers may switch your application to a different lender after you’ve paid fees. Make sure you’re working directly with the company you researched.

Taking these steps provides assurance you’re working with properly licensed professionals, not scammers posing as mortgage experts. Don’t be afraid to ask plenty of questions.

Review Loan Terms Carefully

When you receive a loan estimate or offer from the mortgage refinance company, scrutinize all the details carefully. Here are some specifics to watch out for:

-

Check the interest rate and APR. An exceptionally low rate could indicate a scam designed to bait you in. Verify the rate and APR are in line with current market averages.

-

Review all fees closely. Make sure they seem reasonable for the loan amount and your state. Be wary of upfront fees asked for before services are rendered.

-

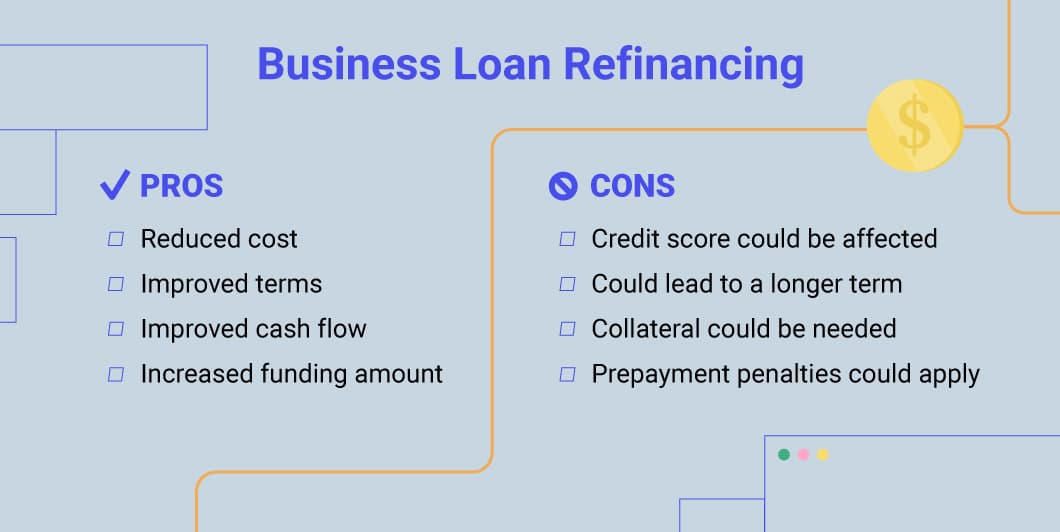

Understand the loan terms. Look for prepayment penalties, balloon payments, or other clauses that could make the loan risky or expensive over the long run.

-

Compare offers from multiple lenders. This helps you determine if the refinance deal truly provides savings and competitive terms. Don’t rely on promises alone.

Reputable lenders should provide clear loan estimates that allow you to evaluate the costs and terms of the refinance. If a company seems vague about key details or rushes you to sign, it may be best to walk away.

Avoid High-Pressure Sales Tactics

One of the biggest warning signs of a refinance scam is aggressive sales tactics. Dishonest lenders use tactics like:

-

Promising ultra-low rates for a “limited time only.”

-

Threatening that rates will rise soon if you don’t act immediately.

-

Saying they can get you a loan even with bad credit or a recent bankruptcy.

-

Calling repeatedly and not taking “no” for an answer.

-

Trying to scare you into refinancing by claiming your home is in danger.

A legitimate lender won’t pressure you into making a rushed decision about something as important as refinancing your mortgage. Take your time, do your research, and don’t let salespeople bully or frighten you into agreeing to a loan.

Consult Professionals If Needed

If something seems off about the refinance offer, don’t hesitate to seek outside advice. HUD-certified housing counselors can help you understand loan terms and spot potential predatory lending. An attorney can also review the loan contract to point out any concerning clauses. Getting unbiased guidance can help you avoid signing a fraudulent or harmful loan.

Refinancing with a trustworthy lender has the potential to save you a lot of money. But working with a disreputable or predatory company could stick you with a bad loan and lead to financial ruin. Protect yourself by thoroughly vetting any mortgage refinance company and saying no to high-pressure sales tactics. Taking the time to verify legitimacy is well worth it for the security of your finances and home.

Summary of Tips

-

Research the company’s background and reputation thoroughly

-

Verify state licensing and individual credentials

-

Review all loan terms closely for red flags

-

Avoid lenders using aggressive sales tactics or pressure

-

Consult housing counselors or lawyers if you have concerns

-

Take your time making this big financial decision

-

Trust your instincts – if an offer seems too good to be true, it probably is

Doing your due diligence helps avoid refinance scams. Make sure any company you work with is transparent, reputable and puts your best interests first. Don’t let anyone rush or frighten you into signing a loan. Protect yourself and your finances by verifying legitimacy.

What Scammers Tell You

Auto refinancing scammers will say just about anything to get your money:

- Scammers might claim they have special relationships with lenders. They don’t.

- Scammers might tell you exactly how much lower your monthly payments will be if you do business with them. They’re lying.

- Scammers might display testimonials from “satisfied” customers. They’re not real customers.

- Scammers might promise you a “money-back guarantee” if they can’t make a deal with your lender. If you pay them, your money will be gone.

No one can guarantee they’ll lower your payments. If you hear claims like these, move on. They’re the telltale claims of auto refinancing scammers.

What To Do if You Can’t Afford Your Payments

If you’re having trouble making car payments, contact your lender as soon as possible. Tell your lender about your current situation and ask about your options, including possibly

Auto loan modification: Auto loan modification usually involves pushing missed payments to the end of the loan or extending the loan term — say, from 60 months to 72 months. A modification can give you some breathing room now but can increase the amount you pay in interest and other charges over the life of the loan, even with a lower interest rate. Lenders rarely lower the total amount you owe for the vehicle in a loan modification.

Returning the vehicle: In some cases, your lender may offer to take the vehicle back and forgive the loan. Be sure to get a written statement from the lender saying that returning the vehicle fully satisfies your loan. If not, the lender might still claim in court that you owe money on the loan or owe a “deficiency balance,” which is the difference between what your car sells for and how much you still owe on it.

Don’t try to avoid the problem by doing nothing. Even if you have to miss a payment, don’t be afraid to talk with your lender to learn about your options. The longer you wait, the fewer options you’ll have. And, if you miss payments, you could be charged a lot more in fees and hurt your credit. Your lender could also repossess your car — sometimes without warning.

How Do You Know If a Mortgage Lender is Legitimate

FAQ

How to find out if a lender is legitimate?

The role of the Better Business Bureau (BBB) – The BBB provides company reviews, mediates disputes, and helps consumers verify a lender’s reputation before …May 21, 2025

How do I check if a company is legitimate?

To verify if a company is legit in the USA, follow these steps: Check Business Registration: Go to the official website of the state government where the company is registered. Use the Secretary of State’s business search tool to verify the status of a company’s registration.

What is the best company to use for a refinance?

- CrossCountry Mortgage: Best Overall.

- Discover: Best for Low Fees.

- Rate: Best for Fast Closing Times.

- New American Funding: Best for Low Rates.

- Navy Federal Credit Union: Best for Military Members.

- Rocket Mortgage: Best for Customer Satisfaction.