Your retirement income can be a good source of income for getting a mortgage, as long as it meets certain requirements. This includes income from Social Security, pensions, and annuities. Each type is treated slightly differently, but the underlying requirement remains the same: the income must be stable, documented, and likely to continue.

Retiring doesn’t mean the end of your homebuying dreams! If you’re wondering whether your pension counts as income for a mortgage, I’ve got good news for you. Yes, pension income absolutely can be used to qualify for a mortgage, and lenders actually view it as a reliable and stable source of income

Let me break down everything you need to know about using pension income to secure a home loan, whether you’re already retired or planning ahead.

How Lenders View Pension Income

Pension income is typically considered more stable than employment income for a simple reason – it’s guaranteed for life in most cases This makes it an attractive qualification factor for mortgage lenders

And while I was researching this subject, I found that most lenders actually like pension income because

- It’s predictable and consistent

- It’s often guaranteed for life

- It’s not dependent on your ability to work

- It’s usually protected against inflation

Bella Mertz writes on TheMoneyKnowHow that “pension income can be used to get a mortgage.” Mortgage lenders actually see it as a reliable and stable way to make money, which makes it a good choice for retirees and people who are almost retired. “.

How Pension Income Gets Verified for Mortgage Applications

When you apply for a mortgage using pension income to qualify, lenders will need to verify this income. Here’s what you’ll typically need to provide:

Documentation Requirements

Lenders will request:

- Award letters – Official documentation showing your pension amount

- Tax returns – Usually the most recent two years

- Bank statements – Showing the regular deposit of pension funds

- Verification of continued income – Proof your pension will continue

According to Fannie Mae’s guidelines, you’ll need to “document current receipt of the income, as verified by one or more of the following:

- a statement from the organization providing the income,

- a copy of retirement award letter or benefit statement,

- a copy of financial or bank account statement,

- a copy of signed federal income tax return,

- an IRS W-2 form, or

- an IRS 1099 form.”

Income Calculation

Here’s where things get a bit technical. Lenders usually use one of these methods to figure out how much pension income qualifies:

- Straight calculation – Using the full pension amount

- Discounted approach – Some lenders use only 70-80% of pension income to account for potential fluctuations

- Duration assessment – Verifying the pension will continue for at least 3 years

As TheMoneyKnowHow points out, “Lenders will typically use 70% of your monthly pension income to calculate your qualifying income. This accounts for potential fluctuations in the value of your pension.”

Types of Retirement Income That Count Towards Mortgage Qualification

Pension isn’t the only source of retirement income that can help you get a mortgage. Lenders consider several sources:

- Traditional pensions – Employer-provided defined benefit plans

- Social Security income – Both retirement and disability benefits

- 401(k)/IRA distributions – Regular withdrawals from retirement accounts

- Annuity income – Fixed payments from insurance products

- Military retirement pay – Benefits for veterans

- Government pension plans – Federal, state, or local government pensions

Fannie Mae specifically confirms that “if retirement income is paid in the form of a distribution from a 401(k), IRA, or Keogh retirement account, determine whether the income is expected to continue for at least three years after the date of the mortgage application.”

How Debt-to-Income Ratio Works with Pension Income

Your debt-to-income (DTI) ratio remains crucial regardless of income source. Here’s how it works with pension income:

- Lenders calculate your DTI by dividing monthly debt payments by gross monthly income

- Most lenders prefer a DTI ratio of 43% or less

- Your pension income is included in this calculation

- Lower DTI ratios can help you qualify for better interest rates

I’ve seen many retirees qualify with higher DTI ratios than working borrowers because their income is considered more stable. But remember, a lower DTI is always better for loan approval and rates.

Benefits of Using Pension Income for Mortgage Qualification

There are several advantages to using pension income when applying for a mortgage:

- Stability factor – Lenders view pension income as highly reliable

- Higher borrowing capacity – Can increase the loan amount you qualify for

- Competitive rates – May help you secure more favorable interest rates

- Flexible terms – Can qualify for various loan programs

As noted by TheMoneyKnowHow, “A stable pension income can increase your borrowing capacity, allowing you to qualify for a larger mortgage.”

Special Mortgage Programs for Retirees

If you’re using pension income to qualify, you might benefit from these special programs:

Government-Backed Loans

- FHA loans – Lower credit score requirements (580 minimum with 3.5% down)

- VA loans – For eligible veterans, no down payment required

- USDA loans – For properties in rural areas, no down payment needed

Conventional Loans

- Fannie Mae and Freddie Mac – Offer mortgages with just 3% down payment

- Asset depletion loans – Calculate income based on dividing your assets over the loan term

According to TheMoneyKnowHow, “Government-sponsored companies Fannie Mae and Freddie Mac drive the housing market by offering mortgages for retired borrowers with a 3% down payment.”

Important Considerations When Using Pension Income

Before applying for a mortgage using pension income, keep these factors in mind:

Tax Implications

Most pension income is taxable, affecting your net income. Remember to factor this in when calculating your budget for mortgage payments.

Inflation Concerns

If your pension doesn’t include cost-of-living adjustments, your purchasing power might decrease over time while your mortgage payment remains fixed.

Survivorship Benefits

If you’re married, consider what happens to pension income if the primary recipient passes away. This could affect long-term mortgage affordability.

Additional Assets

Having liquid reserves beyond your pension provides additional security and might improve your loan terms.

Tips for Strengthening Your Mortgage Application with Pension Income

Want to improve your chances of approval? Here are my top recommendations:

- Maintain excellent credit – A high credit score can offset income concerns

- Save for a larger down payment – Reduces risk for the lender

- Pay down existing debts – Improves your DTI ratio

- Gather documentation early – Have all pension verification ready

- Consider a shorter loan term – 15-year mortgages may be easier to qualify for

Common Questions About Pension Income and Mortgages

Can I use my pension income if I’m not yet retired?

Yes! If you’re planning to retire soon, lenders can use your expected pension income if you provide documentation showing the amount and start date.

What if my pension hasn’t started yet?

Fannie Mae states: “If income from a government annuity or a pension account will begin on or before the first payment date, document the income with a benefit statement from the organization providing the income. The statement must specify the income type, amount and frequency of the payment, and include confirmation of the initial start date.”

Do lenders count 100% of my pension income?

Not always. Some lenders may use only a percentage (often 70-80%) of your pension to allow for taxes and possible fluctuations.

Can I use my spouse’s pension income if I’m applying alone?

Generally no. The person on the mortgage application must be the one receiving the income, unless your spouse is a co-applicant.

Do I need employment history if I’m using pension income?

No! That’s one of the great benefits. As TheMoneyKnowHow points out, “seniors receiving Social Security and retirement income can qualify for most standard loan programs without providing proof of employment.”

Conclusion

Your pension absolutely counts as income when applying for a mortgage, and it’s actually viewed quite favorably by lenders. With proper documentation and planning, retirees and those approaching retirement can successfully qualify for home loans using pension income.

The key is working with a lender who understands how to properly evaluate retirement income and can guide you through the specific documentation requirements. Don’t let being retired stop you from pursuing homeownership – with your stable pension income, you might be in a better position to qualify than you think!

Have you successfully used pension income to qualify for a mortgage? What challenges did you face? I’d love to hear about your experiences in the comments.

Types of Retirement Income Considered

Lenders typically recognize the following sources of retirement income:

- Social Security: Includes retirement, disability (SSDI), and survivor benefits.

- Pension Income: Regular payments from a former employer.

- Annuities: Periodic payments from an investment or insurance product.

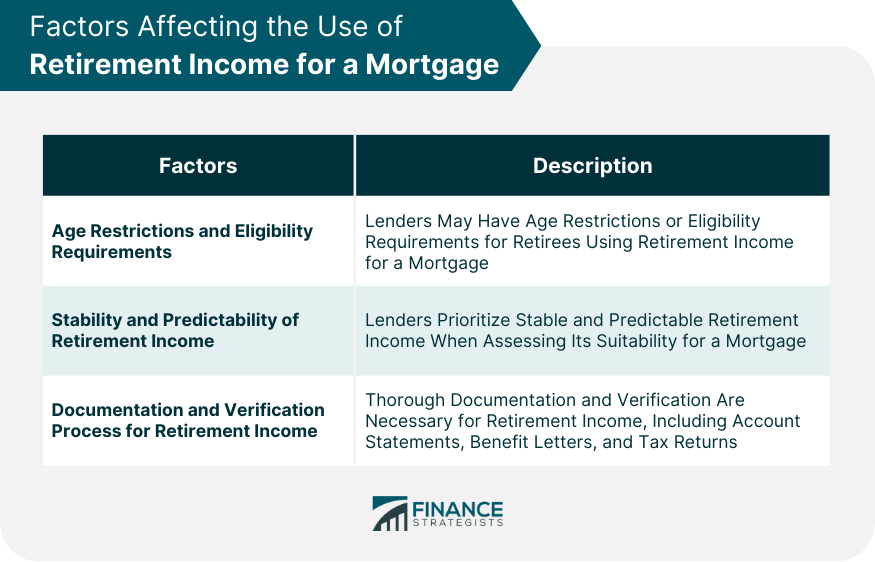

To use retirement income for mortgage qualification, the borrower must provide clear documentation:

- For Social Security, you need the most recent SSA-1099 and your most recent benefit letter.

- For Pension: Award letter, 1099-R, and bank statements showing deposits

- For annuities: a contract or other written document that spells out the terms and length of payments, as well as proof of recent payments

If the retirement income is being received jointly (e.g., spousal benefits), documentation must clearly reflect that.

The income must be expected to continue for at least three years. This is particularly important for annuities, which may be set for a limited term. Social Security and pensions are generally considered stable unless there’s evidence to the contrary.

For people taking money out of retirement accounts like IRAs or 401(k)s, lenders will need proof that the account balance is enough to support regular withdrawals for at least three years. Scheduled distributions must be documented.

Grossing Up Nontaxable Income

A significant benefit of many retirement income sources is that they may be nontaxable. Lenders allow “grossing up” this income, essentially increasing the amount used in the qualification calculation. The typical gross-up rate is 25%, though some programs may allow more based on tax brackets and underwriting systems.