These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Many of our reviewers have advanced degrees and certifications, and they have years of experience with investments, retirement planning, and personal finances.

Ever wondered if those fancy millionaires with their yachts and mansions actually bother with annuities? The answer might surprise you. While annuities are often thought of as retirement tools for the middle class, the wealthy are increasingly turning to these financial products – and for good reason.

As someone who has spent years researching ways to retire, I’ve noticed a growing trend: wealthy people are buying annuities more often than ever before. But why would someone with millions of dollars need annuities, which offer a steady stream of income?

Let’s dive into this fascinating topic and uncover why the rich might be smarter about certain financial moves than we give them credit for

Yes, Millionaires Do Use Annuities

The short answer? Absolutely yes. While not all wealthy individuals purchase annuities, the number who do has been steadily increasing. This isn’t just some random trend – there are specific, strategic reasons why someone with substantial assets might choose an annuity.

According to multiple financial experts, millionaires recognize that annuities are contracts that transfer risk and can protect them from creditors in many circumstances. This risk transfer aspect is particularly appealing to those who’ve worked hard to build their wealth and want to ensure it remains protected.

Why Do the Wealthy Love Annuities?

You might be thinking, “If someone’s already rich, why would they need the steady income annuities provide?” Well, wealthy individuals appreciate annuities for several key reasons:

1. Risk Transfer and Wealth Preservation

Rich people didn’t get rich by making poor financial decisions. They know that transferring risk is a smart way to keep their money safe. Annuities allow them to offload certain risks to insurance companies.

As one financial advisor put it, “The reason a lot of rich people are rich is because they’re smart. Smart people like to transfer risk, and annuities are contracts that allow you to transfer risk.”

2. Protection from Creditors and Lawsuits

In states like Florida and Texas, annuities provide significant protection from creditors and lawsuits. This isn’t about avoiding legitimate debts – it’s about protecting assets from frivolous lawsuits in our increasingly litigious society.

For the wealthy who may be targets for such lawsuits, this protection is incredibly valuable. It’s worth noting that this protection doesn’t apply to criminals trying to hide ill-gotten gains, but rather to hardworking individuals protecting their legitimate earnings.

3. Tax Benefits and Deferral

Who likes paying more taxes? Nobody – including millionaires. In a non-IRA account, annuities allow interest to grow and compound tax-deferred. This can be especially attractive for high-income individuals in top tax brackets.

Many wealthy investors use Multi-Year Guarantee Annuities (MYGAs) specifically for this tax advantage. Unlike CDs, which require annual tax payments on interest earned in non-IRA accounts, annuities allow them to push that tax burden down the road.

4. Guaranteed Lifetime Income

One of the biggest worries of retirees, even wealthy ones, is running out of money. This risk is taken away by annuities, which give you a guaranteed income for life, no matter how long you live after buying them.

As one expert noted: “That type of certainty appeals to all types of investors, not just rich ones.”

5. Legacy Planning

Many wealthy individuals use annuities as part of their estate planning strategy. They can provide for spouses or children who may not be financially savvy or interested in managing complex investments.

For instance, a rich futures trader might buy an annuity to give his spouse a steady income after he die if she doesn’t want to take over the business.

Types of Annuities Preferred by the Wealthy

While millionaires might consider any type of annuity, they tend to favor certain products based on their specific needs:

Multi-Year Guarantee Annuities (MYGAs)

These function similarly to CDs but with tax advantages in non-qualified accounts. The wealthy appreciate the principal protection, guaranteed interest rates, and tax deferral.

Immediate Annuities (SPIAs)

Single Premium Immediate Annuities convert a lump sum into guaranteed lifetime income. Wealthy individuals often use these to create pension-like income streams for themselves or loved ones.

Deferred Income Annuities (DIAs)

These allow the wealthy to secure future income streams starting at a later date, which can be useful for legacy planning or creating income for a specific future need.

Qualified Longevity Annuity Contracts (QLACs)

These specialized annuities can help wealthy individuals manage Required Minimum Distributions (RMDs) from their retirement accounts while securing lifetime income later in life.

The Cons: Why Some Wealthy People Avoid Annuities

Despite their benefits, annuities aren’t for everyone – even among the wealthy. Here are some reasons why some millionaires steer clear:

High Costs and Fees

Annuities are notorious for their costs. Commissions can range from 1-3% for immediate annuities to 6-8% for fixed index annuities. Annual mortality expenses of 0.5-1.5% and surrender charges up to 10% can also apply.

These costs might be more palatable to the ultra-wealthy, but they’re still a consideration.

Poor Liquidity

Annuities are designed as long-term investments. Early withdrawal often means substantial surrender charges and possible tax penalties if taken before age 59½.

Wealthy individuals with diverse investment portfolios may prefer maintaining liquidity with other vehicles.

Complexity

With their numerous features, benefits, and payout options, annuities can be much more complex than simple stocks or bonds. Even sophisticated investors sometimes prefer simpler investment vehicles.

Real-World Example: How Millionaires Use Annuities

Let me share a story from my research that illustrates how the wealthy use annuities strategically:

A multi-millionaire futures trader contacted a financial advisor about securing his wife’s financial future. While he made substantial money trading corn futures, his wife had no interest in taking over the business if something happened to him.

His solution? Purchasing an immediate annuity or deferred income annuity that would provide guaranteed lifetime income for his wife. This gave both of them peace of mind knowing that regardless of what happened, she would have financial security for life.

Are Annuities Right for You? (Even If You’re Not a Millionaire Yet)

The strategies wealthy people use with annuities can often be adapted for those with more modest means. Here are some considerations:

- Income floor planning: Consider creating a guaranteed income floor using annuities to cover essential expenses, with other investments for growth.

- Tax efficiency: If you’ve maxed out traditional retirement accounts, annuities can provide additional tax-deferred growth.

- Legacy planning: Annuities can help ensure loved ones receive steady income rather than a lump sum they might mismanage.

- Creditor protection: Depending on your state, annuities may offer valuable protection from creditors and lawsuits.

The Bottom Line: What We Can Learn from Wealthy Annuity Buyers

While the rich have access to many investment opportunities not available to the average person, their growing interest in annuities highlights the value these products can provide for anyone concerned about:

- Guaranteed lifetime income

- Protection from market volatility

- Tax deferral benefits

- Creditor protection

- Legacy planning

Wealthy investors can leverage certain aspects of annuities effectively. They often have enough disposable income to max out traditional retirement plans and then contribute to annuities. They’re also less likely to be concerned with early withdrawal penalties since they can afford to leave investments alone for extended periods.

But here’s the key takeaway: these benefits aren’t exclusive to the wealthy. Annuities can offer similar advantages to everyday investors who understand how to use them appropriately.

Final Thoughts

So, do millionaires use annuities? The answer is a resounding yes – though not all of them, and not for all their assets. The wealthy use annuities strategically as part of a comprehensive financial plan, recognizing their unique benefits for risk transfer, tax management, and guaranteed income.

If you’re considering annuities for your own portfolio, remember to thoroughly understand all aspects – including fees, surrender periods, and payout options – before making a decision. And always consider working with a financial advisor who can help determine if and how annuities might fit into your overall financial strategy.

How Annuities Can Fit Into Your Portfolio

Your overall wealth and how much money you are looking to invest will help determine if an annuity makes sense as part of your portfolio.

Annuities are often used as a safe and effective way to guarantee income in retirement. For this reason, they may not make sense as part of a strategy for the ultra-wealthy (think those with net worths in the tens of millions or higher).

“The very wealthy probably don’t need annuities,” Rob Williams, managing director at the Schwab Center for Financial Research, told Annuity. org. “They may have enough money just to support their retirement without needing to buy annuities. Annuities are a form of insurance. ”.

But there are plenty of ways that buying an annuity can fit soundly and efficiently into a high-net-worth individual’s portfolio.

For individuals with assets well over $500k, you will have better flexibility in structuring for retirement.

It may not be necessary for you to focus only on income planning. When you retire and stop getting paid, you might not have as much of a gap in your income as middle-class investors or people who have saved $50,000 to $350,000 to live on in retirement.

How Annuities Can Benefit High-Net-Worth Individuals

- Diversification

- Tax advantages

- Inflation protection

- Legacy

High-net-worth individuals are often well-versed in the importance of having a strong and diversified portfolio.

“A diversified portfolio has historically been the best hedge against inflation and provides the best opportunity to have your savings, as well as your income, keep pace with or exceed inflation,” Williams said.

Buying an annuity is one effective way to help further that diversification. Annuities are not investments; they are insurance products that require you to give money that can be turned into guaranteed payments in the future.

This built-in safety, along with the chance for the value to rise, can make your portfolio safer and give you a steady stream of income.

Annuities can also help combat inflation by creating streams of guaranteed income set to begin later in life. If you buy multiple annuities and ladder them, you can create a system where you receive more and more payments as you age and inflation grows.

Williams pointed specifically to the idea of marrying an annuity with an existing portfolio to best combine the benefits of your different investments and what each tool does best. Pro Tip

Laddering annuities involves buying multiple annuities at different times to take full advantage of market conditions.

Select all that apply

Adding Safety and Principal Protection to Your Portfolio

Your portfolio may already contain a significant amount of risk, which is often necessary to grow your investments.

That’s why a major appeal of annuities to high-net-worth individuals is their perceived safety. While there is always some level of risk associated with annuities, the primary concerns are liquidity risk, where the money is inaccessible, and inflation risk, where inflation outpaces annuity growth. Annuities, however, are protected from market risk. Overall, they tend to be much more secure than some other forms of investments.

What Makes Annuities So Safe?

- Your principal investment is protected.

- Annuities result in guaranteed payments.

This is the case for a couple of reasons. First off, your principal investment is generally protected when you buy an annuity. Unlike other traditional investments, you don’t have to worry about losing all the money you placed into the product.

Additionally, annuities result in guaranteed payments that can last for the rest of your life. Depending on the type of annuity you have, those payments may fluctuate based on the performance of investments.

But you are always guaranteed to get something and can rest easy knowing those payments will never end.

There is a drawback to achieving this security that high-net-worth individuals should be aware of, and it is that annuities tend to be illiquid products. It can be difficult to get your money out of an annuity if you change your mind down the road, and you may be subject to surrender fees.

Worried About Your Retirement Savings?Discover how to protect your nest egg from market volatility.

Dave, Can You Clarify What A Fixed Index Annuity Is?

FAQ

Do the rich invest in annuities?

So, many wealthy people use annuities to protect themselves in our litigious world, but they also buy them for lifetime income streams. Many rich people buy annuities for their spouses, kids, or grandkids.

How much would a $1,000,000 annuity pay monthly?

The exact payout depends on multiple factors, including your age, gender, type of annuity and additional features like survivor benefits or death benefits. As the quotes show, a $1 million annuity can provide anywhere from $4,736 to over $14,000 per month, depending on the contract structure.

Does Dave Ramsey recommend annuities?

If you need to get to your money in the first few years after buying an annuity, you’ll have to pay a fee called a surrender charge. This is why we don’t recommend them.

Why do financial advisors not like annuities?

Many financial advisors hate annuities because of the marketing tactics often employed by them. At the end of the day, annuities themselves aren’t all bad. But a lot of the ways that annuities are marketed play on people’s fears and emotions to get them to buy.

Are annuities a good investment?

However, most annuities share these general characteristics. Probably the most popular and widely cited benefit of annuities is the opportunity to generate lifelong income. This makes sense, as one of the most common anxieties that retirees have is that they will outlive their income.

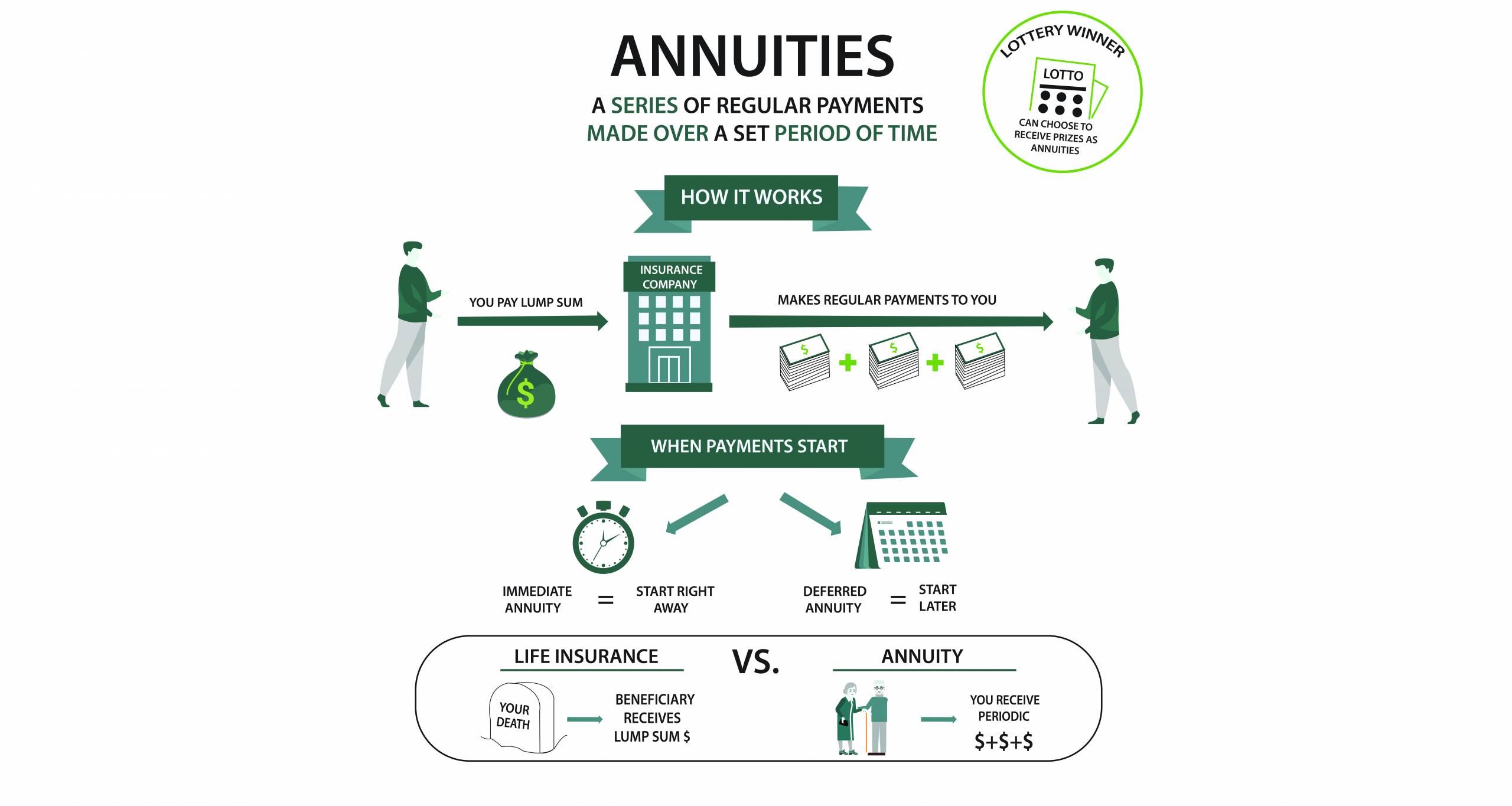

What are annuities & how do they work?

Annuities are investment contracts that you can buy from an insurance company. In the simplest terms, annuities can either be immediate or deferred. With immediate annuities, you can turn a one-time investment into a steady stream of income for a set amount of time.

Should you invest in annuities or unregistered securities?

For example, to invest in certain types of unregistered securities or private hedge funds, you may need to be an “accredited investor,” meaning you have a very high income and/or net worth. Annuities, on the other hand, are a fairly pedestrian type of investment that anyone can access.

How do deferred annuities work?

Deferred annuities have an accumulation period, during which an annuity’s value can increase, and an annuitization period, at which point the value of the annuity converts into a stream of income. Explore More: 10 Valuable Stocks That Could Be the Next Apple or Amazon

Should you invest in an investment-only variable annuity (Iova)?

An investment-only variable annuity (IOVA) provides an opportunity for more tax-deferred investing once you have maximized contributions to an IRA and 401(k). However, keep in mind that annuities can be complex and may charge high fees that can erode benefits.

What is the difference between immediate and deferred annuities?

Immediate annuities convert a lump-sum investment into a stream of income that lasts for a specified period of time. Deferred annuities have an accumulation period, during which an annuity’s value can increase, and an annuitization period, at which point the value of the annuity converts into a stream of income.