In a 401(k) freeze, an employer temporarily halts all new contributions to and withdrawals from its 401(k) plan.

When two companies merge, your 401(k) plan may be frozen while the new company figures out what to do with the plan it took over. You can either wait and see what the company does, or you can move your money into an IRA rather.

Ever watched your retirement savings take a nosedive during market chaos and wished you could just hit the pause button? Many of us have been there! The question “can you freeze your 401(k) investments” becomes super relevant when markets get crazy As someone who’s navigated these waters before, I want to share what freezing your 401(k) actually means and whether it’s something you can (or should) do

What Does “Freezing” a 401(k) Actually Mean?

Let’s clear something up right away – there are two completely different situations where the term “frozen 401(k)” comes up

- Company-initiated freeze: When your employer freezes the 401(k) plan

- Individual investment decisions: When you want to “freeze” or pause your investments during market volatility

These are totally different scenarios with different implications Let’s dive into both!

When Your Company Freezes Your 401(k) Plan

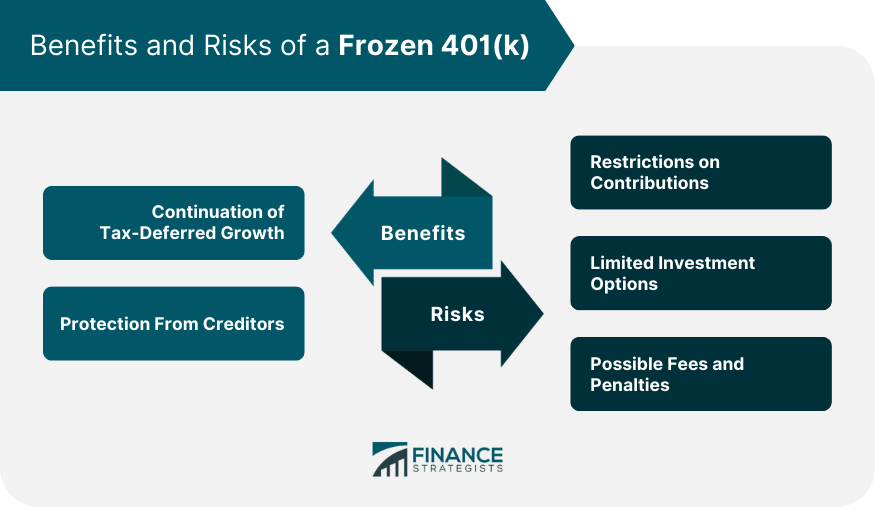

If your employer freezes your 401(k) plan, this is something they control – not you. According to Investopedia, a company-initiated 401(k) freeze means:

- You cannot make new contributions to the plan

- You cannot take withdrawals from your account

- Your existing investments continue to gain or lose value with the market

- You typically can still change how your existing money is invested

Company freezes usually happen during:

- Corporate mergers or acquisitions

- When changing 401(k) plan providers

- During major company restructuring

While the company is working to fix things, there is a freeze. This does not mean that your money is locked at its current value. It just means that no new money can come in or go out.

Can YOU Freeze Your Own 401(k) Investments?

Now here’s the question most people are actually asking: “Can I freeze my 401(k) investments to protect them during market downturns?”

In short, you can’t really “freeze” your 401(k) at its present value, which would be like putting money in a time machine. You CAN, however, plan ahead to keep your retirement savings safe.

Here’s what you can actually do:

1. Adjust Your Asset Allocation

You can move your existing 401(k) investments into more conservative options within your plan. This isn’t technically “freezing,” but it’s the closest thing available.

Options might include:

- Money market funds

- Stable value funds

- Short-term bond funds

- Cash equivalents

These investments won’t completely stop fluctuations, but they’ll minimize volatility compared to stocks.

2. Pause New Contributions (But Should You?)

You can temporarily stop putting money into your 401(k), but during market downturns, most experts say you shouldn’t do this. Why? Because:

- You might miss out on buying investments at discount prices

- You’ll lose your employer match (free money!) if your company offers one

- You’re disrupting the powerful long-term strategy of dollar-cost averaging

Keep putting money into your 401(k) during both bull and bear markets, says SmartAsset. This will help you save more for retirement in the future. “.

Better Strategies Than “Freezing” Your 401(k)

Instead of trying to freeze your investments, consider these smarter approaches recommended by financial experts:

1. Diversify Your Portfolio

According to SmartAsset, “Finding the right asset allocation can be key for protecting your 401(k) from a stock market crash, while also maximizing returns.”

A well-diversified portfolio might include:

- Domestic stocks

- International stocks

- Bonds of various durations

- Real estate investments (REITs)

- Cash equivalents

2. Use the Age-Based Rule

A simple rule of thumb for asset allocation: subtract your age from 110. The result is approximately how much of your portfolio should be in stocks.

For example:

- At age 30: 80% stocks, 20% bonds/cash

- At age 50: 60% stocks, 40% bonds/cash

- At age 70: 40% stocks, 60% bonds/cash

This automatically becomes more conservative as you approach retirement.

3. Rebalance Regularly

Rebalancing is crucial for protecting your retirement savings. As SmartAsset explains, “The idea is that over time, some investments may fare better than others, changing the percentage of money in each asset and potentially exposing you to more risk.”

I personally rebalance my 401(k) every quarter to make sure my asset allocation stays on target. It’s easy to do and keeps me from getting too heavy in any one area.

4. Consider a Bucket Strategy in Retirement

If you’re near or in retirement, the bucket strategy divides your savings into three categories based on time horizon:

- Short-term bucket: Cash for immediate expenses (1-3 years)

- Medium-term bucket: Moderate-risk investments like bonds (4-10 years)

- Long-term bucket: Growth-focused investments like stocks (10+ years)

This approach lets you avoid selling long-term investments during market downturns.

What NOT to Do When Markets Get Scary

When markets crash, our emotions can lead us astray. Here are some common mistakes to avoid:

1. Panic Selling

SmartAsset warns, “Withdrawing money early from a 401(k) can result in hefty IRS tax penalties, which won’t do you any favors in the long run.”

Consider the 2020 pandemic crash as a perfect example: The Dow Jones fell from about 29,500 to 19,000 in just one month… but then recovered and hit new highs by November that same year! Investors who panicked and sold missed that entire recovery.

2. Trying to Time the Market

Nobody – not even professional investors – can consistently predict market tops and bottoms. Trying to freeze your investments at the “perfect time” almost never works out.

3. Ignoring Your Time Horizon

If you’re decades from retirement, short-term market fluctuations matter much less. Your investment strategy should align with your time horizon, not react to every market hiccup.

Real-Life Strategies for Different Scenarios

Let me share some practical approaches for different situations:

If You’re Young (20s-40s)

When I was in my early 30s during the 2008 financial crisis, I actually INCREASED my 401(k) contributions and kept them heavily in stocks. It felt terrifying at the time, but those investments made during the market bottom became my best-performing assets over the next decade.

Young investors should:

- Maintain higher stock allocations (70-90%)

- View market crashes as buying opportunities

- Focus on long-term growth rather than short-term stability

If You’re Near Retirement (50s-60s)

My parents were approaching retirement during the 2020 pandemic crash. Their strategy:

- Gradually shifted to a more conservative allocation (about 50/50 stocks and bonds)

- Kept 3-5 years of planned withdrawals in cash/stable investments

- Didn’t panic-sell their stock positions during the crash

If You’re In Retirement

Retirees need to be more careful but still shouldn’t completely “freeze” their investments. A good approach includes:

- Keeping 1-3 years of expenses in cash

- Having another 3-7 years in conservative investments

- Maintaining some stock exposure for long-term growth to fight inflation

- Using the bucket strategy mentioned earlier

The Psychological Aspect of Market Crashes

Let’s be honest – the desire to “freeze” investments often comes from fear and anxiety. I’ve felt that panic too! Some tips that have helped me manage the psychological aspects:

- Limit how often you check your 401(k) balance during volatile periods

- Remember your time horizon and long-term goals

- Consider working with a financial advisor who can provide objective guidance

- Review market history to see that recoveries have followed every crash

When Might Adjusting Your Investments Make Sense?

While completely “freezing” isn’t usually wise, there are legitimate times to adjust your 401(k) investments:

- When approaching retirement (gradually becoming more conservative)

- After reaching your retirement savings goals (preservation becomes more important)

- When your personal risk tolerance has genuinely changed

- As part of a regular, planned rebalancing strategy

The Bottom Line: Protection Without Freezing

To sum it all up, while you can’t literally “freeze” your 401(k) at a specific value, you CAN take smart steps to protect your retirement savings:

- Diversify across different asset classes

- Adjust your asset allocation based on your age and risk tolerance

- Rebalance regularly (quarterly or annually)

- Continue contributing during market downturns

- Stay calm and focused on your long-term goals

Remember that market volatility is normal and expected. The stock market has historically recovered from every crash, though past performance doesn’t guarantee future results.

As SmartAsset wisely points out, “remaining calm during times of volatility may keep you positioned to capitalize on the eventual recovery.”

Have you ever been tempted to freeze your 401(k) investments during market turmoil? What strategies have worked for you? I’d love to hear your experiences and questions in the comments below!

FAQs About 401(k) Freezes

Can I completely pause my 401(k) growth during market downturns?

No, there’s no way to completely pause market effects on your existing investments. You can move to more conservative options, but even those have some level of risk and return.

What happens if my employer freezes our 401(k) plan?

Your existing investments remain in the plan and continue to gain or lose value with the market. You can’t make new contributions or take withdrawals during the freeze, but you can usually still adjust your investment allocations.

How long can an employer freeze a 401(k) plan?

According to Investopedia, “Legally, there are no restrictions on how long a company can keep a 401(k) plan frozen.” However, most companies work to resolve the situation quickly.

Will Required Minimum Distributions (RMDs) still be paid during a freeze?

Yes, frozen 401(k) plans are still required to pay out required minimum distributions (RMDs) after you reach the age of 73.

Remember, managing your retirement savings is a marathon, not a sprint. Don’t let short-term market movements derail your long-term financial security!

Terminate the Plan

Your plan won’t end until the new company gets a letter from the Internal Revenue Service (IRS) saying that everything was taken care of correctly. After termination, your contributions, vested matches, and earnings are all returned to you.

If the 401(k) plan at your new job lets you rollover funds, you can choose to have your retirement savings moved over to that plan. Note that if you are under age 59 ½, you must complete your rollover within 60 days in order to avoid a tax penalty.

What a Frozen 401(k) Means for You

If your 401(k) has been frozen by your company’s management, you will still retain all of the rights you had prior to the freeze. Your current investments will still grow or shrink depending on how the market does, and the tax benefits of your retirement savings will stay the same. The only difference is that you cannot add new funds or make withdrawals from your account.

In most cases, you can change the composition of your existing retirement portfolio and shift assets from one investment to another. You should also continue to receive statements in accordance with Employee Retirement Income Security Act (ERISA) guidelines.