“FIRE” stands for “financial independence, retire early.” This has become one of the most popular phrase among people under 60 in the last ten years. 1 But the reality is that leaving the workforce in the prime of your life requires even higher investment contributions and more severe cost-cutting than you might think.

Has anyone ever wished they could quit their 9-to-5 job while they were still young enough to enjoy real freedom? I know I have! For years, I’ve been wondering if I could retire at 40 with $1 million. I’m here to share what I’ve learned from doing a lot of research: yes, it’s possible, but there are some important things you need to think about.

The Short Answer: Yes, But It’s Complicated

To cut to the chase: yes, you can retire at 40 with $1 million, but you’ll need to plan carefully, be disciplined with your money, and maybe make some changes to the way you live. Life expectancy in the US is about 77 years, but many people live much longer than that. That $1 million needs to last you at least 40 years.

The 4% Rule and Early Retirement

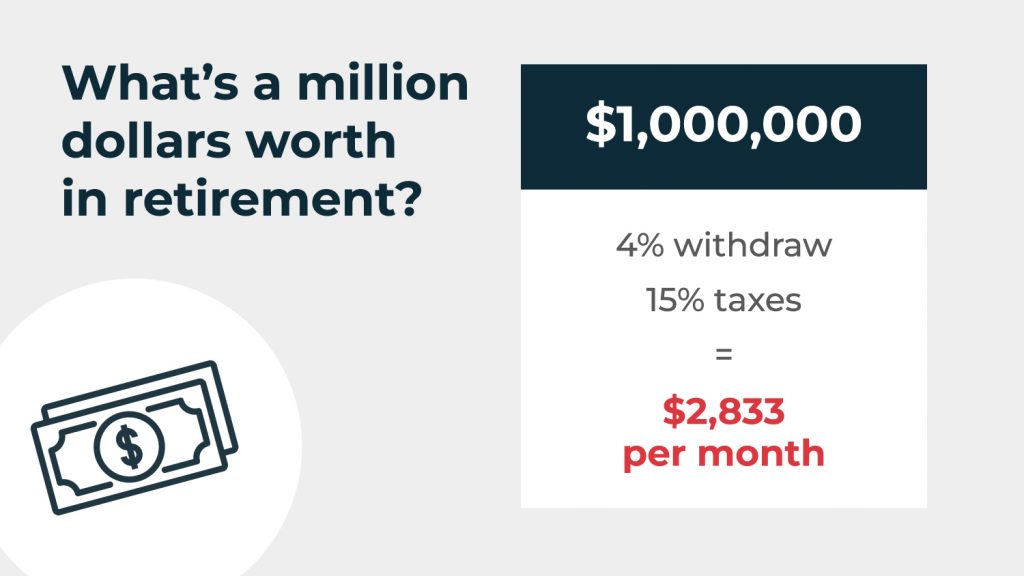

Financial planners often recommend the 4% rule as a guideline for retirement withdrawals. This rule suggests withdrawing 4% of your retirement portfolio in the first year then adjusting that amount for inflation in subsequent years.

With $1 million, this would give you:

- Year 1: $40,000 withdrawal

- Subsequent years: Previous year’s amount + inflation adjustment

The 4% rule was made to make your savings last about 2030 years. But if you retire at that age, your money might need to last for 40 years, which could mean you need to change your withdrawal rate to a more conservative 3%.

Let’s do the math:

- With a 3% withdrawal rate: $30,000 in year 1

- With a 3.5% withdrawal rate: $35,000 in year 1

- With a 4% withdrawal rate: $40,000 in year 1

If you’re wondering if you could live comfortably on $30,000-$40,000 a year, that brings us to our next consideration.

Cost of Living Factors

Your location plays a massive role in whether $1 million is enough. Living in Nevada (with costs at 95.5% of the national average) will stretch your dollar further than living in Hawaii (where costs are 113.2% of the national average).

Consider these typical annual expenses:

- Housing (mortgage/rent): $16,200-$22,000

- Healthcare coverage: $15,000

- Utilities and property taxes: $5,000

- Food: $7,000

- Entertainment and technology: $6,000

- Transportation: $3,000

This adds up to approximately $52,200-$58,000 annually. There must be a hole in your finances that needs to be filled since you’re only taking out $40,000.

The Early Retirement Income Puzzle

One major challenge with retiring at 40 is that you won’t be eligible for traditional retirement benefits for decades:

- Social Security benefits won’t kick in until at least age 62 (that’s 22 years away!)

- Medicare won’t be available until age 65

- Traditional retirement accounts like 401(k)s and IRAs typically can’t be accessed penalty-free until 59½

This means you’ll need alternative income sources for those first couple decades of retirement.

Creating Income Streams from Your $1 Million

To make early retirement work, you’ll need to develop multiple income streams. Here’s an example of how you might allocate your $1 million:

-

Real Estate Investments: $500,000

- Generating approximately $48,000 annually ($4,000/month) in rental income

-

Conservative Savings: $250,000

- In high-yield savings accounts or CDs at 4% interest

- Producing around $10,000 annually

-

Brokerage Account: $250,000 (or $500,000)

- Invested in dividend-paying stocks and ETFs

- Targeting 5-6% returns

- Generating $12,500-$30,000 annually

With this approach, you could potentially generate $70,500-$88,000 in annual income before taxes. After accounting for taxes, you’d likely have enough to cover your expenses with some buffer for unexpected costs.

The Tax Puzzle in Early Retirement

Taxes can significantly impact your retirement income. Without access to tax-advantaged retirement accounts in those early years, you’ll need to be strategic about your investments and withdrawals.

For instance:

- Rental income is taxed as ordinary income

- Long-term capital gains from brokerage accounts are typically taxed at 15% (lower than ordinary income rates)

- Interest from savings accounts is taxed as ordinary income

Living in a tax-friendly state like Nevada, Florida, or Texas (which have no state income tax) can help maximize your after-tax income.

Healthcare: The Big Unknown

Healthcare is a massive consideration for early retirees. Without access to Medicare until age 65, you’ll need to budget for private health insurance, which can easily cost $15,000+ annually for a single person.

Additionally, Fidelity estimates that a healthy couple retiring at 65 will need approximately $330,000 for healthcare throughout retirement. Retiring 25 years earlier means you’ll likely need significantly more.

Real-Life Scenario Analysis

Let’s analyze a real-life scenario of a 40-year-old retiree with $1 million living in Nevada:

Annual Expenses:

- Housing: $16,200

- Healthcare: $15,000

- Utilities/property taxes: $5,000

- Food: $7,000

- Entertainment: $6,000

- Transportation: $3,000

- Total: $52,200 ($4,350/month)

Income Sources:

- Rental properties ($500,000 invested): $48,000/year

- Conservative investments ($250,000): $10,000/year

- Brokerage portfolio ($250,000): $15,000/year

- Total pre-tax income: $73,000/year

After taxes (assuming 15-20% effective tax rate), you’d have approximately $58,400-$62,050 annually, which covers your expenses with a small buffer for inflation and unexpected costs.

Strategies to Make $1 Million Last Longer in Early Retirement

1. Create a Solid Budget

Track every dollar and stick to a clear spending plan. This will help prevent lifestyle creep and ensure your savings last.

2. Eliminate Debt Before Retiring

Debt payments can quickly eat into your retirement income. Aim to retire completely debt-free, including your mortgage if possible.

3. Develop Passive Income Streams

Consider these options:

- Rental properties

- REITs (Real Estate Investment Trusts)

- Dividend-paying stocks

- Creating digital products (courses, e-books)

4. Consider Downsizing

Do you really need that large house or apartment? Moving to a smaller home or lower cost-of-living area can significantly reduce your expenses.

5. Minimize Tax Impact

Work with a financial advisor to develop tax-efficient withdrawal strategies and potentially implement a Roth conversion ladder.

6. Stay Healthy

Healthcare costs can quickly deplete savings. Investing in your health through proper diet and exercise can help minimize medical expenses.

7. Consider Part-Time Work

Even a small amount of income from part-time work can significantly extend the life of your portfolio.

Is Early Retirement Right for You?

Early retirement has both pros and cons:

Benefits:

- More time to travel while young and healthy

- Opportunity to pursue passions and hobbies

- Potential mental and physical health benefits

- Freedom to start new projects or businesses without financial pressure

Drawbacks:

- Risk of running out of money

- Possible negative health impacts if you don’t have meaningful activities

- Missed opportunity for higher Social Security benefits

- Extended period without Medicare coverage

The Bottom Line: Possible But Challenging

Retiring at 40 with $1 million is technically possible, but it requires careful planning, disciplined spending, and potentially some creativity with income generation. Your success will largely depend on:

- Your cost of living and lifestyle expectations

- Your investment returns

- Your tax situation

- Healthcare costs

- Inflation over a potentially 40+ year retirement

I strongly recommend working with a financial advisor who specializes in early retirement planning. They can help create a personalized plan that accounts for your specific situation and goals.

My Personal Take

Having researched this topic extensively, I believe that $1 million can work for early retirement at 40, but it doesn’t leave much room for error or luxury. If you’re considering this path, I’d suggest aiming for $1.5-2 million instead, which would provide more flexibility and security.

Alternatively, consider a “semi-retirement” where you work part-time or as a consultant in your field. This approach can give you much of the freedom you’re seeking while reducing the financial pressure on your savings.

Whatever you decide, remember that retirement isn’t just about having enough money—it’s about creating a fulfilling life that brings you joy and purpose. With careful planning and realistic expectations, retiring at 40 with $1 million can be your reality.

Have you been planning for early retirement? What’s your target number? I’d love to hear your thoughts and strategies in the comments below!

How Will You Cover Health Care Needs?

And that doesnt even cover one of the biggest spending categories for any retiree: health care. Those who retire at an age when most people are considered “mid-career” face something of a conundrum. Theyre far too young for Medicares relatively low premiums and unable to get subsidized care through an employer.

If you can get coverage through your spouse’s plan, that’s a big plus. Going it alone can get expensive. A 40-year-old person in a private plan could pay $342 a month for the cheapest option, according to the Kaiser Family Foundation. If they wanted to stay on the most expensive plan, they might have to pay $472 3.

Needless to say, those rates can climb quickly if you have to add kids or a spouse to the plan. And they could rise even further as you get older.

How Much You Need to Budget to Retire at 40

If youre looking for a quick answer, the amount is a lot. Extremely early retirement can be tricky because you have less time to save money and more time to live off of that money.

The more optimistic FIRE adherents assume that a 4% withdrawal rate from savings, adjusted annually for inflation, will leave them with enough funds for a prolonged retirement (assuming at least half their money is invested in stocks).2 That means theyd be able to quit their full-time job once theyve saved 25 times their yearly wages. In a low-interest-rate environment, some suggest even greater reserves.

Its true that you might not need quite as much income in retirement, as you wont have to commute every day and can save on other costs associated with working full-time. But in a lot of cases, your current spending levels are a pretty good starting point for estimating what your post-work budget is going to look like.

Here are the future expenses youll want to consider:

- Housing costs

- Car payments and fuel costs

- Grocery bills

- Utilities

- Student loans and other debt

- Child care costs and college savings, if applicable

- Entertainment and travel expenses

Use your current spending to forecast your needs in retirement. Start Your Free Plan

Retiring With $1,000,000 in Your 40s (Is $1M Enough?)

FAQ

Can I retire at 40 with 1 million dollars?

You might be able to retire at age 40 if you have $1 million, but you need to carefully plan your retirement, be disciplined with your investments, and have a good idea of how much your costs will be, including healthcare and inflation. Your ability to do so depends on factors like your lifestyle and living costs, your chosen investment strategy and withdrawal rate, and your willingness to manage risks like market downturns.

How much money to comfortably retire at 40?

To retire at 40 and live comfortably on an annual income of $50,000, you would need to have saved approximately $1. 25 million by the time you end your career, assuming a 4% withdrawal rate.

How many people actually retire with 1 million dollars?

Key Takeaways. Only 3. 2% of retirees have $1 million in retirement accounts vs. about 2. 6% of Americans in general.

Can I live off interest of 1 million dollars?

Yes, you can potentially live off the interest of $1 million, but it depends on your spending, lifestyle, and investment strategy; .

Can you retire on 1 million dollars?

Saving a million dollars is doable if you start early, and it could last you decades in retirement. Can You Retire on $1 Million? Factors such as housing and health care will also impact your budget and determine whether $1 million is the right savings goal for your needs. Many people think $1 million is sufficient savings for retirement.

Is 1 million enough savings for retirement?

Many people think $1 million is sufficient savings for retirement. How long $1 million will last depends on how much a retiree spends on housing, health care and other expenses. Retirement savings can be supplemented with other income, such as Social Security and pensions, to make them last longer.

Should you retire at 40?

Furthermore, retiring at 40 means addressing an additional 25 years of medical costs. To do so, experts advise designating 15% of your annual income for healthcare costs. However, this amount may be higher if you have a chronic health condition. And having children at home is expensive, whether you’re retired or not.

How much money should a 40-year-old retire with?

Many companies also match employee contributions. Both can quickly add to retirement savings. What’s more, $330 per month is significantly better than the $1,547 per month that a 40-year-old with no previous savings will need to tuck away to retire with the same amount. But even compounding has its limits.

Should you save $1 million while working?

Retiring at 40 may sound like a pipe dream. But it’s entirely within reach if you save $1 million while working. The key elements for achieving this feat are sticking to a budget and implementing a comprehensive retirement strategy. But with rising expenses, is $1 million enough?.

How much money do you need to retire comfortably?

Bankrate principal writer and editor James F. Royal, Ph. D. , covers investing and wealth management. His work has been cited by CNBC, the Washington Post, The New York Times and more. One in three Americans in the workforce say they need more than $1 million to retire comfortably, but is even that amount of income enough?.