Getting a mortgage for a home purchase is exciting but comes with financial responsibilities. Private mortgage insurance (PMI) is often required when the down payment is less than 20% of the purchase price. PMI adds to your monthly payment and delays homeownership. However, there are strategies to eliminate PMI, including getting an appraisal. This blog post explores private mortgage insurance, its impact on your mortgage, strategies to eliminate it, and the appraisal process. AmeriMac can assist you throughout the appraisal process for a smooth PMI removal journey.

Private mortgage insurance (PMI) is an additional cost often required for conventional loans with less than 20% down payment This extra monthly expense protects lenders from losses if the borrower defaults Many homeowners want to know – can a new appraisal eliminate PMI and help me cancel this unwanted insurance premium?

The short answer is yes a new appraisal showing 20% equity or more allows you to request PMI removal in many cases. However loan and property requirements still apply.

Let’s break down how home appraisals, equity, and market value factor into PMI cancellation. Read on to learn:

- What is private mortgage insurance and why it’s required

- How you may be able to cancel PMI with a new appraisal

- When lenders allow PMI termination with increased home value

- Steps to request an appraisal and remove PMI

- Other options like refinancing to eliminate PMI

What is Private Mortgage Insurance?

Also called PMI, private mortgage insurance is an insurance policy protecting the lender if you default on mortgage payments. It’s typically required by lenders when borrowers make a down payment of less than 20% on a conventional home loan.

PMI makes it possible to buy with less cash upfront. But it also increases your regular housing costs until canceled. PMI annual premiums range from 0.3% to 1% of the mortgage amount. On a $200,000 loan at 0.5% PMI rate, you’d pay $1,000 extra per year.

The good news? PMI can be eliminated once you build 20% home equity through payments or appreciation. Let’s look at how an appraisal factors in.

Can Appreciation & New Appraisal Eliminate PMI?

In short – yes, sometimes! If your home value rises, a new appraisal can potentially cancel PMI by proving you’ve hit key equity milestones.

How Home Value and Equity Impact PMI Removal

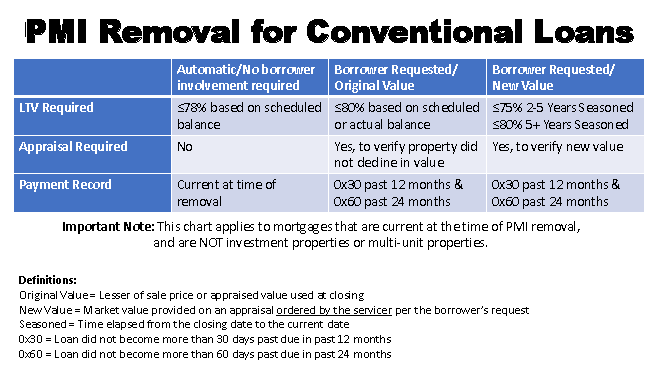

The loan-to-value ratio (LTV) compares your unpaid mortgage balance to the home’s value. PMI can often be canceled when:

-

Your home value rises and your LTV hits 78% through payments and appreciation. At 78% LTV, PMI terminates automatically.

-

Your home value rises and your LTV reaches 80%. You can request PMI cancellation from lender.

-

An appraisal confirms your home value has increased enough that you have 20% equity or more.

As an example:

-

You purchased a $200,000 home with 10% down payment. Your mortgage balance was $180,000.

-

After a few years, local home values increased. You think your home is now worth $230,000.

-

You’ve paid down your mortgage balance to $170,000 through monthly payments.

-

A new appraisal confirms your home’s $230,000 market value.

-

You now have $60,000 equity – exceeding 20%.

In this case, the appraisal allows you to prove 20% equity and request PMI removal.

But this strategy doesn’t work automatically. Let’s look at why lenders might deny PMI cancellation even with a new appraisal.

Lender Rules on Value Appreciation

Lenders have final say on accepting your home’s new value for PMI termination. Unfortunately, some limit equity calculations to:

-

The home’s original appraised value when purchased

-

The principal balance paid down through regular installments

These lenders ignore appreciation, only allowing PMI removal when you reach 78% LTV per the initial home purchase price and loan amount.

To cancel PMI based on appreciation, your servicer must accept the new appraisal value. Check with them first before ordering your own appraisal.

Some general lender requirements include:

-

Good payment history with no late payments

-

No secondary liens or loans against the property

-

An appraisal from an approved, third-party appraiser

-

Meeting a “seasoning” requirement, like 2+ years of mortgage payments

Talk to your mortgage servicer to learn their specific guidelines for terminating PMI based on home value increases.

How to Order an Appraisal to Remove PMI

If your lender confirms they’ll cancel PMI using your home’s new value, follow these steps:

1. Request an appraisal through your servicer. Lenders often require using their approved appraiser list. Provide access and schedule the inspection.

2. Review the appraisal. Verify it reflects your home’s fair market value based on recent sales and updates.

3. Submit your removal request. Provide the new appraisal and ask your servicer to cancel PMI based on increased equity.

4. Get PMI removal confirmation. Receive written confirmation from servicer when PMI is terminated.

5. Watch for premium refunds. If canceled mid-year, you may get a prorated PMI premium refund within 45 days.

Removing PMI sounds straightforward. But missed requirements like seasoning rules or appraisal denials can derail the process. Have patience and follow up if your servicer doesn’t quickly approve the cancellation.

Alternatives Like Refinancing to Cancel PMI

If your loan or servicer won’t budge on removing PMI even with a new appraisal, you may consider:

-

Waiting for auto-termination – PMI ends automatically when your principal hits 78% LTV based on the original home purchase price and mortgage amount.

-

Paying down the mortgage – Making extra principal payments to reach 78% LTV faster.

-

Refinancing – Taking out a new mortgage can eliminate PMI immediately if an appraisal shows 20% equity. But refinancing also comes with closing costs. Shop rates and run the numbers to see if it makes financial sense.

-

Piggyback loan – Paying down 20% with a second loan, like a HELOC, avoiding PMI on the main mortgage.

For most homeowners, hitting 20% equity is the golden ticket to escaping PMI premiums. While your specific servicer guidelines matter, generally – yes, a new appraisal can eliminate PMI by proving your home’s value has risen.

Strategies to Eliminate PMI

Automatic PMI cancellation occurs when specific lender requirements are met, such as having a good payment history and not having unpaid contract work on the property. Requesting PMI cancellation can be initiated by contacting your loan servicer once you believe you have enough equity in your home to meet the lender’s criteria. Using a new appraisal to remove PMI involves an appraisal of your home’s current value to prove that the LTV ratio has decreased due to an increase in your home’s original value. Refinancing is another option, allowing you to secure a lower rate or switch from an FHA loan to a conventional mortgage.

Automatic cancellation of private mortgage insurance (PMI) is a relief for many homeowners. When you hit the halfway point of your loan, some loans automatically end PMI. Attaining a specific loan-to-value ratio triggers automatic PMI termination, making it a crucial milestone in your mortgage journey. Homeowners must grasp the criteria for this cancellation to be financially prepared. This hassle-free termination spares you from unnecessary expenses. Understanding the conditions for automatic PMI cancellation is crucial for your financial well-being.

When you’ve built up enough equity in your home, you can ask for PMI cancellation, a significant step towards cost savings. It’s essential to follow the correct procedures diligently when requesting this cancellation. Submitting a written request to your mortgage servicer is typically the process to initiate PMI removal, although a phone call may also suffice. Understanding these steps and taking action empowers homeowners to manage their finances effectively. Navigating the PMI cancellation process can save on your mortgage expenses.

The Impact of PMI on Your Mortgage

Homeowners must understand the implications of Private Mortgage Insurance (PMI). PMI, a requirement when the down payment is less than 20%, affects your mortgage in various ways. It adds to the cost of homeownership by increasing monthly payments and can hinder personal finance goals. If you’ve paid the principal balance below 80% of the home’s original value, PMI can typically be removed. This process involves getting a new appraisal to determine the home’s current value and ensuring it meets the lender’s requirements under the Homeowners Protection Act.

PMI Appraisal – How to remove your PMI Insurance

FAQ

Can PMI be removed with a new appraisal?

No you can’t. The PMI is based off of the purchase price; not the appraised value.

Can PMI be removed if house value increases?

Yes, you may be able to have PMI removed if your home’s value increases. But it ultimately depends on whether your home’s LTV is now below 80%. For example, if you owe $300,000 on your mortgage and your home appraises for $360,000, then you could find your LTV by dividing $300,000 by $360,000 to get 0.83.

Do I have to wait 2 years to remove PMI?

If you’ve owned the home for at least five years and your loan balance is no more than 80 percent of the new valuation, you can ask for PMI cancellation.Jun 6, 2025

How much does an appraisal cost for PMI removal?

If you’re paying PMI, the additional monthly cost can range from 0.5% to 1% of your loan amount per year. For example, on a $250,000 loan, PMI could cost between $1,250 and $2,500 annually. If a $500 appraisal confirms that you have 20% equity and eliminates PMI, you could save thousands over the life of your loan.

Can you get rid of PMI with a new appraisal?

For homeowners with a conventional mortgage loan, you may be able to get rid of PMI with a new appraisal if your home value has risen enough to put you over 20 percent equity. However, some loan servicers will re-evaluate PMI based only on the original appraisal. Can you get an appraisal to remove PMI without refinancing?

How much does a PMI appraisal cost?

An appraisal may cost as much as $500. But the fee would be worth it if your home’s current value shows you have 20 percent home equity — enough equity to cancel PMI on a conventional mortgage, which will save you money each month. Will a lender cancel PMI automatically?

Does a house need to be appraised to drop PMI?

When you enter into a contract to buy a home, your lender will require that the house be appraised to determine its value. If the initial appraisal comes in higher than what you’ve agreed to pay for the home, it will increase your equity, which can lower the amount of PMI needed. How much does my house need to appraise for to drop PMI?

How do I get rid of PMI If I refinance?

If you refinance to get rid of PMI, the process will include a new property value to verify that your loan is below 80 percent LTV. For homeowners with a conventional mortgage loan, you can get rid of mortgage insurance with a new appraisal if your home value has risen enough to put you over 20 percent equity.

Can I get rid of mortgage insurance with a new appraisal?

For homeowners with a conventional mortgage loan, you can get rid of mortgage insurance with a new appraisal if your home value has risen enough to put you over 20 percent equity. However, some loan underwriters will re-evaluate PMI based only on the original appraisal. So contact your lender directly to learn about your options.

Should I remove PMI from my home?

A higher equity stake in your home can lower the perceived risk of your mortgage and, in some cases, speed up the path to PMI removal. And because PMI can add tens of thousands of dollars in housing costs over the life of a loan, it’s important to consider taking steps to remove PMI as soon as you’re eligible.