When planning for retirement, understanding how your Roth IRA distributions will be taxed isn’t just about federal taxes. The state you live in can have a significant impact on your retirement income. While Roth IRAs offer tax-free distributions at the federal level, state taxation rules vary widely and can complicate your retirement planning.

The Basics: Roth IRA Tax Treatment

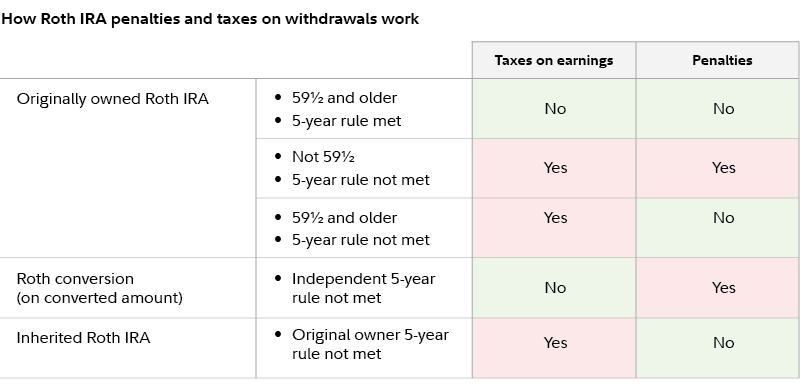

Roth IRAs are funded with after-tax dollars, meaning you don’t get a tax deduction when you contribute. The big advantage comes during retirement – qualified distributions (typically after age 59½ and the account being open for at least 5 years) are completely tax-free at the federal level. This is one of the main reasons Roth IRAs are so popular.

But what happens at the state level? That’s where things get complicated.

State Taxation Categories for Roth IRA Distributions

States handle Roth IRA distributions differently. Here’s how they break down:

States That Don’t Tax Roth IRA Distributions

These states have no income tax so they don’t tax any retirement income including Roth IRA distributions

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

For people who live in these states, taking money out of a Roth IRA won’t be taxed by the state.

States That Fully Tax Roth IRA Distributions

Some states don’t follow the federal treatment and may fully tax your Roth IRA distributions

- Alabama

- Arkansas

- California

- Delaware

- District of Columbia

States With Partial Taxation or Special Rules

The majority of states fall somewhere in the middle, with partial taxation or special exemptions:

- Arizona

- Colorado

- Connecticut

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Utah

- Vermont

- Virginia

- West Virginia

- Wisconsin

The Complexities of State Taxation

Residency Laws Impact Your Tax Liability

Your home state is a very important factor in figuring out how to tax the money you get from your Roth IRA. Each state has its own criteria for defining residency:

-

Physical Presence: Some states, like California, consider you a resident if you’re in the state for more than a temporary purpose.

-

Domicile: Other states focus on your intent to stay indefinitely.

-

Statutory Residency Tests: For example, in New York, you are a resident if you live there permanently and spend more than 183 days a year.

This could be a problem if you spend time in more than one state. If you’re not careful, you could accidentally owe taxes in more than one state.

Withholding Requirements Vary By State

State withholding rules add another layer of complexity. These rules dictate how much tax is withheld from your distributions before you receive them.

For example:

- Connecticut requires withholding on IRA distributions unless you specifically opt out

- Texas has no withholding requirements (because it has no income tax)

- Arkansas provides specific withholding tables that must be followed

From the Merrill Lynch document, here are some notable withholding rates:

- California: 10% of Federal Tax

- Oregon: 8% (Mandatory with opt-out option)

- Massachusetts: 5% (Mandatory)

- Vermont: 30% of Federal Tax (Mandatory)

The Risk of Double Taxation

One of the most concerning issues is potential double taxation. This can happen when:

- States don’t recognize the federal tax treatment of Roth IRAs

- States have their own definition of taxable income

- You move between states with different tax rules

For example, if you contributed to a Roth IRA while living in a state that didn’t give you a tax break on contributions, and later moved to a state that taxes distributions, you could effectively be taxed twice on the same money.

Special State-Specific Considerations

Some states have unique rules worth noting:

Michigan

Michigan has mandatory withholding on the taxable portion of excess contributions distributed, and doesn’t allow voluntary withholding. The withholding rate is 4.25%.

Mississippi

Mississippi imposes a mandatory 5% withholding rate for premature distributions and removal of excess contributions. Voluntary withholding isn’t allowed for Roth IRAs.

New Jersey

New Jersey doesn’t follow federal guidelines for Roth IRAs and may require distributions to be included in gross income unless specific conditions are met.

Massachusetts

Massachusetts has state tax rules that significantly differ from federal ones, requiring careful attention to avoid unexpected tax liabilities.

Strategies to Minimize State Taxes on Roth IRA Distributions

If you’re concerned about state taxation of your Roth IRA, consider these strategies:

1. Consider Your Retirement Location

If you’re planning to relocate for retirement, the state’s tax treatment of Roth IRAs should be a factor in your decision. Moving from a high-tax state to a no-income-tax state can significantly increase your retirement income.

2. Time Your Withdrawals Strategically

If you split time between two states, understand both states’ residency requirements and time your withdrawals when you’re a resident of the more tax-favorable state.

3. Focus on Qualified Distributions

By ensuring your withdrawals meet the qualifications for tax-free treatment (generally, being over 59½ and having the account for at least 5 years), you’ll maximize your chances of favorable tax treatment.

4. Consult With a Tax Professional

State tax laws change frequently, and the interactions between federal and state tax codes are complex. Working with a tax professional who understands retirement account taxation in your specific state is invaluable.

How State Withholding Works

When you take distributions from your Roth IRA, you need to be aware of state withholding requirements. Here’s what happens:

- Your financial institution will withhold the required amount based on your state’s rules

- This withholding serves as a pre-payment of your state income taxes

- When you file your state tax return, you’ll reconcile the amount withheld with your actual tax liability

Many states offer an “opt-out” option for withholding, but the process varies. The Merrill Lynch document shows many states have “Mandatory Opt Out” provisions, which means withholding is required unless you specifically complete paperwork to avoid it.

Real Examples: State-Specific Situations

Maine

Maine has a relatively high withholding rate of 5%. While there’s a $30,000 pension exclusion (increasing to $35,000 in 2024), some retirement income is still taxed. Qualified Roth IRA distributions are generally not taxed, but non-qualified distributions might be.

North Dakota

North Dakota taxes most retirement income, but at relatively low rates (maximum of 2.9%). This means even if your Roth IRA distributions are taxable at the state level, the impact may be minimal compared to higher-tax states.

Common Questions About State Taxation of Roth IRAs

Do you have to pay state taxes on a Roth IRA withdrawal?

It depends entirely on your state of residence. Some states don’t tax them at all, others fully tax them, and many have partial taxation or exemptions.

What taxes do you pay on Roth IRA distributions?

If you’ve met the five-year holding requirement and are over 59½, you typically pay no federal taxes. State taxes vary by location.

Are IRA distributions taxed at the state level?

Yes, in many states. Your state may require income tax withholding from your distribution as a pre-payment toward your current-year state income tax liability.

Conclusion

Understanding how your state taxes Roth IRA distributions is crucial for effective retirement planning. While the federal tax treatment is straightforward (qualified distributions are tax-free), state taxation varies dramatically.

The best approach is to research the specific rules in your state of residence and any state you’re considering moving to. Work with a qualified tax professional who understands the nuances of retirement account taxation to develop a strategy that minimizes your tax burden.

Remember that state tax laws change frequently, so regular reviews of your retirement tax strategy are essential. With careful planning, you can maximize the benefits of your Roth IRA regardless of where you live.

And hey, we all want our retirement savings to stretch as far as possible – understanding these state tax implications is one more way to make sure you’re getting the most from your hard-earned money!

Have you checked how your state treats Roth IRA distributions lately? It might be worth a look – tax laws change more often than I change my mind about what to have for dinner!

How much can I contribute to an IRA?

In 2023, the most you can put into an IRA is $6,500, unless your taxable income is less than that. In that case, your income is the most you can put in. If you are aged 50 or more, the limit is $7,500. The contributions are tax-deductible if you don’t have an employer-sponsored 401(k) or similar plan. If you do have an employer-sponsored plan, the limit on what you can contribute to an IRA is determined by your MAGI (modified adjusted gross income). The highest amount of money that can be deducted from your taxes is $83,000 if you are single and $136,000 if you are married and filing jointly. In the case of a couple, there is a different limit when one spouse is eligible to invest in a workplace plan, and the other is not.

The limits are the same for contributions to a Roth IRA, but higher earners may not be eligible to make contributions, depending on their income. The limits apply to your total contributions to either type of IRA.

Who should invest in a Roth IRA?

Whether its wiser to contribute to a Roth or Traditional IRA depends on your current and anticipated future tax brackets. So, if you think your income is higher now than it will be later, the Traditional IRA might be the best choice for you. On the other hand, if you think your future income tax obligation will be higher (due to income or the expectation that taxes may rise), the Roth might be a better option. Also, if you prefer to avoid mandatory minimum distributions, the Roth makes sense.

In either case, your withdrawals from a Roth IRA won’t be taxed at the federal or state level. Instead, you will pay the applicable taxes when you contribute to the account.

This material is for general information and educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

Realized does not provide tax or legal advice. This material is not a substitute for seeking the advice of a qualified professional for your individual situation.

Find Ways To Diversify Your Retirement Income Download eBook