There has been a lot of talk about annuities and whether they are a good investment for years, and it doesn’t look like it will end any time soon. But instead of rehashing the usual arguments, lets look at it from a different perspective.

If you are planning for retirement and want to find the best way to grow your money and get a steady income, you should invest in dividend stocks instead of annuities.

When my clients are planning for retirement, they always ask me the same question: “Are annuities better than stocks?” It’s like trying to choose between chocolate and vanilla ice cream—each has its pros and cons, but in the end, your personal taste (and finances) will determine which is best.

As someone who’s spent years helping folks navigate the complex world of retirement planning, I can tell you there’s no one-size-fits-all answer. Let’s dive into this financial face-off and explore which option might be better suited for your golden years.

Understanding the Contenders: Annuities vs. Stocks

What Are Annuities?

Annuities are contracts between you and insurance companies where you make payments (either in a lump sum or over time), and in return, the insurer promises to pay you a stream of income, either immediately or at some point in the future

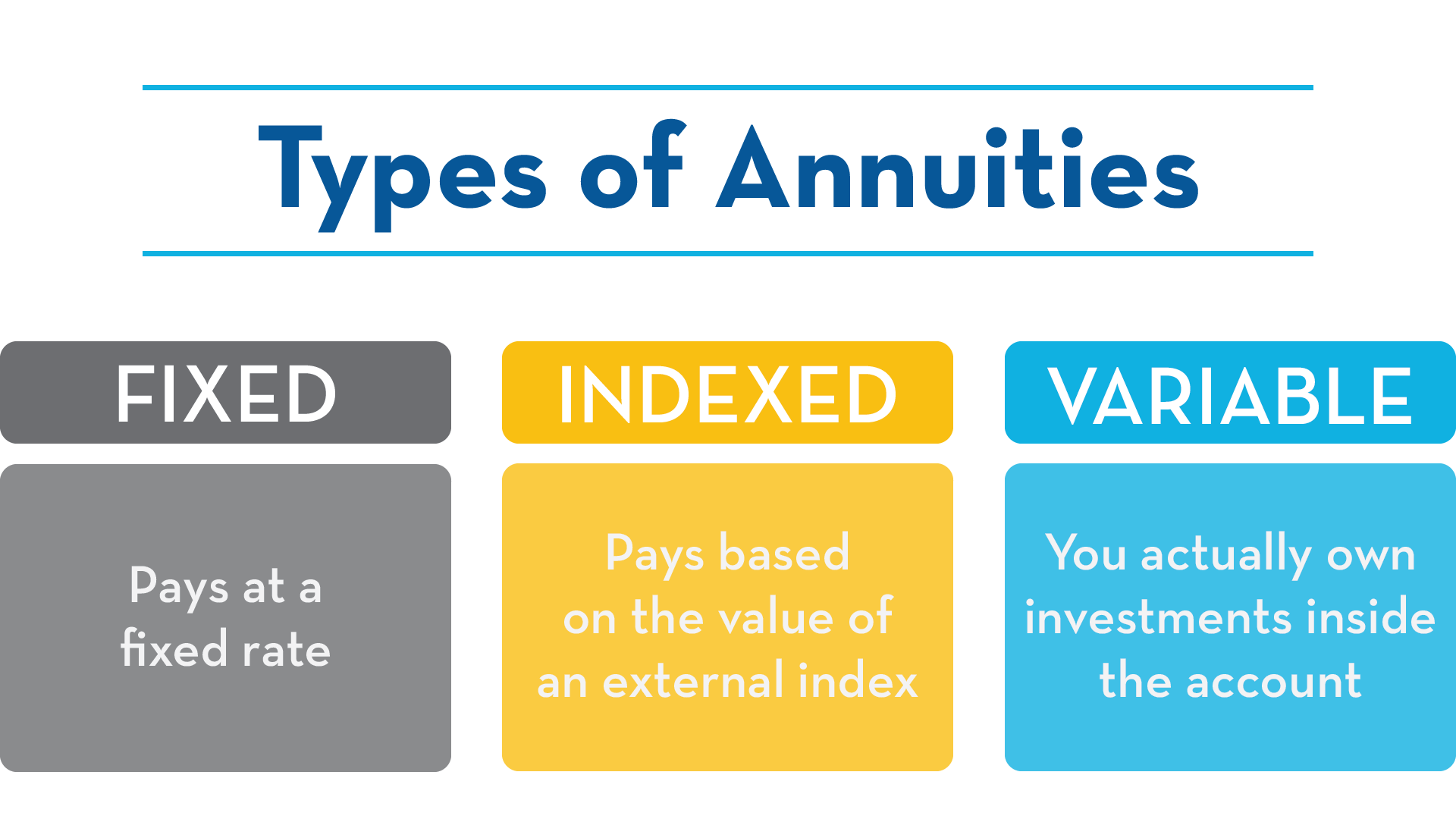

There are three main types of annuities:

- Fixed annuities guarantee your principal plus a minimum interest rate (currently can exceed 5% annually)

- Variable annuities are tied to the performance of underlying investments (similar to mutual funds)

- Indexed annuities link returns to a market index like the S&P 500, offering a middle ground between fixed and variable options

What Are Stocks?

Stocks represent ownership shares in companies. When you purchase stocks, you’re buying a piece of that business and potentially benefiting from its growth and profits through:

- Capital appreciation (increase in stock value)

- Dividend payments

- Long-term wealth accumulation

The Pros of Annuities: Safety First

Guaranteed Income

The biggest advantage of annuities—especially fixed annuities—is the guarantee. Just like your grandparents might’ve loved the predictability of pension plans, annuities provide that same sense of security.

“A life annuity provides guaranteed income for as long as you live, even after the insurer’s payouts have matched the amount of money you chipped in,” notes the Insurance Information Institute, which calls this type of annuity a “personal pension plan.”

Tax-Deferred Growth

With annuities, you don’t pay taxes on your earnings until you start receiving payments. This tax-deferred status means your money can grow faster over time—a huge plus if you’re in a higher tax bracket now but expect to be in a lower one during retirement.

No Contribution Limits

Unlike 401(k)s or IRAs that cap how much you can contribute annually, annuities have no limits. If you’ve maxed out other retirement accounts and still have money to invest, annuities provide an additional tax-advantaged option.

Optional Features (Riders)

Many annuities offer add-on features called riders that can provide inflation protection or guarantee that you won’t lose your initial investment, even if the market crashes. These customization options can be invaluable for tailoring your retirement strategy.

The Cons of Annuities: Limitations Abound

High Costs

Let’s be honest—annuities ain’t cheap! They typically come with various expenses, including:

- Administrative fees

- Investment management fees

- Surrender charges (if you withdraw early)

- Rider costs (if you add optional features)

All these fees can significantly reduce your returns compared to stocks.

Limited Liquidity

Ever tried to break a piggy bank that’s been super-glued shut? That’s kinda what accessing your annuity money early feels like. Most annuities charge substantial surrender fees (sometimes as high as 10%) if you withdraw funds within the first 6-10 years.

Plus, withdrawals before age 59½ typically incur a 10% tax penalty from the IRS. Ouch!

Complex Structures

Annuities can be confusing—there are immediate vs. deferred options, different payout structures, various fees, and numerous riders. Because they are so complicated, many people find it hard to fully understand them.

The Pros of Stocks: Growth Potential

Higher Return Potential

Historically, stocks have delivered impressive returns over the long haul. According to data from NYU’s Stern School of Business, $100 invested in S&P 500 stocks at the beginning of 1928 would have grown to nearly $625,000 by the end of 2022 (including dividends). That same $100 in Treasury bonds? Just over $7,000.

Liquidity

Unlike annuities, stocks can be sold quickly if you need cash. While market timing issues exist, there’s no surrender period or contractual limitations on accessing your money.

Tax Advantages

Stocks held in retirement accounts like IRAs or 401(k)s enjoy tax benefits. Even outside these accounts, long-term capital gains are typically taxed at lower rates than ordinary income (which is how annuity payments are taxed).

Step-Up in Basis

When stocks are inherited, beneficiaries receive a “stepped-up” cost basis to the market value at the time of death, potentially eliminating capital gains tax on appreciation that occurred during the original owner’s lifetime. Annuities don’t offer this benefit.

The Cons of Stocks: Risks and Volatility

Market Volatility

Stocks can be a wild ride! The S&P 500 jumped 28.7% in 2021 but plummeted 18.1% in 2022. This volatility can be nerve-wracking, especially as you approach or enter retirement when you have less time to recover from market downturns.

No Guarantees

Unlike annuities, stocks offer zero guarantees. Your investments could decrease significantly in value, potentially affecting your retirement lifestyle if the market tanks at the wrong time.

Requires Active Management

Managing a stock portfolio demands time, knowledge, and emotional discipline. Many retirees prefer not to worry about market fluctuations or investment decisions during retirement.

Who Should Choose Annuities?

Annuities might be better for you if:

- You prioritize guaranteed income above all else

- You’re uncomfortable with market risk and volatility

- You’ve already maxed out other retirement accounts

- You want protection against outliving your money

- You desire simplicity in your retirement income plan

One of my clients, Martha, was so stressed about market swings that she couldn’t sleep at night. Moving a portion of her portfolio to a fixed annuity gave her peace of mind, even though it meant potentially lower returns.

Who Should Choose Stocks?

Stocks might be better for you if:

- You seek maximum growth potential

- You have a long time horizon before retirement

- You’re comfortable with market volatility

- You want maximum flexibility and liquidity

- You’re concerned about keeping pace with inflation

On the other hand, my client Jack knows how markets work and keeps a long-term view. To get the most growth out of his retirement savings, he likes to keep most of them in a diversified stock portfolio.

The Best of Both Worlds: A Balanced Approach

The smartest strategy might be combining both annuities and stocks in your retirement portfolio. This approach, which I recommend to most of my clients, provides both security and growth potential.

Here’s how it might work:

-

Cover essential expenses with guaranteed income: Use Social Security, pensions, and annuities to ensure your basic needs (housing, food, healthcare) are covered regardless of market performance

-

Invest the rest of the money to grow it. Keep some in stocks and other investments to cover extra costs and fight inflation.

-

Adjust the mix as you age: Gradually shift from growth-focused investments to income-producing ones as you move through retirement

Real-World Example: The Bucket Strategy

One practical approach is the “bucket strategy,” where you divide your retirement savings into three categories:

| Bucket | Time Horizon | Primary Vehicles | Purpose |

|---|---|---|---|

| 1 | 1-3 years | Cash, CDs | Immediate living expenses |

| 2 | 4-10 years | Fixed annuities, bonds | Medium-term needs |

| 3 | 10+ years | Stocks | Long-term growth |

This strategy allows you to benefit from stock market growth while ensuring you have stable income for immediate needs.

Key Factors to Consider When Deciding

When weighing annuities against stocks, consider:

- Your risk tolerance: How comfortable are you with market fluctuations?

- Income needs: Do you need predictable income or maximum growth?

- Time horizon: How many years until and during retirement?

- Other income sources: What guaranteed income (Social Security, pensions) do you already have?

- Legacy goals: How important is leaving money to heirs?

- Tax situation: How will different investment vehicles affect your tax liability?

My Bottom Line: It’s Not Either/Or

So, are annuities better than stocks? The answer is: it depends on your personal situation and goals.

For many retirees, the best strategy isn’t choosing one over the other but finding the right balance between them. I’ve seen the most successful retirees use annuities for financial security and stocks for growth potential.

Remember, retirement planning isn’t a competition between investment vehicles—it’s about creating a strategy that provides both financial security and peace of mind during your golden years.

Before making any decisions, consult with a financial advisor who can help you develop a personalized retirement plan based on your specific circumstances. What works for your golf buddy might not be the right fit for you!

Have you considered how annuities and stocks might work together in your retirement plan? What questions do you still have about these options? I’d love to hear your thoughts!

Dividend Growth Prospects

When you set up an annuity, the upside on your portfolio becomes very limited. Your annuity may not grow at all if you choose an immediate annuity, or it may grow very little because of fees if you choose another type of annuity. Not only do dividends give you money, but the price of the stocks you own also go up, giving you capital gains.

When you buy growth stocks with dividends, you also buy more risk because there is no guarantee of growth. As long as you are not selling your stock when the market goes down and are only living off of the dividends, this isnt a big issue.

On the other hand, if this factor would keep you up at night, guarantees that come with annuities may be worth the growth trade-off for you. Just remember that annuities are an insurance policy, so theyre only as good as the company you buy them from. If the firm goes out of business, youre out the money.

Taxation on dividends depends on whether they are qualified dividends or ordinary dividends. Qualified dividends are taxed at the lower capital gains tax rate while ordinary dividends are taxed at ordinary income tax rates.

What Is the Biggest Disadvantage of an Annuity?

The biggest disadvantage of an annuity is its high cost. Annuities have several different fees, such as administrative fees, surrender charges, and investment management fees, which all reduce the return on your investment. Additionally, annuities lack flexibility. Once you purchase an annuity, your funds are generally locked in for a long period. You may be able to withdraw, but this can come with penalties.

Here’s Why Annuities Are SO Bad!

FAQ

Are annuities better than the stock market?

Annuities offer guaranteed income, making them ideal for retirees who want financial security and protection against market volatility — and don’t mind giving up higher potential returns in the process. Dividend stocks come with market risks, but provide greater growth potential and the potential to outpace inflation.

What does a $100,000 annuity pay per month?

What is the biggest disadvantage of an annuity?

The most significant disadvantages of annuities are their lack of liquidity, due to high surrender charges and penalties for early withdrawals, and high fees and complexity, which can significantly reduce returns over the long term.

Are annuities safe if the stock market crashes?

Yes, fixed annuities and fixed index annuities are usually thought to be safe during market crashes since they protect your principal and offer a stable interest rate or returns tied to an index with no risk of losing money. However, variable annuities, which are invested in subaccounts linked to market performance, do carry market risk and can lose value during a crash.

Should you invest in dividend stocks or annuities?

If you are planning for retirement and want to find the best way to grow your money and get a steady income, you should invest in dividend stocks instead of annuities. Dividend stocks provide both appreciation and income, making them better suited for retirement than annuities.

What is the difference between annuities and dividend-paying stocks?

Annuities and dividend-paying stocks work differently when it comes to income, taxes and risk. Annuities offer fixed or variable payments under a contract, often used for retirement. Dividend stocks pay income from company profits and may also grow in value. Which one works better depends on your needs for taxes, flexibility and risk.

Are variable annuities better than stocks?

However, variable annuities usually give investors risk-modifying optionality, whereas stocks do not. The best variable annuities offer flexible investment strategies that allow investors to spread their money across multiple asset classes (stocks, bonds, alternative investments, cash, etc).

Are annuities a good investment?

Another key advantage of annuities is that you don’t pay any income taxes on the principal or gains until you start receiving payouts. If those payouts begin during retirement, you may be in a lower tax bracket by then. Annuities are different from IRAs and 401(k) plans in that you can put as much money into them as you want.

What is the difference between an annuity and a stock?

With an annuity, they get the same basis that you had. With stocks, they get what is called a step-up basis —this means that their cost basis is what the price of the stock was on the day you died. This can make a major difference in how much they eventually get taxed even if you had a 100% gain on the stock.

Do you have to pay tax on stocks & annuities?

Outside of retirement plans, common stock investors must pay tax on all capital gains and dividends in the year of distribution. This diminishes returns and slows the rate at which wealth accumulates. When choosing to implement stocks or [variable] annuities into your financial plan, it’s important to consult with a financial professional.