A key focus in retirement is determining how your investments can generate sufficient income to support the lifestyle you choose. Yet that is only part of the challenge. Given today’s longer life expectancies and the realities of higher living costs over time, the income stream you generate today will most likely not meet your future income needs.

Consider that the average life expectancy for a person who reaches age 65 in the U.S. is roughly 85 years.1 Many will live far longer. Today, about one out of every three 65-year-olds will live until at least age 90, and about one in seven will live until at least 95.1

This means if you plan on retiring in your 60s, as many people do, your retirement savings might need to last for three decades.

You also need to keep in mind that over time, living costs will increase. Consider what happens to a person who withdraws $50,000 from savings and investments to fund retirement’s first year. If inflation averages 3% per year, after 30 years, close to $118,000 would need to be withdrawn to maintain the same living standard. That’s a lot of pressure to place on a traditional retirement account.

Are you approaching retirement or already enjoying your golden years? If so, you’re probably wondering what is the safest investment for retirees? It’s a question that keeps many soon-to-be or current retirees tossing and turning at night.

I totally get it After decades of hard work, the last thing you want is to see your nest egg disappear because of risky investments or market volatility You need reliable income streams that won’t evaporate when the economy hiccups.

In this article, I’m gonna share the safest investment options for retirees that can help protect your principal while still generating decent returns These investments might not make you rich overnight, but they’ll help you sleep soundly knowing your retirement savings are secure.

Why Safety Matters More in Retirement

Before we dive into specific investments, let’s talk about why safety becomes so crucial during retirement:

- Limited recovery time: Unlike younger investors, retirees don’t have decades to recover from significant market downturns.

- Income dependence: Many retirees rely on their investments for regular income to cover living expenses.

- Inflation protection: Your retirement could last 20-30 years or longer, so you need investments that can keep pace with rising costs.

According to data from the Social Security Administration, the average life expectancy for someone reaching 65 is around 85 years. About one in three 65-year-olds will live past 90, and about one in seven will live beyond 95. That’s a long time to make your money last!

The 7 Safest Investments for Retirees

Let’s explore the safest investment options that can provide reliable income while minimizing risk during your retirement years:

1. High-Yield Savings Accounts

High-yield savings accounts offer a safe place for cash while earning better interest rates than traditional savings accounts. These accounts are typically offered by online banks rather than brick-and-mortar institutions.

Benefits:

- FDIC-insured up to $250,000

- Completely liquid – access your money anytime

- No risk of losing principal

- Currently offering competitive interest rates

Best for: Emergency funds or short-term savings that you might need to access soon.

2. Certificates of Deposit (CDs)

CDs are time deposits offered by banks that provide a stated return in exchange for leaving your money untouched for a specified period.

Benefits:

- FDIC-insured up to $250,000

- Fixed, predictable returns

- Higher interest rates than regular savings accounts

- Various term lengths to choose from (3 months to 5+ years)

Drawbacks:

- Funds are locked in until maturity

- Early withdrawal penalties may apply

- May not keep pace with inflation over time

I remember my grandpa loving CDs because he always knew exactly what he was gonna get. No surprises, just steady, reliable returns.

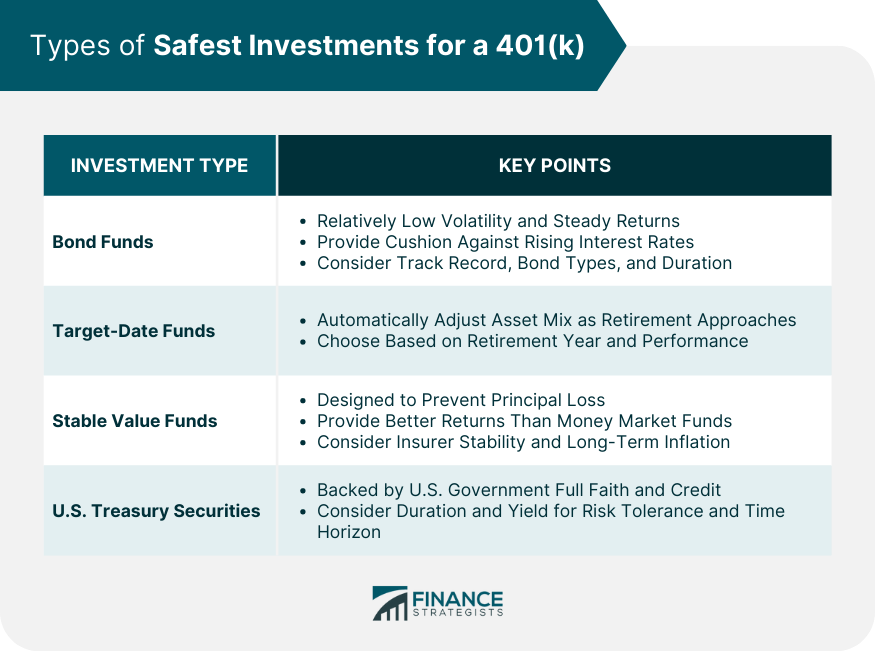

3. U.S. Treasury Securities

Treasury securities are considered among the safest investments in the world because they’re backed by the “full faith and credit” of the U.S. government.

Types of Treasury Securities:

- Treasury bills (T-bills): Short-term securities (4 weeks to 1 year)

- Treasury notes (T-notes): Medium-term securities (2 to 10 years)

- Treasury bonds (T-bonds): Long-term securities (20 to 30 years)

- Treasury Inflation-Protected Securities (TIPS): Securities that protect against inflation

Benefits:

- Extremely low risk of default

- Interest exempt from state and local taxes

- Available in various maturities to match your needs

- TIPS provide built-in inflation protection

4. Fixed Annuities

Fixed annuities are contracts with insurance companies that provide guaranteed income for a specific period or for life.

Benefits:

- Guaranteed income stream that can last throughout retirement

- Tax-deferred growth until withdrawal

- Protection from market volatility

- Can be structured to cover both you and your spouse

Drawbacks:

- Limited liquidity and access to your principal

- Potential surrender charges for early withdrawals

- Returns typically lower than equity investments

- Dependent on the financial strength of the insurance company

A friend of mine opted for a fixed annuity that covers both him and his wife, providing them with predictable monthly income they can’t outlive. It’s not exciting, but it gives them incredible peace of mind.

5. Dividend-Paying Stocks

While stocks generally carry more risk than the options above, high-quality dividend-paying stocks from established companies can provide reliable income and potential growth.

Benefits:

- Regular income from quarterly dividend payments

- Potential for dividend increases over time to help combat inflation

- Possible capital appreciation

- More growth potential than fixed income investments

What to look for:

- Companies with long histories of consistent dividend payments

- “Dividend aristocrats” (companies that have increased dividends for 25+ consecutive years)

- Strong balance sheets with manageable debt

- Stable business models less affected by economic cycles

6. Stable Value Funds

Stable value funds are a low-risk investment option typically found in employer-sponsored retirement plans like 401(k)s.

Benefits:

- Designed to preserve capital while providing steady returns

- Higher yields than money market funds

- Less sensitive to interest rate changes than bond funds

- Low volatility makes them ideal for retirees

“These don’t get nearly enough attention,” says Neal Gordon, founder and CEO at Gordon Wealth Planning. “They can be a great fit for someone who’s looking for safety but wants better returns than your standard savings account.”

7. Total Return Approach with Balanced Portfolio

A total return approach involves creating a diversified portfolio of stocks and bonds, then taking systematic withdrawals.

How it works:

- Build a balanced portfolio based on your risk tolerance

- Withdraw a sustainable percentage (typically 3-5%) annually

- Focus on the total return (income plus capital appreciation), not just income

- Rebalance periodically to maintain your target asset allocation

Benefits:

- Provides growth potential to combat inflation

- Offers more diversification than single-asset strategies

- Can be more tax-efficient than pure income strategies

- Flexibility to adjust withdrawals based on market conditions

Creating a Safe Investment Strategy for Retirement

So which of these safe investments should you choose? The answer is probably a mix of several, tailored to your specific needs and situation.

Here’s my simple 4-step process for creating a safe investment strategy:

-

Determine your income needs: Calculate how much monthly income you need from investments after accounting for Social Security and pensions.

-

Build your safety net: Create a “bucket” of ultra-safe investments (high-yield savings, CDs, Treasury bills) to cover 1-2 years of expenses.

-

Create your income stream: Allocate funds to investments that generate regular income (bonds, annuities, dividend stocks).

-

Add growth components: Include some growth investments to help combat inflation over a potentially lengthy retirement.

Remember, even the safest investment strategy needs regular review and occasional adjustments as market conditions and your needs change.

Common Questions About Safe Retirement Investments

Should I include stocks in my retirement portfolio?

Yes, most retirees should include some allocation to stocks. Given that retirement could last 20-30 years, you need some growth potential to offset inflation. The key is finding the right balance based on your risk tolerance and income needs.

What is the best source of retirement income?

There’s no single “best” source – a diversified approach is typically most effective. Combining Social Security, pensions (if available), annuities, bond income, and dividends creates multiple income streams and reduces risk.

How much of my retirement portfolio should be in safe investments?

A common rule of thumb is to have 5-10 years of anticipated withdrawals in safer investments. For instance, if you plan to withdraw $40,000 annually, you might keep $200,000-$400,000 in safer investments like bonds, CDs, and Treasury securities.

Final Thoughts

Finding the safest investments for your retirement isn’t about eliminating all risk – it’s about managing risk appropriately while ensuring your money lasts as long as you do.

The perfect balance will depend on your specific situation, including your age, health, other income sources, and personal risk tolerance. Many retirees benefit from working with a financial advisor who can help develop a customized strategy.

What safe investment strategies are you considering for your retirement? I’d love to hear your thoughts and questions in the comments below!

Frequently asked questions

There are a variety of ways this can occur. Among the strategies to consider are:

- Annuities, which can generate a guaranteed stream of income for a period of years or until your death or the death of you and a joint recipient such as a spouse.

- A diversified bond portfolio that can generate a stream of income paid regularly.

- A total return approach, building a diversified portfolio of stocks and bonds and taking systematic withdrawals.

- Income-producing equities that pay competitive dividend yields, which can provide cash flow in retirement.

You may want to utilize one or a combination of these strategies to meet your retirement income needs.

Given life expectancies today, you need to consider that your retirement may last 20 years or longer. It’s important to protect yourself from the potential impact of inflation. With an average inflation rate of 3%, your living costs will double in less than 25 years. Therefore, you need to structure a portfolio that includes a portion of the portfolio dedicated to growth. That way, you’ll be in a position to have your retirement savings generate a growing stream of income to keep pace with rising living costs.

Just as when you were younger and accumulating savings to meet future needs, the idea of owning a diversified portfolio makes sense. Investing in a portfolio of income-generating bonds won’t provide sufficient inflation protection to meet higher living costs as you grow older. Only owning stocks means your savings may be subject to too much fluctuation, which can be costly to your long-term financial security if markets suffer periods of extreme volatility. Likewise, choosing to only put money to work in annuities may make you too dependent on a single source of income that may not include inflation protection. It’s important to structure a retirement income solution that meets your income needs while accounting for your risk tolerance and the potential of a long life expectancy. A financial professional can help you better understand your options and determine the most appropriate for your retirement income strategy.

4 investment options for generating retirement income

Here are four common investment options to help you generate income in retirement. Everyone’s risk tolerance is different, so these options are listed from lower to higher risk.

An income annuity is a contract between you and an insurance company where you pay a sum of money, either all at once or monthly, in exchange for regular income payments. While the insurance company holds your contributions, that money has the potential to accrue on a tax-deferred basis.

Annuities can help you set up a guaranteed income stream that is designed to last for a certain period or for the rest of your life. This income can also be paid throughout your life or through both your and another person’s lifespan (for example, your spouse). Since annuities provide income guarantees, theyre often considered a form of insurance against the risk that you will outlive your retirement savings.

When you start taking disbursements, typically after you turn 59 ½, you can choose to receive a specific dollar amount regularly or payments that are adjusted for inflation. A financial professional can help you determine which type of annuity best fits your needs. “Annuities should be evaluated based on your specific circumstances,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “You must determine if it can sustainably generate sufficient income to meet your needs over time.”

Retirees often use annuities to supplement other guaranteed sources of income (such as Social Security) to offset non-discretionary expenses.

Benefits of annuities:

- A steady, predictable source of income in retirement, regardless of market fluctuations.

- Tax-deferred growth and tax-advantaged income.

- Flexibility in how you both save for and receive money in retirement.

- The potential for payments to continue for beneficiaries after you die.

Challenges of annuities:

- Guarantees are subject to the claims-paying abilities of the underlying insurance company.

- Liquidity may be limited.

- Withdrawals from annuities before age 59 ½ may be subject to a 10% tax penalty.

- Risks can be higher if your annuity isn’t underwritten by a highly rated insurance company.