Are you struggling to understand tax terms that seem like they’re written in another language? You’re not alone! Today, I’m going to break down one of those confusing tax concepts that can actually save you money: for AGI deductions.

As someone who’s spent countless hours trying to maximize tax savings for both myself and our readers, I can tell you that understanding these deductions is absolutely worth your time. They directly reduce your taxable income, which means more money stays in your pocket!

What Exactly is a “For AGI” Deduction?

If you have a “for AGI” deduction, which is also known as an “above-the-line deduction,” it lowers your gross income so that your Adjusted Gross Income (AGI) can be found.

These deductions are unique because you can use them even if you don’t list all of your deductions on your tax return. Yes, these tax breaks are open to everyone, whether they use the standard deduction or the itemized deduction.

“Above-the-line” comes from the way the old tax forms were set up, where these deductions were placed above the line where AGI was calculated. They are strong because they lower your income right away, before any other calculations are made.

Why Your AGI Matters So Much

Your Adjusted Gross Income isn’t just another number on your tax return – it’s super important because

- It determines eligibility for many tax credits and deductions

- It affects how much of certain expenses you can deduct

- It’s used to calculate limitations on other deductions

- It’s often used as verification when e-filing tax returns

- Many states use it as the starting point for state income taxes

The lower your AGI, the more tax benefits you might qualify for. That’s why “for AGI” deductions are so valuable!

3 Powerful Examples of For AGI Deductions

Let’s dive into three common “for AGI” deductions that might save you serious money:

1. Retirement Plan Contributions

One of the most powerful for AGI deductions comes from contributing to retirement accounts. These include:

- Traditional IRA contributions (up to $6,500 in 2023, or $7,500 if you’re 50 or older)

- SEP IRA, SIMPLE IRA, and other qualified plans for self-employed individuals

- 401(k) contributions for the self-employed

For instance, if you make $60,000 a year and put $6,000 into a traditional IRA, your AGI will go down to $54,000. This not only lowers your tax bill now, but it also helps you save money for retirement.

There are income limits for some retirement deductions, particularly if you’re covered by a retirement plan at work. For 2024, you can deduct traditional IRA contributions subject to these MAGI income limits if you have a workplace retirement plan:

- $123,001-$143,000 if married filing jointly

- $77,001-$87,000 if single or head of household

- Less than $10,000 if married filing separately

2. Student Loan Interest Deduction

If you’re paying off student loans, the IRS offers some relief. You can deduct up to $2,500 of the interest you paid on qualified student loans during the year.

This deduction is particularly helpful because:

- You don’t need to itemize to claim it

- It applies to loans for yourself, your spouse, or dependents

- It covers all student loans used for qualified education expenses

There are income limitations, though. The deduction begins to phase out when your MAGI reaches $70,000 ($145,000 if married filing jointly) and disappears completely at $85,000 ($175,000 for joint filers).

3. Self-Employment Tax Deduction

If you’re self-employed, you’re responsible for both the employer and employee portions of Social Security and Medicare taxes (self-employment tax). However, the IRS allows you to deduct half of your self-employment tax as a for AGI deduction.

For example, if you pay $4,000 in self-employment tax, you can deduct $2,000 from your gross income when calculating your AGI.

This deduction happens automatically when you complete Schedule SE with your tax return. It’s the government’s way of giving self-employed individuals partial relief from the double taxation they face.

Other Notable For AGI Deductions You Shouldn’t Miss

While we’ve covered three major for AGI deductions, there are several others worth knowing about:

- Health Savings Account (HSA) contributions – If you have a high-deductible health plan, contributions to your HSA reduce your AGI

- Moving expenses – This is now limited to active-duty military members moving due to military orders

- Educator expenses – Teachers can deduct up to $250 for classroom supplies they purchase

- Early withdrawal penalties – If you paid penalties for withdrawing from CDs or time-sensitive accounts early

- Self-employed health insurance premiums – Self-employed individuals can deduct health, dental, and long-term care premiums

- Alimony payments – For divorce agreements executed before 2019

How For AGI Deductions Differ From Itemized Deductions

Many people confuse for AGI deductions with itemized deductions, but they’re very different:

| For AGI Deductions | Itemized Deductions |

|---|---|

| Available whether you itemize or take standard deduction | Only beneficial if total exceeds standard deduction |

| Directly reduce AGI | Claimed after AGI is calculated |

| No overall limit on total deduction amount | May be subject to overall limitations |

| Each has specific rules and limits | Listed on Schedule A |

| Examples: IRA contributions, student loan interest | Examples: Mortgage interest, charitable donations |

A Simple Example of How For AGI Deductions Work

Let’s see how this works with a practical example:

Imagine Sarah has:

- $65,000 in total income

- $5,000 traditional IRA contribution

- $1,500 in student loan interest

- $2,000 in self-employed health insurance

Her for AGI deductions total $8,500, making her AGI $56,500.

From this AGI, she can either take the standard deduction or itemize, but either way, she benefits from the $8,500 in for AGI deductions that have already reduced her taxable income!

How to Calculate Your AGI

Calculating your AGI is actually pretty straightforward:

- Start with your total (gross) income from all sources (wages, tips, interest, dividends, business income, etc.)

- Subtract all eligible for AGI deductions

- The result is your Adjusted Gross Income

For example:

- Income: $50,000 wages + $12,000 rental income + $8,500 from part-time driving + $500 bond interest = $71,000 gross income

- Adjustments: $250 educator expenses + $2,500 student loan interest = $2,750

- AGI = $68,250 ($71,000 – $2,750)

MAGI: The AGI’s Complicated Cousin

You might also encounter the term Modified Adjusted Gross Income (MAGI). This is your AGI with certain deductions added back in. Different tax benefits use different MAGI calculations.

For most people, MAGI is very close to AGI, but it matters for:

- IRA contribution deductibility

- Education tax credits

- Child Tax Credit

- Premium Tax Credit for health insurance

Tax software will calculate your MAGI for you, but it’s good to understand the concept.

Finding Your AGI From Previous Years

Sometimes you need your prior year’s AGI to verify your identity when e-filing. You can find it:

- On line 11 of your previous year’s Form 1040

- In your IRS online account

- By requesting a copy of last year’s return

Maximizing Your For AGI Deductions

To make the most of these valuable deductions:

- Keep good records of expenses that qualify for for AGI deductions

- Maximize retirement contributions when possible

- Consider bunching deductions in years when they’ll provide the most benefit

- Check income limits to ensure you qualify

- Use tax software that prompts you for potential deductions you might miss

Final Thoughts

For AGI deductions are a powerful way to reduce your taxable income and potentially qualify for additional tax benefits. Unlike itemized deductions, these work for everyone, regardless of whether you take the standard deduction.

The three prime examples we’ve covered – retirement contributions, student loan interest, and self-employment tax deductions – represent just a few of the possibilities that could save you money this tax season.

I always recommend consulting with a tax professional for personalized advice, but understanding these basic concepts can help you have more informed conversations about your tax situation and potentially identify savings opportunities you might have missed.

Have you been claiming all the for AGI deductions you’re entitled to? The answer might surprise you – and save you money!

Do you have questions about for AGI deductions or other tax concepts? Drop them in the comments, and I’ll do my best to help!

When you need your MAGI

You use your modified adjusted gross income to calculate:

- Certain tax breaks, such as the Child Tax Credit and the Adoption Tax Credit

- Deductions for IRA contributions

- Some types of income, like interest on savings bonds, are not taxed.

Based on your MAGI, you get a different amount for each credit, deduction and income you can exclude from tax.

When you need your AGI

You may need your AGI to:

- Confirm your identity when you e-file your return

- Qualify for tax credits and other benefits

Adjusted Gross Income, Explained in Four Minutes | WSJ

FAQ

What are examples of AGI deductions?

How to calculate your AGIAlimony payments. Educator expenses. Certain business expenses – reservists, performing artists, fee-based government officials. Deductible HSA contributions. Deductible IRA contributions. Moving expenses – military only. Deductible self-employment taxes. Penalties on early savings withdrawal.

What are for AGI deductions?

Your total (or “gross”) income for the tax year, minus certain adjustments you’re allowed to take. Adjustments include deductions for conventional IRA contributions, student loan interest, and more. Adjusted gross income appears on IRS Form 1040, line 11.

What are 5 examples of deductions?

If you itemize, you can deduct these expenses:Bad debts. Canceled debt on home. Capital losses. Donations to charity. Gains from sale of your home. Gambling losses. Home mortgage interest. Income, sales, real estate and personal property taxes.

What does AGI mean?

Adjusted gross income. Your adjusted gross income (AGI) is the sum of all of your gross income from all sources minus the changes listed on Schedule 1 of Form 1040.

What is a deduction for AGI?

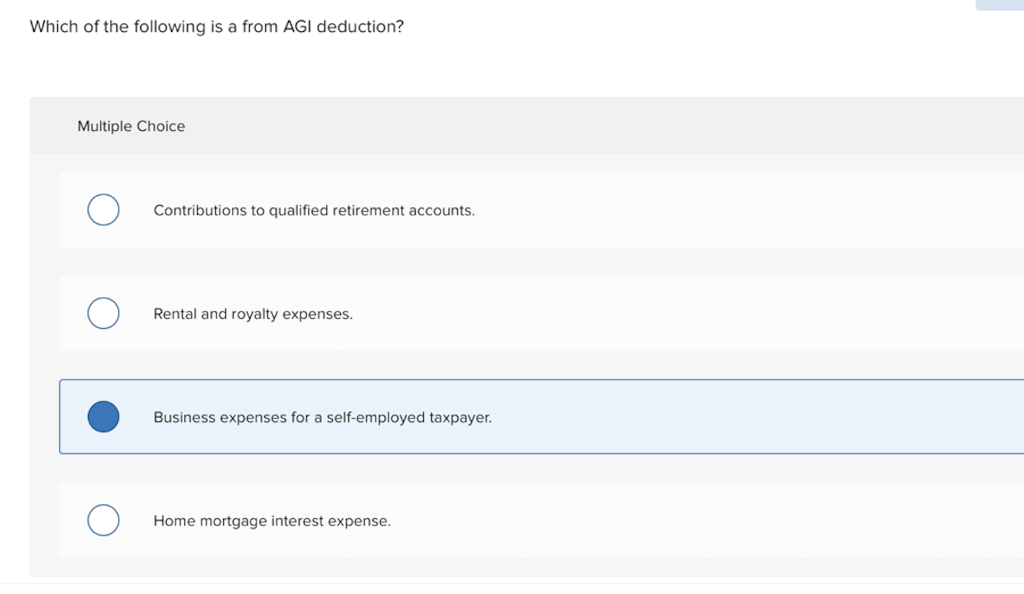

from adjusted gross income. Deductions for AGI can be claimed whether or notthe taxpayer itemizes. Deductions from AGI result in a tax benefitonly if they exceed the taxpayer’s standard deduction. 2. Tax Drill –Identify DeductionsFor and From AGI Indicate whether each of the following items is a “Deduction for AGI” or a “Deduction from AGI”. a.

How does the IRS calculate adjusted gross income (AGI)?

The amount of income tax you owe for the year is based on your adjusted gross income (AGI). Your AGI is calculated by subtracting certain adjustments to income from your total income for the year (your gross income).

What are the components of AGI?

Components of AGI: AGI includes income from wages, business income, investment income, and retirement income minus applicable adjustments to the income. Calculating AGI: To calculate AGI, start with your total gross income and subtract specific adjustments to income. Use IRS Form 1040 for this calculation during your annual tax return preparation.