Have you ever wondered if you could put money into both your employer’s 401(k) and your own Roth IRA? The good news is that you can! Not only is it legal, but it could be one of the best things you do in retirement.

It surprises me how many people don’t know they can use these two powerful retirement tools together. I’ve spent years helping people plan their retirement. Here is everything you need to know about having both accounts and how they could help your retirement savings.

The Quick Answer: Yes, You Can Have Both!

The IRS completely allows you to contribute to both a 401(k) plan through your employer AND maintain your own individual Roth IRA. This combo approach can significantly increase your annual retirement savings potential and give you more tax flexibility down the road.

However, there are some income limits and contribution rules you’ll need to understand, which I’ll explain in detail below.

What’s the Difference Between a 401(k) and a Roth IRA?

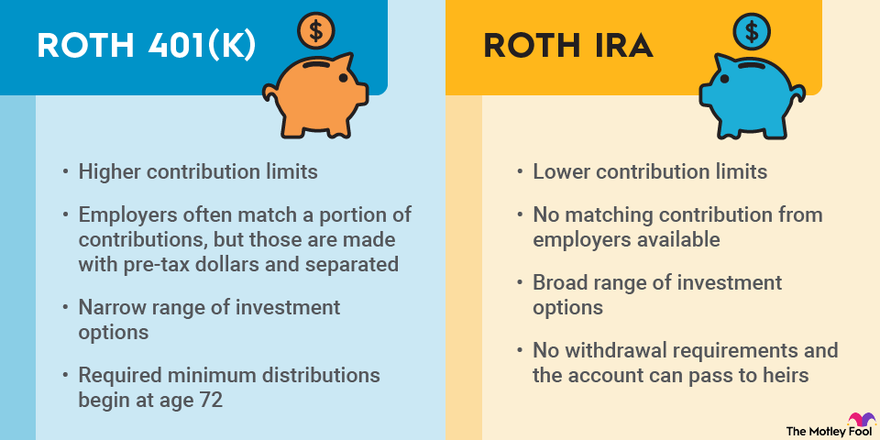

Before diving deeper, let’s clarify the key differences between these two retirement accounts:

401(k) Plans:

- Employer-sponsored retirement plan

- Contribution limit (2024): $23,000 ($30,500 if you’re 50+)

- Contribution limit (2025): $23,500 ($31,000 if you’re 50+, and up to $34,750 if you’re age 60-63)

- Tax treatment: Traditional 401(k) contributions are typically pre-tax, reducing your current taxable income

- Employer matching: Many employers offer matching contributions (free money!)

- Withdrawals: Taxed as ordinary income in retirement; penalties may apply for early withdrawals

Roth IRA:

- Individual retirement account you open yourself

- Contribution limit (2024): $7,000 ($8,000 if you’re 50+)

- Contribution limit (2025): $7,000 ($8,000 if you’re 50+)

- Tax treatment: Contributions are made with after-tax dollars (no immediate tax break)

- No employer involvement: No matching contributions

- Withdrawals: Tax-free in retirement if account is at least 5 years old and you’re 59½ or older

- Income limits apply: Not everyone qualifies to contribute to a Roth IRA

4 Awesome Benefits of Having Both Accounts

If you use both a 401(k) and a Roth IRA at the same time, you get some great benefits:

1. Supercharge Your Annual Savings

The biggest benefit is simple math – you can save more money each year! For 2024, you could potentially save:

- Up to $23,000 in your 401(k)

- Plus up to $7,000 in your Roth IRA

That’s $30,000 a year, or even more if you’re 50 or older and make catch-up contributions.

By 2025, the maximum combined contribution increases to $30,500 for those under 50, and potentially up to $42,750 for those ages 60-63 (thanks to higher catch-up contribution limits).

2. Tax Diversification = Flexibility in Retirement

This is my favorite part about using both accounts. You’re essentially creating two different tax buckets:

- 401(k) money: Will be taxed when withdrawn in retirement

- Roth IRA money: Tax-free withdrawals in retirement

This gives you incredible flexibility to manage your tax situation in retirement. Having some tax-free income can help you stay in a lower tax bracket and potentially reduce taxes on Social Security benefits.

3. Emergency Access to Funds if Needed

While I don’t recommend treating retirement accounts as emergency funds, the Roth IRA does offer a unique advantage: you can withdraw your contributions (not earnings) at any time without penalties or taxes.

This provides a financial safety net that traditional 401(k) plans don’t offer. With a 401(k), early withdrawals typically come with a 10% penalty plus taxes.

4. Less Required Distributions in Retirement

With a traditional 401(k), you’ll need to start taking required minimum distributions (RMDs) at age 73. The IRS basically forces you to withdraw money and pay taxes on it.

But guess what? Roth IRAs have no RMDs during your lifetime! This means you can let that money continue growing tax-free for as long as you want, or even leave it to your heirs.

Who Can Contribute to Both Accounts?

While anyone with access to an employer 401(k) can contribute to it, the Roth IRA has income limits. Here’s who qualifies for 2024:

2024 Roth IRA Income Limits:

- Single filers: Full contribution if income is below $146,000; partial contribution between $146,000-$161,000; no contribution above $161,000

- Married filing jointly: Full contribution if income is below $230,000; partial contribution between $230,000-$240,000; no contribution above $240,000

2025 Roth IRA Income Limits:

- Single filers: Full contribution if income is below $150,000; partial contribution between $150,000-$165,000; no contribution above $165,000

- Married filing jointly: Full contribution if income is below $236,000; partial contribution between $236,000-$246,000; no contribution above $246,000

If your income exceeds these limits, don’t worry – I’ll cover some alternatives later.

How to Strategically Use Both Accounts

If you can contribute to both accounts, here’s my recommended approach:

Step 1: Get Your Full 401(k) Match

Always contribute enough to your 401(k) to get your employer’s full matching contribution. This is literally free money, and you should never leave it on the table. If your employer matches 3% of your salary, make sure you’re contributing at least 3%.

Step 2: Max Out Your Roth IRA

After securing your 401(k) match, focus on maxing out your Roth IRA contribution ($7,000 in 2024/2025, or $8,000 if you’re 50+). The tax-free growth and withdrawals make this incredibly valuable.

Step 3: Return to Your 401(k)

If you still have money to save after maxing out your Roth IRA, go back to your 401(k) and contribute additional funds up to the annual limit.

Step 4: Consider After-Tax Options

If you’ve maxed out both accounts and still want to save more, look into other options like HSAs (if eligible), taxable brokerage accounts, or see if your 401(k) plan allows after-tax contributions.

What If You Can’t Contribute to a Roth IRA?

If your income is too high for direct Roth IRA contributions, you still have options:

1. Backdoor Roth IRA

This involves making a non-deductible contribution to a traditional IRA and then converting it to a Roth IRA. There are no income limits on conversions! Just be aware that this strategy works best if you don’t have other traditional IRA assets.

2. Check if Your Employer Offers a Roth 401(k)

Many employers now offer Roth 401(k) options, which have no income limits. This allows you to make after-tax contributions that grow tax-free, similar to a Roth IRA but with much higher contribution limits.

3. Consider a Traditional IRA

If you don’t have access to a 401(k), a traditional IRA might be an option. However, if you or your spouse have a workplace retirement plan, the deductibility of your contributions may be limited based on your income.

Common Questions About Having Both Accounts

Does contributing to a 401(k) affect my Roth IRA eligibility?

No! Having a 401(k) doesn’t affect whether you can contribute to a Roth IRA. Only your income and filing status determine Roth IRA eligibility.

What if I contribute too much to my IRA?

Be careful not to exceed contribution limits. The IRS imposes a 6% excise tax on excess contributions each year until you correct the error. You can fix this by withdrawing the excess amount before your tax filing deadline.

Can my spouse contribute to an IRA if they don’t work?

Yes! If you’re married filing jointly and one spouse doesn’t work, the working spouse can make contributions to an IRA for the non-working spouse. This is called a spousal IRA contribution.

Getting Started with Both Accounts

Setting up your dual retirement strategy is easier than you might think:

- Enroll in your employer’s 401(k) through your HR or benefits department

- Open a Roth IRA through a financial institution like Fidelity, Vanguard, or Charles Schwab

- Set up automatic contributions to both accounts to make saving effortless

- Review your investment choices in both accounts to ensure they complement each other

- Track your progress annually and adjust as needed

Final Thoughts: Double Your Retirement Power

Using both a 401(k) and a Roth IRA is kinda like having your cake and eating it too. You get tax advantages now AND later, more flexibility, and a bigger total savings potential. It’s one of the smartest retirement moves you can make.

The key is starting early and being consistent. Even if you can’t max out both accounts right away, contribute what you can and gradually increase your savings rate over time.

I’ve seen clients completely transform their retirement outlook by implementing this dual-account strategy. Ten or twenty years from now, you’ll be so glad you took advantage of both these powerful retirement tools.

Have you started using both a 401(k) and Roth IRA? Share your experience in the comments below!

Note: Tax rules and contribution limits can change. This article reflects information as of 2024-2025. Always consult with a financial advisor or tax professional regarding your specific situation.

Benefits of a traditional 401(k)

A traditional 401(k) plan is a great way to save for retirement, especially if your company matches or partially matches your contributions.

- Contributions are usually taken out of your paycheck and put into your account automatically, so you pay yourself first.

- Most 401(k) plans are funded with pre-tax contributions, which lower your taxable income for the current year. This is helpful when it comes time to file your taxes.

- 401(k) withdrawals in retirement are typically taxed.

Investing Insights newsletter

Subscribe to receive tips to help navigate your financial journey and ideas for setting and reaching your goals.

Tax requirements differ

Pairing a 401(k) with a Roth IRA may help your tax situation at different points in your life.

Contributing to your 401(k) plan at work is an important step toward saving for your retirement. But a 401(k) alone may still fall short of the funds needed for the rest of your life. 1.

You might be able to add to your retirement savings and have more options for meeting your changing financial needs during and after your working years if you put money into both a traditional 401(k) and a Roth IRA.

| Roth IRA | Traditional 401(k) | |

|---|---|---|

| Roth IRA | Traditional 401(k) | |

| Management/control | You | Employer |

| Contributions | Post-tax | Typically pre-tax |

| Contribution limits | 2024: $7,000 ($8,000 if over age 50) 2025: $7,000 ($8,000 if over age 50) | 2024: $23,000 ($30,500 if over age 50) 2025: $23,500 ($31,000 if over age 50) |

| Withdrawals | Qualified distributions are tax-free2 | Typically taxed |

| Required minimum distributions (RMD) | No RMDs | At age 73—or 75 if born 1960 or later—you must take the RMD each year to avoid tax penalties3 |

| Tax benefits | No tax benefit for the current year | Potentially lower current year taxable income |