When contributing or taking a distribution from a 401(k), you might ask yourself âwhat are the taxes on my 401(k)s?â. Find out when a tax is charged on 401(k)s. 3 min read.

A 401(k) is a tax-deferred account, and employees are not required to pay income taxes on their contributions. You will still be required to pay FICA taxes i. e. Social Security and Medicare Taxes. If you make a withdrawal, you will be required to pay income taxes on the withdrawal amount, and a penalty tax if you are below 59 ½.

For most retirement savers, 401(k) provides a way to reduce income taxes on the paycheck. However, you dont avoid paying taxes forever. But when you take money out of your 401(k), you get a tax bill. The amount of tax you pay depends on your age and income. Â Â.

Are you getting ready for retirement and wondering about the tax implications of your 401(k) withdrawals? One of the most common questions we hear from our readers is whether they’ll need to pay Social Security taxes when they take money out of their 401(k) accounts The good news is – you don’t! Let me explain why and what other taxes you should be prepared for

The Quick Answer

No, when you take money out of your 401(k), you do NOT have to pay FICA taxes for Social Security or Medicare.

This is true whether you’re making early withdrawals or taking distributions during retirement. However, you will still have to pay federal income tax and possibly state income tax on these withdrawals.

Why 401(k) Withdrawals Aren’t Subject to Social Security Tax

When you put money into a traditional 401(k), Social Security and Medicare taxes have already been taken out. Only the income tax was deferred. As Personal Finance’s Joe

“401(k) withdrawals – early or otherwise – are not subject to FICA or Medicare taxes That’s because they already were taxed when they were contributed”

This makes sense when you think about it. Your paycheck had Social Security and Medicare taxes (collectively known as FICA taxes) withheld before your 401(k) contribution was calculated. You only got the income tax break, not a break on Social Security taxes.

What About the Investment Earnings?

An important detail – even the earnings portion of your 401(k) is not subject to Social Security or Medicare taxes when you withdraw it. This is because investment earnings are not considered “earned income” (i.e., they’re not payment for work), so they’re never subject to these payroll taxes regardless of the account they come from.

Taxes You WILL Pay on 401(k) Withdrawals

While you don’t have to worry about Social Security taxes, your 401(k) withdrawals will typically be subject to:

- Federal income tax at your ordinary income tax rate

- State income tax (depending on your state)

- Potential 10% early withdrawal penalty if you’re under age 59½ (with some exceptions)

For a traditional 401(k), your entire withdrawal will be taxed as ordinary income. For a Roth 401(k), qualified withdrawals are completely tax-free (as long as you’ve had the account for at least 5 years and are age 59½ or older).

How 401(k) Withdrawals Are Taxed in Retirement

Let’s break this down more specifically:

Traditional 401(k) Taxation

With a traditional 401(k), you made contributions with pre-tax dollars, reducing your taxable income at the time. In exchange, you’ll pay ordinary income tax on withdrawals in retirement. Here’s what happens:

- Withdrawals are taxed at your current income tax bracket

- The entire withdrawal (both contributions and earnings) is taxable

- No Social Security or Medicare taxes apply

- Special tax treatment may be available if you were born before January 2, 1936 and take your distribution as a lump sum

Roth 401(k) Taxation

With a Roth 401(k), you contributed after-tax dollars, meaning you already paid income tax on that money. The major benefit comes in retirement:

- Qualified withdrawals (including earnings) are completely tax-free

- To be qualified, the account must be at least 5 years old and you must be 59½ or older

- No Social Security or Medicare taxes apply

- Exception: Employer matching contributions to a Roth 401(k) are taxable upon withdrawal because those were pre-tax contributions

Impact on Your Social Security Benefits

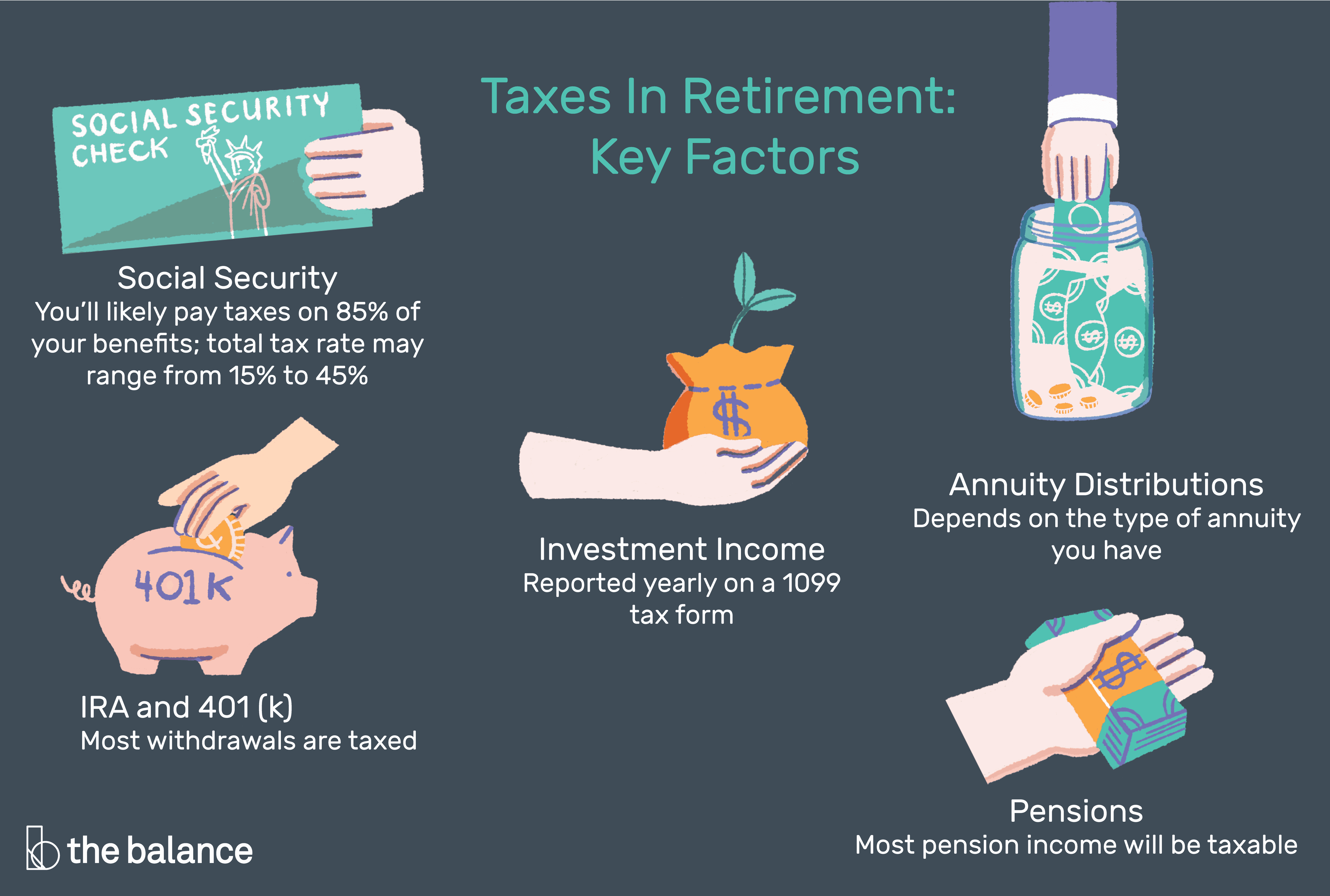

While 401(k) withdrawals aren’t subject to Social Security tax, they can affect how your Social Security benefits are taxed. This is an important consideration many retirees overlook.

Fidelity says that up to 85% of your Social Security benefits may be taxed if your combined income (including 401(k) withdrawals) goes over certain thresholds:

- For singles: combined income over $34,000

- For couples: combined income over $44,000

This “combined income” is calculated using a specific formula for Social Security taxation purposes.

2 Smart Strategies to Reduce Taxes in Retirement

To minimize your overall tax burden in retirement, Fidelity suggests two key strategies:

1. Converting to a Roth IRA

Some of your traditional 401(k) or IRA savings are moved into a Roth IRA as part of a partial Roth conversion. This can help because:

- Qualified Roth withdrawals are tax-free

- Roth withdrawals don’t count toward the income threshold that determines if your Social Security benefits are taxable

- You can convert just enough each year to stay in your current tax bracket

- You’ll pay taxes now on the converted amount, but potentially save more in the long run

2. Delaying Social Security Benefits

Delaying when you claim Social Security can also help reduce your overall tax burden:

- For every year you delay past full retirement age (up to age 70), your benefit increases by about 8%

- By waiting until 70 to claim Social Security, you might be able to reduce the percentage of your benefits that get taxed

- During the delay period, you can make strategic withdrawals from retirement accounts

Fidelity provides a helpful example of a couple who claims Social Security at 65 versus 70:

- Claiming at 65: 85% of their Social Security income is taxable

- Claiming at 70: Only 44% of their Social Security income is taxable

- The result: About 51% less in taxes despite the same retirement income

Common Questions About 401(k) Taxation

Do I pay Social Security tax on 401(k) rollovers?

No. Rollovers from one retirement account to another (like from a 401(k) to an IRA) are not subject to Social Security or Medicare taxes. Just make sure you complete a direct rollover to avoid any tax complications.

What about early withdrawals?

Early withdrawals (before age 59½) from a 401(k) are still not subject to Social Security or Medicare taxes. However, they’re subject to ordinary income tax plus a 10% early withdrawal penalty in most cases.

How does the 10% penalty work?

If you withdraw $1,000 from your 401(k) early, you’ll pay:

- Your marginal income tax rate (let’s say 25%): $250

- 10% penalty: $100

- Total tax and penalty: $350

The penalty is calculated on the full withdrawal amount, not on the tax you pay.

Planning for Retirement: Tax-Smart Strategies

As you approach retirement, here are some strategies to consider:

- Diversify tax treatment of accounts: Having a mix of traditional and Roth accounts gives you flexibility in managing your tax burden year to year

- Consider Roth contributions: Even if you can’t contribute directly to a Roth IRA due to income limits, you might be able to make Roth 401(k) contributions or do backdoor Roth conversions

- Time your withdrawals strategically: Plan which accounts to tap and when to minimize overall taxation

- Be mindful of RMDs: Required minimum distributions from traditional 401(k)s currently start at age 73 (or age 75 if you turn 74 after Dec. 31, 2032)

- Consider HSA accounts: Health Savings Accounts offer triple tax advantages and aren’t subject to Social Security tax on qualified withdrawals

Bottom Line

While you won’t pay Social Security or Medicare taxes on your 401(k) withdrawals, planning for income tax implications is crucial for maximizing your retirement income. The decisions you make now about account types, contribution strategies, and withdrawal timing can significantly impact your tax burden in retirement.

I always recommend working with a qualified financial advisor or tax professional to create a personalized retirement tax strategy. Everyone’s situation is different, and tax laws change over time.

Disclaimer: This article is for informational purposes only and should not be considered tax or financial advice. Always consult with a qualified tax professional about your specific situation.

Exemptions for the 10% Early Withdrawal Penalty

The IRS may provide an exemption to the 10% penalty for early 401(k) withdrawal in certain circumstances. Some of these circumstances include:

- Medical expenses that exceed 7.5% of the Adjusted Gross Income

- Buying a first home

- You become completely disabled

- You quit your job, retire, or get fired at age 55.

- Qualify for a hardship distribution

These events only waive the 10% penalty, but not the income taxes. You must report the withdrawal amount in the tax return for the year.

Tax Treatment of Roth 401(k) Contributions

A Roth 401(k) account is a special 401(k) plan, and it has different tax treatment rules compared to the traditional 401(k) plan. A Roth 401(k) plan is funded with after-tax dollars, and the IRS deducts taxes on the contributions you make to the plan. Withdrawal of contributions in retirement is made tax-free, as long as the IRS considers these distributions qualified.