Are you worried about creditors coming after your hard-earned money? You’re not alone Many people face financial challenges that might lead to debt collection efforts, including bank account garnishment The good news is that not all bank accounts can be touched by creditors. In this comprehensive guide, I’ll walk you through the types of bank accounts that are protected from garnishment and how you can safeguard your funds.

What Is Bank Account Garnishment?

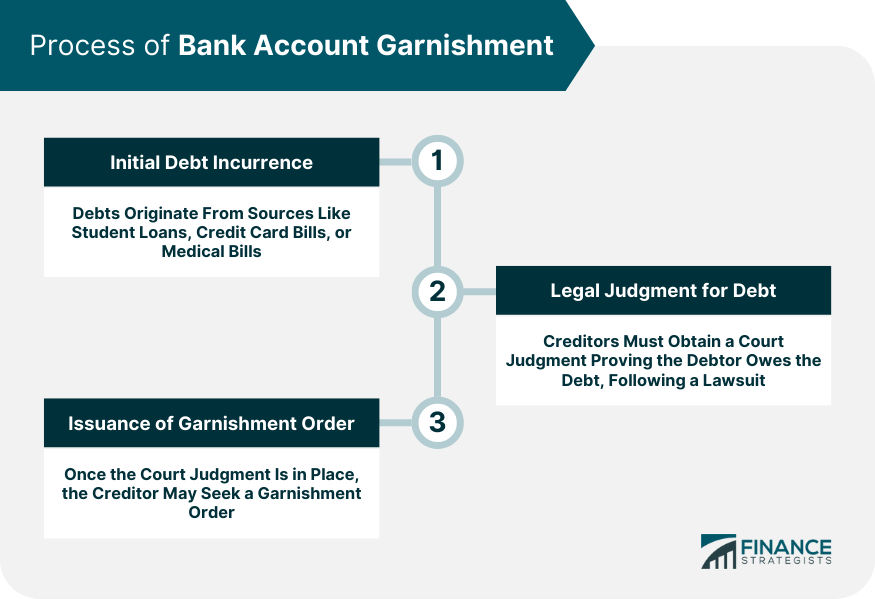

Before diving into protection strategies, let’s understand what we’re dealing with. Bank account garnishment is a legal process where a creditor, after obtaining a court judgment for an unpaid debt, can seize funds directly from your bank account. It’s a powerful collection tool that creditors use to recover money owed to them.

What’s particularly concerning is that in almost every state, your bank account can be garnished without notice. A creditor doesn’t need to tell you in advance that it plans to garnish your account You might only discover the garnishment after your account has been frozen!

When a garnishment order is served, your bank must freeze up to twice the amount owed. This freeze happens immediately, potentially leaving you without access to your funds when you need them most.

Types of Bank Accounts That Cannot Be Garnished

1. Accounts Containing Federal Benefits

Federal law provides strong protections for accounts containing certain government benefits. These include:

- Social Security benefits (retirement and disability)

- Supplemental Security Income (SSI)

- Veterans’ benefits

- Federal employee retirement benefits

- Railroad retirement benefits

- Federal student loan disbursements

- FEMA disaster assistance

For these funds to remain protected, they should be directly deposited into your account rather than deposited as a check. Direct deposit creates an electronic trail that makes it easier to identify the source of the funds.

It’s worth noting that only two months’ worth of these benefits are automatically protected. Any amount above that could potentially be garnished unless you take additional steps to protect it.

2. Retirement Accounts

Retirement accounts enjoy special protections under federal and state laws:

- 401(k) plans

- Pension plans

- Individual Retirement Accounts (IRAs)

As a general rule, the Employee Retirement Income Security Act (ERISA) of 1974 protects qualified retirement plans like 401(k)s indefinitely. IRAs are not protected by ERISA, but they are often protected by state laws or in bankruptcy proceedings.

3. Tenancy by Entireties Accounts

In some states, married couples can own bank accounts as “tenants by entireties.” These accounts are protected from garnishment by creditors of either spouse individually (though not from creditors of both spouses).

Florida is known for having strong protections against tenancy by entireties. To keep an exempt entireties account at a Florida bank, a debtor doesn’t even have to live in Florida. The best thing to do is to find a Florida bank that is licensed by the state and offers accounts for tenants by entirety.

4. Accounts in States That Prohibit Garnishment

There are laws in some states that limit or don’t allow bank account garnishments. Some states don’t let bank garnishments happen when the account has only a small amount of money in it.

- South Carolina

- Maryland

- North Dakota

- New York

- New Hampshire

Additionally, some states prohibit wage garnishments for consumer debts:

- North Carolina

- South Carolina

- Pennsylvania

- Texas

5. Specialized Exempt Accounts

There are several other types of specialized accounts that may be exempt from garnishment:

- Wage accounts: In states with head of household exemptions, accounts containing only wages may be protected.

- Child support and alimony accounts: Funds designated for child support or alimony are typically exempt.

- Homestead accounts: Accounts tied to protected homestead property may be exempt in some states.

Strategies to Protect Your Bank Account from Creditors

Now that you know which accounts are usually safe, let’s look at some ways to keep your money safe.

Keep Exempt Funds Separate

One of the most important strategies is to avoid commingling funds. When exempt money (like Social Security benefits) is mixed with non-exempt money (like wages) in the same account, it becomes difficult to prove which dollars are protected.

For example, if you receive a monthly $1,500 Social Security payment and a $2,000 paycheck in the same account, it can be challenging to distinguish the protected funds from the non-exempt ones.

The solution? Maintain separate accounts for different types of funds:

- One account exclusively for Social Security or other exempt government benefits

- Another account for wages and other non-exempt funds

Consider an Offshore Bank Account

While not technically exempt, offshore bank accounts can make it more difficult for creditors to reach your funds. An offshore bank account is simply a bank account located outside the United States.

In Florida, for example, a court must have jurisdiction over both the offshore bank and the funds themselves to issue a garnishment. This creates an additional hurdle for creditors trying to seize your money.

However, be aware that:

- Opening offshore accounts has become more difficult due to anti-terrorism rules

- They can be expensive to set up and maintain

- You may need to work through attorneys to establish offshore trusts or LLCs

- Transfers to offshore entities could be attacked as fraudulent conveyances

Use Business Bank Accounts Strategically

If you own a business, keeping funds in your business account rather than distributing them to yourself personally can be an effective protection strategy. If a creditor has a judgment against you as an individual (not your business), they cannot directly garnish your business bank account.

Instead, the creditor would need to focus on your ownership interest in the business:

- For corporations, creditors could levy on your stock

- For multi-member LLCs or partnerships in Florida, the creditor’s exclusive remedy would be a charging lien on distributions

If your LLC doesn’t make distributions, the creditor may get nothing. The effectiveness of this strategy depends on the language in your LLC operating agreement or partnership agreement.

What to Do If Your Bank Account Is Garnished

If your bank account has already been garnished, don’t panic. You have options:

-

Review the source of funds in the account: Determine if the money came from an exempt source.

-

Obtain documentation: Get a copy of your account signature card (especially important for joint accounts with a spouse to prove tenancy by entireties).

-

File a claim of exemption: If the funds are exempt by statute, you must file a claim of exemption to dissolve the garnishment.

-

Evaluate the garnishment procedures: Check if the creditor violated any aspect of state garnishment law. Garnishment rules are strictly enforced, and procedural errors can lead to the garnishment being dissolved.

Common Questions About Bank Account Garnishment

Can a joint account be garnished?

Whether a joint account can be garnished depends on the laws of your state:

- In community property states, a creditor can generally garnish a joint account for debts of either spouse.

- In common law or separate property states, creditors may be limited to garnishing only the debtor’s portion of the account.

Can a savings account be garnished?

Yes, savings accounts can be garnished just like checking accounts. A bank account garnishment makes no distinction between account types—it applies to checking accounts, savings accounts, money-market accounts, and even CDs.

Can Cash App and similar services be garnished?

Yes, electronic funds wallets like Cash App can be garnished. According to Cash App’s Terms of Service, they will adhere to garnishment orders and may freeze, withhold, or surrender funds in response to legal garnishment orders.

Can I open a new account while my current one is garnished?

Yes, you can still open new accounts at different banks even if one of your accounts has been garnished. A garnishment against one bank doesn’t prevent you from opening accounts elsewhere.

Final Thoughts: Proactive Protection Is Key

The best way to protect your bank accounts from garnishment is to be proactive. Rather than trying to hide your assets (which can lead to legal troubles), use legitimate exemptions and strategies to safeguard your money.

If you’re facing significant debt issues, consider:

- Negotiating a debt settlement plan with creditors

- Filing for exemptions from garnishment if eligible

- Consulting with an attorney about bankruptcy options as a last resort

Remember, proper asset protection planning doesn’t involve hiding assets from creditors—it involves structuring your finances in a legal way that maximizes available protections.

By understanding which bank accounts cannot be garnished and implementing appropriate strategies, you can help ensure that your money remains accessible to you even during financial difficulties. Don’t wait until a creditor comes knocking—start protecting your assets today!

Have you had experience with bank account garnishment or used any of these protection strategies? I’d love to hear your thoughts in the comments!

How are wages garnished?Debt collectors and creditors can only garnish your wages once they obtain a court order called a garnishment order or writ of garnishment. The court order permits employers to withhold some of your earnings to cover the debt you owe. Federal benefits are typically exempt from garnishment unless theyâre being used to pay child support, student loans, delinquent taxes or alimony.

- North Carolina

- Pennsylvania

- South Carolina

- Texas

Be aware: Creditors can try to get around state-imposed limits. For example, you may have a bank account in one of the four protected states, but if your employer has an office in another state, a creditor may try to circumvent that protection by seeking to garnish your wages in that state instead.

What can be garnished?

- Consumer debts

- Delinquent taxes

- Unpaid alimony

- Unpaid child support

- Unpaid student loans