Retirement planning can feel like trying to hit a moving target. When you think you know the magic number for a comfortable monthly income in retirement, things like rising costs, changes in the market, or changes in your lifestyle can move the goalposts. Adding to the uncertainty right now, though, is the fact that the economic environment is in flux. With issues like inflation trending slightly above the Federal Reserves long-term target and ongoing healthcare price increases, many retirees are reassessing what they thought was enough.

In general, though, retirees in the U. S. spend an average of around $5,000 per month to cover living expenses, healthcare, travel and leisure activities. This is only an average, though. Some households get by on far less, while others need significantly more to maintain the lifestyle they want. Social Security continues to provide a base layer of income — the average monthly payment is $1,976 for 2025 — but most households need additional income streams to bridge the gap and cover discretionary spending.

Given all of these factors, how do you figure out what a “good” retirement income really is? And how can you make your retirement income bigger to reach your goal?

Have you ever thought about whether or not your retirement savings are on track? Or maybe you’re already retired and want to know how your income compares to others? I’ve been researching this subject for weeks, and what I found may surprise you!

The Current State of Retirement Income in America

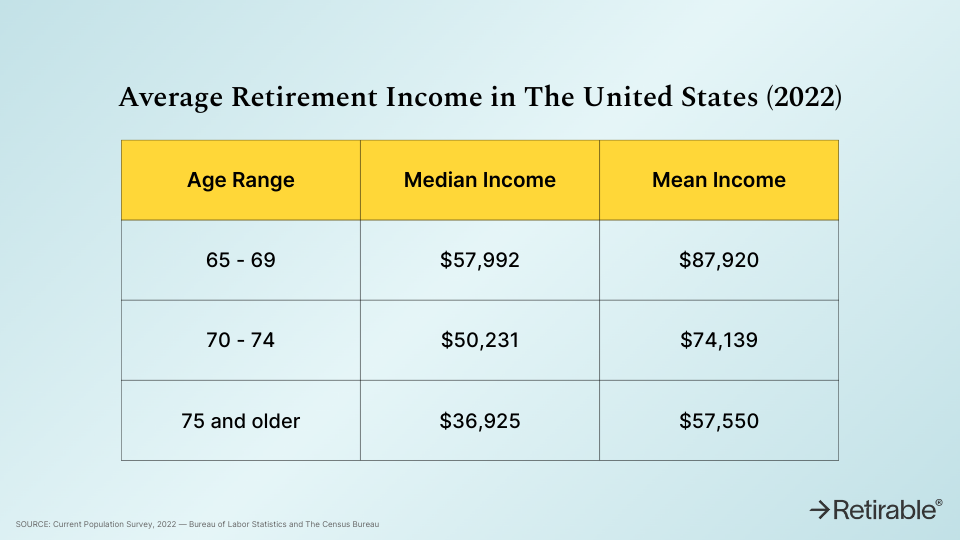

According to the latest data from the 2025 Current Population Survey (CPS), the numbers tell an interesting story about retiree finances:

- Median retirement income: $56,860 per year (or about $4,738 monthly)

- Mean retirement income: $87,260 per year (or about $7,272 monthly)

There’s a pretty big difference between these two numbers, right? That’s because retirees with lots of money push up the mean (average). The median, which is the point where half of the retirees make more money and half make less, gives us a better idea of what life is like for most retirees.

Breaking Down Retirement Income by Age

One interesting trend is that retirement income tends to decline as retirees get older. Here’s what the 2025 CPS data shows:

| Age Group | Median Income | Mean Income |

|---|---|---|

| 55-59 | $101,000 | $147,500 |

| 60-64 | $83,770 | $125,100 |

| 65-69 | $68,860 | $102,000 |

| 70-74 | $61,780 | $92,600 |

| 75+ | $47,790 | $73,820 |

This decline makes sense when you think about it. Many people in their early retirement years (65-69) might still work part-time while those in their late 70s and beyond typically have fully exited the workforce.

Retirement Income vs. Spending: The Gap

Here’s where things get concerning The Bureau of Labor Statistics reports that Americans 65 and older spent an average of $60,087 in 2023 (and likely more in 2025 with inflation)

That means that the average costs of living in retirement are more than $3,000 more than the median income of $56,860 per year. This gap highlights why proper retirement planning is so important!.

The Employee Benefit Research Institute, on the other hand, found that most retirees spend less than you might think:

- 15% spend less than $1,000 monthly

- 33% spend between $1,000-$1,999 monthly

- 20% spend between $2,000-$2,999 monthly

- 13% spend between $3,000-$3,999 monthly

- Only 18% spend $4,000 or more monthly

So while the average spending might be higher, about 68% of retirees manage to live on less than $40,000 per year.

Where Does Retirement Income Come From?

Retirees typically rely on several sources for their income:

-

Social Security: The average monthly benefit was $1,975 as of December 2024, providing about $23,700 annually. This represents nearly a third of income for most retirees over 65.

-

Retirement accounts: 401(k)s, IRAs, and other retirement savings vehicles.

-

Pensions: Less common nowadays but still significant for government employees and some long-term private sector workers.

-

Continuing employment: Many retirees work part-time in their early retirement years.

-

Financial assets: Investments, annuities, and other income-producing assets.

Gender Gap in Retirement Income

Unfortunately, the retirement income gap between men and women persists even into the golden years:

- Men 65+ living alone: Median income of $35,650

- Women 65+ living alone: Median income of $29,280

This difference of over $6,000 annually reflects lifetime earning disparities and often translates to women having less retirement security.

Are Retirees Getting Enough?

Financial experts typically suggest that retirees need about 70-80% of their pre-retirement income to maintain their standard of living. Social Security only replaces about 40% for the average earner, which means additional savings are crucial.

Many Americans are falling short of their retirement income needs. According to Pew, 32.6 million retirement-age households will have an annual income below $75,000 with an average cash shortfall of $7,050 by 2040.

Even more alarming, the National Council on Aging found that 45% of Americans over 60 have incomes insufficient to cover basic needs, and 80% are either financially struggling or at risk of financial insecurity.

How to Boost Your Retirement Income

If these numbers have you worried, don’t panic! There are several strategies to increase your retirement income:

-

Max out retirement contributions: Contribute as much as possible to your 401(k) or IRA during your working years.

-

Delay Social Security: Waiting until age 70 to claim benefits can increase your monthly payment by up to 30% compared to claiming at 62.

-

Consider a phased retirement: Working part-time in early retirement can preserve savings.

-

Optimize your pension distributions: If you have a pension, carefully consider lump-sum versus monthly payment options.

-

Invest in income-producing assets: Dividend stocks, REITs, and bonds can provide steady income.

-

Look into public assistance: Some retirees qualify for programs that help with healthcare, meals, and utilities.

-

Consider a reverse mortgage: For homeowners, this can provide additional income without selling your home.

How Much Should You Save for Retirement?

The 4% rule suggests that retirees can withdraw 4% of their savings annually without running out of money. Using this guideline:

- To generate $40,000 annually from savings, you’d need $1 million

- To generate $20,000 annually, you’d need $500,000

But remember, these withdrawals may be taxable depending on the type of account, so plan accordingly.

Real-World Retirement Spending Patterns

I’ve talked with lots of retirees over the years, and many say their spending follows a “U-shape” pattern:

- Early retirement (65-70): Higher spending on travel, hobbies, and fulfilling bucket-list dreams

- Mid-retirement (70-80): Reduced spending as activity levels naturally decrease

- Late retirement (80+): Increased spending on healthcare and possibly long-term care

This pattern means your income needs might not be constant throughout retirement.

The Impact of Inflation on Retirement Income

Inflation can significantly erode purchasing power over time. The 2025 Social Security cost-of-living adjustment (COLA) was 2.5%, which helps recipients maintain some purchasing power.

However, retirees often face higher inflation in categories like healthcare than the general population. This means your retirement income plan should account for increasing costs over time.

Regional Variations in Retirement Income Needs

Where you live dramatically impacts how far your retirement income will stretch. A $50,000 annual retirement income might provide a comfortable lifestyle in rural areas but could be challenging in expensive coastal cities.

Many retirees relocate to lower-cost areas to maximize their retirement dollars. Popular destinations include Florida, Arizona, and increasingly, overseas locations with lower costs of living.

The Retirement Income Reality Check

Let’s be honest – the average retirement income statistics reveal a concerning reality: many Americans aren’t saving enough. The gap between median income ($56,860) and average spending ($60,087) highlights this challenge.

If you’re still working, use these numbers as motivation to increase your retirement savings rate. If you’re already retired and struggling, consider adjusting your spending or exploring additional income sources.

My Thoughts on Retirement Planning

I’ve always believed that retirement planning shouldn’t be a one-size-fits-all approach. While the averages give us a baseline, your personal retirement income needs depend on your lifestyle, health, location, and goals.

The key is to start planning early and review your retirement strategy regularly. I recommend working with a financial advisor to create a personalized plan that accounts for your unique circumstances.

Final Takeaways

The average retirement income in America reveals both opportunities and challenges. While many retirees live comfortably on their income, others struggle to make ends meet.

By understanding these averages and planning accordingly, you can work toward a retirement that’s not just financially secure but also fulfilling and stress-free.

What steps are you taking to ensure your retirement income will be sufficient? It’s never too early (or too late) to improve your retirement outlook!

How to add guaranteed income streams to your retirement portfolio

In todays economic landscape, smart retirement planning means thinking beyond traditional savings accounts. It requires, in many cases, the creation of multiple income streams that can weather market volatility and inflation. And, there are a few ways you can do that.

Annuities offer the closest thing to a personal pension in todays retirement landscape. These insurance products provide a guaranteed stream of income for a set period or even for life. There are different kinds of annuities, such as immediate annuities that start paying right away and deferred annuities that start paying in the future.

Reverse mortgages are another option worth considering for homeowners aged 62 and older. Reverse mortgages are designed to help retirees who are asset-rich and cash-poor. A reverse mortgage can convert a portion of your home equity into monthly payments or a line of credit that only needs to be repaid when you move out permanently, die or sell your home.

Social Security optimization is another strategy that may be worth employing. By waiting until age 70 to claim Social Security, you can boost your benefit checks by 24% compared to claiming at full retirement age (which is 66 or 67, depending on the year in which you were born). The maximum monthly benefit for high earners who delay until age 70 exceeds $5,000 in 2025.

A good monthly retirement income in 2025 is less about a specific number and more about meeting your unique needs while maintaining flexibility. First, guess how much your necessary costs will be. Then, add in your extra spending. Don’t forget to include inflation and any surprises that might come up. Ultimately, the goal is to create a portfolio of income sources that allows you to live comfortably, confidently and on your own terms.

Angelica Leicht is the senior editor for the Managing Your Money section for CBSNews. com, where she writes and edits articles on a range of personal finance topics. Angelica previously held editing roles at The Simple Dollar, Interest, HousingWire and other financial publications.

What’s a good monthly retirement income in 2025?

The answer to this question isnt as straightforward as you might hope, and thats actually by design. Financial planners have moved away from universal recommendations because retirement needs can vary wildly based on factors like your location, lifestyle and health considerations. Generally, though, a good retirement income is about 75% to 85% of the pre-tax income earned in your last working year, according to financial planning experts. But lets translate that into real numbers. For someone earning $120,000 annually before retirement, this threshold means needing between $90,000 and $102,000 per year in retirement, or about $7,500 to $8,500 in monthly retirement income.

Thats unfortunately not what most Americans actually have saved, though. According to the latest data, the average retirement income in the United States in 2025 for individuals is approximately $60,000 per year, which includes income from both high earners and lower-income retirees. The median retirement income, which is typically a better indicator of what the average retiree has saved, is closer to $47,000 annually, or around $3,900 per month, however. For married couples, the numbers are higher, with average retirement income around $100,000 annually, or about $8,300 per month.

But heres where factors like geography become crucial. Those retiring in areas or states with high costs of living will likely need access to a lot more than the average retirement amount to live comfortably, as their overall costs will be higher. Meanwhile, retirees in lower-cost states might stretch their dollars much further.

So, the key takeaway is that “good” is relative. People who are retired in lower-cost areas might be fine with a few thousand dollars a month, but people who live in expensive cities might need a lot more to maintain the same level of living. Its also important to consider the other unexpected costs you may face during retirement, such as long-term care, home repairs or family obligations.

The Average Income Of Retirees (and what they spend it on)

FAQ

What is a good income for retirees?

A “good” retirement income is personal but often falls between 70-80% of your pre-retirement income. For example, a $120,000 annual income before retirement might mean a $7,000 to $8,000 monthly target in retirement.

What is the average monthly income of retirees?

The average monthly income for U. S. adults 65 and older is approximately $6,996, while the median monthly income is about $4,559, according to a 2024 study by The Motley Fool citing the U. S. Census Bureau and Bureau of Labor Statistics. The median provides a more realistic view of typical retirement income because the average (mean) can be skewed by a small number of high earners.

Can you live on $4 000 a month in retirement?

In summary, $4000 a month can be a reasonable amount for retirement for some individuals, particularly in lower-cost areas or with additional income sources. It is important to look at your current and future financial situation and needs to see if it’s enough for you.

How much does the average person retire with?

The “average person” retires with roughly $300,000 to $400,000 in retirement savings, but this is a misleading average that is heavily skewed by high-income households, as the median retirement savings for all US families is around $87,000. However, Synchrony data shows that the average amount saved for retirement by people nearing or at retirement age (65-74) is about $200,000.

How much does a retiree make a year?

Retirement income varies considerably based on region. In some states, you might receive generous retirement incomes, while in others, you can expect payments below the annual national average of $27,617. For instance, the District of Columbia has the highest average retirement income at $43,080 per year.

What is the average retirement income in the US?

In the US, the average retirement income is about $28,000. This is just one of many facts about retirement income that may help you plan for your future.

What is the average retirement income for a 65 year old?

The average retirement income for individuals 65 and older in the US is $75,254, according to the United States Census Bureau. Understanding this can help you better establish a baseline target. Annuities can help protect your savings from market volatility and guarantee income for life. Do you know how you’ll fund your retirement?

What is a good retirement income?

“You can have a great retirement on $5,000 a month, and you can have a great retirement on $50,000 a month,” says Joe Conroy, financial advisor and owner of Harford Retirement Planners in Bel Air, Maryland. However, before you retire, understand what defines a good retirement income for you and where that money will come from.

How do retirees make money?

Income from individual retirement accounts (IRAs) and employer-sponsored retirement plans like 401 (k)s plays a significant role. The average withdrawal from these accounts varies widely based on the retiree’s savings. Many retirees also draw income from personal investments in stocks, bonds, mutual funds, and real estate.

How much money do you need to retire?

Retirement income varies from household to household and may often depend on where you live. Most Americans believe they need just shy of $2 million in savings and investments socked away to retire, but most fall far short of that — as such, most will depend on some sort of income during their post-work years.