So you’ve hit the big 6-0 and you’re eyeing that Traditional IRA you’ve been faithfully feeding for decades. Maybe you’re planning retirement, facing unexpected expenses, or just curious about your options. Whatever your reason, understanding what happens when you tap into your Traditional IRA at age 60 is crucial to making smart money moves.

I’ve helped countless clients navigate these waters and trust me – there’s good news for 60-year-olds looking to access their retirement funds!

The Good News: No Early Withdrawal Penalty at 60!

Here’s the most important thing you need to know right off the bat At age 60 you can withdraw money from your Traditional IRA without paying the dreaded 10% early withdrawal penalty.

Why? Because the IRS considers withdrawals penalty-free once you reach age 59½. So at 60, you’re already in the clear on that front! This is a significant milestone in your retirement journey that opens up more financial flexibility.

But before you start planning a spending spree, there’s something else you really need to understand.

Taxes Still Apply: Uncle Sam Wants His Share

You don’t have to pay the 2010 tax penalty until you turn 60, but withdrawals from your Traditional IRA aren’t completely free. ” Here’s what happens on the tax front:

- All withdrawals are taxed as ordinary income. Remember those tax deductions you got when contributing? It’s payback time.

- Your withdrawal amount gets added to your annual income. This might push you into a higher tax bracket.

- State taxes may also apply depending on where you live.

Essentially, you’re paying the taxes you originally deferred when you made those pre-tax contributions. The government’s bill has finally come due!

How Much Can You Withdraw at 60?

Once you hit 59½, the training wheels come off. You can withdraw:

- As little as you want

- As much as you want (even the entire account!)

- Whenever you want

There’s no monthly limit or annual cap on withdrawals. It’s your money, and the IRS gives you full access to it without penalties after 59½.

However, just because you can withdraw everything doesn’t mean you should. Your future self might not appreciate an empty retirement account!

No Required Minimum Distributions Yet

Another piece of good news: at 60, you’re still years away from being forced to take money out of your Traditional IRA.

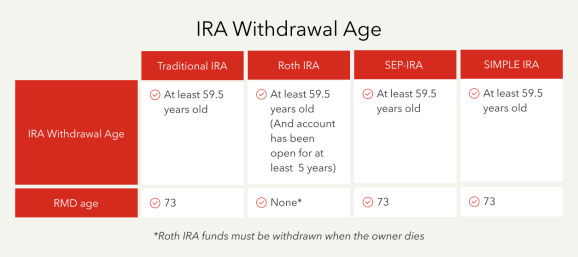

Required Minimum Distributions (RMDs) don’t kick in until age 73 (as of current law). So while you can withdraw money at 60, you don’t have to until much later.

This gives you significant flexibility in planning your retirement income strategy.

Strategic Considerations for Traditional IRA Withdrawals at 60

Before you start making withdrawals, consider these important factors:

1. Your Current and Future Tax Situation

If you’re still working at age 60, taking money out of your IRA on top of your salary could make your tax bill bigger. It might be smarter to:

- Wait until retirement when your income (and tax bracket) might be lower

- Take smaller withdrawals to stay in a lower tax bracket

- Consider a Roth conversion strategy during lower-income years

2. Social Security Optimization

If you haven’t started taking Social Security yet, using IRA funds first might allow you to delay claiming Social Security benefits. This can increase your eventual Social Security payments by approximately 8% for each year you delay (up to age 70).

3. Healthcare Costs

At 60, you’re still five years away from Medicare eligibility. If you want to retire early, you should think about how much health care will cost and whether the money you take out of your IRA needs to pay for private health insurance.

4. Long-Term Retirement Needs

Before withdrawing, ask yourself:

- How long do I need this money to last?

- What other retirement income sources do I have?

- How will inflation affect my needs over time?

Do not forget that people are living longer now than ever before. Your savings may need to last 30 years!

Real-World Example: Sarah’s Traditional IRA Withdrawal at 60

Let me tell you about my client Sarah (name changed for privacy). She retired at 60 with a Traditional IRA worth $500,000. She decided to withdraw $30,000 for the year to supplement her other income.

Here’s what happened:

- The $30,000 was added to her taxable income for the year

- She paid approximately $6,600 in federal taxes on this amount (22% tax bracket)

- Her state also took about $1,500 (5% state tax)

- She received about $21,900 after taxes

Sarah was initially surprised by the tax impact but had planned for it. By taking a moderate withdrawal instead of emptying her account, she kept her tax burden manageable while securing her long-term retirement needs.

Smart Withdrawal Strategies at 60

If you’re 60 and considering tapping your Traditional IRA, here are some strategies worth considering:

1. Systematic Withdrawals

Instead of large lump sums, consider setting up regular, smaller withdrawals. This can help:

- Manage your tax burden

- Ensure your funds last longer

- Provide predictable income

2. Tax-Efficient Withdrawal Sequencing

If you have multiple retirement accounts (401(k), Roth IRA, taxable investment accounts), withdrawing from them in the optimal order can significantly reduce your lifetime tax burden.

Many financial experts suggest this withdrawal sequence:

- Required Minimum Distributions (when applicable)

- Taxable accounts

- Traditional IRAs and 401(k)s

- Roth accounts (last, since they grow tax-free)

3. Roth Conversion Ladder

Some retirees benefit from converting portions of their Traditional IRA to a Roth IRA over several years, paying taxes on smaller amounts each time. At 60, you might have time to implement this strategy before RMDs begin.

Special Circumstances: Exceptions to Know About

While you won’t face the 10% penalty at age 60, it’s worth knowing about some exceptions that apply to those under 59½. These include penalty-free withdrawals for:

- First-time home purchase (up to $10,000 lifetime limit)

- Qualified educational expenses

- Unreimbursed medical expenses exceeding 7.5% of your adjusted gross income

- Health insurance premiums during unemployment

- Birth or adoption expenses (up to $5,000)

- Disability or death

- Periodic payments through a 72(t) distribution

Even though these exceptions aren’t relevant for your age 60 withdrawals, understanding them might help if you’re advising family members or if you’re approaching 60 but need funds sooner.

Common Questions About Traditional IRA Withdrawals at 60

Can I still contribute to my Traditional IRA after I start withdrawing?

Yes! As long as you have earned income, you can continue making contributions to your Traditional IRA regardless of your age.

Will withdrawing from my Traditional IRA affect my Social Security benefits?

Possibly. If you’ve started taking Social Security benefits, your IRA withdrawals might make a portion of those benefits taxable if your combined income exceeds certain thresholds.

Should I withdraw from my Traditional IRA or 401(k) first?

This depends on your specific situation, but many financial advisors suggest keeping money in employer 401(k) plans longer if they offer lower fees or unique investment options not available in IRAs.

Can I take my Traditional IRA as a lump sum at 60?

Absolutely! There’s no rule against withdrawing your entire IRA balance at once. However, doing so could create a significant tax event and potentially push you into a much higher tax bracket.

What’s Right for You?

Deciding when and how much to withdraw from your Traditional IRA at age 60 is highly personal. Your unique circumstances—including your other income sources, health status, expected longevity, and financial goals—should guide your decision.

I always tell my clients that while understanding the rules is important, applying them to your specific situation is what makes the difference between a good retirement and a great one.

Remember these key points:

- No 10% penalty applies at age 60

- All withdrawals are taxed as ordinary income

- You can withdraw any amount you choose

- No required withdrawals until age 73

- Strategic withdrawals can optimize your retirement income

Final Thoughts: Balance Freedom with Future Needs

Reaching 60 marks an important milestone in your retirement journey. The freedom to access your Traditional IRA without penalty gives you more options, but it also requires careful planning.

The biggest challenge isn’t understanding what happens when you withdraw money from your Traditional IRA at age 60—it’s balancing your current desires with your future needs.

I’ve seen too many people get excited about penalty-free access only to face challenges years later when their accounts were depleted faster than expected. Don’t let that be you!

Consider working with a financial advisor who specializes in retirement income planning to develop a sustainable withdrawal strategy. They can help you navigate the tax implications and ensure your retirement savings last as long as you need them to.

Your 60-year-old self has done a great job saving for retirement. Make sure your 80-year-old self will thank you for how you manage those withdrawals!

Have you started planning your Traditional IRA withdrawal strategy? What questions do you still have about accessing your retirement funds? Share your thoughts in the comments below!

Distributions while still working

You can take distributions from your IRA (including your SEP-IRA or SIMPLE-IRA) at any time. There is no need to show a hardship to take a distribution. However, your distribution will be taxed as income, and you may have to pay an extra tax on it if you are under 18 years old. The additional tax is 25% if you take a distribution from your SIMPLE-IRA in the first 2 years you participate in the SIMPLE IRA plan. There is no exception to the 10% additional tax specifically for hardships. See chart of exceptions to the 10% additional tax.

What is a qualified charitable distribution?

If someone over 70½ takes money out of an IRA (but not an ongoing SEP or SIMPLE IRA) and gives it directly to a qualified charity, this is called a qualified charitable distribution. However, the money would normally be taxed as income. See Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs) for additional information.