Your score falls in the range of scores, from 800 to 850, that is considered Exceptional. Your FICO® ScoreΠand is well above the average credit score. Consumers with scores in this range may expect easy approvals when applying for new credit.

Less than 1% of consumers with Exceptional FICO® Scores are likely to become seriously delinquent in the future.

Having a credit score of 823 puts you in an excellent position to qualify for a mortgage with great terms. But is a credit score of 823 good enough on its own to get approved? Let’s take a closer look at what goes into mortgage approval and how your credit score factors in.

What Does a Credit Score of 823 Mean?

A credit score of 823 falls in the “exceptional” credit range of 800-850, This means lenders will view you as an extremely low-risk borrower who is highly likely to repay debts

According to FICO, less than 1% of people with credit scores of 800+ become seriously delinquent on loans So with a score of 823, you demonstrate a long history of responsible credit use to potential lenders.

Is a Credit Score of 823 Good Enough for a Mortgage?

An 823 credit score puts you in a very strong position when applying for a mortgage Most lenders only require minimum scores in the 620-680 range

So yes, a score of 823 is more than good enough to qualify for a mortgage. In fact, it will make you eligible for the very best mortgage rates and terms.

But your credit score isn’t the only factor lenders look at. They will also consider:

- Your debt-to-income ratio

- Employment history

- Income

- Assets

- Down payment amount

Scoring 823 on your credit report checks the credit score box, but you still need to meet the lender’s other requirements to be approved.

What Mortgage Rate Can I Expect With a Credit Score of 823?

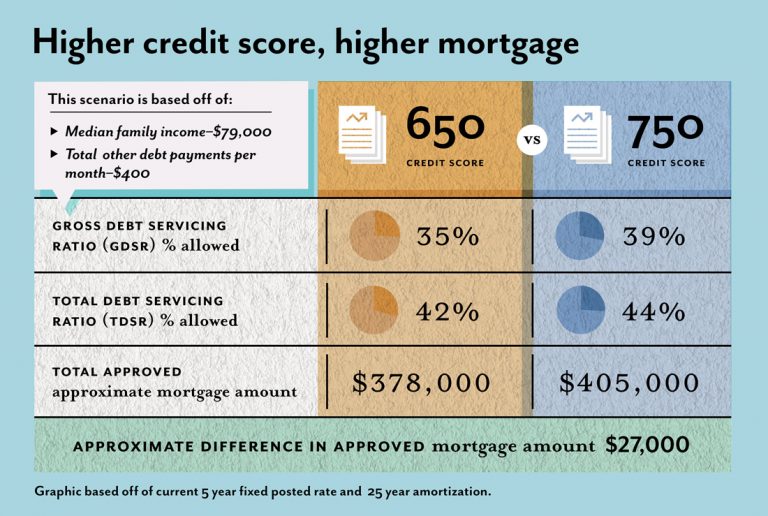

The higher your credit score, the better mortgage rate you can qualify for. According to myFICO, here are average 30-year fixed mortgage rates by credit score range as of February 2023:

- 760-850: 6.545% APR

- 700-759: 6.767% APR

- 680-699: 6.944% APR

With a score of 823, you will likely qualify for rates in that excellent 760-850 bracket. This means you could potentially save thousands of dollars over the life of your mortgage compared to borrowers with lower scores.

However, mortgage rates fluctuate daily and lenders use customized loan pricing. So shop around with multiple lenders to find the very best rate available to you.

Getting pre-approved also allows you to lock in a rate while you search for your dream home.

Tips for Maximizing Your Chances With an 823 Credit Score

Here are a few tips to ensure your high 823 credit score translates to mortgage approval:

-

Shop lenders – Compare mortgage rates from multiple lenders to find the best deals. Avoid settling for the first offer.

-

Lower your DTI – Keep debt payments minimal compared to income. This demonstrates you manage finances responsibly.

-

Make a sizable down payment – A 20% or higher down payment reduces risk for the lender.

-

Don’t apply for new credit – New credit inquiries can impact your score if done right before applying for a mortgage.

-

Review credit reports – Verify all information is accurate and work to correct errors that may be lowering your score.

The Bottom Line

A credit score of 823 is sure to make lenders eager to approve you for a mortgage. It shows them you are an exceptionally low-risk borrower.

This high credit score makes you eligible for the very best mortgage rates available. But lenders will look at other factors too, so maintain good finances overall to maximize approval chances.

Shop multiple lenders, make a solid down payment if possible, keep debts low, and avoid applying for new credit right before your mortgage application. Do those things, and your 823 score will unlock phenomenal mortgage terms.

How to improve your 823 Credit Score

A FICO® Score of 823 is well above the average credit score of 714. An 823 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, youll receive a report that uses specific information in your credit report that indicates why your score isnt even higher.

Because your score is extraordinarily good, none of those factors is likely to be a major influence, but you may be able to tweak them to get even closer to perfection.

Shield your credit score from fraud

People with Exceptional credit scores can be prime targets for identity theft, one of the fastest-growing criminal activities.

Credit-monitoring and identity theft protection services can help ward off cybercriminals by flagging suspicious activity on your credit file. By alerting you to changes in your credit score and suspicious activity on your credit report, these services can help you preserve your excellent credit and Exceptional FICO® Score.

By using credit monitoring to keep track of your credit score, youll also know if it starts to dip below the Exceptional range of 800-850, and you can act quickly to try to help it recover.

How Do I Get A Mortgage with a Zero Credit Score?

FAQ

What can a credit score of 823 get me?

Your 823 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates.

What is the lowest credit score to get a mortgage?

The lowest credit score to buy a house typically starts at 500 for FHA loans with a higher down payment, while conventional loans often require a minimum score of 620. Knowing the lowest credit score to buy a house can help you assess your options and take steps to improve your financial standing.

What credit score is needed for a $250000 house?

What credit score do I need to buy a $250,000 house? You can buy a $250,000 house with a wide range of credit scores, from as low as 500 to as high as 800+.Mar 19, 2025

How to go from 825 to 850 credit score?

- Pay your credit card bills on time. …

- Keep a solid payment history. …

- Consider your credit mix. …

- Increase your credit limit. …

- Don’t close old accounts. …

- Regularly monitor your credit report. …

- Only open a new credit card when you really need it.