When it comes to how often you should apply for a card, thereâs no one-size-fits-all answer. But there are some considerations that can help you figure out whatâs best for your situation.

Before you apply for a new card, its important to understand how it might impact your credit. And considering factors like interest rates, annual fees and credit limits can help you choose the card that best fits your financial goals. Keep reading to learn how timing your applications can affect your financial health.

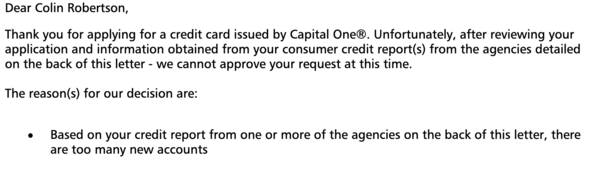

Getting approved for a new credit card can be tricky, especially if you have opened several accounts recently. The 5/24 rule used by issuers like Chase has made it harder for people with a number of new accounts to get approved. But what about Capital One – do they follow the 5/24 guideline too?

In this comprehensive guide, we’ll explain exactly what the 5/24 rule is, whether Capital One adheres to it, and tips for getting approved if you have opened a lot of accounts lately.

What is the 5/24 Rule?

The 5/24 rule is an unofficial policy used by some issuers, most notably Chase, when evaluating credit card applications.

It means that if you have opened 5 or more credit card accounts in the past 24 months, your application will most likely be denied. The reason is that opening many new accounts in a short period of time is seen as a sign of potential risk

So if you have opened 5+ credit cards in the last 2 years you can pretty much forget about getting approved for most Chase cards like the Sapphire Preferred or Reserve.

Does Capital One Use 5/24 For Approvals?

Unlike Chase, Capital One does not seem to use a strict 5/24 policy when evaluating applications

However, that doesn’t mean they completely ignore your number of recent accounts. Having too many new credit cards can still lead to denial for Capital One cards like the Venture, VentureOne, and Savor.

In fact, Capital One specifically lists “too many accounts opened recently” as a potential reason for declining applications. But there is no evidence they adhere to a strict 5/24 cutoff.

Some people have reported getting approved for Capital One cards with as many as 10+ new accounts in 2 years. So while 5/24 isn’t a hard rule, too many recent accounts can still hurt.

Tips For Getting Approved If You’re Over 5/24

If you want to get approved for a Capital One card but have opened many accounts lately, here are some tips that may help:

-

Check for pre-approvals: Capital One has a pre-qualification tool you can use to check if you are pre-approved without a hard inquiry. This can avoid a denial.

-

Reduce credit limits: Lowering your existing credit limits can immediately improve your credit utilization ratio before applying.

-

Wait and garden: If you are way over 5/24 after a spree of applications, wait 6+ months with no new accounts before applying again. This cooling off period can help.

-

Try for a secured card: Capital One’s secured credit cards like the Platinum Secured are easier to get approved for. After 6-12 months you can upgrade to an unsecured card.

-

Strengthen your credit: In general, having a long credit history, low utilization, and good payment history can outweigh having many new accounts. Focus on improving these factors.

While Capital One may not have an official 5/24 policy, opening too many new accounts in a short period of time can still lead to denial. Following the tips above can help improve your chances of getting approved if you are over 5/24.

The Bottom Line

Unlike issuers like Chase, Capital One does not seem to enforce a strict 5/24 rule when it comes to approving credit cards. However, having too many recent inquiries and new accounts is still listed as a potential reason for denial.

If you are over 5/24, your best bet is checking for pre-approvals first and following tips like lowering limits, waiting 6+ months before applying again, and building your credit history in the meantime. With some caution, getting approved for Capital One cards even if you are over 5/24 is definitely possible.

How often to apply for a credit card FAQ

Here are the answers to a few frequently asked questions about applying for new credit cards:

How many credit cards can I apply for at once?

Theres no set number of credit cards you can apply for at once. But each credit card application can trigger a separate hard inquiry.

FICO says a single hard pull has little effect on your credit scores. Having multiple inquiries on your credit reports within a short timeframe may have a bigger impact, according to the CFPB.

âIf you apply for a lot of credit over a short period of time, it may appear to lenders that your economic circumstances have changed negatively,â the CFPB explains. âThatâs why the agency recommends applying only for the credit you need.â

How long should I wait between credit card applications?

Thereâs no rule about how long you must wait between credit card applications. Companies like Experian® and Bankrate suggest waiting six months. Waiting could help protect your credit scores from the negative effects of multiple hard inquiries.

Keep in mind that other factors, like your payment history and credit utilization ratio, can still affect your credit scores between applications.

When should I get a credit card?

Choosing to get a credit card is a personal decision. Everyoneâs situation is different, so thereâs no single right time that works for everyone.

Opening your first credit card can help you build or establish a credit history. And using a credit card responsibly may help you improve your credit scores over time. Before applying, think about how you plan to use the card and whether you can keep up with monthly payments.

How often can you apply for a new credit card?

Credit card issuers may have their own rules and limits as to how often you can open a new account. Here are a few examples:

- The 5/24 rule: For some issuers, applicants canât open more than five new credit card accounts in 24 months.

- The 2/3/4 rule: According to this rule, applicants are limited to two new cards in 30 days, three new cards in 12 months and four new cards in 24 months.

- The six-month or one-year rule: Some credit card companies may only let borrowers open a new credit card account once every six months or once a year.

Capital One OWNS Discover! Here’s What Happens to YOUR Credit Cards!

FAQ

Does Capital One do the 5/24 rule?

Generally, all personal credit cards, including charge cards and retail store cards, are factored into your 5/24 count. In addition, business cards with TD Bank, Capital One and Discover are included.

Which banks have the 5/24 rule?

Because the 5/24 rule only applies to Chase credit cards, it’s best to apply for the credit cards you want from Chase first. Once you have the Chase cards you want, you can expand to other issuers. Of course, you’ll have to adhere to the rules that apply to the other banks.

Does Capital One have a 5/24 rule on Reddit?

I do not believe there is any evidence Capital One has a 5/24 rule. However, they are new account sensitive. They are just very cautious of churners. Your chances of approval are typically better if you have less recent accounts and inquiries in general.

Does Capital One Spark count against 5/24?

Additionally, you may be wondering why no Capital One business cards are on this list. That’s because all Capital One business cards count toward your 5/24 status except the ones with no preset spending limits, the Capital One Venture X Business and the Capital One Spark Cash Plus.Jun 6, 2025