Hello, my name is Stan The Annuity Man, and I’m an American annuity agent licensed in all fifty states. I’m also the best teacher out here, and I do sell annuities if they’re right for you. If you want to connect with us, visit our website to learn about annuities and use our proprietary annuity calculators. The question you have, which is a question that should be asked more often, is why do financial advisors hate annuities? You didnt say why do all, but why do too many of them hate annuities? Thats a good question. To that question, I will now say, “I think I know.” I will explain in more detail in a moment, but stay with me because I will soon tell you how to get free books I have written and how to get in touch with us to get a quote.

âNow, see, I can talk about this. I can talk about why financial advisors hate annuities because before Stan The Annuity Man existed, I know thats a horrific thought. I mean, the world is a better place with me here, right? Just nod your head. I used to be a financial advisor at the major firms, the stock and bond firms, back in the day. Im kind of older. I know I dont look older, but I am older. We were called stockbrokers, and I worked for some of the biggest firms on the street. When I was younger and still now, companies don’t want their financial advisors to sell annuities because most of them don’t let you charge an annual fee. That’s fine from the companies’ point of view. There are fee-only advisors and fee-based advisors, and theyre both charging fees.

âThey dont want their army of advisors pushing Immediate Annuities, Deferred Income Annuities, QLACs, and Qualified Longevity Annuity Contracts. Why? You cant charge a fee on those, and those are irrevocable lifetime income products, which means that money in the firms eyes is gone. So, I dont blame the financial advisors for mouthing and mimicking the “I hate annuities” mantra because, number one, theyre kind of told that a little bit. Number two, they really dont have a good education on what annuities do. And the reason I know that for a fact is when I was at those firms, I had no clue. I mean, seriously, I really wasnt up to speed on the annuity side because youre getting hit by all kinds of wholesalers. The world is your oyster when youre a financial advisor. You can sell anything: mutual funds, ETFs, bonds, REITs, and annuities, but most of them focus on the growth side of the portfolio, which is fine, but that doesnt give them license to comment on things they dont know about.

âAnd what they need to learn about are the myriad of ways that annuities can complement a portfolio. I think thats tragic because with 10,000 baby boomers retiring every single day, a lot of people, and that might be you, right? Youre looking for guarantees with at least a part of your portfolio. And this is a fact. The only product on the planet that can provide a lifetime income stream you can never outlive is an annuity, a Single Premium Immediate Annuity, a Deferred Income Annuity, a Qualified Longevity Annuity Contract, or a lifetime benefit Income Rider. Those products will pay you regardless of how long you live.

âNow, isnt that a benefit? Yeah, nod your head. It is a benefit. Suppose Im a financial advisor and acting in a fiduciary role, meaning I have to put your interest ahead of mine, which is what, listen. In that case, there shouldnt be a fiduciary standard.

âWe all should be acting like fiduciaries, right? Thats common sense. But with annuities being the only product that gives that benefit proposition of a lifetime income stream, shouldnt it be something financial advisors talk about, at least without saying, “I hate all annuities.”

âThe other thing that financial advisors do mistakenly is they compare annuities regardless of the type of investments. And see, I dont think they are. Annuities are contracts. If you dont believe it, buy one; youll get a contract in the mail. Theyre not investments. Now, many of them are sold as investments, but in my opinion, if you want true market growth, you dont buy annuities. You buy annuities for the transfer of risk aspect. Most people are looking at them now for lifetime income stream guarantees. And with that being said, all you financial advisors out there who are listening, you need to get a little bit more educated.

âYou can download all my books for free, and for you out there that is getting told by your financial advisor that you should never look at an annuity or you should never have an annuity in an IRA, which is a joke, or all annuities are bad, or all annuities are expensive, filter that. Filter that just like you filter the news. When you watch the news on the cable channels, filter it, theres an agenda behind it. Im not saying its a bad one, but there is an agenda behind it. I do work with a lot of fee-only planners out there. I mean, some of the biggest ones in the country use Stan The Annuity Man for any quotes that they need or advice if some of their clients have bought an annuity, they really dont know what they own. I work with many of them across the country, and many fee-only and fee-based, but primarily fee-only advisors work with me because they know annuities have a role.

Have you ever noticed how many financial planners seem to cringe when annuities come up in conversation? Despite annuities having one of their best sales years in 2024 (totaling a whopping $434.1 billion according to LIMRA), there’s still this weird disconnect between the popularity of these products and how financial professionals feel about them.

I’ve spent years working with clients puzzled by this contradiction. One day, a client asked me point-blank: “If annuities are selling so well, why does my financial advisor act like I suggested investing in magic beans when I bring them up?”

That’s a fair question. I’m going to talk about the real reasons why financial planners don’t like or even hate annuities today.

The Disconnect Between Advisors and Annuities

It was interesting to learn that most financial experts know how dangerous it is to outlive your retirement savings, but they rarely recommend annuities as a way to protect your money. Even when advisors do mention annuities many clients dismiss them.

So what’s going on here? Why the aversion to a product that on paper. offers something pretty valuable—guaranteed lifetime income?

4 Reasons Financial Planners Avoid Recommending Annuities

1. Annuities Are Complicated AF

Let’s be honest—annuities are confusing. Even for well-informed investors and professionals. There are multiple types:

- Fixed annuities

- Variable annuities

- Indexed annuities

- Immediate annuities

- Deferred annuities

Each comes with its own structure rules and fees. Some annuity contracts are dozens of pages long, and it’s not easy to compare your options.

As Craig Toberman, a certified financial planner, puts it: “The fees and complexity built into many annuities can make them difficult to evaluate, even for professionals.”

There are also surrender charges, insurer credit risk, and riders (optional features) to think about. That’s a lot to tell a client in just one hour!

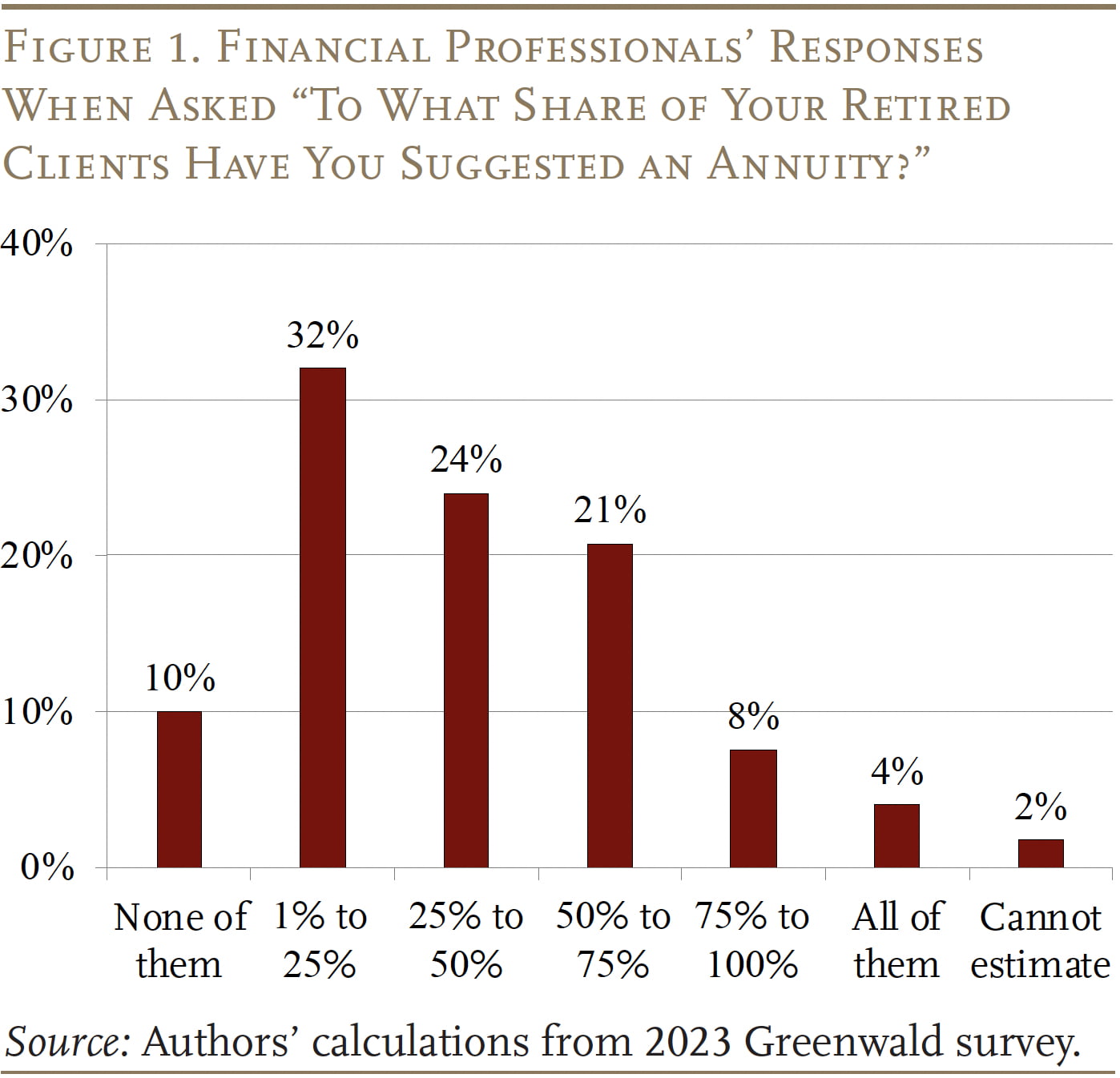

According to the Boston College study, even among relatively wealthy clients (those with over $100,000 in financial assets), more than one-third weren’t familiar with lifetime income products, and another 40 percent were only somewhat familiar. This puts a massive burden on advisors to educate clients from scratch.

Toberman offers this advice: “If you can’t explain what you’re buying back to me in plain language, you probably shouldn’t sign the dotted line.”

2. Those Darn Fees Are High

Historically, most annuities came with steep costs. These include:

- Commissions

- Mortality and expense (M&E) fees

- Administrative costs

- Fees for optional riders

Variable annuities, in particular, are notorious for fee layers that can add up to 3% or more annually (though their popularity has declined over the past five years).

Meanwhile, many financial advisors today prioritize low-cost, transparent investment strategies. When you can build a portfolio of index funds at a fraction of the cost that still delivers strong results, it’s hard to justify recommending a more expensive and less flexible product.

Nate Baim, a certified financial planner, explains: “From my perspective, simpler, lower-cost solutions—such as adjusting withdrawal strategies and maintaining proper cash reserves—can often effectively address the same concerns of outliving income.”

And let’s face it—annuities often generate higher commissions for those who sell them. This high commission potential can lead to a significant influence on the recommendations provided by financial advisors. Many fee-only planners are put off by this aspect of the industry.

3. Annuities Lock Up Your Money

When you put money into an annuity—especially a deferred or fixed annuity—you’re agreeing to surrender access to those funds for a period of years. If you pull money out early, you face surrender charges and tax penalties.

This lock-up period is by design. By restricting access to funds, insurers can pool risk across many policyholders and offer lifetime payouts.

But this makes many clients nervous, and advisors know it. In a world where people want quick access to their assets, “locking in” part of a portfolio can feel too restrictive.

Baim points out that for an annuity to be a good fit, the person should have enough liquid assets to cover at least two years of living expenses, “plus any foreseeable large purchases, and still have a reserve for unexpected needs.”

Financial planners also know that clients’ needs and circumstances change quickly—and once you’re in an annuity contract, it’s not easy to get out.

4. Annuities Got a Bad Reputation

Years of aggressive sales tactics—especially from insurance agents and brokers working on commission—have left many people suspicious of the entire annuity industry, including financial advisors.

Combine that with horror stories about retirees buying expensive, inefficient annuity products they didn’t understand, and you get an industry image that’s tough to polish up.

“Broadly speaking, the industry still needs to do more to improve transparency, reduce costs and align product complexity with client understanding,” says Baim.

Advisors who want to maintain credibility and trust often steer clear to avoid the association with what some clients see as a questionable product.

The Fee Structure Conflict

Another reason many financial planners (particularly those at major investment firms) don’t recommend annuities is more self-serving: you can’t charge an annual fee on most annuities.

As Stan The Annuity Man explains: “The firms don’t want their advisors’ pushing annuities because you can’t charge an annual fee on most annuities, which is kind of where the industry is from the financial advisor standpoint.”

This is especially true for Immediate Annuities, Deferred Income Annuities, and QLACs (Qualified Longevity Annuity Contracts). These are irrevocable lifetime income products, which means that money, in the firm’s eyes, is gone.

When Annuities Actually Make Sense

Despite the concerns, annuities can still play a valuable role in a retirement plan for the right client in the right situation—particularly those who are anxious about outliving their money.

Joe Conroy, a certified financial planner, observes: “I see increased calm during periods of market volatility from clients that have some type of annuity or guarantee in their portfolio.”

For clients who lack a pension and want a steady paycheck in retirement, an annuity may be a good fit.

A well-structured annuity can offer these benefits:

- Guaranteed lifetime income, no matter how long you live

- Protection against market downturns, particularly with fixed and indexed annuities

- Tax-deferred growth on earnings until withdrawals begin

- Peace of mind for retirees who don’t want to manage investments in their 80s and 90s

- Spousal benefits, when joint-life annuities are used

As Conroy puts it: “I don’t like or dislike annuities any more than I like or dislike a screwdriver—they’re both just tools.”

The Evolution of the Annuity Industry

The annuity industry has been evolving. Fee-based annuities with no commissions and products with more flexibility—including contracts that allow 10 percent annual penalty-free withdrawals—are helping improve access.

More fiduciary advisors now have commission-free options, allowing them to make recommendations without conflicts of interest.

How to Have Better Conversations About Annuities

If you’re interested in annuities despite your financial planner’s hesitation, here are some ways to approach the conversation:

-

Ask for education, not a sales pitch: Request information about different types of annuities and how they might fit your situation.

-

Inquire about fee-based annuities: These newer products often have lower costs and more transparency.

-

Discuss specific concerns: If you’re worried about outliving your money, make this clear and ask how an annuity might address this specific fear.

-

Request comparisons: Ask your advisor to compare annuity options with other strategies for creating retirement income.

-

Get a second opinion: Consider speaking with an advisor who specializes in retirement income planning or annuities specifically.

Bottom Line

Annuities remain a complex product. While some financial advisors are hesitant to recommend them, they can still offer meaningful benefits for certain clients. But not all annuities are created equal, and many experts agree that more transparent, simpler products are needed.

If you’re considering an annuity, it’s worth having an open conversation with your financial advisor. They can help you understand whether it fits your goals, how the product works, and whether recent changes in the industry make it a suitable option for you.

Just remember that annuities should never be a stand-alone solution. As Baim says, an annuity is “one piece of a larger, well-thought-out plan.”

And if your financial advisor dismisses all annuities outright? Maybe ask them why they hate all screwdrivers too.

FAQs About Financial Planners and Annuities

Do all financial planners dislike annuities?

No, not all financial planners dislike annuities. Many fee-only planners work with annuities when they’re appropriate for clients, especially newer, more transparent products.

Are annuities always a bad choice?

Definitely not. For the right person in the right situation, annuities can provide valuable guaranteed income and peace of mind in retirement.

What questions should I ask a financial planner about annuities?

Ask about their experience with annuities, how they’re compensated for recommending them, what types might fit your situation, and how they compare to other retirement income strategies.

Should I be suspicious if my financial planner recommends an annuity?

Not necessarily. Ask about their reasoning, how they’re compensated, and request a clear explanation of the product, its costs, and how it fits your overall financial plan.

âBook a Call With Me

âThey know in some cases with their clients that income flooring using an annuity makes sense. So, I do work with those people. If you know an advisor who needs to know about annuities, please let me know. Tell them to call me, tell them to interact with me, and I can work in conjunction with them to compliment the portfolio they put together for you and manage for you, and maybe add an annuity in there that will help them. Perhaps they can buy it themselves, or I will have to do it for them. Whatevers in your best interest, thats what well do. But if youre running into some headwind with your advisor on annuities, lets open up the conversation because they can get my books for free.

âI think theyre looking bad by saying carte blanche that they hate annuities. I think its a bad reflection on them because if I said to you, “I hate all stocks,” what would you think? You wouldnt be too thrilled about that. Or “I hate all mutual funds. ” That would make no sense to you. The same thing applies to annuities. I think its time to start educating the advisors a little bit, as well as consumers.

âAll right, so you hung in there with me. There is a video that I want you to check out after reading this blog: What Is A Pension Annuity And How Does It Work? Because a lot of people right now are looking to create their own personal pension. So, this video explains how to do that, how to go about shopping for it, and how to structure the payment, etc.

âIt might be something your financial advisor should see as well. So, with that, go to my website. Theres a myriad of things you can learn more about annuities. I have a podcast. We do multiple YouTube videos every single week. So please click the subscribe button. We can get you quotes, and we can get you anything you need because why? Im Stan The Annuity Man, Americas annuity agent, licensed in all 50 states and here to help you if needed.

Never forget to live in reality, not the dream, with annuities and contractual guarantees! You can use our calculators, get all six of my books for free, and most importantly book a call with me so we can discuss what works best for your specific situation. Share this article: