If youâre trying to figure out which credit score is most accurate, then you already know there are multiple scores out there. But one credit score isnât necessarily more accurate than another. Itâs more complicated than that.

Find out what factors make for good credit scores, how credit bureaus and credit-scoring companies fit in, and how you can monitor your credit.

Hey there! If you’re scratching your head wondering, “Who’s got the most accurate credit score out there?” you ain’t alone. I’ve been down that rabbit hole myself, checking my numbers on different apps and getting all sorts of whacky results. One day it’s 720, next day it’s 698—what gives? We’re gonna dive deep into this mess today, break it down in plain English, and figure out what’s really up with credit scores. Spoiler alert: there ain’t a simple “winner” here, but stick with me, and you’ll know exactly what to focus on for your financial game.

Let’s get straight to the meat of it Credit scores are them three-digit numbers that can make or break your chances at a loan, a credit card, or even renting a dope apartment. They’re like a report card for your money habits But when you’ve got different scores from different places, it’s natural to wonder which one’s the real deal. Is it Experian? Equifax? Or maybe that FICO thing everyone keeps yapping about? We’re gonna unpack all this, starting with the big players and why they don’t always agree.

What Even Is a Credit Score, Anyway?

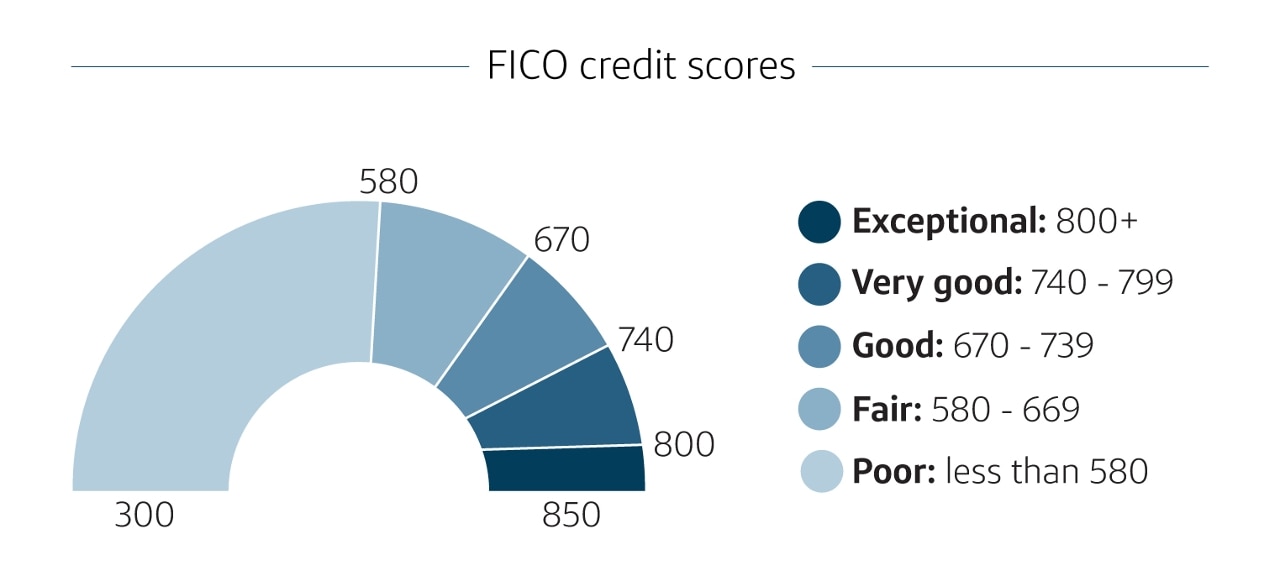

Before we get into the “who’s got the best” debate, let’s make sure we’re on the same page. A credit score is basically a snapshot of how good you are with money—at least in the eyes of lenders. It ranges from 300 to 850, with higher being better. Think of it as your financial street cred. Banks and credit card companies peek at this number to decide if they wanna trust you with their cash, and at what interest rate.

Now these scores come from data collected by credit bureaus and they’re crunched using different formulas or “models.” That’s where the confusion creeps in. Different bureaus, different models, different results. But don’t worry, I’m gonna lay it out clear as day.

The Big Three: Experian, Equifax, and TransUnion

Let’s meet the heavy hitters in the credit game. There’s three main credit bureaus in the US that collect info on your financial life:

- Experian: The biggest of the bunch, but size don’t mean better.

- Equifax: Another major player, just as legit.

- TransUnion: The third in the trio, equally important.

These guys gather stuff like your payment history, how much debt you’ve got, how long you’ve had credit, and whether you’re applying for new cards left and right. They package this into credit reports and sell ‘em to lenders. Here’s the kicker, though—not every lender reports to all three bureaus. Some might skip one or two, so the info each bureau has on you might not be identical. And boom, that’s one reason your scores can differ.

So, does one of ‘em have the “most accurate” score? Nah, not really. They’re all considered equal in terms of reliability. If there’s no errors in your reports, none is more “right” than the others. It’s just that the data they’re working with might be a lil’ different. Kinda like three chefs making the same dish but using slightly different ingredients.

FICO vs. VantageScore: The Real Battle

Now, let’s talk about how them scores are actually calculated The bureaus don’t just spit out a number—they use scoring models to crunch the data Two big dogs in this space are FICO and VantageScore, and they’re what most lenders look at.

- FICO Score: This is the OG, been around since the late ‘80s. About 90% of lenders use FICO scores when deciding whether to approve you. The most common version is FICO Score 8, which loves to focus on how much of your credit you’re using and doesn’t punish a one-off late payment too hard.

- VantageScore: A newer player, created by the three bureaus themselves. It’s gaining traction, used by thousands of financial folks. VantageScore 4.0 is the latest, and it weighs payment history even heavier than FICO does.

Here’s how they break down what matters in your score (based on their latest models):

| Factor | FICO Score 8 | VantageScore 4.0 |

|---|---|---|

| Payment History | 35% | 41% |

| Credit Utilization/Amount Owed | 30% | 20% |

| Length of Credit History | 15% | 20% (age & mix) |

| New Credit/Inquiries | 10% | 11% |

| Credit Mix | 10% | Included in age/mix |

| Other Factors | N/A | Balance (6%), Available Credit (2%) |

See how they ain’t the same? FICO might ding you more for maxing out cards, while VantageScore is harsher if you miss payments. So, even with the same credit report, your score can shift depending on which model’s used. Neither is more “accurate”—they just got different vibes on what’s important.

Why Your Scores Ain’t Matching Up

I remember the first time I checked my scores on different sites and nearly flipped. One bureau had me at 710, another at 689. I thought someone messed up big time! But here’s the deal—there’s a bunch of reasons why your numbers don’t match across bureaus or models. Let’s break it down:

- Not All Lenders Report to Everyone: Some banks or card companies only send your payment info to one or two bureaus. If you’ve got a card that don’t report to TransUnion, your score there might look lower or higher depending on what’s missing.

- Timing Matters: Scores change based on when they’re pulled. Say you max out a card mid-month, check your score, then pay it off a week later. That second check might show a better number ‘cause your utilization dropped. Timing’s everything!

- Different Models, Different Rules: Like I said, FICO and VantageScore weigh stuff differently. Plus, there’s tons of versions of each—FICO got like Score 2, 5, 8, even auto-specific ones. A lender might use a version you ain’t even seen.

- Errors Sneak In: If one bureau’s got wrong info—like a late payment you never made—your score there’s gonna be off. That’s why checking your reports is clutch.

- Data Ain’t Always Synced: Lenders might report to bureaus at different times. One might update your balance today, another next week. It’s a mess, but it happens.

So when you’re asking “who’s got the most accurate score,” it’s less about one being right and more about why they’re different. Ain’t no conspiracy—just how the system rolls.

Which Score Do Lenders Actually Care About?

Alright, let’s get to the nitty-gritty. If no single score is the “most accurate,” which one matters when you’re tryna get a loan or a shiny new credit card? Here’s where it gets real: it depends on the lender and what you’re applying for.

Most lenders—about 90% of ‘em—lean on FICO scores. That’s a huge chunk, so if you’re wondering what to keep an eye on, FICO’s a safe bet. The version they use, though, can vary:

- Credit Cards: Often FICO Score 8 or a special “Bankcard Score.”

- Mortgages: Might be older versions like FICO 2, 4, or 5.

- Auto Loans: Usually a FICO Auto Score, tuned for car financing.

VantageScore is picking up steam, especially with some newer or online lenders. It’s not as common, but don’t sleep on it—lots of banks are starting to use versions like 3.0 or 4.0.

Here’s the thing: you don’t always know which bureau or score a lender will pull. Some grab all three and average ‘em, others stick to one. That’s why obsessing over “accuracy” is kinda pointless. What matters is keeping all your scores in a good range so you’re golden no matter who’s looking.

So, Who’s Got the Most Accurate Credit Score? Spoiler: No One!

I’m gonna be straight with ya—there ain’t no “most accurate” credit score or bureau. Experian, Equifax, and TransUnion are all legit, and as long as there’s no mistakes in your reports, they’re equally trustworthy. FICO and VantageScore? Both solid, just different. Accuracy ain’t the right word here—it’s more about which score a specific lender uses and what data they’re seeing.

Think of it like this: if three friends describe your outfit, one might focus on the cool sneakers, another on the funky shirt. They’re all right, just noticing different stuff. Same with credit scores. Instead of chasing the “best” one, focus on what builds a strong score across the board.

How to Keep Your Credit Score Lookin’ Fly

Since we can’t crown a winner for the most accurate score, let’s talk about what you can control—making your credit look good no matter who’s checking. I’ve picked up a few tricks over the years, and trust me, they work if you stick with ‘em. Here’s your game plan:

- Pay Them Bills on Time: This is huge—payment history is the biggest chunk of your score, whether it’s FICO or VantageScore. Late payments sting, so set reminders or auto-pay. Don’t let a silly oops tank your number.

- Keep Credit Use Low: Try not to use more than 30% of your available credit. Got a $1,000 limit? Keep the balance under $300. It shows you ain’t desperate for cash.

- Don’t Go Wild with New Accounts: Every time you apply for credit, it’s a “hard inquiry” that can dip your score a bit. Be picky—only apply when you really need it.

- Check Your Reports Like a Hawk: Errors happen, and they can mess you up. Grab your free reports from the big three bureaus once a year and dispute anything fishy. There’s a site for that, easy peasy.

- Mix It Up a Lil’: Having different types of credit—like a card, a loan, maybe a mortgage—can help. Shows you can handle variety. But don’t overdo it if you can’t manage.

- Give It Time: The longer your credit history, the better. Don’t close old accounts just ‘cause you don’t use ‘em—they add to your track record.

Follow these, and your scores will climb, no matter which bureau or model’s looking. It’s like eating healthy—you don’t gotta pick one “perfect” diet; just keep the basics solid.

Why You Should Check All Your Scores

Since scores can differ, I always tell folks to keep tabs on all of ‘em. You don’t wanna be blindsided when a lender pulls a score you didn’t expect. There’s free tools out there—some banks and apps let you see your FICO or VantageScore without hurting your credit. Also, you can get your credit reports from each bureau for free once a year. Make it a habit to peek at ‘em and make sure nothing’s off.

I had a buddy who found a wrong late payment on one bureau’s report—fixed it, and his score jumped 30 points. That kinda stuff happens more than you’d think. Stay on top of it, and you won’t get caught slippin’.

Common Myths About Credit Scores

While we’re at it, let’s bust a couple myths I hear all the time. People got some wild ideas about credit, and I wanna set the record straight:

- Myth 1: Checking Your Score Hurts It: Nah, not if you’re doing it yourself. “Soft inquiries” like checking through a bank app or free service don’t touch your score. Only “hard inquiries” from applying for credit do that.

- Myth 2: One Bureau Rules ‘Em All: Some swear Experian’s the best ‘cause it’s biggest. Nope. All three are equal—lenders might use any of ‘em.

- Myth 3: Closing Old Cards Helps: Actually, it can hurt. Old accounts boost your credit history length, which is a plus. Keep ‘em open if there’s no annual fee.

Clearing up this junk helps you focus on what really matters—your habits, not rumors.

Wrapping It Up: Focus on You, Not the Score

So, back to that big question—who’s got the most accurate credit score? Truth is, there ain’t a clear champ. Experian, Equifax, TransUnion—they’re all legit, just working with different pieces of your financial puzzle. FICO’s the go-to for most lenders, but VantageScore ain’t far behind. Instead of stressing over which one’s “right,” put your energy into building strong money habits. Pay on time, keep debt low, check for errors, and you’ll be in a good spot no matter who’s pulling your number.

Types of credit-scoring models

FICO and VantageScore use similar factors to calculate credit scores. But they weigh those factors differently.

Why are my credit scores different?

The Consumer Financial Protection Bureau (CFPB) explains that itâs normal to have slightly different credit scores. Thatâs because scores can vary based on factors like the credit report data, the credit-scoring model and even the timing of the calculation.

Hereâs a little more about what each score can depend on:

- Which credit bureau supplied the data: Each of the three major credit bureausâEquifax®, Experian® and TransUnion®âkeeps records of credit history. But not every lender reports information to each bureau. Lenders may also report to credit bureaus at different times of the month, which can also affect calculations.

- When the score was calculated: Credit-scoring factors change over time. This means scores vary as they change, depending on the day they were calculated. For example, as you use your card, your credit utilization goes up. When you pay your statements, it goes down.

- Which scoring model was used: Different credit reporting companies use different scoring models. And the factors affecting your credit scores can carry different weights.

FICO Score vs Credit Score vs Credit Karma (Why Are My Credit Scores So Different?)

FAQ

Which credit score company is most accurate?

Which credit rating is the most accurate?

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important.Jan 31, 2025

Is Experian more accurate than Credit Karma?

What is the most reliable place to check your credit score?

Your credit scores are calculated based on the information in your credit history. This means it’s important to review your credit reports. You can view and request your credit reports weekly, at no cost to you, at www.AnnualCreditReport.com .

Which credit scoring model is the most accurate?

The most accurate credit scores are the latest versions of the FICO Score and VantageScore credit-scoring models: FICO Score 8 and VantageScore 3.0. It is important to check a reputable and accurate credit score because there are more than 1,000 different types of credit scores. Which credit bureau uses these models?

Which credit scoring model is most accurate?

The primary credit scoring models are and VantageScore®, and both are equally accurate. Although both are accurate, most lenders are looking at your FICO score when you apply for a loan.

Which credit score is most important for lenders?

While there’s no exact answer to which credit score is most important for lenders, FICO® Scores are used in over 90% of lending decisions. The most accurate credit scores are the latest versions of the FICO Score and VantageScore credit-scoring models: FICO Score 8 and VantageScore 3.0.

Are Fico® and VantageScore® credit scores accurate?

FICO® and VantageScore® are two popular credit-scoring companies. Credit scores vary depending on the credit bureau, credit-scoring company, model used and timing of the score. One credit score isn’t inherently more accurate than another. Rather than comparing scores for accuracy, it might help to compare scores at different points in time.

Is one credit score more accurate than another?

One credit score isn’t inherently more accurate than another. Rather than comparing scores for accuracy, it might help to compare scores at different points in time. Which credit score is used can depend on the lender and what you’re applying for. It’s possible to check your own credit without hurting your credit scores.

Which credit bureau is most accurate?

The Big Three Credit Bureaus: Experian, Equifax, and TransUnion Although Experian is the largest credit bureau in the US, all three bureaus (Experian, Equifax, and TransUnion) are considered equally accurate and important. They collect and maintain consumer credit information, which they then sell to other businesses in the form of credit reports.