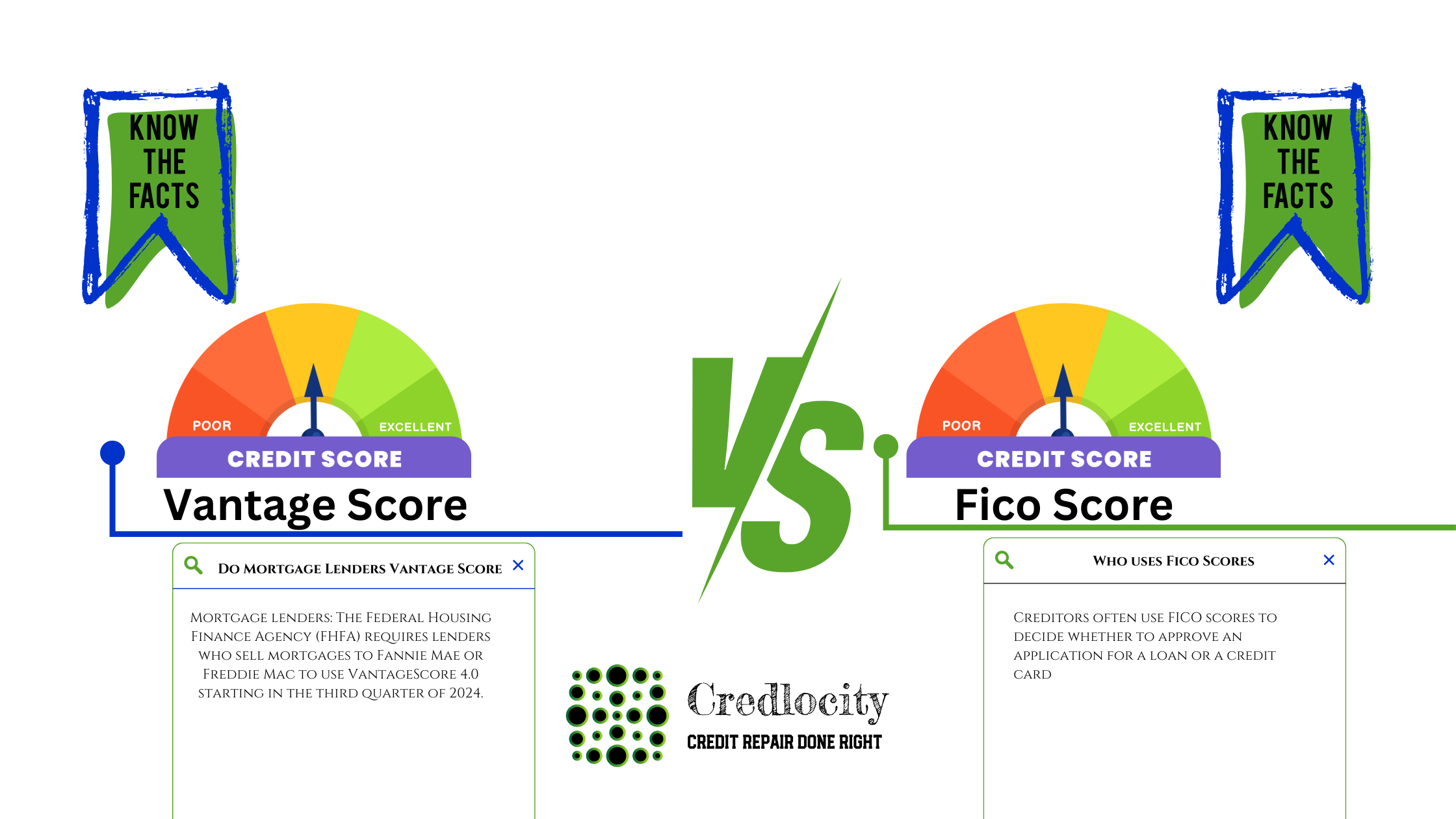

In the U.S., two companies dominate the credit scoring industry. FICO® is the industry leader, but VantageScore® has been gaining market share since the three major credit reporting agencies created it in 2006. Both companies develop credit scores that lenders and creditors can use to evaluate applicants and manage customers accounts. However, VantageScore and the FICO® scoring models use slightly different criteria to determine your scores.

When applying for loans or credit cards, lenders will look at your credit scores to determine your creditworthiness. The two most common scoring models used in the US are VantageScore and FICO Score. Both provide numerical representations of your creditworthiness, but they differ in their scoring methods. So which of these scores is usually higher? Let’s take a closer look at how VantageScores and FICO Scores are calculated to find out which score tends to be higher.

An Overview of VantageScore and FICO Score

VantageScore and FICO Score are credit scoring models developed by two different companies

-

VantageScore was created in 2006 by the three major credit bureaus – Equifax, Experian, and TransUnion. There have been four versions released so far, with VantageScore 4.0 being the latest in 2017.

-

FICO Score was developed by the Fair Isaac Corporation in 1989 The most commonly used version today is FICO Score 8, launched in 2008. However, lenders may also use older or newer versions like FICO Score 2 or FICO Score 9

Both scoring models analyze information in your credit report to predict the likelihood of you becoming seriously delinquent on credit obligations over the next 24 months. The credit report data considered includes

- Payment history

- Credit utilization

- Length of credit history

- Credit mix

- Recent credit applications

However, VantageScore and FICO Score differ in how they weigh the importance of these factors in calculating your final score. Understanding these differences can help explain which model tends to produce a higher score.

Key Differences Between VantageScore and FICO Score

Here are some of the main ways that VantageScore and FICO Score treat credit report data differently:

1. Credit History Requirements

-

VantageScore can generate a score based on as little as one month of credit history and one recently reported account.

-

FICO Score requires at least six months of credit history and recent account activity to produce a score.

This means VantageScore may be able to score individuals with very new or sporadic credit histories, while FICO cannot.

2. Collection Accounts

-

VantageScore ignores all paid collection accounts, even medical collections. Unpaid medical collections are also ignored.

-

With FICO Score, paid collection accounts still negatively impact scores. Unpaid medical collections are weighted less than other collections, but not ignored.

This differential treatment can result in unpaid collections hurting a FICO Score more than a VantageScore.

3. Credit Inquiries

-

VantageScore counts all credit inquiries within 14 days as just one inquiry, even if the inquiries are for different types of credit.

-

For FICO Score, inquiries for student, auto, and mortgage loans within 45 days are combined as one inquiry. Other inquiries are counted separately.

VantageScore’s approach reduces the negative impact of shopping for the best rates, since all inquiries are bundled together regardless of purpose.

4. Credit Utilization

-

VantageScore looks at up to 24 months of credit utilization trends.

-

FICO Score considers only your latest reported balances and limits.

By factoring in longer utilization patterns, VantageScore may benefit individuals who show improving trends.

VantageScore vs FICO Score Ranges

In addition to calculation methodologies, the range of possible scores differs slightly between models:

- VantageScore: 300-850

- FICO Score: 300-850

Within these ranges, a score above 700 is generally considered good for VantageScore, while a FICO Score above 670 is seen as good.

Very poor scores fall below 550 and 580 for VantageScore and FICO respectively.

So while the ranges largely overlap, the thresholds for a “good” score are set a little higher for VantageScore compared to FICO.

Which Score Is Usually Higher?

Given the above differences, is it possible to tell which type of score is higher on average?

VantageScore scores tend to run slightly higher than FICO Scores, though individuals’ results can vary case-by-case.

For example, in a 2016 study by VantageScore of 600,000 anonymized credit scores:

-

The average VantageScore was 40 points higher than the average FICO Score.

-

Over 80% of consumers had a VantageScore at least 20 points higher than their FICO Score.

-

Only 5% of consumers had a VantageScore more than 20 points lower than their FICO.

Key reasons for VantageScore’s edge include:

- More forgiving thresholds for new/infrequent credit users

- Not counting paid collections against the score

- Longer window for combining inquiries

- Factoring in improving utilization trends

However, for some individuals the opposite may be true if their profile hits FICO’s sweet spots better, such as having a very long and stellar credit history.

Checking Your VantageScore and FICO Score

Since lenders can use either scoring model, it’s a good idea to monitor both your FICO Score and VantageScore regularly.

You can obtain free scores through:

- Credit card issuers

- Personal finance websites like Credit Karma

- Directly from credit bureaus like Experian

Checking both scores gives you a more complete picture of your credit health. A higher VantageScore is good news, but ensure your FICO Score is also in good shape for the majority of lenders.

Focus on responsibly managing credit by paying bills on time, keeping balances low, and limiting hard inquiries. This will help lift both your VantageScore and FICO Score over time.

The Bottom Line

While VantageScore and FICO Score both aim to measure creditworthiness, their methodologies differ. On average, VantageScore produces a slightly higher score due to factors like recent trends and fewer negatives counted. But for some, FICO Score may still come out on top. Checking and monitoring both scores is key to understanding your true credit standing.

VantageScore and FICO Create Multiple Credit Scores

VantageScore and FICO® create credit scoring modelsâsoftware that can analyze a credit report to generate a credit score. And the consumer risk scores that VantageScore and FICO® create have the same goal: to predict the likelihood that a person will fall at least 90 days behind on a bill within the next 24 months.

The VantageScore models and the base FICO® models are generic credit scores, meaning theyre created for use by a wide range of creditors, such as private student loan companies, online lenders and card issuers. FICO® also creates industry-specific auto and bankcard scores, which are built on the same criteria as the base FICO® ScoresΠbut tailored for auto lenders and card issuers.

As with other types of software, VantageScore and FICO® occasionally update their scoring models to ensure they remain predictive as consumer behavior changes, and to incorporate new technology, information and industry practices.

The first VantageScore model, version 1.0, was launched in 2006; the company released the latest version, 4.0, in 2017. The FICO® base scoring model dates back to 1989, but the latest versions are the FICO® Score 8 (launched in 2004) and FICO® Score 9 (launched in 2014). Creditors can choose which model to use and may test out different models to figure out which one is best at helping them determine risk with their particular customer base.

You might check your VantageScore credit scores and FICO® credit scores and wonder why theyre different. In part, its because the models give varying levels of importance to different parts of your credit report.

VantageScore Credit Scores vs. FICO Credit Scores

While VantageScore credit scores and FICO® Scores try to predict the same thing, their credit scoring models arent identical. Here are some of the main differences between the two companies and their scores:

VantageScore vs FICO – Credit Score Ranges (EXPLAINED)

FAQ

Are Vantage scores higher than FICO?

Do car dealerships use FICO or Vantage?

Why is my FICO score 100 points higher than Credit Karma?

The primary reason for any discrepancy is that Credit Karma uses the VantageScore model, while most lenders use FICO scores. Additionally, Credit Karma doesn’t include data from Experian, the third major credit bureau.

Which credit score is most accurate?