Which One Is Better Equifax TransUnion or Experian?

When applying for credit, lenders will often check your credit report from one or more of the three major credit bureaus – Equifax, TransUnion and Experian. But is one bureau better than the others? Here’s an in-depth look at how these three credit bureaus compare.

The Big Three Credit Bureaus

Equifax, TransUnion and Experian are the three dominant credit bureaus in the United States. They each independently collect and maintain credit information on millions of consumers.

While they serve the same essential functions, there are some key differences between the three bureaus:

-

Equifax is the oldest and second largest credit bureau. It offers a free credit lock service.

-

Experian is the largest credit bureau. It provides credit monitoring and identity protection services.

-

TransUnion is the smallest bureau but has a big focus on educational resources.

When it comes to credit reports and scores, no one bureau is considered better or more important. All three are widely used by lenders and creditors.

Getting Your Credit Reports

Since each bureau maintains separate records, it’s crucial to check your credit report with all three bureaus. This gives you a complete picture of your credit history.

You can get free annual credit reports from Equifax, TransUnion and Experian at AnnualCreditReport.com. It’s recommended to stagger your requests throughout the year so you can monitor your reports year-round.

You can also purchase credit monitoring services that provide unlimited access to reports from all three bureaus.

Information In Credit Reports

While the credit bureaus collect mostly the same types of information, the specifics may vary between bureaus.

All three credit reports will include:

-

Personal information like your name, address and employment history

-

Details on open credit accounts like payment history and balances

-

Public records such as bankruptcies and tax liens

-

Inquiries made by lenders into your credit report

But a credit account or loan that shows up with Equifax may not appear on your TransUnion or Experian reports. Not all lenders report to all three bureaus.

Credit Scores

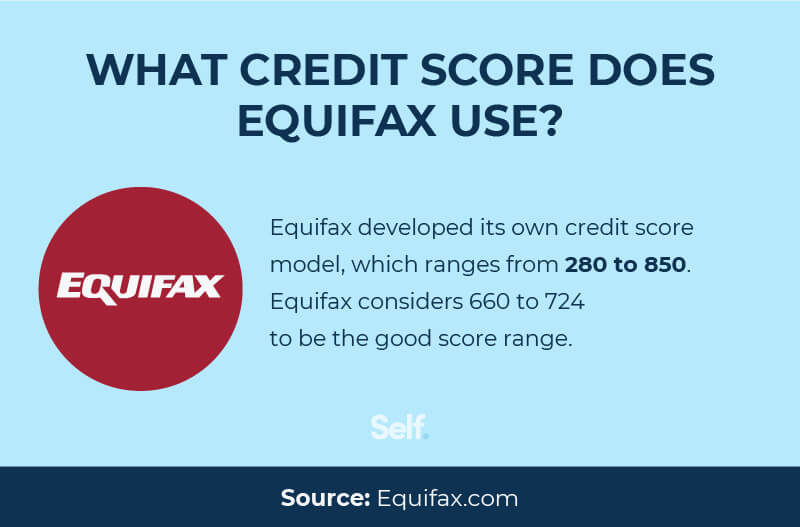

The three major credit bureaus offer different credit scoring models. The most commonly used are the FICO Score and VantageScore.

While the scores use different algorithms, the main factors that influence your scores are the same across bureaus: payment history, credit utilization, credit history length, credit mix and new credit applications.

It’s important to monitor your scores from each bureau since lending decisions are often based on your credit scores.

Dealing With Credit Report Errors

Because credit information can vary between bureaus, it’s possible that your reports contain inconsistent or incorrect information.

If you find an error on your Equifax, TransUnion or Experian credit report, you should dispute it with the relevant bureau right away. They are legally required to investigate disputed items.

You can also place a fraud alert or security freeze to help protect your credit if identity theft is suspected. And be sure to monitor your credit reports regularly to catch any suspicious activity.

How Often To Check Credit Reports

Checking your credit reports frequently enables you to catch mistakes and detect potential fraud early. It’s recommended to check your credit reports from each of the three major bureaus at least once per year.

Checking your own credit reports does not hurt your credit scores. A “soft inquiry” when you access your own reports does not impact your scores like a “hard inquiry” from a lender does.

Credit Monitoring Services

Signing up for a credit monitoring service can provide easy, regular access to your credit information. The main advantage is getting alerts whenever changes are made to your credit reports.

The downside is you have to pay a monthly or annual fee. And no service can fully prevent identity theft or fraud – they can only notify you if suspicious activity is found.

Which Credit Bureau Is Best?

When comparing TransUnion vs. Equifax vs. Experian, there is no single best credit bureau. Each bureau offers unique tools and services that may benefit different consumers.

The most important thing is to check your credit reports and scores from all three bureaus. This gives you a complete, accurate picture of your financial profile and helps you catch any discrepancies early.

While one bureau may provide more detailed information than others in certain areas, it’s the full view from all three that matters most when monitoring your credit.

The Takeaway

Reviewing your Equifax, TransUnion and Experian credit reports provides vital insights into your credit standing and financial health. Stay vigilant in checking your credit reports from each bureau to ensure accuracy and identify any suspicious activity.

There is no superior credit bureau – all three are important for maintaining good credit. Check your credit reports from Equifax, TransUnion and Experian on a regular basis for a comprehensive view of your credit history and to maximize your financial opportunities.

What’s different between Equifax vs Experian vs TransUnion?

The credit bureaus collect information about your credit history. Sometimes, the information reported by different credit bureaus can vary slightly, leading to slight differences in credit scores. It’s best to check each bureau’s credit report to get the most accurate information.

For example, a loan, financial institution, or credit card issuer that shows up on your Equifax report might not be on your TransUnion report. Lenders are not required by law to report account information to all three credit bureaus. Credit card companies may report to one or all three bureaus.

All three credit bureaus provide similar services and products to consumers. The major credit bureaus operate on different schedules for compiling data. No one credit bureau is considered more accurate or better than the others.

Each bureau also uses its own way of calculating your credit score, so you might have different scores from each one. To ensure your credit history is accurate, it is essential to check your credit reports from all three bureaus, as each collects and maintains unique financial and personal information.

When comparing Equifax, TransUnion, or Experian credit reports, it’s essential to consider their similarities and differences. While they all provide similar information about an individual’s credit history, there may be variations in how they present the data.

For example:

- Equifax may provide additional details on your overall credit usage.

- Experian might offer more comprehensive identity theft protection services.

- TransUnion could focus more on educational resources for consumers looking to improve their credit scores.

- Understanding these distinctions can help individuals make informed decisions.

How do I deal with fraud and identity theft on my Credit Report?

You must act quickly if you suspect that someone has used your personal information or stolen your identity. First, you can ask the three big credit bureaus to put a fraud alert or freeze on your credit file. This will help protect your credit and stop more fraud.

A fraud alert instructs lenders to verify your identity before extending credit. A security freeze makes it difficult for unauthorized individuals to access your credit report and open new accounts. However, be cautious because placing a fraud alert may require you to verify your identity when applying for credit.

A security freeze might prevent you from seeing your credit report. It’s also important to check your credit reports regularly to identify any unknown accounts or activities.

Tell the credit bureau immediately if you see something strange, such as accounts or addresses you don’t recognize. If you discover that someone has stolen your identity, notify the relevant bureaus and report the incident to the police.

Finally, work with the bureaus to remove any incorrect information from your credit reports. Send them letters and proof, and continue to check to ensure they resolve the problem.

You can formally dispute inaccuracies with each of the major credit bureaus if you find errors. Reviewing your credit reports regularly is the best way to identify errors, allowing you to dispute them effectively. Federal law requires the credit bureau to investigate any disputes you raise about inaccuracies in your report.

Transunion vs Equifax – Which Credit Score Matters More? (What’s the Difference?)

FAQ

Do banks use TransUnion or Equifax?

Every bank uses Equifax, Experian, or TransUnion to evaluate creditworthiness — some even use more than one bureau.Apr 4, 2025

Do lenders look at Equifax or Experian?

Lenders then use this data to decide whether to approve your loan applications. Equifax and Experian are two of these CRAs and probably the most well-known. If you’re wondering which one to pay more attention to, the answer is simple: whichever one the lender you’re asking for a loan works with.

Which credit report is most accurate?

FICO Scoring Model. The FICO scoring model is an algorithm that produces what is considered the most reliable credit scores.

What are the top 3 credit bureaus?

The three major credit bureaus are Equifax®, Experian® and TransUnion®. Credit bureaus are different from credit-scoring companies such as VantageScore® and FICO®. Credit reports contain information about people’s identity, credit history and credit activity as well as information from public records.

Is TransUnion better than Equifax?

Say you were late on a payment, for example, but it was only reported to your Equifax credit report, not TransUnion. In that case, your TransUnion score would likely be better than your Equifax score. Similarly, credit inquiries may appear on only one credit report if a credit issuer pulls your credit history from only one credit bureau.

What is the difference between Equifax & TransUnion credit reports?

When comparing Equifax, TransUnion, or Experian credit reports, it’s essential to consider their similarities and differences. While they all provide similar information about an individual’s credit history, there may be variations in how they present the data. For example: Equifax may provide additional details on your overall credit usage.

Does Equifax show up on TransUnion?

For example, a loan, financial institution, or credit card issuer that shows up on your Equifax report might not be on your TransUnion report. Lenders are not required by law to report account information to all three credit bureaus. Credit card companies may report to one or all three bureaus.

Does Equifax pull more than Experian?

“In general, lenders have a preferred credit report between Equifax, Experian, or TransUnion. However, they may pull more than one credit report if they can’t determine if you qualify for a loan based on one. Why is Equifax lower than Experian?

Why are my TransUnion & Equifax scores different?

Here are a few reasons why your TransUnion and Equifax scores may not exactly match: When a lender or creditor reports your credit data, they may not pass on your information to all of the major consumer credit bureaus. This is one of the most common reasons for credit score discrepancies.

What is the difference between Experian & TransUnion?

Both Experian and TransUnion have A+ ratings from the Better Business Bureau. There are some key differences in the products and services the two credit bureaus offer. Experian’s free credit score is the FICO Score 8, the score most lenders use. TransUnion provides the VantageScore 3.0, which is used far less often.