The rules of intestacy decide what happens to someone’s estate when they die without a will.

When someone writes a will, they have the opportunity to say who they want to inherit their estate and how much each of them should get. People often leave their entire estate to their spouse, civil partner, or children. However, many people also choose to leave their estate to extended family, friends, or charities.

When someone dies intestate, there are no legally-binding wishes regarding what should happen to their estate. In cases where there isn’t a will, the rules of intestacy come into play.

Let me create a comprehensive article on this topic

Ever think about what would happen to your things if you died suddenly without leaving any instructions? It’s not something we like to think about, but it’s really important to know. Today, I’m going to talk in depth about the idea of dying without a will, which is officially called intestacy.

What Does Intestacy Mean?

Let’s get straight to the point. A person dies without leaving a valid will, which is called intestacy in the law. If someone dies “intestate,” it means they didn’t leave any legally binding instructions about how their property and assets should be shared after they cross over.

The word might sound complex, but understanding it could save your family a lot of headache and heartache later. When you die intestate, you’re essentially letting the government decide what happens to everything you own

What Happens When Someone Dies Intestate?

When someone dies without a will, a few things may happen that aren’t in line with what they would have wanted:

- State Laws Take Control: The intestacy laws of your state determine how your property is distributed

- Court Appointment: A probate court gets involved to oversee the process

- Administrator Assignment: The court appoints an administrator to handle the estate

- Statutory Distribution: Your assets are divided according to a predetermined formula, not personal wishes

If you die, your estate is usually split between your surviving spouse, children, parents, or siblings based on rules set by state law. These formulas don’t take into account personal relationships, falling out with someone, or specific wishes you may have had.

The Distribution Formula: Who Gets What?

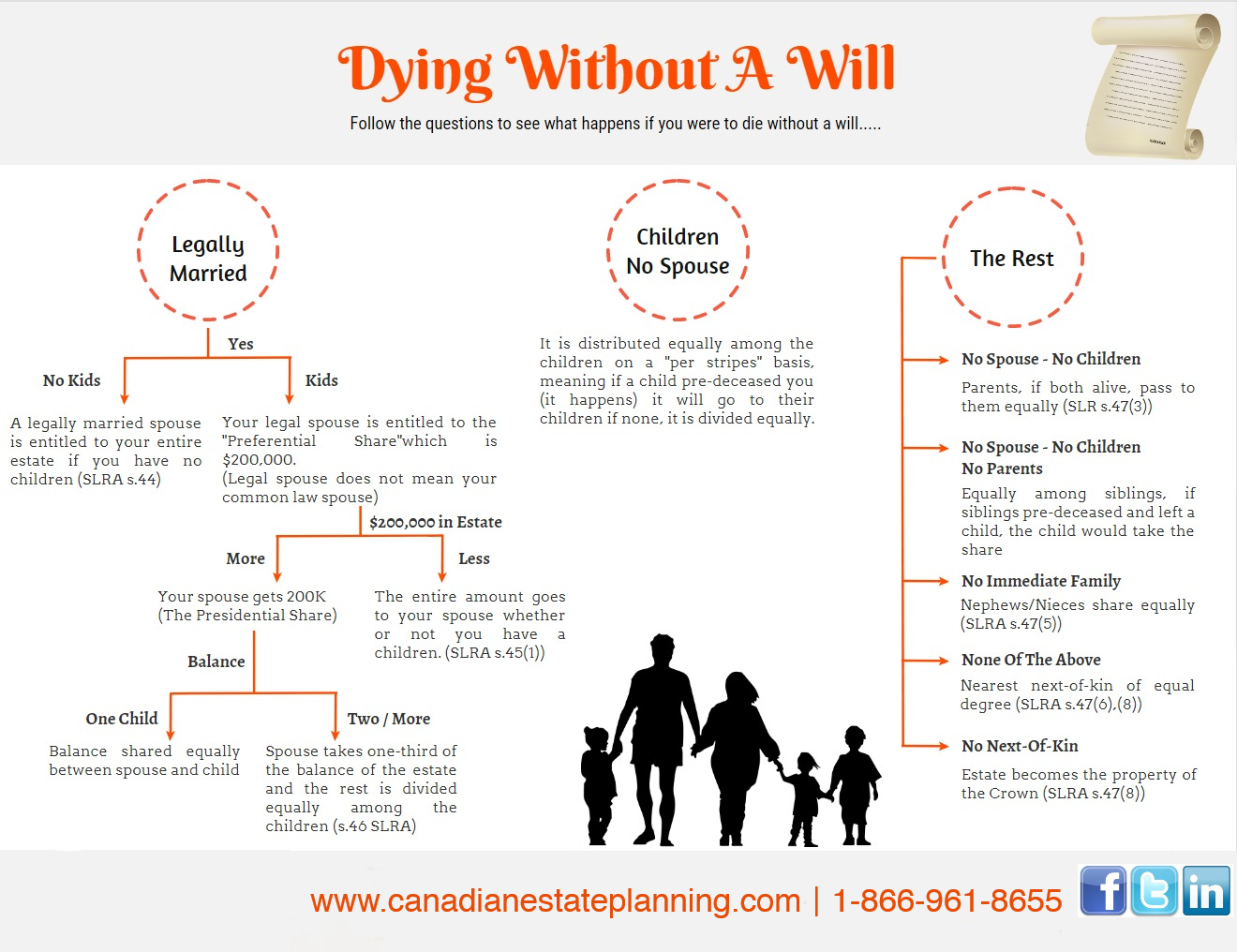

Without a will, your state’s intestacy laws create a “one-size-fits-all” approach to distributing your assets. Here’s generally how it works:

- If you’re married: Your spouse typically receives a substantial portion or all of your estate

- If you have children: Assets may be split between spouse and children

- If single with children: Children generally inherit everything

- If single without children: Parents, siblings, or other relatives inherit according to state law

- If no relatives can be found: Your property may “escheat” to the state (meaning the state takes ownership)

The exact distribution varies significantly from state to state, which adds another layer of unpredictability to dying intestate.

Real-Life Example: No Will, Big Problems

Let me share a hypothetical scenario. Imagine John, who lives with his partner of 15 years but never married them. John has two children from a previous relationship and owns a house, retirement accounts, and other assets.

If John dies without a will:

- His long-term partner might receive nothing

- His assets would likely go to his children and possibly his parents

- His partner could be forced to leave their shared home

- Family conflicts might emerge during this already difficult time

This situation could be completely avoided with a proper will that expresses John’s actual wishes.

What’s the Difference Between Dying Testate and Intestate?

To understand intestacy better, it helps to know its opposite. When someone dies “testate,” it means they died with a valid will in place. Here’s how they compare:

| Dying Intestate | Dying Testate |

|---|---|

| No valid will exists | Valid will exists |

| State laws determine distribution | Deceased’s wishes determine distribution |

| Court appoints an administrator | Deceased names an executor |

| More complicated and time-consuming | Typically more straightforward |

| No control over asset distribution | Full control over asset distribution |

| Can’t include gifts to friends or charities | Can leave assets to anyone or any organization |

Power of Attorney: It Doesn’t Survive Death

Another important point to understand: if you had given someone power of attorney during your lifetime, that power ENDS when you die. Many people mistakenly think that a power of attorney continues after death, but it doesn’t.

After death, if there’s no will, the administrator appointed by the court takes over. This person may not be who you would have chosen to handle your affairs.

The Probate Process for Intestate Estates

When someone dies intestate, their estate typically goes through probate court. This process includes:

- Court appointment of an administrator

- Identification and inventory of all assets

- Payment of debts and taxes

- Distribution of remaining assets according to intestacy laws

The probate process for intestate estates is often more complex, time-consuming, and expensive than for estates with valid wills. Plus, it all happens in public court, so there’s little privacy for the family.

Who Can Serve as Administrator of an Intestate Estate?

When there’s no will naming an executor, the court must appoint someone to administer the estate. Generally, preference is given in this order:

- Surviving spouse or registered domestic partner

- Adult children

- Parents

- Siblings

- More distant relatives

- Public administrator (if no family members are available)

The administrator has similar responsibilities to an executor named in a will, but they must strictly follow intestate succession laws rather than the deceased’s wishes.

Important Intestacy Rules to Know

Some additional intestacy rules that vary by state but are commonly applied:

- Survivorship requirement: In many states, heirs must survive the deceased by a certain period (often 120 hours) to inherit

- Half-relatives: In many jurisdictions, half-siblings inherit the same as full siblings

- Adopted children: Generally inherit the same as biological children

- Step-children: Typically do not inherit unless legally adopted

- Non-marital children: Usually inherit if paternity has been established

The Limitations of Intestacy

Intestacy laws have significant limitations:

- Can’t recognize unmarried partners: Common-law relationships often aren’t recognized

- No charitable giving: You can’t leave assets to charities or causes

- No specific gifts: You can’t designate specific items for specific people

- No guardianship designation: You can’t name guardians for minor children

- No trusts: You can’t establish trusts for beneficiaries who might need protection

How to Avoid Intestacy

The simplest way to avoid intestacy is to create a valid will. However, there are other estate planning tools that can help assets bypass intestacy:

- Living trusts: Assets in trust pass outside of probate

- Beneficiary designations: Retirement accounts, life insurance, and certain financial accounts pass to named beneficiaries

- Joint ownership: Property owned jointly with right of survivorship passes to the surviving owner

- Transfer-on-death deeds: In some states, real estate can transfer automatically at death

Common Misconceptions About Intestacy

There are several myths and misconceptions about dying without a will:

- “The government takes everything” – While estates can escheat to the state, this only happens when no heirs can be found

- “My spouse gets everything automatically” – Not necessarily; children or other relatives may be entitled to portions

- “Only wealthy people need wills” – Everyone with any assets or dependents should have a will

- “My family knows what I want” – Without a legal document, their knowledge doesn’t matter to the court

- “I’m too young to worry about a will” – Unexpected deaths happen at all ages

Special Considerations for Blended Families

Intestacy laws can be particularly problematic for blended families. Without a will:

- Step-children typically don’t inherit unless legally adopted

- Ex-spouses might have claims in certain situations

- Current spouses may inherit assets intended for children from previous relationships

- Family heirlooms might not go to blood relatives

International Complications

If you own property in multiple countries or aren’t a citizen of the country where you reside, intestacy becomes even more complicated. Different countries have different intestacy laws, potentially leading to conflicting claims.

Creating a Valid Will: It’s Easier Than You Think

Many people avoid creating wills because they think it’s complicated or expensive. However, basic wills can be relatively simple to create. Options include:

- Hiring an attorney (most comprehensive option)

- Using online legal services

- Using will-creation software

- In some cases, handwritten (holographic) wills are valid

The most important thing is to create a legally valid document that clearly expresses your wishes.

Final Thoughts: Don’t Leave It to Chance

Intestacy—dying without a will—essentially means giving up control over what happens to everything you’ve worked for throughout your life. It can create unnecessary stress, conflict, and financial strain for your loved ones during an already difficult time.

I believe everyone over 18 should have at least a basic will, regardless of wealth or family status. It’s one of the kindest things you can do for the people you care about.

Have you created your will yet? If not, what’s stopping you from taking this important step? Remember, intestacy is the default when we don’t make a choice—and rarely does it align perfectly with what we would have wanted.

Taking the time to create a will isn’t just about your assets. It’s about creating clarity, providing direction, and giving one final gift of peace of mind to the people you love.

Unmarried and has children or grandchildren

The estate is shared equally between the children, not including any step-children. If any of the children has already died, grandchildren or great-grandchildren can inherit their parent’s share.

For example: Mandy was unmarried and had two children, Daniel and John. When she died without a will, her estate was worth £600,000. Daniel inherited £300,000 but, because John had already passed away, his £300,000 share was split equally between his three children.

Note: If John didn’t have children or grandchildren of his own, his share would also have been inherited by Daniel.

What are the rules of intestacy?

There are laws in England and Wales called the rules of intestacy that say what should happen to someone’s property when they die without a will. They usually work reasonably well for traditional families whose circumstances are fairly straightforward, but things can be more difficult for unmarried partners, cohabitees and step-children.

Who gets your property if you die without a will

FAQ

What is a person dies without a will?

If you die without a valid Will, the law decides who gets your assets. This is called ‘dying intestate’.

What is the word for having no will?

“Intestate” is the legal term for someone who dies without leaving a valid will that says what will happen to their property and interests after they die.

What is testate and intestate?

When you die testate, your assets are distributed according to your wishes because you had a valid will. When you die intestate, you did not have a will and your assets are distributed by state law. A person who dies testate is called a “testator” and an executor manages the estate. A person who dies intestate has their estate managed by an administrator, who distributes assets to heirs according to a predetermined order of priority set by state intestacy laws.

What is a death will called?

If you die without a will, also known as a “last will and testament,” your property and other assets will be given to the people you choose.

What happens if you die without a will?

The fate of your assets when you die without a will varies by state. Usually, it depends on the status of your relationships with your surviving spouse, partner, children, and other relatives. The probate court will also appoint a personal representative to administer your estate. Be aware of the following common scenarios if you don’t have a will.

How is property divided if you die without a will?

The method the court uses to divide property when you die without a will depends on whether you live in a community property or separate property state, how your assets are titled, and your state’s intestacy laws. In a community property state, your estate will go entirely to your surviving spouse.

Who gets what if a person dies?

This means they leave no legal instructions to guide the distribution of their assets. In that case, state laws decide who gets what—regardless of the person’s real wishes. Intestate succession is the legal process the state uses to decide who inherits the deceased person’s assets when intestacy occurs.

What happens if a domestic partner dies without a will?

In most states however, a domestic partner is given the same rights as a spouse (depending on how the property is owned). Dying without a Will can precipitate a myriad of burdens for the deceased’s family members. Think of a Will as your “voice” after you’ve passed.

What happens if you pass away before creating a will?

Your state’s intestate succession laws will determine where your money goes if you pass away before creating a Will. This requires going into probate court where the court will appoint someone as a personal representative to oversee distribution of your belongings.

How does probate work without a will?

Probate without a will is called intestate probate. Here’s how it works: Petition Filed: A family member requests the court to open probate. Administrator Appointed: The court names someone to manage the estate. Notices Sent: Heirs and creditors are notified. Asset Inventory: The estate’s assets are identified and valued.