Are you stuck between choosing an annuity or a certificate of deposit (CD) for your savings strategy? You’re not alone! I’ve been researching these financial products extensively to help my clients make better decisions with their money and I’m excited to share what I’ve discovered.

Annuities and CDs both offer safe and guaranteed returns, but they work in very different ways. Let’s compare them in more depth to help you decide which one might be better for your 2025 financial goals.

Understanding the Basics: Annuities vs. CDs

What is a CD?

A certificate of deposit (CD) is a type of time deposit account that banks, credit unions, and brokerages offer. When you open a CD, you put down a lump sum of money for a certain amount of time (the term), and in return, you get a guaranteed interest rate.

Key features of CDs include:

- Terms ranging from 3 months to 5+ years

- Fixed interest rates for the entire term (in most cases)

- FDIC or NCUA insurance up to $250,000

- Early withdrawal penalties if you take out money before maturity

What is an Annuity?

An annuity is a contract between you and a financial services company (usually an insurance company) You make a premium payment or series of payments, and in return, the company promises to make payments to you either immediately or at a future date.

Annuities have two main phases:

- Accumulation phase: When you pay premiums

- Distribution phase: When you receive payments

There are three primary types of annuities

- Fixed annuities: Offer a guaranteed interest rate

- Indexed annuities: Returns linked to a market index

- Variable annuities: Returns based on investment performance

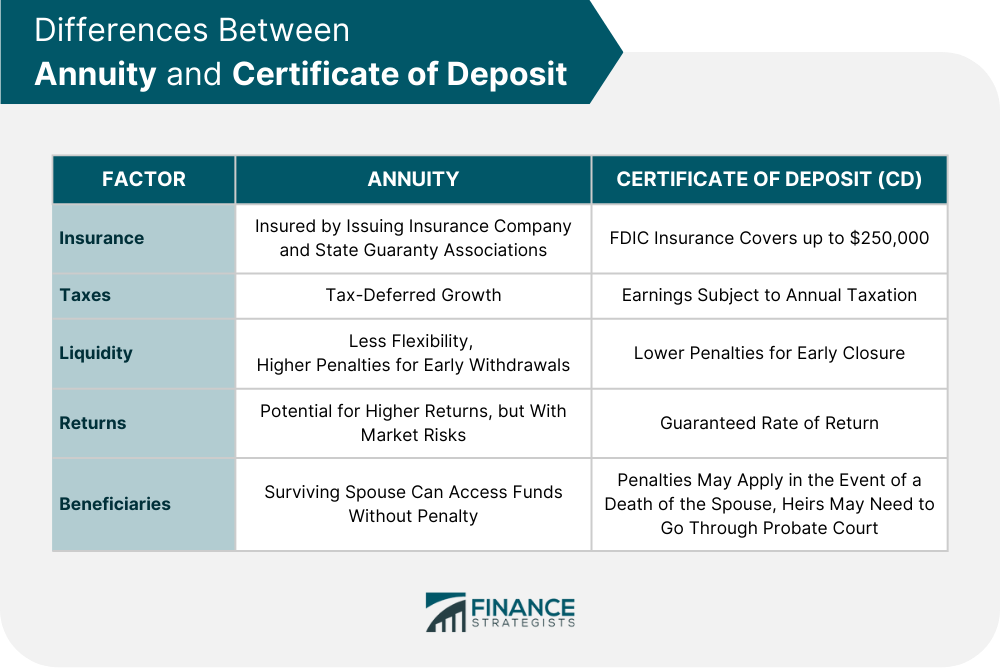

4 Key Differences Between Annuities and CDs

1. Taxation

CDs:

- Interest earned is taxable in the year you earn it

- If held in a tax-advantaged account like an IRA, taxes may be deferred

Annuities:

- Tax-deferred growth during the accumulation phase

- Taxes are only paid when you receive distributions

- This can be advantageous for those looking to control when income hits their tax return

2. Liquidity

CDs:

- Early withdrawals typically result in penalty fees (usually several months’ worth of interest)

- No-penalty CDs allow withdrawals without fees

- When a CD matures, you get access to your full principal plus earned interest

Annuities:

- Subject to surrender charges (often around 10%) if withdrawn early

- Many annuities allow annual withdrawals of up to 10% without surrender charges

- Withdrawals before age 59½ may trigger an additional 10% IRS penalty

- Designed as long-term products with less liquidity than CDs

3. Interest Rate Period

CDs:

- Interest rate is fixed for the entire term

- When the CD matures, you can renew at current market rates

- Terms are typically shorter (months to a few years)

Annuities:

- Fixed annuities have guaranteed minimum interest rates

- Multi-year guaranteed annuities (MYGAs) provide fixed rates for specific periods

- Interest rate periods are often longer than CDs

- Even after the guaranteed period, rates won’t fall below the contractual minimum

4. Withdrawal Options

CDs:

- At maturity, you receive your principal plus interest in a lump sum

- Some CDs allow interest-only withdrawals without penalty

Annuities:

- Multiple distribution options, including:

- Lump-sum payments

- Annuitization (regular payments for a set period)

- Lifetime income options

- Various payout structures based on your needs

Pros and Cons Breakdown

Advantages of Fixed Annuities

✅ Tax-deferred growth

✅ Potential for lifetime income options

✅ Higher interest rates than CDs in some cases

✅ Longer guaranteed rate periods

✅ Not impacted by market fluctuations

✅ Multiple withdrawal options in retirement

Disadvantages of Fixed Annuities

There is less liquidity because of surrender charges and a 2010 IRS penalty for withdrawals before age 55. There are also longer commitment periods and guarantees based on the financial strength of the issuing company.

Advantages of CDs

– More access to cash with clear penalties

– Up to $250,000 in FDIC/NCUA insurance

– Easy to understand

– No age limits on penalty-free access

– Good for short-term financial goals

– Several term options (3 months to 5 years)

Disadvantages of CDs

❌ Interest taxed annually

❌ No tax deferral benefits

❌ No lifetime income options

❌ Typically lower interest rates than annuities

❌ Limited to lump-sum withdrawal at maturity

Which is Better for You? 5 Key Factors to Consider

1. Time Horizon

Choose a CD if: You have a short-term goal (less than 5 years) like saving for a down payment on a house or a new car.

Choose an annuity if: You’re planning for retirement or have a long-term time horizon (10+ years) and won’t need the money before age 59½.

2. Tax Situation

Choose a CD if: You’re in a low tax bracket or hold the CD in a tax-advantaged account.

Choose an annuity if: You’re currently in a high tax bracket but expect to be in a lower bracket during retirement when you’ll take distributions.

3. Income Needs

Choose a CD if: You need a lump sum of money at a specific future date.

Choose an annuity if: You want guaranteed income payments in retirement, potentially for life.

4. Safety Concerns

Choose a CD if: You value FDIC/NCUA protection and absolute safety of principal.

Choose an annuity if: You’re comfortable with the financial strength of insurance companies and state guaranty associations.

5. Interest Rate Environment

Choose a CD if: Interest rates are expected to rise significantly in the near future, allowing you to reinvest at higher rates when your CD matures.

Choose an annuity if: You want to lock in current rates for a longer period or benefit from tax-deferred growth.

Current Rates Comparison (October 2025)

As of October 2025, here’s a general comparison of rates you might expect:

| Product | Average Rate | Term/Period |

|---|---|---|

| 1-Year CD | 3.5% – 4.5% | 12 months |

| 5-Year CD | 4.0% – 5.0% | 60 months |

| Fixed Annuity | 4.5% – 5.5% | 5-10 years |

| MYGA (5-year) | 4.8% – 5.8% | 5 years |

Note: Rates are subject to change and may vary based on provider and amount invested.

Can You Use Both in Your Financial Plan?

Absolutely! In my experience working with clients, I’ve found that using both CDs and annuities can be a smart strategy. For example:

- CDs for short-term goals: Use CDs for emergency funds or goals within the next 1-5 years

- Annuities for retirement income: Allocate a portion of retirement savings to annuities for guaranteed lifetime income

- CD ladder + annuity: Create a CD ladder for near-term needs while using an annuity for long-term growth and income

Real-World Scenarios

Scenario 1: Pre-Retirement (Age 55)

Maria is 55 and wants to retire at 65. She has $200,000 to invest and needs both growth and safety.

Solution: Split funds between a 5-year CD ladder ($100,000) for liquidity and a fixed annuity ($100,000) for tax-deferred growth and future income.

Scenario 2: Near Retirement (Age 62)

John is 62 and retiring in 3 years. He has $300,000 from a 401(k) rollover and wants guaranteed income.

Solution: Allocate $75,000 to CDs for immediate needs and $225,000 to a fixed indexed annuity with income rider for lifetime payments starting at 65.

Scenario 3: Young Saver (Age 35)

Lisa is 35 and saving for a house down payment in 2 years while also planning for retirement.

Solution: Use CDs for the house down payment fund and consider a variable annuity inside her retirement accounts for long-term growth potential.

Making Your Decision

When deciding between annuities and CDs, consider working with a financial advisor who can help analyze your specific situation. Neither option is inherently “better” – the right choice depends on your:

- Financial goals

- Time horizon

- Tax situation

- Income needs

- Risk tolerance

The Bottom Line

CDs are generally better for short-term goals and liquidity, while annuities excel for tax-deferred growth and guaranteed retirement income. Many successful financial plans incorporate both tools for different purposes.

In 2025’s economic environment, with interest rates still relatively attractive, both products deserve consideration in your financial portfolio. The key is matching the right tool with your specific financial objectives.

I’ve seen clients achieve great results using both these financial vehicles when applied correctly. What’s your financial timeline looking like? That might be the most important factor in determining which option is better for you.

Have you considered using both annuities and CDs as part of your financial strategy? I’d love to hear about your experiences in the comments below!

Annuities

The issuing insurance company guarantees annuities. You could lose your guarantee if the insurance company goes out of business. While state-based guaranty associations add some protection, theres a chance only part of your claim may be paid due to limitations.

Other risks shared with CDs include interest-rate risk if interest rates go up, and inflation risk, where your investment cant keep up with inflations impact on costs. Unlike CDs, annuities may also feature a death risk — some annuities dont continue annuity payments if you die.

Special Considerations

There are many kinds of annuities, but most people use them for retirement to protect against the risk of outliving their savings. An annuitys appeal is a dependable income stream over time, which makes it suitable for people looking to secure a steady income stream in retirement.

CDs come with different maturities and pay you a lump sum when they mature. So, CDs are more suited to those looking to save money for a short-term goal. However, using a CD ladder approach, you can use CDs to design income streams. Rather than rolling them into another CD, you can use the proceeds as income as they mature and payout.

What’s The Difference Between a CD and a Fixed Annuity?

FAQ

Is it better to have an annuity or a CD?

Neither annuities nor Certificates of Deposit (CDs) are inherently “better”; the ideal choice depends on your specific financial goals, risk tolerance, and investment horizon. CDs are low-risk, FDIC-insured products suitable for short-term goals with fixed, predictable returns but are taxed annually.

What does a $100,000 annuity pay per month?

Is there a downside to annuities?

Yes, annuities have significant downsides, including limited liquidity, making funds difficult to access; high fees and commissions that can erode returns; potentially lower returns than direct market investments; the risk of inflation eroding payment value; and the complexity of the products themselves, which can be difficult to understand.

What does Suze Orman say about fixed annuities?

Suze Orman’s Preference: The CD-Type Annuity Guaranteed Interest for the Entire Term: Unlike traditional fixed annuities that may have fluctuating interest rates, a CD-type annuity guarantees the same interest rate for the entire length of the surrender period.

Are annuities better than CDs?

Annuities provide guaranteed regular income, grow tax-deferred, and offer personalized features. CDs, on the other hand, offer higher rates, guaranteed returns, and flexibility due to CD laddering. However, annuities can be expensive with annual fees and high commission rates, while CDs have penalties for early withdrawal.

Should you invest in a CD or annuity?

If you want to set aside money for medium-term financial goals with little market risk, a CD may be your best bet. But an annuity is a better choice if you want to add an extra income stream in retirement so that you don’t run out of money. A financial advisor could help you figure out how CDs and annuities fit into your portfolio.

Should you choose a fixed annuity or a CD?

Choose a CD if: Choose a fixed annuity if: In 2025, both CDs and fixed annuities offer high APYs. Annuities tend to pay more, but they come with bigger commitments and more complex terms. They’re best for retirement savers who want guaranteed income down the road. CDs are simpler and better for short- or medium-term savings.

What is the difference between a guaranteed annuity and a CD?

CDs offer no such optionality. Below are a handful of other notable differences between multi-year guaranteed annuities and CDs. The interest rates offered on CDs are generally lower than the interest rates available from annuities. Over long periods of time, even a 1% or 2% differential can make a huge difference in terms of accumulating wealth.

Are annuities safe if you have two CDs at one bank?

But if you have two CDs at one bank, only the first $250,000 is guaranteed. As for the safety of annuities, the different types of contracts come with varying levels of risk. Fixed annuities are the safest, followed by indexed annuities and variable annuities. Fixed annuities offer guaranteed income.

What is the difference between a CD and a variable annuity?

This is because the financial institution where you hold your annuity is exposed to less risk because you will keep it longer. Most CDs feature fixed interest rates. Annuities may have fixed rates, but variable annuities feature variable interest rates. Annuities are designed for retirement and come with tax advantages when used in this way.