Living on the Edge: Millions of Seniors Depend Entirely on Monthly Benefit Checks

If your only source of income in retirement was your Social Security check, have you ever thought about what that would be like? For nearly 22 million American seniors, this isn’t just a question; it’s their everyday life.

According to the most recent Senior Survey 202025 from The Senior Citizens League (TSCL), about 339 percent of seniors in the United States depend on Social Security 100% of the time for their income. That’s right—not just to help out, but as their only way to pay for everything from food and shelter to medical bills and other costs.

As someone who helps clients plan for retirement, I find these numbers not just concerning, but downright frightening Let’s dive deeper into what this means for millions of Americans and why we should all be paying attention.

Breaking Down the Numbers: How Many Seniors Live Only on Social Security?

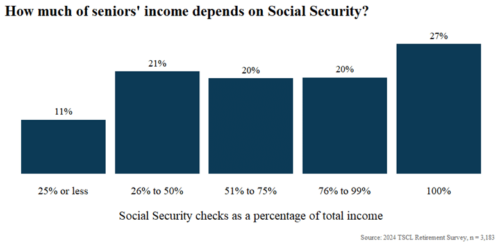

The TSCL survey findings paint a stark picture of retirement in America today:

- 39% of seniors rely on Social Security for 100% of their income (equating to approximately 21.8 million Americans)

- 19% of seniors depend on Social Security for at least 75% of their income

- 15% of seniors depend on it for between 50-75% of their income

- 18% of seniors rely on it for 25-50% of their income

- 9% of seniors depend on it for less than 25% of their income

When we combine these statistics, the reality becomes even more sobering: nearly three-quarters (73%) of American seniors rely on Social Security for more than half their income.

But wait, the data gets even more troubling…

Living Below the Poverty Line: The Financial Reality for Millions

The median U.S. senior lives on between $1,000 and $2,000 per month, according to Census Bureau data cited in the TSCL report. Let’s break down seniors’ monthly income levels:

| Monthly Income | Percentage of Seniors |

|---|---|

| Less than $1,000 | 13% |

| $1,000-$2,000 | 44% |

| $2,000-$3,000 | 21% |

| $3,000 or more | 22% |

This means that approximately 7.3 million American seniors are surviving on less than $1,000 per month—significantly below the 2025 federal poverty line of $15,650 per year for a household of one.

And with an estimated 31.8 million seniors getting by on less than $2,000 a month, it’s no wonder that financial anxiety is sky-high among America’s elderly population.

Social Security Was Never Designed to Be Your Only Income

Here’s the thing—Social Security was never meant to be anyone’s sole source of retirement income. The program was designed to replace about 40% of pre-retirement income for average earners, with the expectation that retirees would have additional sources like pensions, savings, or investments.

But for almost four out of ten seniors, Social Security is their only source of income. In 2025, the average monthly Social Security payment will be around $2,000. This means that many seniors have to choose between things like food, medicine, and housing.

“Cutting Social Security benefits is not an option,” says Shannon Benton, Executive Director of TSCL. “Almost three quarters of seniors depend on Social Security for at least half of their income. Any changes to the program or lower benefits would put millions of hardworking Americans even further into poverty and take away their right to retire with honor.” “.

Why Seniors Are Dissatisfied with Their Benefits

The TSCL survey also revealed widespread dissatisfaction with Social Security benefits:

- Almost two-thirds of seniors reported being unhappy with their monthly benefit amounts

- An overwhelming 94% felt the 2025 cost-of-living adjustment (COLA) of 2.5% was too low

- 80% of seniors believed actual inflation in 2024 was 3% or higher, based on their personal experiences

This disconnect between official inflation figures and seniors’ lived experiences highlights a critical issue: the current method for calculating COLAs doesn’t adequately reflect seniors’ spending patterns, particularly their higher healthcare costs.

The Looming Crisis: Trust Fund Insolvency

To make matters worse, we’re facing a ticking time bomb. According to the Committee for a Responsible Federal Budget, without Congressional intervention, the Social Security Old-Age and Survivors Insurance (OASI) Trust Fund is projected to become insolvent by 2033.

What does this mean? While benefits wouldn’t disappear entirely, they could be slashed by about 23%. For someone receiving the average $2,000 monthly benefit, that would mean a cut to approximately $1,540.

Now imagine if that check was your ONLY source of income. How would you manage a sudden 23% reduction in your already limited budget?

What Can Be Done? Reforms Seniors Support

The TSCL survey found that 95% of respondents believe reforming Social Security and Medicare should be a top priority for the federal government. Here are some reforms seniors favor:

-

Better COLA calculations: 68% of seniors support calculating COLAs using the Consumer Price Index for the Elderly (CPI-E) instead of the current Consumer Price Index for Urban Wage Earners (CPI-W), which would better reflect seniors’ spending patterns.

-

Removing the tax cap: 50% of survey respondents support eliminating the limit on earnings subject to Social Security payroll taxes. For 2025, the cap is $176,100, meaning income above this amount isn’t subject to the 6.2% Social Security tax.

-

Increasing payroll tax rates: 31% of seniors would support an increase to the current 6.2% employee/6.2% employer tax rate to strengthen the program.

According to analysis cited by the Peter G. Peterson Foundation, eliminating the Social Security tax cap while providing benefit credit for those earnings could raise an additional $3.2 trillion over 10 years—covering about 53% of the trust fund’s 75-year funding gap.

Tips for Seniors Living on Social Security Alone

If you’re among the millions of Americans relying heavily or solely on Social Security, here are some strategies that might help:

-

Create a detailed budget: Track ALL expenses for several months to identify areas where you might be able to cut back.

-

Prioritize your spending: Focus on essentials first and rank expenses from most to least important.

-

Review your Medicare plan annually: You might find better coverage at lower costs by shopping around during open enrollment.

-

Take full advantage of preventative services: Many Medicare plans offer free preventative care that can help avoid costly treatments later.

-

Look into assistance programs: Many utility companies offer discounted rates for seniors. Local senior centers can be great resources for learning about meal services, transportation assistance, and other programs.

The Bottom Line: A Call for Action

The fact that 39% of American seniors—21.8 million people—rely entirely on Social Security is not just a statistic. It’s a national crisis that demands attention from policymakers, communities, and individuals planning for their own retirement.

For those of us still in our working years, these numbers serve as a stark reminder of the importance of retirement planning beyond just counting on Social Security. We need to save aggressively, take advantage of employer-matching retirement programs, and consider long-term care needs well before retirement age.

And for our society as a whole, we need to have serious conversations about how we support our elders and what reforms are needed to strengthen Social Security for current and future generations.

What are your thoughts? Are you surprised by how many seniors rely solely on Social Security? Do you have tips for maximizing benefits or stretching a fixed income? I’d love to hear your perspective in the comments below!

Final Thoughts

The reality that nearly 4 in 10 seniors depend completely on Social Security is a wake-up call for all of us. Whether you’re already retired, approaching retirement, or have decades of working years ahead, understanding the limitations of Social Security is crucial for financial planning.

No one wants to imagine a retirement where every penny is counted and tough choices must be made between necessities. Yet for millions of Americans, that’s exactly what retirement looks like.

By advocating for sensible reforms, supporting assistance programs for seniors, and taking personal responsibility for our retirement planning, we can work toward ensuring that Social Security remains a safety net—not the only lifeline—for future generations of retirees.

This article is based on the 2025 Senior Survey conducted by The Senior Citizens League and additional data from reputable financial sources. The statistics reflect the most current information available as of September 2025.

Social Security and Work: How Much Can You Make in 2025?

FAQ

How many retirees rely solely on Social Security?

Different studies and years come up with different numbers, but a 2025 report from The Senior Citizens League (TSCL) said that about 22 million seniors get all of their money from Social Security.

What is it like to retire on just Social Security?

Dependring on Social Security alone for your retirement income can be hard and put your money at risk. While Social Security benefits provide essential support, they are typically insufficient to cover all living expenses, especially in the face of rising healthcare costs and inflation.

Can you survive on only Social Security?

If someone waits until age 70 to claim Social Security, they might get almost twice as much money as if they claimed at age 62. Living on Social Security alone is possible but may require cutting expenses and finding cheaper housing.

What percent of seniors have no savings?

20 percent of adults ages 50 and over have no retirement savings at all. 61 percent are worried they will not have enough money to support themselves in retirement. Perhaps most startling, only 40 percent of men who are regularly saving for retirement believe they are saving enough. For women the number is 30 percent.

What percentage of older Americans receive Social Security?

WASHINGTON, D.C., January 14, 2020 – Only a small percentage of older Americans, seven percent, receive income from Social Security, a defined benefit pension, and a defined contribution account.

What percentage of retirees rely only on social security?

A new report also finds that a large portion (40 percent) of older Americans rely only on Social Security income in retirement. What percent of retirees rely solely on Social Security? From the SIPP, NIRS declares that 40.2 percent of retirees receive all of their income from Social Security. Can most people live on Social Security alone?

How many seniors rely on social security?

New survey data from The Senior Citizens League indicates nearly three in four seniors depend on Social Security for at least half their income. A startling number of seniors get by on Social Security alone, even though the program was never intended to be recipients’ sole source of income.

How many people rely on social security?

We find that about half of the population aged 65 or older live in households that receive at least 50 percent of their family income from Social Security benefits and about 25 percent of aged households rely on Social Security benefits for at least 90 percent of their family income. What happens to Social Security if the debt ceiling isn t raised?

Do older Americans only receive Social Security in retirement?

Americans are concerned and even afraid for their retirement security. And the news headlines often don’t make them feel better. The latest is a claim from the National institute for Retirement Security that “A plurality of older Americans, 40.2 percent, only receive income from Social Security in retirement.” If true that’s very worrying.

How much social security do retirees get?

From the SIPP, NIRS declares that 40.2 percent of retirees receive all of their income from Social Security. And yet, a 2017 study by researchers at the Social Security Administration, also using the SIPP, found that only 19.6% of Americans 65 and over received at least 90% of their total incomes from Social Security.