You can’t deduct contributions to a Roth IRA, but earnings can grow tax-free, and qualified withdrawals are free of tax and penalties. Roth IRA withdrawal and penalty rules vary depending on your age, how long youve had the account, and other factors.

Have you ever wondered why some people are so obsessed with Roth accounts? It’s not just because they sound fancy – it’s because of the magic words “tax-free distributions.” But here’s the thing not all Roth distributions are created equal. To get that sweet tax-free money, your distribution needs to be “qualified.”

I’ve spent years helping clients understand the maze of retirement account rules and the question “what makes a Roth distribution qualified?” comes up constantly. Let’s break this down in simple terms so you can understand exactly what makes your Roth distribution qualified and how to avoid those nasty tax surprises.

The Two Core Requirements for a Qualified Roth Distribution

When it comes to Roth distributions. The IRS has two main requirements that must be met in order for your distribution to be “qualified” and not subject to any taxes.

Requirement #1: The Five-Year Rule

The first hurdle is the five-year holding period. People often get lost here, so pay close attention!

For a Roth IRA, the five-year clock starts ticking on January 1 of the tax year for which you made your first contribution to ANY Roth IRA. This is super important – it’s not five years from when you made each contribution, but five years from your very first contribution to any Roth IRA.

Let me give you a real example: If you made your first Roth IRA contribution for the 2024 tax year on April 10, 2025 (before the tax filing deadline), your five-year period actually started on January 1, 2024. So the five-year requirement would be satisfied on January 1, 2029.

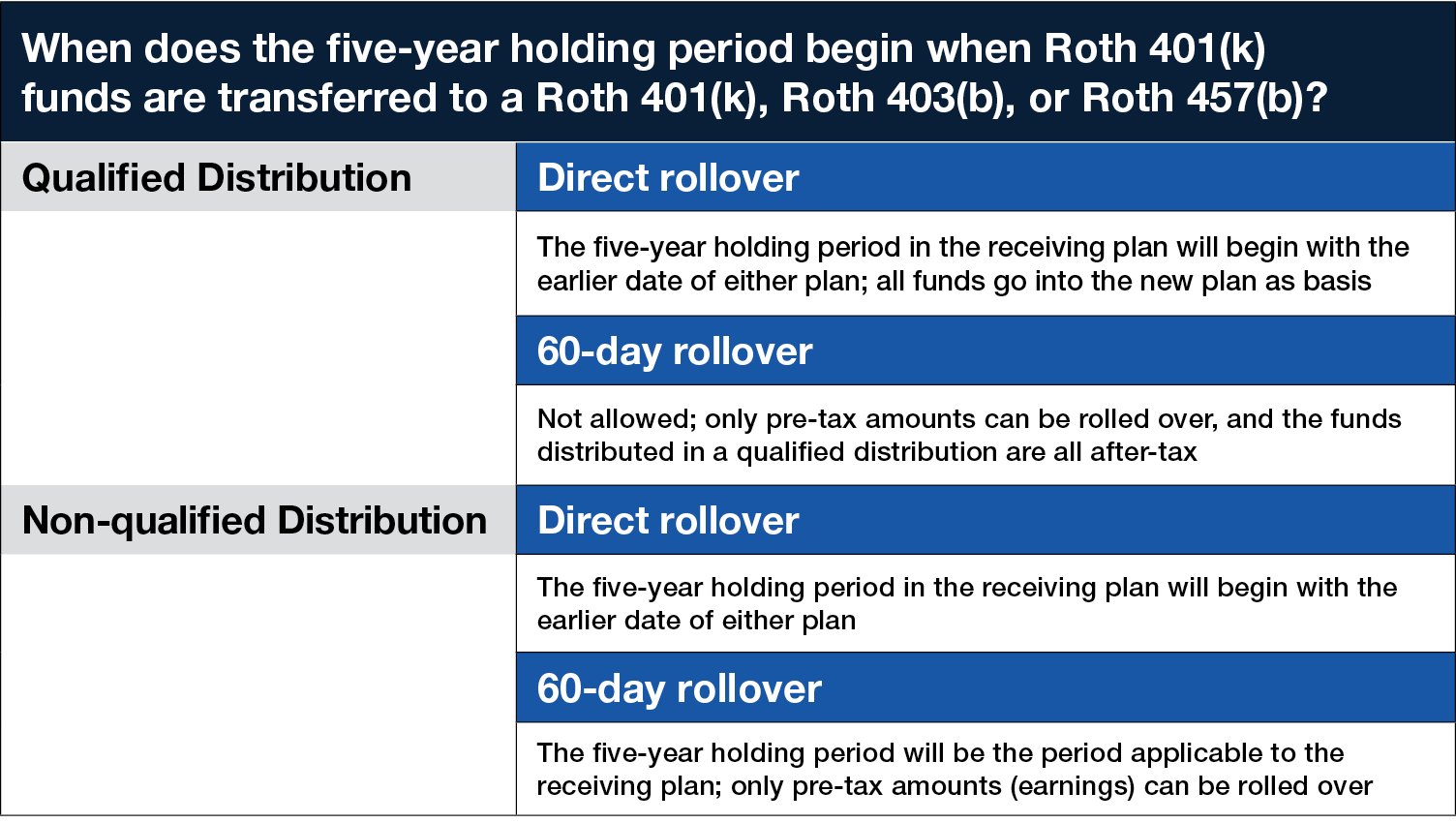

Things are a little different for Roth 401(k)s and Roth 403(b)s. Each Roth account set up through a different employer plan has its own five-year clock. When it comes to Roth IRAs, all of your Roth IRAs use the same five-year clock.

Requirement #2: A Qualifying Event Must Occur

The second requirement is that the distribution must be made under one of these specific circumstances:

- You’ve reached age 59½

- You’ve become totally and permanently disabled

- This means you cannot perform any substantial gainful activity due to a physical or mental impairment

- The distribution is made to a beneficiary or your estate after your death

- The withdrawal is for a first-time home purchase (up to a $10,000 lifetime limit)

- These funds must be used within 120 days of withdrawal

Both conditions must be met for a distribution to be valid. If you’re 60 years old but haven’t met the five-year rule, you can’t get your distribution. You also wouldn’t be able to take money out of your Roth if you’ve had it for 10 years but are only 55 years old (unless one of the other events listed above happens).

What Happens with Non-Qualified Roth Distributions?

If your distribution doesn’t meet both requirements above, it’s considered “non-qualified.” This doesn’t mean you’re completely out of luck – there are specific rules about how these distributions are taxed.

For non-qualified distributions, the IRS follows an ordering rule for withdrawals:

- Contributions come out first – Since you’ve already paid tax on these, they come out tax-free and penalty-free

- Conversion amounts come out next – These are generally tax-free but might be subject to a 10% penalty if withdrawn within five years of conversion by someone under 59½

- Earnings come out last – These are subject to ordinary income tax and potentially a 10% early withdrawal penalty

Here’s a real-world example: Let’s say you’re 50 years old and have a Roth IRA that you’ve had for 3 years. Inside is $20,000 of your contributions and $5,000 in earnings. If you take out $22,000, the first $20,000 (your contributions) comes out tax-free and penalty-free. The remaining $2,000 (part of your earnings) would be subject to both ordinary income tax AND a 10% early withdrawal penalty.

Different Types of Roth Accounts: Similar but Not Identical

It’s worth noting that the rules can vary slightly between different types of Roth accounts:

Roth IRAs

- No required minimum distributions (RMDs) at age 73

- Contributions can be withdrawn at any time tax-free and penalty-free

- Income limits may restrict who can contribute (2025 limits: MAGI under $150,000 for single filers, under $236,000 for married filing jointly)

- Maximum contribution for 2024: $7,000 ($8,000 if 50 or older)

Designated Roth Accounts (401(k)s, 403(b)s)

- Subject to RMDs at age 73 (or 70½ if you reached that age before January 1, 2020)

- Higher contribution limits: $23,000 for 2024 ($30,500 if 50 or older)

- No income limits for contributions

- Each plan has its own five-year holding period

- In-plan Roth rollovers are possible

Exceptions to the 10% Penalty (But Not Income Tax)

For non-qualified distributions where the 10% early withdrawal penalty would normally apply, there are several exceptions:

- Unreimbursed medical expenses exceeding 7.5% of your adjusted gross income

- Health insurance premiums during unemployment

- Qualified higher education expenses

- Distributions due to an IRS levy on the account

- Qualified reservist distributions

- Distributions that are part of a series of substantially equal periodic payments

Remember, these exceptions only waive the 10% penalty – you’d still owe ordinary income tax on any earnings withdrawn in a non-qualified distribution.

Special Considerations for Beneficiaries

If you inherit a Roth account, the rules get a bit more complicated:

- The five-year holding period is measured from when the deceased owner first contributed

- If the original owner met the five-year rule, you as the beneficiary are also considered to have met it

- The SECURE Act generally requires most non-spouse beneficiaries to withdraw all assets from an inherited Roth IRA by the end of the tenth year following the owner’s death

- Beneficiaries don’t have to take annual withdrawals and can allow the funds to grow tax-free for the entire period before withdrawing

Tax Reporting for Roth Distributions

When you take a distribution from a Roth account, the financial institution will report it on Form 1099-R. This form includes a code in Box 7 that indicates the nature of your withdrawal:

- A ‘Q’ means the custodian believes it’s a qualified distribution

- Codes like ‘J’ or ‘T’ indicate a potentially taxable, non-qualified distribution

If your distribution isn’t fully qualified, you’ll need to file Form 8606 (Part III) with your tax return to calculate the taxable portion of your withdrawal.

Strategies to Maximize Qualified Roth Distributions

Here are some practical strategies to make the most of your Roth accounts:

- Start the five-year clock early – Even a small Roth contribution starts your five-year clock

- Keep good records – Document when you made your first Roth contribution

- Consider Roth conversions strategically – Remember, converted funds have their own five-year rule for penalties

- Use your contributions first – If you need money before age 59½, withdraw contributions before touching earnings

- Plan rollovers carefully – If rolling from a Roth 401(k) to a Roth IRA, understand how the five-year rules interact

Common Mistakes to Avoid

I’ve seen people make these mistakes over and over:

- Assuming all Roth withdrawals are tax-free – Only qualified distributions are completely tax-free

- Forgetting about the five-year rule – Even if you’re over 59½, the five-year rule still applies

- Not keeping track of basis – You need records of your contributions and conversions

- Mixing up Roth IRA and Roth 401(k) rules – They have important differences

- Ignoring beneficiary considerations – Make sure your heirs understand the rules

Is a Roth Right for You?

Roth accounts offer amazing tax benefits, but they’re not for everyone. They work best when:

- You expect to be in a higher tax bracket in retirement

- You want to leave tax-free money to heirs

- You value tax diversification in retirement

- You don’t want to worry about RMDs (Roth IRAs only)

- You can let the money grow for at least five years

Final Thoughts

Understanding what makes a Roth distribution qualified isn’t just some academic exercise – it can save you thousands in taxes and penalties. The beauty of Roth accounts is that they can provide completely tax-free income in retirement, but only if you follow the rules.

I always tell my clients: “Contribute early, withdraw carefully, and keep good records.” With proper planning, your Roth can be one of your most powerful retirement tools.

Disclaimer: This article is for informational purposes only and does not constitute tax, investment, or legal advice. Everyone’s situation is different, so please consult with a qualified financial advisor or tax professional before making decisions about your retirement accounts.

Repayment of certain distributions

You may be able to pay all or a portion of certain distributions. Please consult with your tax advisor and learn more at IRS Publication 590-B.

Roth IRA withdrawal guidelines

Before taking money out of your Roth IRA, make sure you follow these rules to avoid getting hit with a penalty for taking money out too soon:

- Withdrawals must be taken after age 59½.

- Withdrawals must be taken after a five-year holding period.

- You have up to 60 days to put the check from the transfer of your Traditional or Roth IRA into another IRA without having to pay taxes or penalties. This is true no matter what age you are. This is called a “nontaxable rollover,” and you can only do it once every 12 months.

What are QUALIFIED Distributions From a Roth IRA?

FAQ

What is considered a qualified distribution from a Roth IRA?

What is the difference between a Roth qualified distribution and a normal distribution?

If you meet the requirements for a qualified withdrawal from your Roth account, your withdrawal is tax free. If the distribution from your account is a non-qualified withdrawal, any earnings included in withdrawal would be taxable income and subject to federal and state taxes.

What are the rules for taking distributions from a Roth IRA?

Roth IRA withdrawals are governed by a two-part rule: first, you must take out contributions (which are always tax-free) and then conversions and earnings (which are subject to taxes and potential penalties). Distributions are qualified if the account is at least five years old and you are 59½, disabled, a beneficiary after death, or using funds for a first-time home purchase (up to a $10,000 limit), making them tax- and penalty-free.

Which of the following is a requirement for a qualified distribution from a Roth IRA?

Requirements for a Qualified Withdrawal The account must be open for at least five years, with the five-year period starting on January 1 of the tax year in which you made the first contribution. For instance, if you opened a Roth IRA in April 2020, the account would meet the five-year requirements on January 1, 2025.

Is a Roth IRA distribution qualified?

A distribution also is qualified when taken as a series of equal periodic payments. A Roth IRA-qualified distribution includes a withdrawal of up to $10,000 if the withdrawal is for the purchase of a first home. However, any of the above distributions must have been made from a Roth IRA for at least five years.

What are the requirements for a qualified Roth IRA distribution?

Age: The person receiving the distribution must be at least 59½ years old at the time of the distribution. Account Age: The Roth IRA must have been established for at least five years before the distribution. Non-Qualified Roth Distributions: Subscribe to Empowering Your Financial Journey!.

What is a non-qualified distribution in a Roth IRA?

Non-qualified distributions are those that happen at any other time. Additionally, a Roth IRA must have been opened for at least five years for distributions to be qualified. Roth IRAs also aren’t subject to RMDs the way traditional IRAs are. That allows you to grow your money without triggering a tax penalty.

Is a Roth IRA distribution tax-free?

Whether a distribution is tax-free depends on if it meets the criteria to be considered “qualified. ” For a Roth IRA distribution to be qualified and tax-free, it must satisfy two conditions. The first is a five-year holding period, which starts on January 1 of the tax year for which the first contribution was made to any of your Roth IRAs.

What is a Roth IRA distribution?

A Roth IRA is an individual retirement account funded with post-tax dollars, meaning that taxes are paid upfront, allowing for tax-free withdrawals during retirement under qualifying conditions. A Roth IRA distribution will be considered qualified if it meets the age and time period requirements discussed earlier.

What types of distributions can I take from my Roth IRA?

There are two basic types of distributions you can take from your Roth IRA: qualified and non-qualified. Qualified distributions generally take place after the owner is 59 ½, or when they have a permanent disability or pass away. Non-qualified distributions are those that happen at any other time.