Are you ready for the greatest wealth transfer in history? Ready or not, it’s already happening!

It’s estimated that $70 trillion worth of assets will pass down from older to younger generations over the next two decades.1 That is a lot of money—and some of it might be heading your way.

But if you’re not careful, it’s easy to let an inheritance go to waste. In fact, more than one-third of all inheritors see no change or even a decline in their wealth after getting an inheritance.2

Did you catch that? Some folks are worse off after they inherit a financial windfall. But that doesn’t have to be your story. Your inheritance has the potential to change your family tree forever—so make it count!

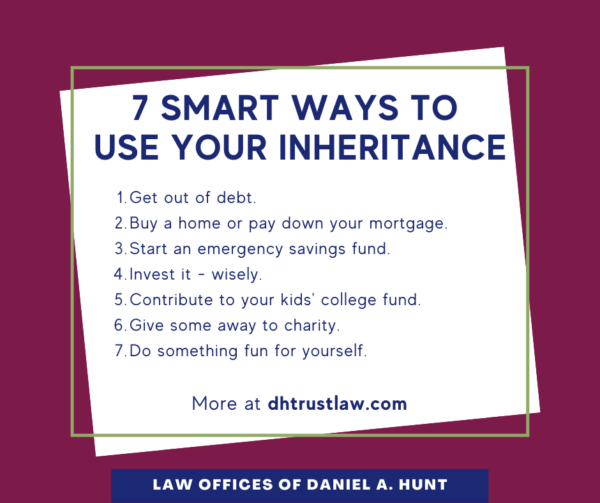

Receiving an inheritance can be a financial blessing, but it can also present some challenges if you don’t handle it wisely. With some planning and guidance, you can make the most of your inheritance and use it to improve your financial situation. Here is a look at some of the smartest things to do when you receive an inheritance.

Take Your Time Before Making Any Major Decisions

When you first receive an inheritance, it may be tempting to go out and make some big purchases or investments. However, it’s usually best to avoid any rash decisions. Take some time, even a few months, before doing anything major with your inheritance. This gives you time to think carefully, weigh your options, and develop a plan. Don’t feel rushed into putting the money anywhere right away.

Pay Off High-Interest Debt

One of the smartest things you can do with an inheritance is pay off any high-interest debt you may have, such as credit cards or personal loans. This can save you a lot in interest costs over time. Focus first on paying off debts with interest rates of 10% or higher. However even debts with lower rates such as student loans or auto loans, are good to pay down or pay off if possible.

Build Up Your Emergency Fund

A key part of any financial plan is having an emergency fund with three to six months of living expenses. If you don’t already have this, use part of your inheritance to build up your emergency savings. This fund protects you from having to go into debt to cover unexpected costs. It’s smart to keep this money in an accessible account such as a money market account.

Fund Your Retirement Accounts

Increasing your retirement savings is another smart move. Fund any retirement accounts that allow lump sum contributions, like IRAs and 401(k)s This can help you reach your retirement goals faster. If you already max out contributions, use the inheritance to open or build up a taxable brokerage account earmarked for retirement

Invest for Long-Term Growth

Once you check off some short-term financial goals invest the rest of your inheritance for long-term growth potential. This can include low-fee stock index funds target date funds, and other diversified investments suited to your risk tolerance. Avoid speculative investments like individual stocks or cryptos. Work with a financial advisor to develop an investing strategy.

Set Up Education Savings Accounts

If you have children you plan to send to college, you can use some of your inheritance to open or contribute to 529 plans and other education savings accounts. This can give your kids’ college funds a nice head start and make it easier to meet education goals.

Pay Down Your Mortgage

If you have a mortgage, putting part of your inheritance towards the principal can help you pay off your home faster and save money on interest. Run the numbers to see if this makes sense based on your mortgage rate. However, it’s smart to prioritize higher-interest debt first before making extra mortgage payments.

Update Your Estate Plan

Receiving an inheritance gives you a chance to update your own estate plan to specify how you want your assets passed on when the time comes. Work with an estate planning attorney to write or update your will and set up trusts, powers of attorney, and other components of a complete estate plan.

Enjoy Some of the Money

It’s perfectly fine to use a small portion of the inheritance to treat yourself and your family to something special in honor of your loved one. Just set a reasonable budget for this. Funding a dream vacation, remodeling your kitchen, or donating to a charity you care about can be meaningful ways to enjoy an inheritance.

Get Professional Advice

Managing an inheritance can involve various complex financial, legal, and tax considerations. Working with qualified financial, tax, legal, and investment professionals is key to navigating everything properly. Don’t go it alone. The right advisors can help you make wise moves and avoid costly mistakes.

The smartest thing to do when you receive an inheritance is avoid quick decisions and instead take some time to consult professionals and develop a thoughtful plan. Pay off debts, boost savings and investments, update estate plans, and use a portion to enjoy life more. With care and guidance, your inheritance can positively impact your finances for years to come.

Option 1: Take a lump sum payment.

This option is available for everyone.

This option has some advantages, especially if you’re trying to pay off debt or build an emergency fund, but it also comes with some drawbacks. The good news is you can take the lump sum payment without taking a 10% early withdrawal penalty and you’ll have access to that money right away.

The bad news is that you’ll have to pay taxes on the money if it was in a tax-deferred account—like a traditional IRA or traditional 401(k)—and lose out on any potential future growth from keeping the money invested.

Pay down your mortgage.

Can you imagine having no more house payments? Using part of your inheritance to pay down your mortgage can move you closer to that finish line and save you thousands of dollars in interest!

The Smartest Thing To Do With An Inheritance

FAQ

What’s the best thing to do with inheritance money?

If you inherit a large amount of money, take your time in deciding what to do with it. A high-yield savings account is a safe place to park the money while you make your decisions. Paying off high-interest debts such as credit card debt is one good use for an inheritance.

What is the best asset to inherit?

“Cash is king when it comes to leaving an inheritance,” said Carbone. “It’s the simplest asset to deal with in terms of a transfer.”May 27, 2025

How to be smart with inheritance money?

Stay Disciplined: Avoid impulsive spending. It can be tempting to make big purchases, but staying disciplined will help you make the most of your inheritance over time. By taking a thoughtful approach and considering your long-term goals, you can use your inheritance to build a secure financial future.

What not to do with an inheritance?

- Not Factoring in Potential Inheritance Taxes. …

- Failing to Make a Budget. …

- Spending Too Much. …

- Not Paying Off Debts. …

- Losing Other Income Sources. …

- Not Saving Enough. …

- Not Getting Expert Advice.

What can I do with my inheritance?

When you boil it all down, there are three things you can do with your money: give, save and spend. An inheritance is no different! Market chaos, inflation, your future—work with a pro to navigate this stuff. Just like you give every dollar an assignment in your monthly budget, it’s important to do the same thing with your inheritance.

What should I do if I receive a large inheritance?

When you receive a large inheritance, there are some basic financial steps to take to protect your future and ensure you end up better off financially after the inheritance. The first steps are the basis: Pay off high-interest debt like credit card debt and create an emergency fund.

How do I make wise decisions with inheritance money?

As you can see, making wise decisions with inheritance money takes some time and usually involves other advisors. But in the end, by investing your time in planning and research you’ll be able to enjoy your inheritance for many years to come.

How can I use my inheritance to save money?

One of the smartest ways to use part of an inheritance is to pay off high-interest debt. Credit card balances, personal loans, and other high-interest liabilities can erode your financial security over time. By paying off these debts, you free up more of your future income for saving, investing, or other priorities.

What should you do with an inheritance?

During this stressful and emotionally taxing time, you also find out that you’re receiving an inheritance, which can bring its own share of stress. Some smart inheritance planning can help you make the most of it. You just learned of the passing of a loved one.

How do I make the most of my inheritance?

Here’s our advice for making the most of your inheritance. Here’s the deal: When a loved one dies, you’re not thinking clearly enough to make major financial decisions. And in most cases, you don’t have to make any major decisions right away. There’s nothing wrong with letting your inheritance sit there for a while as you grieve.