With the Federal Reserve restarting its campaign of interest-rate cuts last week, markets may be entering a new phase that could create fresh opportunities for investors across a range of asset classes.

Historically, rate cuts have had mixed implications for markets. But there’s reason to believe that this time around, certain specific market segments—as well as some broad asset classes—could respond positively.

Ever looked at your savings account and wished it would magically multiply? You’re not alone! In today’s financial landscape, with interest rates fluctuating, simply keeping money in a bank account won’t help you reach ambitious financial goals If you’re wondering what is the best investment to double money, you’ve come to the right place

I’ve researched the most effective strategies to potentially double your investment, ranging from low-risk options to high-reward (but riskier) alternatives. Let’s dive into practical approaches that can help grow your wealth significantly.

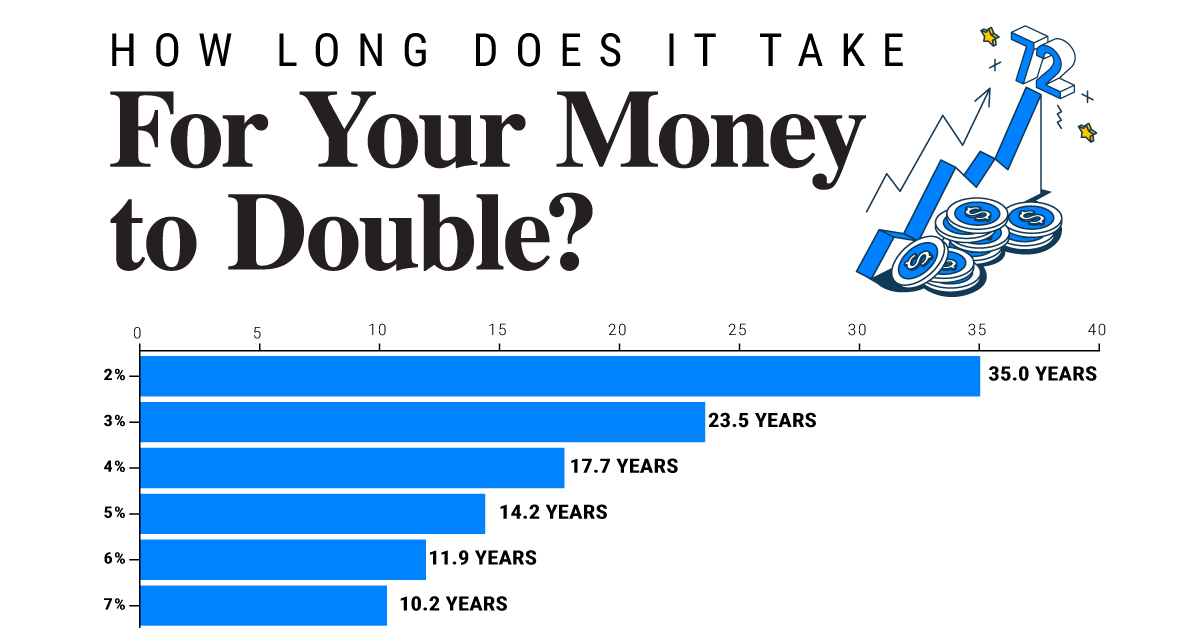

Understanding the Rule of 72: Your Guide to Doubling Money

Before jumping into specific investment options, let’s talk about a handy formula that helps estimate how long it’ll take to double your investment.

The Rule of 72 is beautifully simple:

Years to double your money = 72 ÷ assumed rate of return

For example, if you expect to earn 8% annually on your investment, divide 72 by 8, which equals 9. This means it would take approximately 9 years to double your $10,000 investment to $20,000

It’s worth noting that your actual returns will likely vary since markets are unpredictable, but this rule gives you a quick reference point for planning purposes.

Here’s how different rates of return affect your doubling timeline:

| Rate of Return | Years to Double |

|---|---|

| 2% | 36 years |

| 4% | 18 years |

| 6% | 12 years |

| 8% | 9 years |

| 10% | 7.2 years |

| 12% | 6 years |

Now, let’s explore the 6 best ways to potentially double your money.

1. Take Advantage of Your 401(k) Match

This is literally free money, people! If your employer offers a 401(k) match, this is hands down the easiest and lowest-risk way to double a portion of your money.

Many employers match a percentage of what you contribute to your retirement account. For instance, if you put in 5% of your salary, your employer might add another 5%. Just like that, you’ve doubled your contribution!

The only catch is that some companies require you to remain employed for a certain period (usually 3-4 years) before those matching funds are fully vested. But still, this is the closest thing to a guaranteed double in the investment world.

Plus, you get all the tax benefits of a 401(k) plan – either tax-deferred growth in a traditional 401(k) or tax-free growth in a Roth 401(k). Win-win!

2. Invest in S&P 500 Index Funds

If you’re looking for a relatively safe long-term strategy to double your money, S&P 500 index funds are worth considering. These funds track the performance of about 500 of America’s largest and most profitable companies.

The S&P 500 has historically returned an average of about 10% annually over long periods. At that rate, you could potentially double your money in just over 7 years (using our Rule of 72).

What I love about index funds:

- They’re less risky than investing in individual stocks

- They offer good diversification

- They require minimal expertise to get started

- They have low management fees

Remember, though, that returns in any single year can be significantly different from the long-term average. The market goes through cycles of ups and downs, but patience usually pays off for long-term investors.

3. Real Estate: Leverage Your Way to Doubling

Real estate might not seem like the quickest way to double your money, but thanks to the power of leverage (using a mortgage), it can be surprisingly effective.

Here’s a simple example of how it works:

Imagine buying a $200,000 home with a 20% down payment of $40,000. How much does your home value need to increase for you to double your initial investment? Just 20%!

When your home appreciates to $240,000, you’ve gained $40,000 in equity, effectively doubling your original $40,000 down payment. That’s a 100% return on your initial investment!

Of course, owning a home comes with additional expenses like maintenance, property taxes, and mortgage payments. But you’d have to pay for housing anyway (rent), and homeownership gives you the potential upside of appreciation.

4. Bonds and Fixed Income for Conservative Investors

While bonds typically won’t double your money as quickly as some other investments on this list, they can be a more conservative option for those who prioritize capital preservation.

Looking at historical data, US fixed income has averaged returns of around 3.96%, meaning it would take about 18 years to double your investment using the Rule of 72. This is significantly longer than some other options, but comes with lower risk.

For comparison, certificates of deposit (CDs) have averaged around 4.41% recently, which would double your money in approximately 16 years.

Bonds and fixed-income investments are particularly suitable for:

- People approaching retirement

- Conservative investors

- Those who need income rather than growth

- Investors looking to balance riskier assets in their portfolio

5. Cryptocurrency: High Risk, High Potential Reward

Cryptocurrencies like Bitcoin, Ethereum, and others have created some remarkable wealth in recent years. For example, Bitcoin surged from under $20,000 in late 2022 to more than $100,000 by late 2024 – way more than doubling in just over two years!

However, the crypto market is extremely volatile. These digital assets can experience wild price swings in short periods, making them among the riskiest investments on this list.

If you’re considering crypto as a way to double your money:

- Only invest what you can afford to lose

- Do your research on specific cryptocurrencies

- Consider dollar-cost averaging instead of lump-sum investing

- Be prepared for significant volatility

- Have a clear exit strategy

Cryptocurrency investing isn’t for everyone, and it’s definitely not a place to put money you need in the short term. But for those willing to accept the risks, it has demonstrated potential for substantial returns.

6. Options Trading: Not for the Faint-Hearted

Options trading is one of the fastest ways to double your money – or lose it all. This is definitely in the high-risk, potentially high-reward category.

When trading options, you’re essentially buying the right (but not obligation) to purchase or sell a stock at a specific price by a specific date. The two main types are:

- Call options: Give you the right to buy a stock at a set price

- Put options: Give you the right to sell a stock at a set price

The premium you pay for an option contract could increase many times in value if the underlying stock moves significantly in your favor. However, the option could also expire completely worthless.

Options trading requires knowledge, experience, and a strong stomach for risk. I wouldn’t recommend it for beginners or for any significant portion of your investment portfolio.

Comparing the Options: Which Is Best for You?

Let’s compare these options based on risk level, potential time to double, and expertise required:

| Investment Option | Risk Level | Approximate Time to Double | Expertise Required |

|---|---|---|---|

| 401(k) Match | Very Low | Immediate | Minimal |

| S&P 500 Index Fund | Moderate | 7-10 years | Low |

| Real Estate | Moderate | 3-7 years | Moderate |

| Bonds/Fixed Income | Low | 16-18 years | Low-Moderate |

| Cryptocurrency | Very High | 1-5 years (highly variable) | Moderate-High |

| Options Trading | Extremely High | Days to months (or never) | Very High |

Final Thoughts: Balance Risk and Reward

The “best” investment to double your money depends entirely on your:

- Risk tolerance

- Time horizon

- Financial goals

- Current financial situation

- Investment knowledge

For most people, I’d recommend starting with the safest options like maxing out any employer 401(k) match, then considering index funds for long-term wealth building. Real estate can be an excellent middle-ground option when you’re ready to make a larger commitment.

Higher-risk options like cryptocurrency and options trading should generally make up only a small portion of your overall investment strategy, if any at all.

Remember, get-rich-quick schemes often lead to get-poor-quick results! Sustainable wealth-building usually takes time and patience. The tortoise really does often beat the hare when it comes to investing.

What’s your experience with any of these investment strategies? I’d love to hear which approaches have worked best for you in the comments below!

US stocks: A potential broad lift from falling rates

Rate cuts alone aren’t always bullish for stocks. What really matters is why the Fed is cutting. When the Fed has cut rates because it must—in response to a recession—returns have been poor. When the Fed has cut rates because it may—meaning inflation is low and growth is slowing but not negative—returns have been strong.

Much has been made of recently reported weakness in the job market, with some investors extrapolating that this weakness is a sign of looming recession. But remember that jobs numbers are inherently a backward-looking indicator—they only tell us where the ball has been, and not necessarily where it’s going.

“What I find more convincing are certain leading indicators, meaning metrics that turn before the economy does,” says Chisholm. For example, CEO business confidence—meaning the confidence CEOs have about their own business conditions—saw a big jump recently, rising 30% over the previous quarter. CEOs generally have well-informed views shaped by the concrete outlook for their businesses. In the past, jumps in confidence like this have been leading indicators of future earnings growth and economic growth.

“This is not to say that recession is completely off the table as a possibility, but I believe recession risks are limited right now,” says Chisholm. “If the economy does keep growing, it could create very bullish conditions for US stocks.”

In fact, in past periods with similar conditions, stocks got a lift not only from rising expected earnings growth, but also from rising valuations like price-earnings ratios (PEs).

Read more about why rate cuts could be bullish.

Homebuilders: Poised for a rebound in the housing market

Few segments of the economy are as sensitive to interest rates as the housing market. After a prolonged deep freeze in home sales—driven by affordability challenges and high mortgage rates—the housing market could finally be ready to thaw. Such a turnaround could be bullish for homebuilders.

One key to a continuing rebound? Whether Fed rate cuts translate into lower long-term yields and mortgage rates. That link didn’t hold a year ago as the Fed was cutting rates, but if mortgage rates fall this time, demand for new and existing homes could rise—and homebuilder stocks, which have been trading at low relative valuations, could benefit.

Historically, when homebuilder stocks have been this cheap and long-term rates have fallen, they’ve outperformed nearly 80% of the time. Even if home prices were to decline, those low valuations may help cushion the potential downside.

“Homebuilders offer the closest correlation to home sales that you can find in the stock market, and the risk-to-reward ratio on these stocks looks appealing to me in the current environment,” says Denise Chisholm, director of quantitative market strategy with Fidelity.

Read more about the case for homebuilder stocks.

What’s the Best Way To Invest $200,000?

FAQ

What investment doubles money the fastest?

Trading options is one of the fastest ways to double your money — or lose it all. Options can be lucrative but also quite risky. And to double your money with them, you’ll need to take some risk. The biggest upsides (and downsides) in options occur when you buy either call options or put options.

How to turn $10,000 into $100,000 quickly?

How to turn $1000 into $5000 in a month?

- Stock Market Trading. …

- Cryptocurrency Investments. …

- Starting an Online Business. …

- Affiliate Marketing. …

- Offering a Digital Service. …

- Selling Stock Photos and Videos. …

- Launching an Online Course. …

- Evaluate Your Initial Investment.

What will $10,000 be worth in 10 years?

The table below shows the present value (PV) of $10,000 in 10 years for interest rates from 2% to 30%. As you will see, the future value of $10,000 over 10 years can range from $12,189.94 to $137,858.49.