There are pros and cons to NPS that you should carefully consider before putting money into it. If choosing to invest in NPS is your decision, then remember to check the key benefits and limitations that tag along. We will talk about the important benefits of the National Pension System in this blog post so that you can make an informed choice about your financial future.

Concerned about your life after retirement? Not sure how you’ll handle your money now that you’re not working? The National Pension System (NPS) could be the answer you’ve been looking for!

I’ve been researching retirement options for quite some time now, and NPS consistently stands out as one of the best long-term investment plans for securing your golden years. Let’s dive deep into what NPS is all about and why it could be a game-changer for your retirement planning.

What is the National Pension System (NPS)?

The National Pension System is a government-sponsored pension scheme launched on January 1, 2004. It was initially introduced for new government recruits (except armed forces) but was later extended to all citizens of India on a voluntary basis from May 1, 2009.

NPS aims to provide financial security and stability during old age when people don’t have a regular source of income. It’s regulated by the Pension Fund Regulatory and Development Authority (PFRDA), which was established on October 10, 2003, to develop and regulate India’s pension sector.

The primary objective of NPS is to

- Institute pension reforms

- Inculcate the habit of saving for retirement among citizens

- Provide a structured platform for retirement planning

Who Can Join NPS?

The eligibility criteria for joining NPS are pretty straightforward:

- You must be an Indian citizen (resident or non-resident)

- You should be between 18 and 70 years of age

- You need to comply with Know Your Customer (KYC) norms

- You should be legally competent to execute a contract as per the Indian Contract Act

Please keep in mind that Overseas Citizens of India (OCIs), Persons of Indian Origin (PIOs), and Hindu Undivided Families (HUFs) cannot join the NPS. An NPS account is an individual account, so it can’t be opened for someone else.

Types of NPS Accounts

NPS offers two types of accounts to cater to different investment needs:

1. Tier-I Account

This is a non-withdrawable retirement account and forms the basis of the NPS. Key features include:

- Mandatory for: Government employees; optional for others

- Minimum contribution: Rs. 500 per contribution and Rs. 1,000 per year

- Withdrawals: Restricted until age 60 (partial withdrawals allowed in specific cases)

- Tax benefits: Available under Section 80C (up to Rs. 1.5 lakh) + Section 80CCD(1B) (additional Rs. 50,000)

2. Tier-II Account

This is a voluntary savings facility that offers more flexibility. Features include

- Eligibility: Only those who have an active Tier-I account

- Minimum contribution: Rs. 250 per contribution (no annual minimum)

- Withdrawals: Fully flexible – can withdraw anytime

- Tax benefits: Generally no tax benefits, except for government employees (under Section 80C with 3-year lock-in)

Latest Updates on NPS in 2025

The government has launched the Unified Pension Scheme (UPS) effective from April 1, 2025, available to central government employees and retired NPS subscribers. Retired NPS subscribers now have the option to migrate from NPS to UPS.

UPS, on the other hand, guarantees a minimum pension amount of Rs. 10,000. The tax breaks that were given to NPS are now also available to UPS.

Investment Options in NPS

One thing I love about NPS is that it gives you a lot of options for investments. There are two primary ways to invest:

1. Active Choice

You can actively choose how your funds are allocated across different asset classes:

- Equity (E): Max cap of 50-75% (50% for government employees and senior citizens)

- Corporate Bonds (C)

- Government Securities (G)

- Alternative Investment Funds (A)

2. Auto Choice (Lifecycle Fund)

If you’re not confident about making investment decisions, this option automatically adjusts your portfolio based on your age:

- The younger you are, the higher your equity exposure

- As you grow older, the allocation gradually shifts toward less risky options

Benefits of NPS: Why Should You Consider It?

Now, let’s talk about the real reason you’re here – the benefits of NPS!

1. Tax Benefits

NPS offers some fantastic tax advantages:

For Tier-I Account:

- Self-contribution: Deduction of up to Rs. 1.5 lakh under Section 80CCD(1) within the overall limit of Section 80CCE

- Additional deduction: Exclusive Rs. 50,000 deduction under Section 80CCD(1B)

- Employer’s contribution: Deduction up to 10% of salary under Section 80CCD(2) (14% for central government employees)

- Withdrawal benefits: 60% of the corpus withdrawn as a lump sum is tax-free

For Tier-II Account (with 3-year lock-in):

- Deduction under Section 80C up to Rs. 1.5 lakh (subject to the overall limit)

2. Low Fund Management Charges

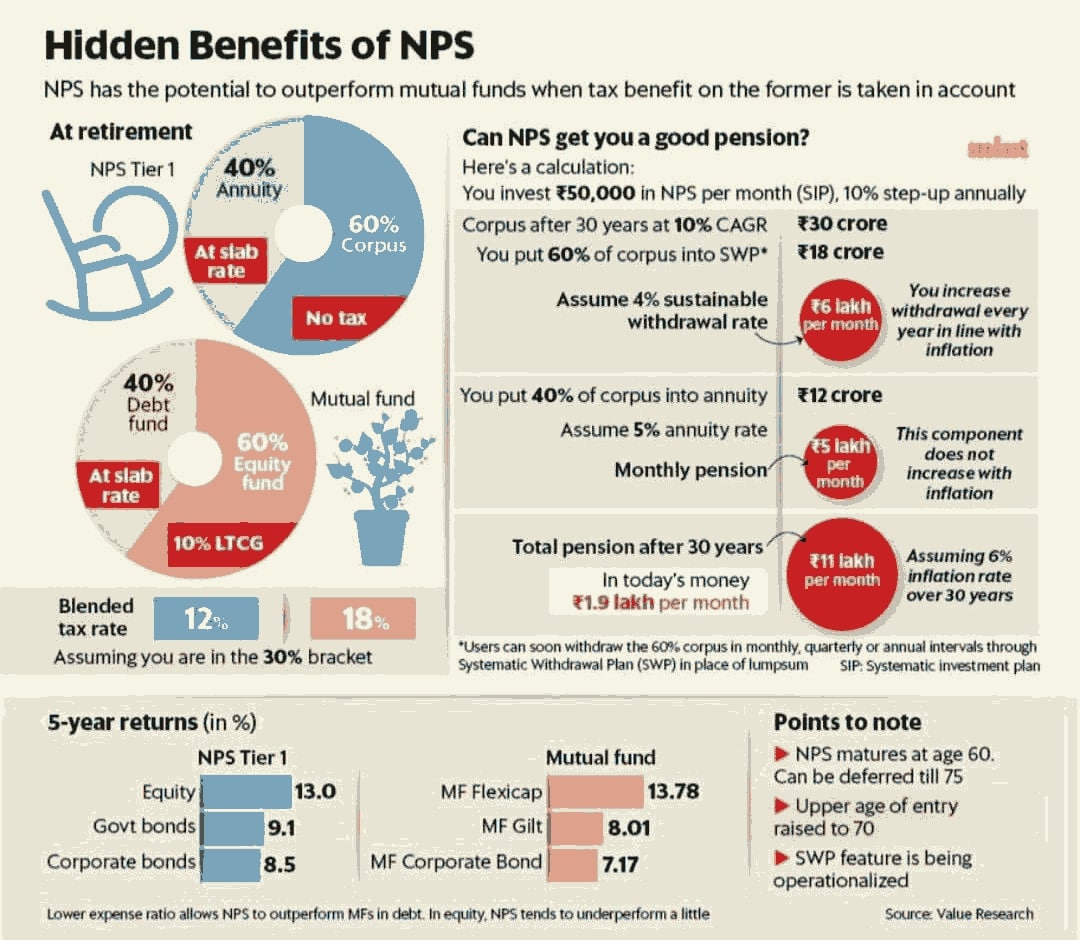

NPS has one of the lowest fund management charges in the industry, typically around 0.01% to 0.03%. This means more of your money goes toward your retirement corpus rather than fees.

3. Market-Linked Returns

Unlike fixed-interest schemes, NPS gives you the opportunity to earn potentially higher returns through market-linked investments. Historical performance shows returns ranging from 11% to 20% annualized, though past performance doesn’t guarantee future results.

4. Flexibility and Portability

- You can change your fund manager once a year if you’re not satisfied with their performance

- The account is portable across jobs and locations

- You can operate your account online from anywhere

- Contributions can be made at any time during the financial year

5. Partial Withdrawal Facility

After three years of joining NPS, you can withdraw up to 25% of your contributions (not the total corpus) for specific purposes like:

- Higher education of children

- Marriage of children

- Purchase/construction of residential house

- Treatment of specified illnesses

6. Systematic Withdrawal Plan

Upon retirement, you can opt for a systematic withdrawal plan at regular intervals (monthly, quarterly, half-yearly, or yearly) instead of taking a lump sum.

NPS Withdrawal Rules

Understanding the withdrawal rules is crucial before investing in any long-term scheme:

Upon Reaching 60 Years or Superannuation:

- You can withdraw up to 60% of the corpus as a lump sum (tax-free)

- The remaining 40% must be used to purchase an annuity that provides monthly pension

- If your total corpus is up to Rs. 5 lakh, you can withdraw the entire amount without buying an annuity

Premature Exit (Before 60 Years):

- At least 80% of the pension corpus must be used to purchase an annuity

- If the total corpus is less than or equal to Rs. 2.5 lakh, you can opt for 100% lump sum withdrawal

Upon Death of the Subscriber:

- The entire accumulated corpus (100%) is paid to the nominee/legal heir

NPS vs Other Retirement Options

Let’s compare NPS with some popular retirement options:

| Feature | NPS | PPF | EPF | UPS |

|---|---|---|---|---|

| Returns | Market-linked (11-20%) | Fixed (7.1% currently) | Fixed (8.15% currently) | Guaranteed minimum pension |

| Tax benefits | Up to Rs. 2 lakh | Up to Rs. 1.5 lakh | Tax exempt | Same as NPS |

| Lock-in period | Until retirement | 15 years | Until retirement | Until retirement |

| Liquidity | Partial withdrawal allowed | Partial withdrawal allowed | Partial withdrawal allowed | Limited |

| Min. pension amount | No guarantee | N/A | N/A | Rs. 10,000 guaranteed |

How to Open an NPS Account?

Opening an NPS account has become super easy! You can do it in less than 30 minutes online. Here’s how:

- Visit enps.nsdl.com

- Link your account to your PAN, Aadhaar, and mobile number

- Validate the registration using the OTP sent to your mobile

- This will generate a PRAN (Permanent Retirement Account Number)

- Use this PRAN for future NPS logins

Alternatively, you can visit any Point of Presence (POP) like banks or post offices to open your account.

NPS Charges

Understanding the charges involved is important for any investment decision:

| Intermediary | Charge Head | Service Charges |

|---|---|---|

| CRA | PRA Opening charges | Rs. 50 |

| CRA | Annual PRA Maintenance cost | Rs. 190 |

| CRA | Charge per transaction | Rs. 4 |

| POP | Initial subscriber registration | Rs. 100 |

| POP | Initial contribution upload | 0.25% (min Rs. 20, max Rs. 25,000) |

| POP | Subsequent contribution | 0.25% (min Rs. 20, max Rs. 25,000) |

| POP | Non-contribution transaction | Rs. 20 |

Is NPS Right for You?

While NPS offers numerous benefits, it may not be suitable for everyone. Consider these factors:

- Long-term commitment: NPS is primarily a retirement-focused investment with limited liquidity

- No guaranteed returns: Unlike some government schemes, returns are market-linked

- Mandatory annuity purchase: You must use at least 40% of the corpus to buy an annuity

In my opinion, NPS is excellent for those who:

- Are disciplined savers looking for a long-term retirement solution

- Want additional tax benefits beyond the standard Section 80C options

- Prefer a regulated, government-backed pension system

- Are comfortable with some market exposure for potentially higher returns

Final Thoughts

The National Pension System is a well-structured retirement plan that helps you build a substantial corpus for your golden years while enjoying tax benefits along the way. Its flexibility in investment choices, low charges, and tax advantages make it an attractive option for retirement planning.

I’ve personally started investing in NPS a couple years back, and the experience has been pretty smooth. The online portal is user-friendly, and the ability to track my investments has given me peace of mind about my retirement planning.

Remember, retirement planning should start early. As the saying goes, “The best time to plant a tree was 20 years ago. The second best time is now.” So, if you haven’t started planning for your retirement yet, perhaps it’s time to consider NPS as an option!

Have you already invested in NPS or are you planning to? What other retirement plans do you have? Share your thoughts and experiences in the comments below!

Limitations Under NPS (National Pension System)

Benefits and limitations of NPS should be understood before investing. There are some good things about the National Pension Scheme (NPS), but there are also some bad things that potential investors should know about.

- Limited Liquidity: One big problem with NPS is that you can’t take money out until you retire. You can, however, take out some of your money after a few years, but only under certain circumstances.

- Required Annuity Purchase: The NPS wants you to buy a mandatory 20%2040%20annuity when it matures. This means that the returns may be lower than with market-linked investments.

- Annuity Income Tax: The annuity income you get after retirement is taxed, which could lower your net retirement income.

- Market-Linked Risks: Returns are higher than with traditional savings plans, but they aren’t guaranteed and depend on how the market does.

- You can choose how to allocate your assets up to a certain point, but you can’t freely switch between different investment products.

- Complex Exit Rules: There are a lot of rules about early withdrawals and exits, and they might not work for everyone.

Benefits of NPS (National Pension System) Scheme

There are a lot of good things about the National Pension System (NPS) scheme for people who want to plan ahead for a safe retirement.

Two major options for investment management come with NPS: Auto Choice and Active Choice. With the Auto Choice option, your investments are managed by fund managers who spread them out among stocks, bonds, and government bonds based on their knowledge. In contrast, active choice gives you the freedom to manage your assets in the way that works best for you. For example, guidelines say that you should keep 20% of your total investment in stocks until you turn 25 years old.

One of its interesting features is that NPS allows partial withdrawals from Tier I accounts. Partial withdrawals from Tier I accounts are allowed after three years of subscription, with up to 25% of contributions allowed for specific purposes such as higher education, marriage, or medical treatment. Maximum three such withdrawals can be made with a gap of at least five years between each withdrawal. The condition of withdrawal after 5 years gap is waived for medical treatment and for those who subscribe after 60 years of age.

Large tax reliefs are given by the NPS scheme. Section 80CCD(1) grants tax deduction till Rs. 1,50,000 for contribution made towards the scheme annually. Besides Section 80CCD(2) provides tax benefits for employer contributions up to 10% of the employees salary (basic + DA). There is a further provision for voluntary contributions up to Rs. 50,000 exempted from tax purposes in this regard when he pays employees’ statutory retirement benefits like pension contributions etc.

Learn more about NPS tax benefits

Low Cost: NPS is a cost-effective investment option, with low fund management charges. This way, you can be sure that more of your money is invested toward building a large retirement corpus.

Power of Compounding: With regular contributions, NPS calls for a long-term investment where you can watch your money grow exponentially through compounding.

All you need to know about NPS (National Pension Scheme) by CA Rachana Ranade

FAQ

What are the benefits of taking NPS?

When you open an NPS account, you are given a “Permanent Retirement Account Number” (PRAN), which is a unique 12-digit number that you will always have. NPS also offers Tax benefits under the Income Tax Act 1961. You get seamless portability across jobs, sectors and locations with NPS.

How much pension do I get from NPS?

The aforesaid NPS calculation is based on the assumption that Mr A opts for a 60% lump sum withdrawal and invests 40% in an annuity plan from an Annuity Service Provider (ASP). This will generate a monthly pension of Rs. 93,464 at a return on annuity of 8% for the lifetime.

What are the disadvantages of NPS?

Disadvantages of the NPSYou must be an NPS subscriber for at least 3 years to request a partial withdrawal. You can withdraw up to 3 times from your NPS account during your entire subscription period. You can withdraw up to 25% of your own contributions (not your employer’s contributions).

Can I withdraw 100% from NPS?

One hundred percent lump sum withdrawal is allowed if the corpus is less than or equal to twenty-eight lakh rupees. If the corpus is more than ₹ 5 Lakh, at least 40% of the accumulated pension wealth of the Subscriber has to be utilized for purchase of an Annuity and the balance 60% is paid as lump sum.

How does the NPS scheme work?

When subscribers retire, they can take out some of the money they’ve saved, and the rest is turned into a monthly pension, which gives them a steady income in their later years. Initially, the NPS scheme was mandatory for Central Government employees joining on or after January 1, 2004.

What are the benefits of NPS?

However, there must be a minimum gap of five years between any two withdrawals, except in the case of medical emergencies. One of the key benefits of the NPS is that it allows you to build a substantial corpus for your retirement. However, this is not the only benefit of NPS; there are other benefits also:

What is the National Pension Scheme (NPS)?

With its portability across jobs and locations and tax-saving advantages under Sections 80C and 80CCD, the NPS offers a flexible and efficient way to prepare for a financially secure retirement. The National Pension Scheme (NPS) is a popular choice for retirement savings due to its many benefits. Here’s a simple breakdown:

What does NPS mean?

National Pension Scheme (NPS) is a government-regulated retirement plan for individuals aged 18-70, offering tax benefits and returns of 9%-12%. The full form of NPS is National Pension Scheme. Launched by the Government of India, this scheme is designed to offer long-term financial security to Indian citizens after retirement.

What are the tax benefits provided by NPS scheme?

The tax benefits provided to NPS is also extended to UPS. Unlike other investment options, it offers returns as per market performance, without offering a fixed interest. This article explains in detail the eligibility, features and withdrawal rules for NPS scheme. To promote savings and investments, and help the citizens to plan their retirement.

What are the benefits of National Pension System (NPS)?

Some of the benefits of the National Pension System (NPS) are: It is transparent – NPS is transparent and cost effective system wherein the pension contributions are invested in the pension fund schemes and the employee will be able to know the value of the investment on day to day basis.