The Walt Disney Company (DIS) has long been a household name for entertainment, but what about as an investment? If you’re considering Disney stock for income, you’ll want to understand its dividend yield. As of November 10, 2025, Disney’s current dividend yield stands at 0.90% with a TTM (trailing twelve months) dividend payout of $1.00 per share.

But what does this really mean for investors? Is Disney a good dividend stock? Let’s dive into everything you need to know about Disney’s dividend yield and history

What Is Dividend Yield?

Before we jump into Disney specifics, let’s clarify what dividend yield actually is.

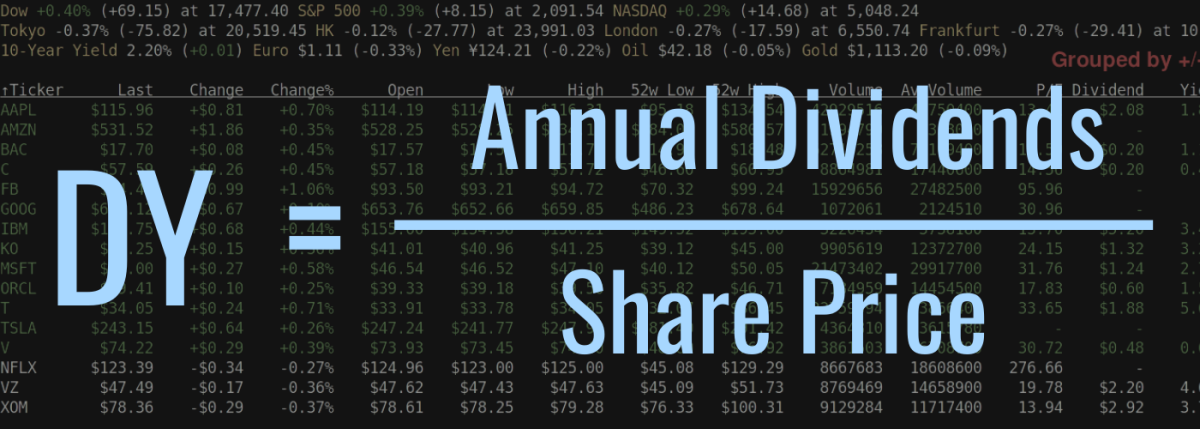

Dividend yield is the percentage return a company pays out to shareholders relative to its current stock price. It’s calculated by:

Dividend Yield = Annual Dividends Per Share ÷ Stock Price × 100%

For example, with Disney’s current annual dividend of $1.00 per share and its stock price (as implied by the 0.90% yield), we can determine Disney shares are trading around $111 per share.

Disney’s Current Dividend Status

As of November 2025, here’s where Disney stands with its dividend:

- Current dividend yield: 0.90%

- TTM dividend payout: $1.00 per share

- Market capitalization: $199.103 billion

- Revenue: $91.361 billion

This yield puts Disney on the lower end compared to some other dividend-paying stocks. For context the average S&P 500 dividend yield historically ranges between 1.5% to 2%.

Disney’s Dividend History

Disney has had an interesting journey with its dividend over the 41 years tracked by MacroTrends. The company suspended its dividend during the COVID-19 pandemic in 2020, which was a significant move considering its previous reputation as a reliable dividend payer.

Before the suspension, Disney had been consistently paying and even increasing its dividend for many years. The company was actually approaching Dividend Aristocrat status (25+ years of consecutive dividend increases) before the pandemic forced their hand.

The good news for income investors is that Disney has restored its dividend, though at a more modest level than pre-pandemic.

How Disney Compares to Industry Peers

Disney operates in the Media Conglomerates industry within the Consumer Discretionary sector. Here’s how it compares to some industry peers:

| Company | Market Cap | Dividend Yield (approx) |

|---|---|---|

| Disney (DIS) | $199.103B | 0.90% |

| Paramount Skydance (PSKY) | $10.181B | Lower/None |

| Nexstar Media (NXST) | $5.780B | Higher |

| Sinclair (SBGI) | $1.143B | Higher |

Within its industry, Disney has one of the largest market caps but not necessarily the highest dividend yield. Some smaller media companies offer higher yields, though often with different risk profiles.

Factors Affecting Disney’s Dividend Yield

Several key factors influence Disney’s dividend yield:

-

Streaming investments – The company continues to invest heavily in Disney+, ESPN+, and Hulu, which impacts available cash for dividends

-

Theme park recovery – The post-pandemic recovery of Disney’s theme parks has been strong but required significant reinvestment

-

Content production costs – Creating premium content for both theatrical release and streaming platforms requires massive capital

-

Competition – Disney faces fierce competition from Netflix, Amazon Prime, and other streaming services

-

Corporate strategy – The current management team has prioritized growth and debt reduction over maximizing dividends

Is Disney a Good Dividend Stock?

This is where I gotta be honest with you – whether Disney is a good dividend stock depends entirely on your investment goals.

If you’re looking for high current income, Disney probably isn’t your best bet with its 0.90% yield. Many utilities, REITs, and some consumer staples companies offer yields 3-4 times higher.

However, if you’re looking for a blend of potential growth and some income, Disney might deserve consideration. The company has several competitive advantages:

- Unmatched content library including Marvel, Star Wars, Pixar and Disney classics

- Irreplaceable theme park assets that generate steady cash flow

- ESPN’s dominance in sports media

- Global brand recognition that few companies can match

Disney’s Dividend Outlook for the Future

Looking ahead, Disney’s dividend has room to grow as the company continues its post-pandemic recovery. Several factors could positively impact future dividend growth:

-

Streaming profitability – As Disney+ and other streaming services reach scale and profitability, more cash could become available for dividends

-

Park expansion – New attractions and international park growth could increase cash flow

-

Debt reduction – As Disney pays down debt acquired during the pandemic and from the Fox acquisition, more resources could be directed to shareholders

However, we must also consider potential risks:

-

Economic sensitivity – Theme park attendance and advertising revenue are cyclical

-

Streaming competition – The battle for subscribers remains fierce

-

Content costs – Creating premium content continues to become more expensive

How to Evaluate Disney’s Dividend

When analyzing Disney’s dividend, look beyond the current yield. Consider these factors:

Dividend Growth Potential

Despite the current modest yield, Disney may have room to increase dividends as its business segments recover and grow.

Dividend Payout Ratio

Disney currently has a conservative payout ratio, indicating room for future increases if management chooses to prioritize dividends.

Total Return Potential

Disney offers a combination of modest income and potential capital appreciation. The total return (dividends plus stock price growth) matters more than yield alone.

Company Fundamentals

Disney remains fundamentally strong with diverse revenue streams across media, entertainment, and theme parks.

Should You Invest in Disney for the Dividend?

If your primary investment goal is current income, Disney probably shouldn’t be your first choice with its 0.90% yield. Other sectors like utilities, telecommunications, or certain REITs typically offer much higher yields.

However, if you’re looking for a balanced approach with some income and growth potential, Disney might deserve a place in your portfolio. The company has demonstrated its ability to adapt through multiple technological transitions over its nearly century-long history.

I personally view Disney as a growth stock with a dividend bonus rather than as a true income stock. The dividend is nice to have, but the main investment thesis centers around the company’s ability to monetize its incredible content library and unique entertainment experiences.

Alternatives to Disney for Dividend Investors

If you’re specifically seeking higher dividend yields, consider these alternatives:

- Telecommunications companies – Often offer yields in the 4-7% range

- Utilities – Typically provide stable yields of 3-5%

- REITs – Many real estate investment trusts yield 4-6%

- Consumer staples – Companies like Coca-Cola or Procter & Gamble often yield 2-4%

- Energy companies – Many oil and gas companies offer higher yields, though with more volatility

Key Takeaways About Disney’s Dividend

To summarize what we’ve learned about Disney’s dividend yield:

- Disney currently offers a 0.90% dividend yield with a $1.00 per share annual payout

- The company suspended dividends during the pandemic but has since reinstated them

- Disney’s yield is lower than many income-focused stocks but comes with growth potential

- The company has multiple strengths that could support dividend growth over time

- Investors seeking primarily income should look to other sectors for higher yields

Final Thoughts

Disney remains one of the world’s most recognizable brands with a diversified business model spanning theme parks, movies, television, and streaming services. While its current dividend yield of 0.90% won’t excite pure income investors, the company offers a combination of modest income and growth potential.

As with any investment, consider how Disney fits into your overall portfolio strategy and investment goals. The company’s dividend should be viewed as just one component of its total return potential rather than its primary attraction for investors.

If you’re building a diversified portfolio, Disney could serve as part of your growth allocation that happens to pay a small dividend, rather than as a core holding in your income-generating assets.

Remember that investment decisions should be based on your personal financial situation, goals, and risk tolerance. Always consider consulting with a financial advisor before making significant investment changes.

Have you considered investing in Disney for its dividend? What other dividend stocks are you looking at? I’d love to hear your thoughts and experiences!

Understand Dividend Yield to get VERY RICH

FAQ

Does Disney pay a good dividend?

)

and it has a history of dividend cuts, although it has recently begun to increase the dividend again after a suspension.Is Disney paying dividends again?

Who pays the highest dividend yield?

What will Disney stock be worth in 10 years?