“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

The advice in this article is offered by the team independent of any bank or credit card issuer. This article may contain from our partners, and terms may apply to offers linked or accessed through this page. as of posting date, but offers mentioned may have expired. Bankrate logo

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

Having a bad credit score can feel overwhelming. You may worry about getting approved for loans or credit cards and feel like you’ll never be able to improve your financial situation. But what exactly constitutes bad credit, and is it really as dire as it seems? In this complete guide we’ll break down everything you need to know about bad credit scores from what they mean to practical steps for improvement.

What is a Bad Credit Score?

Your credit score is a three-digit number ranging from 300-850 that lenders use to evaluate your creditworthiness. The higher your score, the better your chances of getting approved for credit at favorable interest rates.

According to FICO, one of the major credit scoring companies, a bad credit score falls below 580 on their scale. This is considered “poor” credit. With VantageScore, another popular scoring model, a bad credit score falls between 300-600 in the “subprime” range

Here’s a breakdown of the credit score ranges according to NerdWallet’s guidelines:

- 800-850: Excellent

- 740-799: Very good

- 690-739: Good

- 630-689: Fair

- 300-629: Bad

So if your score is below 630, it would be considered bad. But keep in mind that lenders all have their own standards, so one company may consider a 610 bad while another draws the line at 590. The term “bad credit” is broad and subjective.

What Causes a Bad Credit Score?

There are a few key factors that influence your credit score and could cause it to drop into the bad range:

-

Late or missed payments: Paying bills late, or missing payments altogether, can drastically hurt your score. Payment history makes up a significant portion of your credit score.

-

High credit utilization: Using more than 30% of your total available credit limits increases your credit utilization ratio, which can damage your credit health.

-

Too many hard inquiries: When you apply for new lines of credit, credit bureaus log these requests as hard inquiries, which can temporarily ding your score by a few points. Too many in a short period looks risky.

-

Short credit history: If you’re new to credit, you likely don’t have a very long track record for lenders to review, which can cause you to have a lower score.

-

Collections accounts and bankruptcies: Having accounts in collections or declaring bankruptcy are major red flags that can devastate your credit score.

-

Inaccurate information or fraud: Sometimes errors or fraudulent accounts end up on your credit report negatively affecting your score. Regularly reviewing your credit reports can help you catch these issues.

The Impact of Bad Credit

The lower your credit score, the higher risk you represent to lenders. A bad credit score can negatively impact your finances in the following ways:

-

Higher interest rates: Lenders will likely charge you higher interest rates to offset the risk of lending to you, costing you more money over the lifetime of loans or credit cards.

-

Lower approval odds: You may have trouble getting approved for financing at all with some mainstream lenders that are more risk-averse.

-

More fees and restrictions: Lenders may charge application fees, processing fees or annual fees and impose lower starting credit limits for applicants with bad credit.

-

Difficulty renting: Landlords may require larger security deposits or co-signers. Some may deny housing altogether if they check your credit.

-

Higher insurance rates: Car insurance and home insurance companies can raise premiums for policyholders with poor credit scores in most states.

-

Employment limitations: Employers may view bad credit as a red flag during background checks when making hiring decisions for certain positions.

The bottom line is that bad credit closes doors to affordable financing options that help you achieve major financial goals. The good news? There are proven ways to start rebuilding your credit.

How to Improve Bad Credit

Repairing bad credit takes diligence and patience, but your credit score is fluid and you can improve it over time. Here are some tips:

-

Review credit reports: Mistakes are common in credit reports. Dispute any errors you find with the bureaus.

-

Pay bills on time: Set up autopay or calendar reminders for bills to avoid late payments.

-

Lower credit utilization: Keep balances low compared to limits, with experts recommending under 10%.

-

Limit hard inquiries: Only apply for necessary new credit a few times per year to avoid excessive inquiries.

-

Become an authorized user: Ask a friend or family member with good credit to add you as a user on their credit card account.

-

Open a secured card: Secured cards require cash deposits but are easier to qualify for and build credit.

-

Utilize credit builder loans: These loans report on-time payments to the credit bureaus as you pay down the balance.

With a combination of responsible credit habits and time, you can steadily rebuild and improve your credit score. Be patient and don’t get discouraged. For more personalized guidance, consider working with a nonprofit credit counseling agency.

Checking Your Credit Score

To monitor your credit health and track your progress, it’s important to check your credit score regularly. Here are some ways to access your scores for free:

-

Online through your credit card issuer or bank account portal

-

Mobile apps like Credit Karma and Mint

-

AnnualCreditReport.com (you can check each bureau once per year)

-

Free trials for paid services like Experian (30 days) or IdentityForce UltraSecure+Credit (7 days)

Initially checking your credit scores frequently can help you identify errors bringing down your score. After disputes are resolved, checking every few months is ideal for most people to monitor changes over time.

Summing Up Bad Credit

Having bad credit isn’t a reflection of who you are as a person, just an indication that you may have made some financial missteps in the past. The silver lining is that you now recognize the need for credit repair and can take concrete steps toward rebuilding. With diligence and smart credit habits, your score will start trending upward. Don’t get discouraged!

What is a bad credit score?

There are two widely used credit score types: FICO and VantageScore. While both scoring models use a credit spectrum ranging from 300 to 850, their credit scoring ranges differ.

What is a bad FICO credit score?

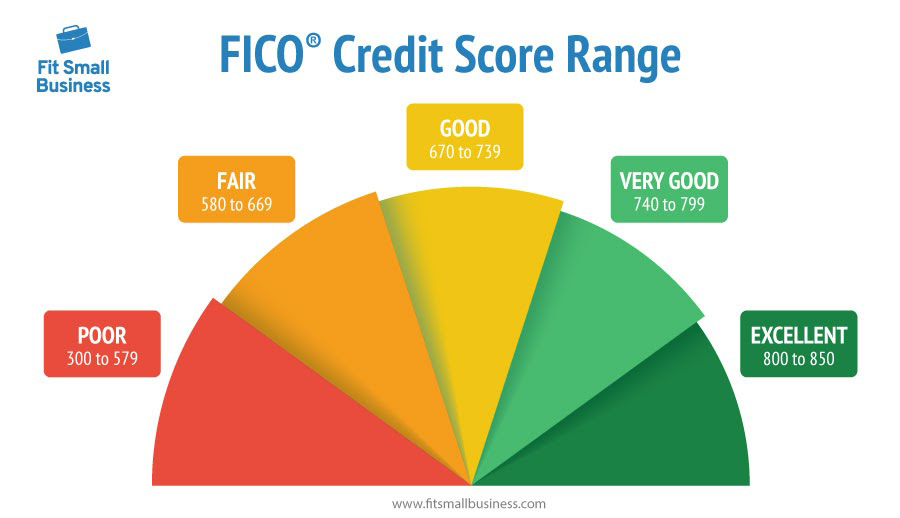

In the FICO (Fair Isaac Corporation) scoring model, scores range from 300 to 850. This number is designed to signal to potential lenders how risky a particular borrower is. If your credit score lands in the range of 300 and 579, it is considered poor, and lenders are more likely to see you as a risk.

Here’s how the FICO credit scoring system ranks credit scores:

In October 2024, the average FICO credit score in the U.S. was 717 points, which is squarely in the good range. If your credit score is less than 670, it falls in either the fair or poor range — which is considered below average and may be considered subprime by lenders.

How To Fix A BAD Credit Score ASAP

FAQ

Is 600 a bad credit score?

Is a $750 credit score good?

A 750 credit score is considered very good and above the average score in America. The average FICO 8 credit score was 715 as of April 2025, according to FICO. The average VantageScore 3.0 was 703 as as of March 2025.

Is a 250 credit score possible?

Is It Possible to Have a Credit Score of 250? It’s impossible for a person’s credit score to drop to 250, but it’s uncommon, as 300 is the lowest number most standard credit scoring models will recognize.

Can you get approved with a 500 credit score?

What is a bad credit score?

A bad credit score is generally below 630 on a scale of 300-850. You can take steps to build it to get better deals. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website.

What happens if you have bad credit?

Those with bad credit might find it harder to qualify for a credit card or get stuck with lower credit limits and higher interest rates if they are approved — something that could quickly make life unaffordable if they have to carry a balance from month to month. It can even prevent you from getting a new job.

What does bad credit mean?

Having bad credit makes it difficult to borrow money, especially at competitive interest rates. A person or business is considered to have bad credit if they have a history of not paying their bills on time or they owe too much money. Bad credit for individuals is often reflected in a low credit score, typically under 580 on a scale of 300 to 850.

Is a credit score below 600 a bad credit score?

A credit score below 600 is generally considered to be a bad credit score, with scores up to the low 600s still below the average. But since everyone has multiple credit scores, “bad” is a relative term depending on how each particular credit score is calculated.

What is a poor FICO credit score?

A poor FICO credit score might be considered less than 580. A poor VantageScore credit score might be 600 or less, with very poor scores being 499 or less. It’s possible to improve a bad credit score by using credit responsibly. That means doing things like paying bills on time and reducing overall debt.

Who has bad credit?

Bad credit is experienced by young adults who are new to credit, applicants who have filed for bankruptcy or foreclosure, and individuals with little to no credit record. A debtor’s credit strength is represented numerically by their credit score based on their credit history.