Have you ever wondered if your pension plan is actually “well-funded”? I’ve spent countless hours researching this topic, and what I discovered might surprise you The common belief that an 80% funded pension is “healthy” is actually a widespread myth that deserves to be busted wide open

The Truth About Pension Funding Levels

A lot of people don’t understand what it means for a pension plan to be “well-funded.” 22% Many experts, media outlets, and even some government reports have stuck to the idea that an 80% funded ratio is the magic number that tells the difference between healthy and troubled pension plans.

But here’s the truth: a pension is well-funded if it has enough assets to pay ALL of its retirees, both now and in the future. Only 80% of them should be targeted, not 90%. The real goal should be 100%.

As someone who’s studied retirement planning for years, I can tell you that actuarial funding methods are designed with a target of 100% funding—not 80%. When a plan falls below 100%, contributions should be structured to reach that 100% funded ratio within a reasonable timeframe.

Understanding the Funded Ratio

The funded ratio is calculated pretty simply:

Funded Ratio = Plan Assets ÷ Plan LiabilitiesFor example, if a pension plan has $800 million in assets and $1 billion in liabilities, its funded ratio would be 80%. But this doesn’t mean the plan is “healthy” – it means the plan only has enough money to pay 80% of what it owes to retirees!

If someone owed you $100 but only had $80 to pay you, would you still think of them as financially healthy? You probably wouldn’t.

Key Factors That Determine Pension Funding Status

Several important factors influence whether a pension plan is well-funded:

- Assets: The total value of the plan’s investments (stocks, bonds, etc.)

- Liabilities: The total amount promised to current and future retirees

- Actuarial Assumptions: Estimates used to calculate future liabilities (discount rates, mortality rates, expected returns)

- Contributions: Money contributed by employers and employees

- Investment Performance: How well the pension fund’s investments perform over time

Why the 80% Myth Persists

So where did this 80% myth come from? It’s kinda hard to pin down exactly, but a 2007 Government Accountability Office (GAO) report mentioned 80% as a benchmark, attributing it to “unidentified public sector experts and stakeholders.” Classic case of citing “experts” without naming them!

The myth spread because the Pension Protection Act of 2006 uses an 80% funded ratio as a trigger point for certain changes in private pension plans. However, this doesn’t mean that 80% is a target; it’s more of a warning sign that calls for more thorough examination.

Why 100% Funding Should Be the Goal

I believe that anything less than 100% funding means the plan has a shortfall. Think about your personal finances – would you be satisfied if you could only pay 80% of your bills? Of course not!

A pension plan with a funding strategy should have a built-in mechanism for achieving the target of at least 100% funding within a reasonable period. The American Academy of Actuaries clearly states that “actuarial funding methods generally are designed with a target of 100% funding—not 80%.”

Current State of Pension Funding

As of fiscal year 2023, the average funded ratio for public pension funds in the U.S. was around 78.1%, up from 74.9% in fiscal 2022. Only six states/jurisdictions had fully funded pensions (above 100%): South Dakota, Wisconsin, Washington, Tennessee, Utah, and Washington, D.C.

This shows that most pension plans are struggling to reach that ideal 100% funded status.

Evaluating a Pension Plan’s Health Beyond the Funded Ratio

The funded ratio is just one piece of the puzzle. When assessing whether a pension plan is truly “well-funded,” we should look at several other factors:

- Funding strategy: Is there a clear plan to reach 100% funding?

- Contribution compliance: Does the sponsor consistently make the required contributions?

- Recent benefit changes: Have there been changes that affect long-term funding?

- Size relative to sponsor: How big is the pension obligation compared to the financial resources of the sponsor?

- Sponsor’s financial health: Is the sponsoring organization financially stable?

- Investment strategy: Is the risk level appropriate?

- Actuarial assumptions: Are the assumptions used to value the pension obligation conservative?

Why a Well-Funded Pension Matters

A well-funded pension provides real benefits for both retirees and plan sponsors:

- Security for retirees: You can be confident you’ll receive your promised benefits

- Less risk for sponsors: Less chance of financial distress

- Better credit ratings: Well-funded plans often receive higher credit ratings

- More investment flexibility: Not having to chase high returns to cover shortfalls

Challenges to Achieving Well-Funded Status

Several challenges can make it difficult to maintain a well-funded pension:

- Market volatility: Wild stock market swings can impact asset values

- Economic downturns: Recessions can lead to reduced contributions

- Demographic shifts: People living longer means paying benefits for longer periods

- Inadequate contributions: Not putting enough money into the plan

How to Keep a Pension Plan Well-Funded

For plan sponsors trying to maintain a well-funded pension, these strategies are key:

- Regularly monitor funding status (not just once a year)

- Make consistent contributions (don’t skip payments when times are good)

- Adopt prudent investment strategies (diversify appropriately)

- Regularly review actuarial assumptions (make sure they’re realistic)

- Consider funding relief options when necessary

The Bottom Line: Don’t Settle for 80%

The idea that an 80% funded ratio is “healthy” or “well-funded” is a myth that needs to be busted. No single level of funding should be used as the main criterion for identifying a plan as either healthy or unhealthy.

All pension plans should aim for 100% funding unless there are specific, well-understood reasons for a different target. The consequences of underfunding include greater future contributions, less security for retirees, and shifting costs to future generations.

Next time someone tells you that an 80% funded pension is healthy, you can confidently explain why they’re wrong. A truly well-funded pension plan is one that has enough assets to meet 100% of its obligations to retirees, both current and future.

FAQs About Well-Funded Pensions

What does a fully funded pension mean?

A fully funded pension has sufficient assets to provide for all the benefits it owes. It can meet all its future obligations to current and prospective pensioners.

What is the average funded status of pension plans?

As of fiscal year 2023, the average funded ratio for public pension plans in the U.S. was 78.1%, which is below the ideal 100% level.

Are most pensions fully funded?

No, most pensions are not fully funded. Only six states or jurisdictions in the U.S. had fully funded pensions (above 100%) at the end of fiscal 2023.

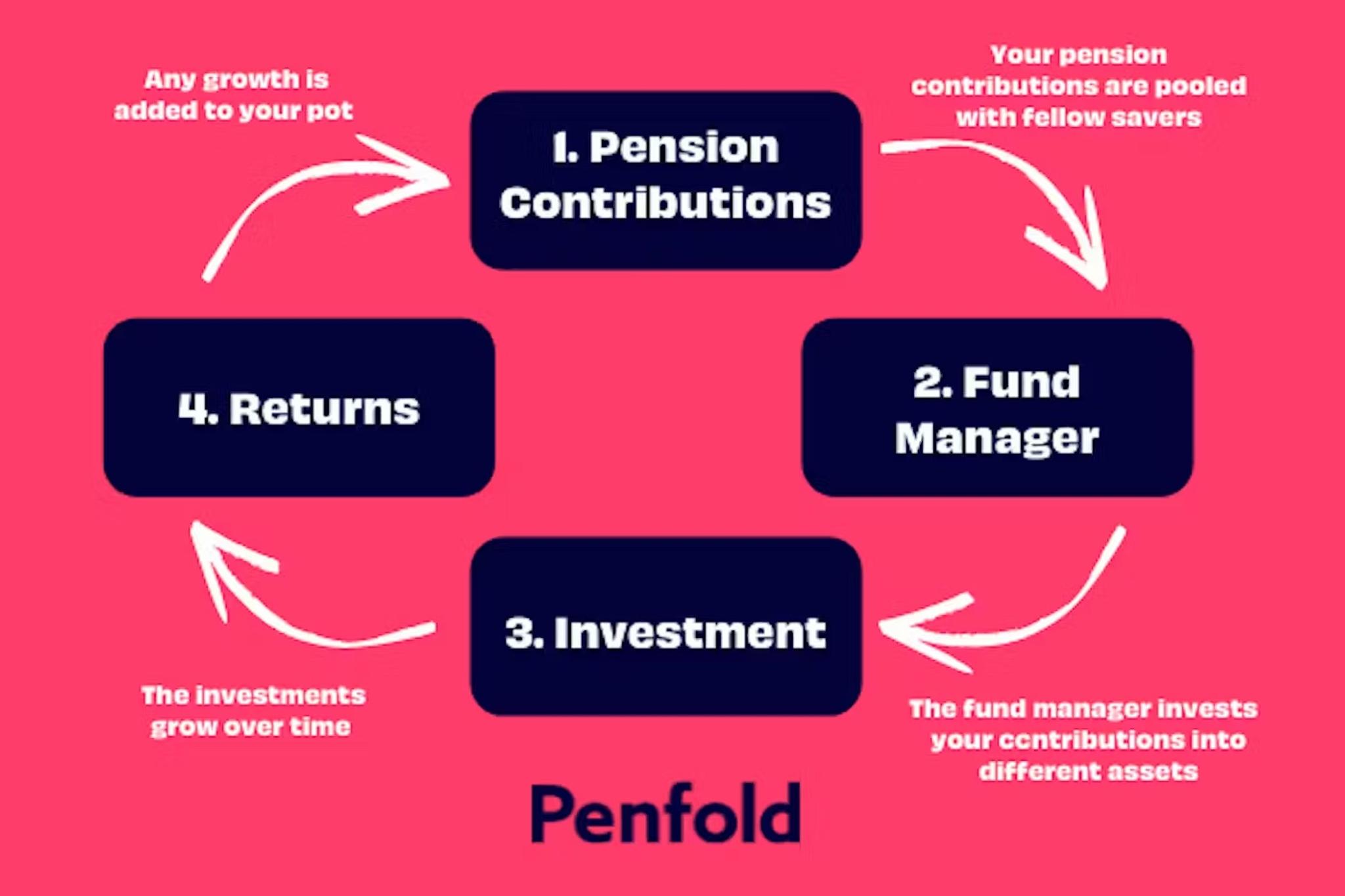

How does a company funded pension work?

In a company funded pension, employers promise to pay a defined benefit to employees for life after they retire. The employer is responsible for making contributions and investing those funds to ensure there’s enough money to pay promised benefits.

What’s your experience with pension plans? Do you know if yours is well-funded? Drop me a comment below!

Measurement 1: Funded Ratio

- The funded ratio is the amount of money in a pension fund divided by the amount of money that is promised in lifetime income benefits.

- A pension plan that promises $1 billion in pensions should have that much money saved up in the event that it needs to be used to make investments and pay out pensions. According to the definition, a pension plan is fully funded when it has 100% of the money it needs.

- If a pension plan promises $1 billion in pensions but only has $900 million in assets, that amount is only 90% funded. That’s not a terrible thing for one or two years at a time, but if a pension plan stays below 10% of its funding level for more than a few years in a row, that means something is wrong.

Measurement 2: Unfunded Liabilities

- This is the difference between how much the promised benefits are worth and how much money is available to pay those benefits. So that all promised benefits can be paid, this is the amount of money that should be in the pension fund and invested.

- One pension plan with $1 billion in promised benefits and $900 million in assets owes another $100 million, which is called pension debt.