“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board is made up of financial experts whose job it is to make sure that all of our content is fair and unbiased.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most — how to save for retirement, understanding the types of accounts, how to choose investments and more — so you can feel confident when planning for your future. Bankrate logo.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo.

“Life insurance IRAs”: What’s all the fuss about? Don’t worry—I’ll help you figure it out! As someone who has spent years helping people figure out their retirement options, I’ll break down this confusing term and explain what people are really talking about when they say “life insurance IRA.” “.

Quick answer: There’s no actual financial product called a “life insurance IRA” – it’s a term people use when comparing two separate retirement savings tools: traditional/Roth IRAs and permanent life insurance policies with cash value components. Let’s dive into what each offers and how they might fit into your retirement strategy.

Understanding the Basics: IRAs vs. Life Insurance

First things first: there is no such thing as a “life insurance IRA” as a separate type of investment. When people use this phrase, they’re usually comparing two different types of money tools:

- Individual Retirement Arrangements (IRAs) – Tax-advantaged accounts specifically designed for retirement savings

- Permanent Life Insurance – Insurance policies that include death benefits AND a cash value component that can potentially be used for retirement

These are completely different financial tools with different purposes, structures, and benefits. Let’s break down each one so you can better understand your options.

What is an IRA?

An Individual Retirement Arrangement (IRA) is a tax-advantaged personal savings plan that allows you to save for retirement with certain tax benefits. The IRS has established these accounts specifically to encourage retirement savings.

Types of IRAs

There are several types of IRAs available

- Traditional IRA – Contributions may be tax-deductible; earnings grow tax-deferred until withdrawal

- Roth IRA – Contributions are made with after-tax dollars; qualified withdrawals are tax-free

- SEP IRA – Simplified Employee Pension plan set up by employers

- SIMPLE IRA – Savings Incentive Match Plan for Employees, typically used by small businesses

- SARSEP – Salary Reduction Simplified Employee Pension plans (established before 1997)

Key Features of IRAs

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Contribution Limits (2024) | $7,000 ($8,000 if 50+) | $7,000 ($8,000 if 50+) |

| Tax on Contributions | Potentially deductible | Not deductible |

| Tax on Withdrawals | Taxed as ordinary income | Tax-free (if qualified) |

| Required Minimum Distributions | Yes, starting at age 73 | No RMDs during owner’s lifetime |

| Early Withdrawal Penalties | 10% penalty before age 59½ (with exceptions) | 10% penalty on earnings before 59½ (with exceptions) |

What is Permanent Life Insurance?

Life insurance is primarily designed to provide a death benefit to your beneficiaries when you pass away. However, permanent life insurance policies (unlike term policies) also build cash value over time.

Types of Permanent Life Insurance

- Whole Life Insurance – Fixed premiums, guaranteed death benefit, and cash value growth

- Universal Life Insurance – Flexible premiums and death benefits, cash value grows based on current interest rates

- Indexed Universal Life – Cash value growth tied to market index performance

- Variable Universal Life – Cash value can be invested in various sub-accounts similar to mutual funds

The Cash Value Component

Some financial experts say that the cash value in permanent life insurance could be used to save for retirement. This component:

- Grows tax-deferred over time

- Can be accessed through policy loans or withdrawals

- May be borrowed against without the age restrictions that apply to IRAs

- Can potentially provide tax-free income in retirement through properly structured withdrawals

Comparing IRAs and Life Insurance for Retirement Savings

Now that we understand what each option offers, let’s compare them directly:

Contribution Limits

IRAs:

- Annual limits set by the IRS ($7,000 for those under 50 and $8,000 for those 50+ in 2024)

- Income restrictions may apply, particularly for Roth IRAs

Life Insurance

- No formal contribution limits

- Premium amounts depend on the policy, with a portion going toward the cash value

- Potentially allows wealthy individuals to put away more money in a tax-advantaged vehicle

Tax Benefits

IRAs:

- Traditional: Tax-deductible contributions and tax-deferred growth

- Roth: Tax-free qualified withdrawals and growth

Life Insurance:

- Tax-deferred growth of cash value

- Tax-free death benefit for beneficiaries

- Potential for tax-free access to cash value through loans (though this reduces the death benefit)

- No required minimum distributions

Costs and Fees

IRAs:

- Typically low maintenance and investment fees

- No commissions if self-directed

Life Insurance:

- Can be very expensive with high upfront costs

- Agent commissions

- Ongoing policy fees

- Can take at least a decade for cash value to build meaningfully

Access to Funds

IRAs:

- 10% penalty on early withdrawals before age 59½ (with certain exceptions)

- Required Minimum Distributions starting at 73 for Traditional IRAs

Life Insurance:

- Can access cash value at any age without penalties

- Policy loans must be managed carefully to avoid policy lapse

- No required distributions, offering more flexibility in retirement

Estate Planning Benefits

IRAs:

- Non-spouse beneficiaries typically must withdraw inherited IRA funds within 10 years

- Subject to income tax for beneficiaries (Traditional IRAs)

Life Insurance:

- Death benefits generally pass income tax-free to beneficiaries

- Proceeds typically bypass probate

- Can be structured to reduce estate tax exposure

When Does Life Insurance Make Sense for Retirement Savings?

Life insurance as a retirement saving tool might make sense in specific situations:

- For high-income individuals who have maxed out traditional retirement accounts and can’t contribute to Roth IRAs due to income limits

- For those seeking tax-free retirement income beyond what Roth accounts can provide

- For individuals with significant estate planning needs who want to ensure efficient transfer of wealth

- For young people who can benefit from lower premiums and a long time horizon for cash value growth

However, it’s important to note that for most people, traditional retirement accounts like 401(k)s and IRAs should be the primary focus before considering life insurance as a retirement savings vehicle.

The Drawbacks of Using Life Insurance for Retirement

While permanent life insurance can have some retirement planning benefits, there are significant drawbacks to consider:

- High costs and fees that eat into potential returns

- Complexity of policy structures and features

- Surrender charges if you need to cash out early

- Reduced death benefit if you take loans against the policy

- Risk of policy lapse if premiums aren’t maintained or loan interest compounds too much

My Recommendation: A Balanced Approach

In my experience working with clients, I’ve found that the best approach is usually to:

- Max out employer-sponsored retirement plans like 401(k)s, especially if there’s an employer match

- Contribute to IRAs (Traditional or Roth, depending on your situation)

- Consider permanent life insurance primarily for its death benefit and only secondarily as a potential retirement supplement if you’ve maxed out other options

For most people, separating your retirement savings (through IRAs and 401(k)s) from your insurance needs (through appropriately sized term or permanent policies) makes more financial sense than trying to combine them.

Final Thoughts: There’s No One-Size-Fits-All Solution

While there’s no actual “life insurance IRA” product, understanding how both IRAs and life insurance work can help you build a comprehensive retirement strategy. Your personal situation, including your income, tax bracket, estate planning needs, and risk tolerance, should guide your decisions.

Remember that retirement planning is complex, and it’s often beneficial to work with a financial advisor who can provide guidance tailored to your specific situation. They can help you determine whether traditional retirement accounts, life insurance, or a combination of both makes the most sense for your long-term financial goals.

Have you considered using life insurance as part of your retirement strategy? Or are you sticking with traditional retirement accounts? I’d love to hear your thoughts in the comments below!

Note: This article is just for your information and shouldn’t be taken as financial advice. Before making big financial decisions, you should always talk to a qualified financial professional.

Pros and cons of life insurance

- There are different types of policies that offer different types of guarantees to protect your premiums. For example, indexed universal life insurance has a minimum guaranteed crediting rate to protect against market downturns.

- When your cash value builds up, you can choose when to use it, if at all.

- Most of the time, the cash value is not taxed if it is less than the cost basis.

- Permanent life insurance can be very pricey, costing a lot more than the small fees you usually pay for an IRA.

- You could lose your policy if you can’t pay your premiums on time or aren’t careful to keep an eye on how the interest on a loan builds over time.

- People who use their cash value to save for retirement might not have a lot of money left over when they die.

How We Make Money

The offers that appear on this site are from companies that compensate us. This payment might change where and how products show up on this site, like the order in which they show up in the listing categories, unless the law says otherwise for our mortgage, home equity, and other home lending products. But the money we get from this doesn’t change the information we post or the reviews you read on this site. We do not include the universe of companies or financial offers that may be available to you.

- • Investing

- • Wealth management

Calendar Icon 15 Years of experience Brian Baker covers investing and retirement for Bankrate. He is a CFA Charterholder and previously worked in equity research at a buyside investment firm. Baker is passionate about helping people make sense of complicated financial topics so that they can better plan for their financial futures.

- • Personal finance

- • Financial planning

Maurie Backman has more than a decade of experience writing about personal finance, including investing and retirement planning.

- • Investing for beginners

- • Retirement

Bankrate investing editor Johna Strickland has explained complicated topics to everyday people for more than 15 years. As an editor and journalist, she has touched on nearly every aspect of personal finance.

- • Social Impact Entrepreneurship

- • Economic & Public Policy

Emmanuel Nyame is a member of Bankrate’s Financial Review Board and the CEO of Twelvenets, where he leads campaigns that drive community and economic growth.

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board is made up of financial experts whose job it is to make sure that all of our content is fair and unbiased.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most — how to save for retirement, understanding the types of accounts, how to choose investments and more — so you can feel confident when planning for your future. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

Roth IRA Explained – MUST-KNOW for the Life Insurance Exam

FAQ

How does a life insurance IRA work?

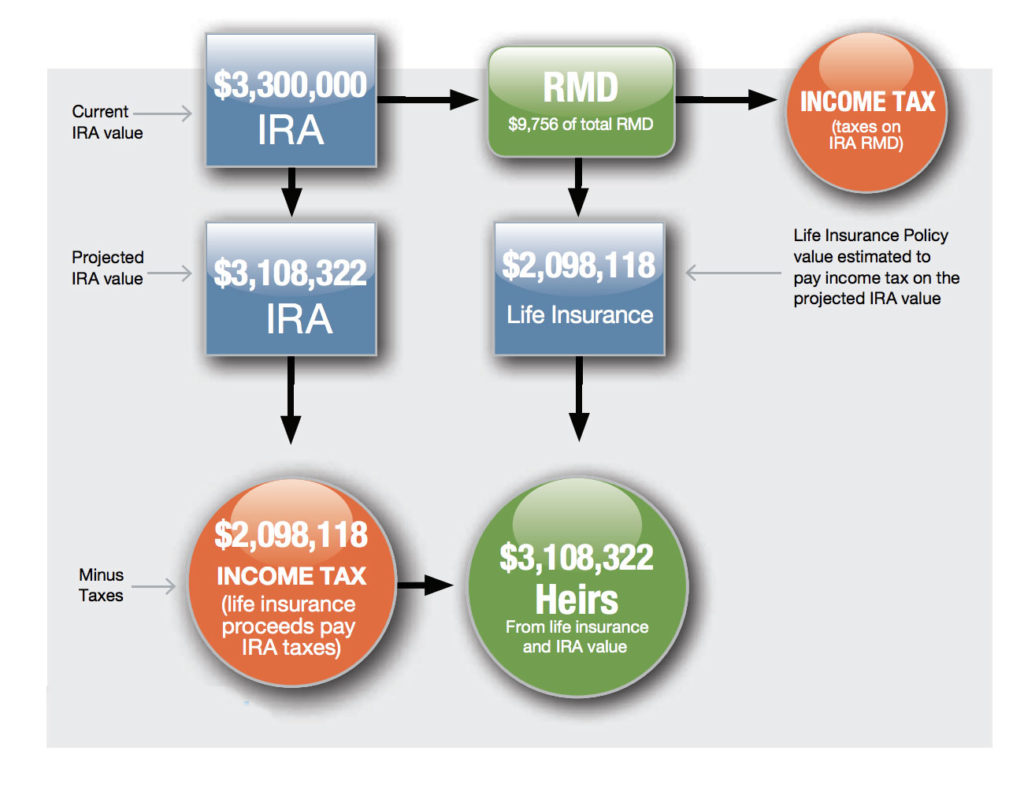

This wealth replacement strategy uses funds distributed from your retirement plan to pay life insurance premiums. Upon your death, the life insurance death benefit replaces the amount of the retirement plan lost to taxes (or provides an even greater amount to your family).

What is the cash value of a $10,000 life insurance policy?

The cash value of a $10,000 life insurance policy is not a fixed amount; it depends on the specific policy type, age, and how long it’s been active. Term life insurance doesn’t have any cash value, but whole life insurance does. Whole life insurance builds cash value over time as a way to save money.

Is it better to have life insurance or Roth IRA?

How to Choose Between Life Insurance and a Roth IRA: A Roth IRA may also be a good choice if you are worried about taxes on withdrawals from your retirement account. Life insurance can become more appealing as you get closer to death. Having the assurance that your beneficiaries will inherit a policy makes the money spent worthwhile.

Are IRAs a good investment?

An IRA can be a good retirement investment for anyone. Think you’ll be in a lower income bracket when you retire? A traditional IRA can help you save now with tax-deductible contributions. If you expect to have higher income in retirement, consider a Roth IRA for income tax-free growth potential.

Can a life insurance IRA fund your retirement?

You can take advantage of a life insurance retirement plan (LIRP), but any money that you borrow will have to be paid back with interest. If you have a retirement account, you can use that to fund your retirement. That’s not something you can do with a life insurance policy. Roth IRAs are great options for planning your retirement.

Are IRAS & life insurance policies right for You?

Individual Retirement Accounts (IRAs) and life insurance policies each offer distinct benefits and considerations. Understanding their unique features will help in making an informed decision tailored to personal needs and goals. The tax implications of IRAs and life insurance policies heavily influence their suitability for retirement savings.

Is a Roth IRA better than a life insurance policy?

Traditional retirement accounts like Roth IRAs are usually the best vehicles to save for retirement. Using a life insurance policy as an investment tool isn’t as effective as an IRA because it’s expensive and comes with more risk.

Can I get life insurance if I don’t have an IRA?

But you can get life insurance or a Roth IRA if your employer doesn’t offer one or if you want to add to one. Most people will benefit more from an IRA, though. Using life insurance to save for retirement is known as having a life insurance retirement plan (LIRP).

What is an IRA to life insurance conversion?

All while contributing just $500 monthly to the IUL policy during his working years. An IRA to life insurance conversion is a process whereby an individual withdraws some or all of the funds in an Individual Retirement Account and then uses the net amount to purchase a permanent life insurance policy that builds cash value on a tax deferred basis.

Should I open an IRA or a life insurance policy?

If you’re trying to decide between opening an IRA (Roth or traditional) or opening a life insurance policy for the purpose of retirement savings, IRAs are almost always a better choice. A Roth IRA offers higher returns on your contributions than what you would get from a life insurance cash value account.